Oil continues to melt down from our call on Jun 6th to be on the lookout for a top post the DeMark 9 sell. Now down about -17% from the signal. This is also when Cramer was advocating to buy all dips in oil. Can't make this stuff up.

We also mentioned to tighten stops on energy longs as a result...XLE is now down -25%.

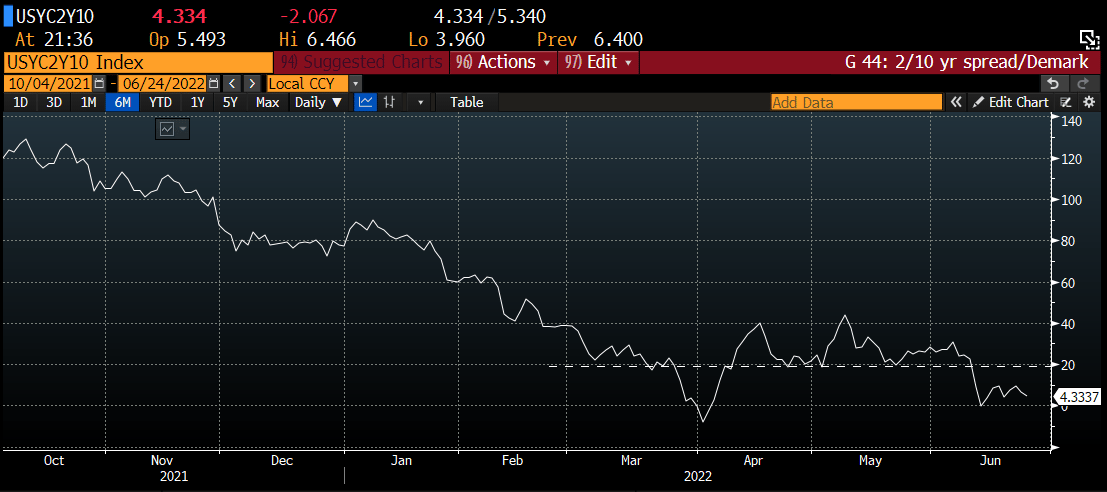

Are we nearing a counter trend move in oil/oil stocks? The market has also been absorbing some pretty nasty news. Should we expect it to rally further? The curve is close to inverting, again, but Powell is out being as hawkish as ever. How should we think about the set up from here?

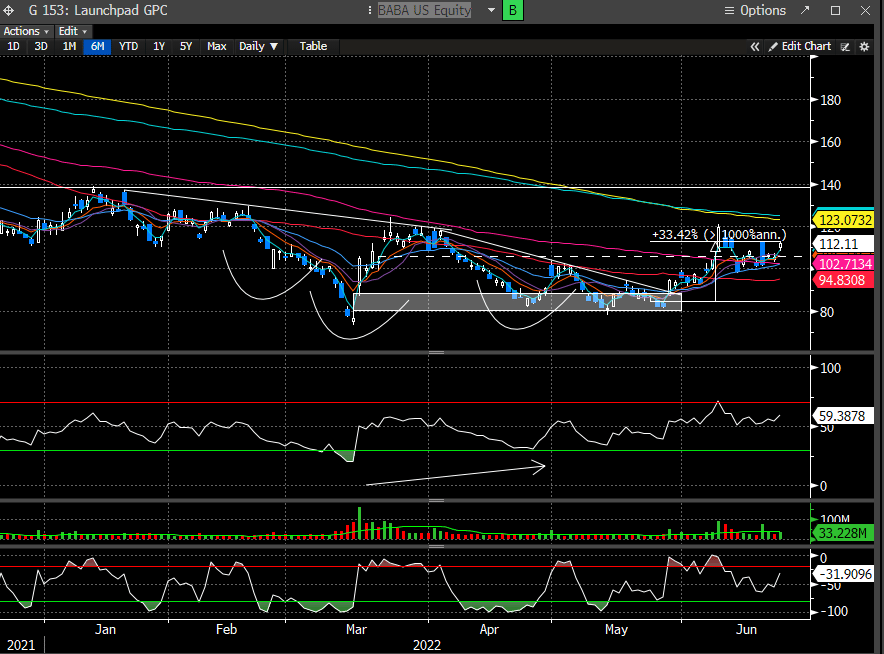

We've been publicly bullish on China equities for a month now and continue to beat the drum and add on weakness. The Nasdaq China Dragon Index was up +3% today. This now takes our call to be long the group +28% since May 23.

BABA is our top name, which is up +33% during that TF.

NIO is another name we have been pounding the table on since the mid-teens. Since our call to get long China, this is up +53%.

Our premium newsletter (2-3 publications a week) is only $19.95 if interested in seeing more....

so now what?