Table of Contents

Introduction

The market continues to defy the skeptics.

Since the April lows, the S&P 500 has rallied nearly 25%—eclipsing the textbook 20% threshold for a bull market. While we don’t put much stock in arbitrary labels, we do believe in trend strength, and as we highlighted last week, the trend remains firmly higher.

From our 6/4 report:

“What matters most is construction — and right now, we don’t see much deterioration. On the contrary, the indexes remain technically strong, and the path of least resistance appears higher.”

Institutional under-positioning has been a consistent theme in our work, and it’s one reason dips have been shallow. Any weakness is met with buying, as funds are forced to chase exposure. Even with negative headlines—from Fed policy to the Trump/Musk feud—the bears have failed to generate meaningful downside. When one side doesn’t show up at key moments, that tells you a lot.

The clearest sign of bullish conviction came with the May 13th SPX gap through the 200-day moving average. Gaps through major battlegrounds like this are rarely accidents—they send a message. Since that gap, the SPX has added another 4% in less than a month—a significant move by historical standards.

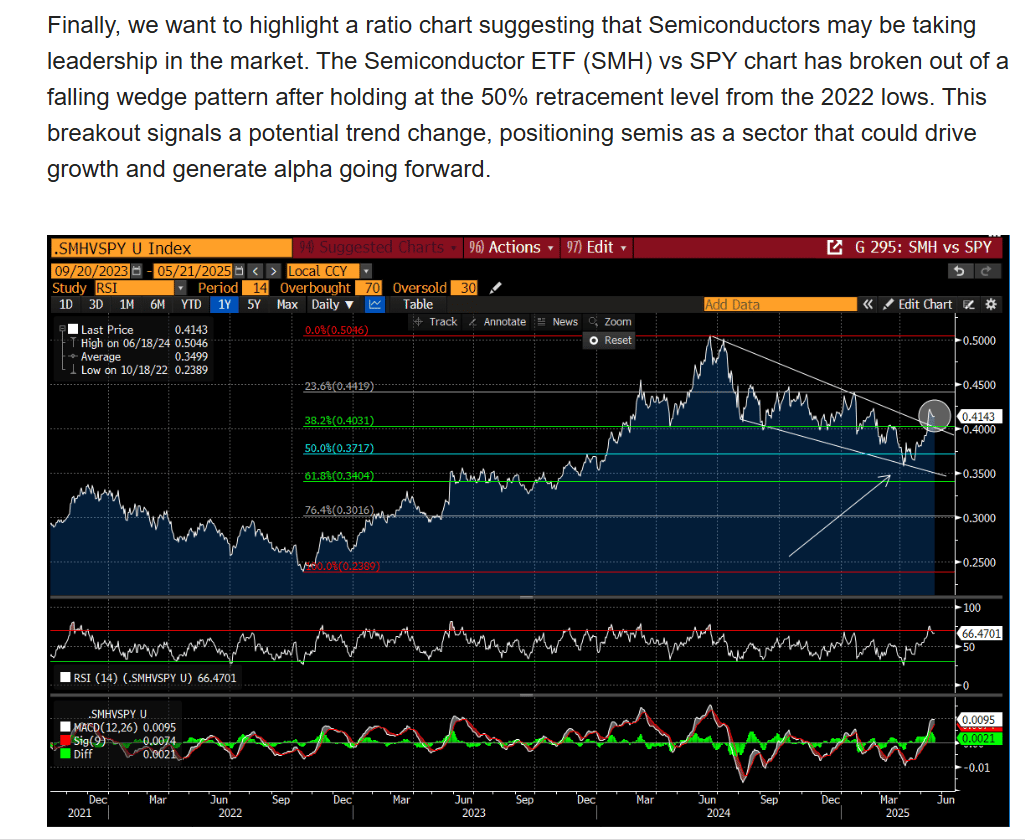

In a market where alpha is hard to come by, we've continued to highlight areas of leadership. Most recently: Semiconductors.

From our 5/21 report:

Since that report, SMH has outperformed the SPX by over 200 basis points, reinforcing our view that semiconductors are reasserting leadership. When markets are trending, leadership matters—and the semis often lead both on the way up and the way down. Their outperformance here is another sign of underlying market strength.

Since the April 7th lows, Semiconductors have returned twice as much as the broader market.

If you're bearish on this market, semiconductor leadership should scare the hell out of you. Historically, when semis lead, it's a hallmark of a strong bull market. Their outperformance reflects rising demand for tech, accelerating innovation, and broader economic strength.

Drill down further, and you’ll see that the leading sub-sectors since the April lows are all tied to the AI theme. When markets are led by innovation—especially in transformative technologies like AI—it usually doesn’t end in lower stock prices. Quite the opposite.

Since the 1990s, periods of strong tech sector performance have consistently aligned with robust GDP growth and low unemployment—most notably during the 2010s tech boom. Semiconductors, often viewed as the heartbeat of technological innovation, tend to lead during these cycles. Their strength isn’t just a sector story—it’s a signal of broader economic expansion, as chips power everything from consumer electronics to industrial systems.

Looking ahead, this week brings fresh inflation data. Expectations are for an uptick, as the effects of tariffs begin to seep deeper into goods and services. May’s reading could mark the first year-over-year acceleration in inflation we’ve seen in 2025—adding another layer of complexity to the macro backdrop.

Friday’s payrolls report pointed to a cooling labor market, though job growth remains solid. These results likely keep the Fed on pause regarding rate cuts—for now.

Following the release, the rates market bounced, with the 30-year Treasury yield printing a weekly hammer candle—a classic reversal pattern that could signal a renewed move higher in yields. With CPI and PPI data on deck this week, how bonds respond will be critical. For now, rates remain the most immediate risk factor for equity markets.

The S&P 500 closed Friday right at the 6,000 mark—a natural psychological level that tends to attract sellers. The question now is whether they can gain traction and push the market lower. Adding to the intrigue, this weekend’s Barron’s cover urged investors to “worry.” Historically, such broadly cautious sentiment rarely marks significant market tops—it’s often seen closer to tradable lows than peaks.

Now let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade