Introduction

The stock market has a special talent: it wears people out.

From the outside, this environment looks almost boring — the major indexes are barely up on the year and volatility seems contained. But peel back the onion and you’ll see what investors have actually been dealing with: violent rotations, sharp reversals, and leadership changing by the hour.

Welcome to January — the month where sectors fight for pole position, trying to convince investors they deserve the next wave of flows.

And so far? The “early leader board” has been a mess. Materials ripped out of the gate, powered by an explosion of fund flows into precious metals and commodity exposure. Fast forward a whole three days and suddenly Energy is wearing the crown — a surprising development considering the group has been left for dead for months. But that’s what geopolitics does: it can resurrect a dormant trade overnight.

The bigger question isn’t what’s leading this week — it’s whether any of this leadership sticks, or if we’re simply watching another round of January chop where positioning changes faster than narratives.

The surprising laggard so far has been Financials — a combination of mediocre early earnings and an unexpected Trump curveball: floating the idea of capping credit card interest rates. We can’t pretend we saw that coming. But we did say 2026 would be volatile and choppy, which means you can’t just “set it and forget it.” This tape demands tactical trading and disciplined profit-taking — because in an environment like this, gains can evaporate quickly.

More importantly, Financials may be the canary in the coal mine. You don’t get a durable bull market without the banks participating. They don’t need to lead, but we absolutely do not want to see them dragging the market from behind. How XLF responds to this bout of selling will be a key read-through for the broader tape.

The current technical picture isn’t pretty. But as we remind readers often: it’s not how the week begins — it’s how it ends.

Technically, XLF has negated the bull flag we highlighted over the weekend and is now attempting to stabilize at an important support zone. If XLF can hold the upper end of this range, the market will likely absorb the weakness without much damage. But if financials continue to deteriorate from here, it should be treated as an early warning sign that a broader corrective move may be developing.

It’s also worth noting that OPEX week tends to invite outsized volatility — and January expiration can be especially disorderly. With large amounts of LEAPS rolling off, dealers are forced to adjust hedges aggressively, which often creates wild, seemingly headline-driven swings.

Not coincidentally, this dynamic has helped deliver the SPX its first back-to-back losses of 2026.

Meanwhile, Russell 2K (RTY) continues to massively outperform, helped further by a softer-than-expected CPI — exactly what we surmised in the 1/11 report. We’ve been writing for over a month to expect a SMID-cap resurgence in 2026, and so far that call has been remarkably prescient.

RTY is now outpacing SPX by roughly ~6x, while leaving the Mag 7 Index in the dust — which is now negative on the year.

Wednesday marks the 9th straight session where SMID caps have outpaced their large-cap peers. It’s good to be positioned on the right side of that disparity.

RTY has now logged its strongest start to a year relative to the Nasdaq since 1979.

While the disparity between large caps and SMID caps continues to widen by the day, it’s reasonable to expect some mean reversion over the course of the year — particularly as OPEX passes and earnings season ramps in earnest, both of which can shift flows and leadership.

We highlighted this ratio chart in our 1/7 report, comparing the RTY (IWM) to the SPY. That ratio has recently broken to a new 52-week high, confirming that the rotation is real.

However, it’s also worth noting that when this ratio has historically reached overbought RSI conditions, pullbacks have tended to follow.

If we layer DeMark signals onto the ratio chart, several sell signals are close to printing. That setup argues for a near-term reversion, or at minimum a pause in the SMID outperformance.

This doesn’t mean the SMID-cap trade is dead — it simply means the rubber band is stretched, and some recoil is likely.

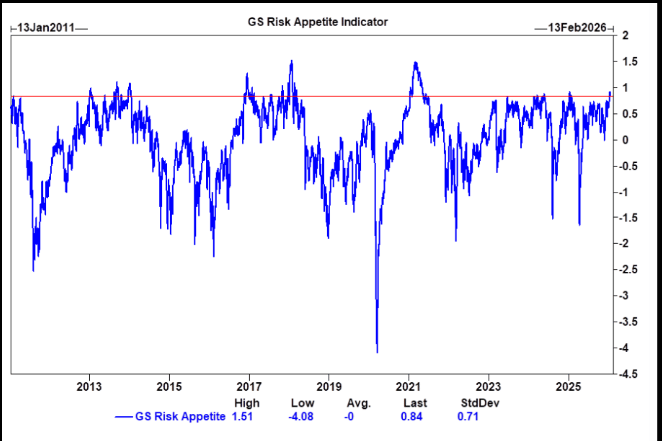

Adding to that, Goldman noted that client optimism has surged to the highest level in a year, with their Risk Appetite indicator climbing to its highest since early 2025 — now sitting in the 96th percentile. That combination contributes to the near-term setup for reversion.

That said, the cracks in large caps need to be repaired soon — otherwise they risk becoming an anchor on the broader tape.

Now let’s see what the charts have to say.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade