Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Table of Contents

Introduction

The 2025 year ended with a bit of thud. What seemingly was setting up for a strong close to the year, saw aggressive selling during the Santa Claus rally period, leaving the eponymous bullish period limping into its final day. The phenomenon measures the final five trading days and the first two of the New Year. While it’s hard to make determinations about the next year based on five light volume days, the historical performance doesn’t lie (see 12/28 report for performance table). With one day left, the markets have some heavy lifting to do to finish green.

That already feels like a tall order given the weekend’s developments. The Trump administration has taken aggressive steps aimed at removing Maduro from Venezuela and occupying the country. While we are not geopolitical analysts—and have no interest in predicting second- or third-order outcomes—the destabilizing nature of any military conflict has the potential to send shockwaves through global markets.

Energy-linked instruments are the most obvious pressure point. In theory, Trump’s stated objectives and rationale could reassure investors and limit near-term dislocation risk. But history offers a sobering reminder: military occupations rarely unfold according to plan—if ever. Exogenous shocks, by definition, are unpredictable, and they represent one of the most persistent risks to participating in risk assets.

There are also broader implications to consider. Does a U.S. occupation embolden Russia or China to pursue more aggressive actions of their own, accelerating global destabilization? That outcome seems entirely plausible. Alternatively, perhaps little materializes, and the U.S. strengthens its strategic position by increasing China’s dependence on oil flows now more firmly under U.S. influence. Could this simultaneously weaken Russia by eroding a key pillar of its control within the global energy complex, pressuring prices and further destabilizing its fiscal position?

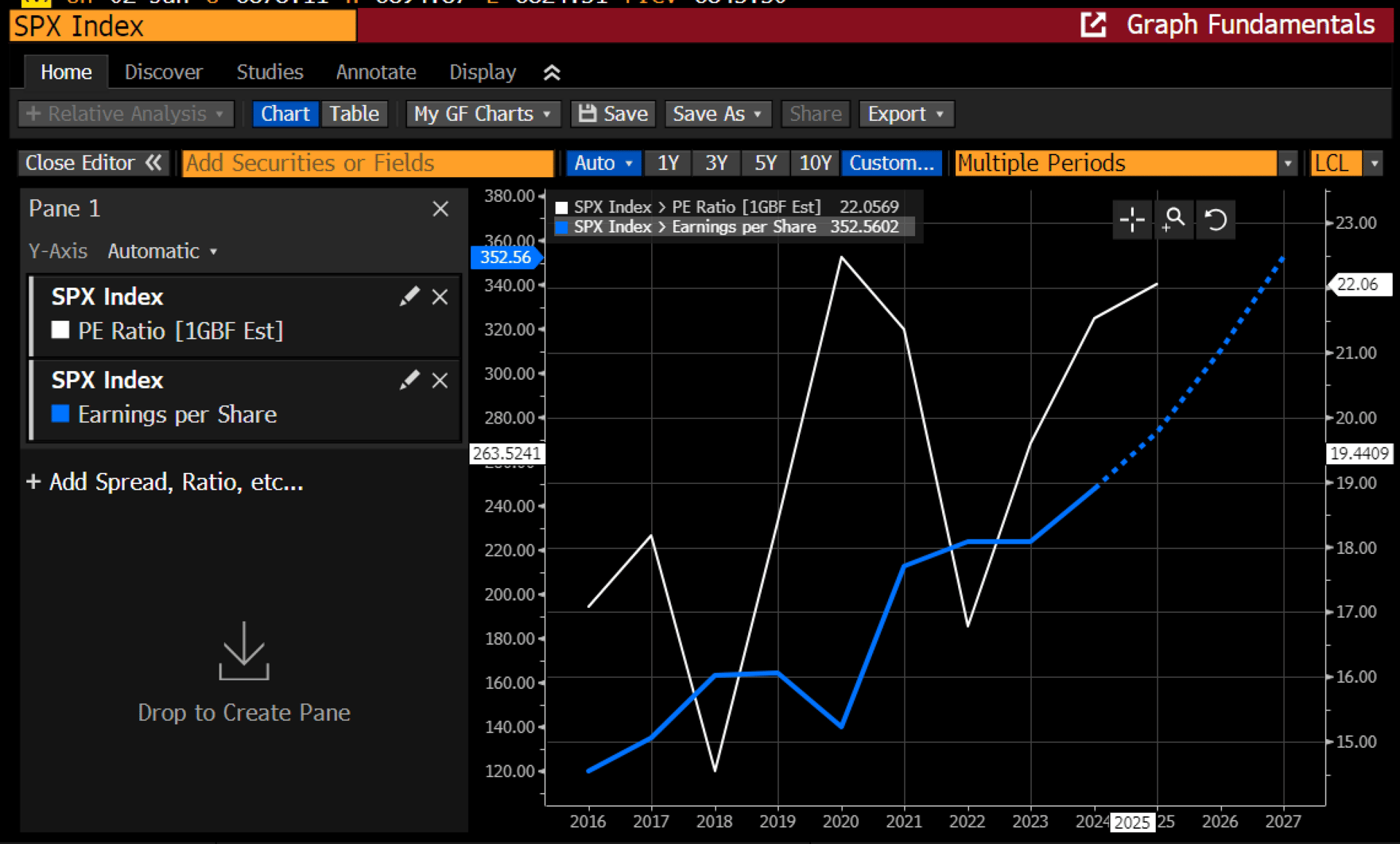

We will not speculate on how these scenarios ultimately resolve, nor how investors will choose to price this emerging geopolitical risk—that task is best left to specialists. What we can say, however, is that these risks are surfacing at a precarious moment. Markets remain priced for near perfection, trading at roughly 25x trailing earnings—uncomfortably close to the ~26x multiple that preceded the 2022 bear market.

Even if the S&P 500 delivers the roughly 10% earnings growth currently expected this year, valuations remain elevated and meaningfully above long-term averages, leaving little room for disappointment.

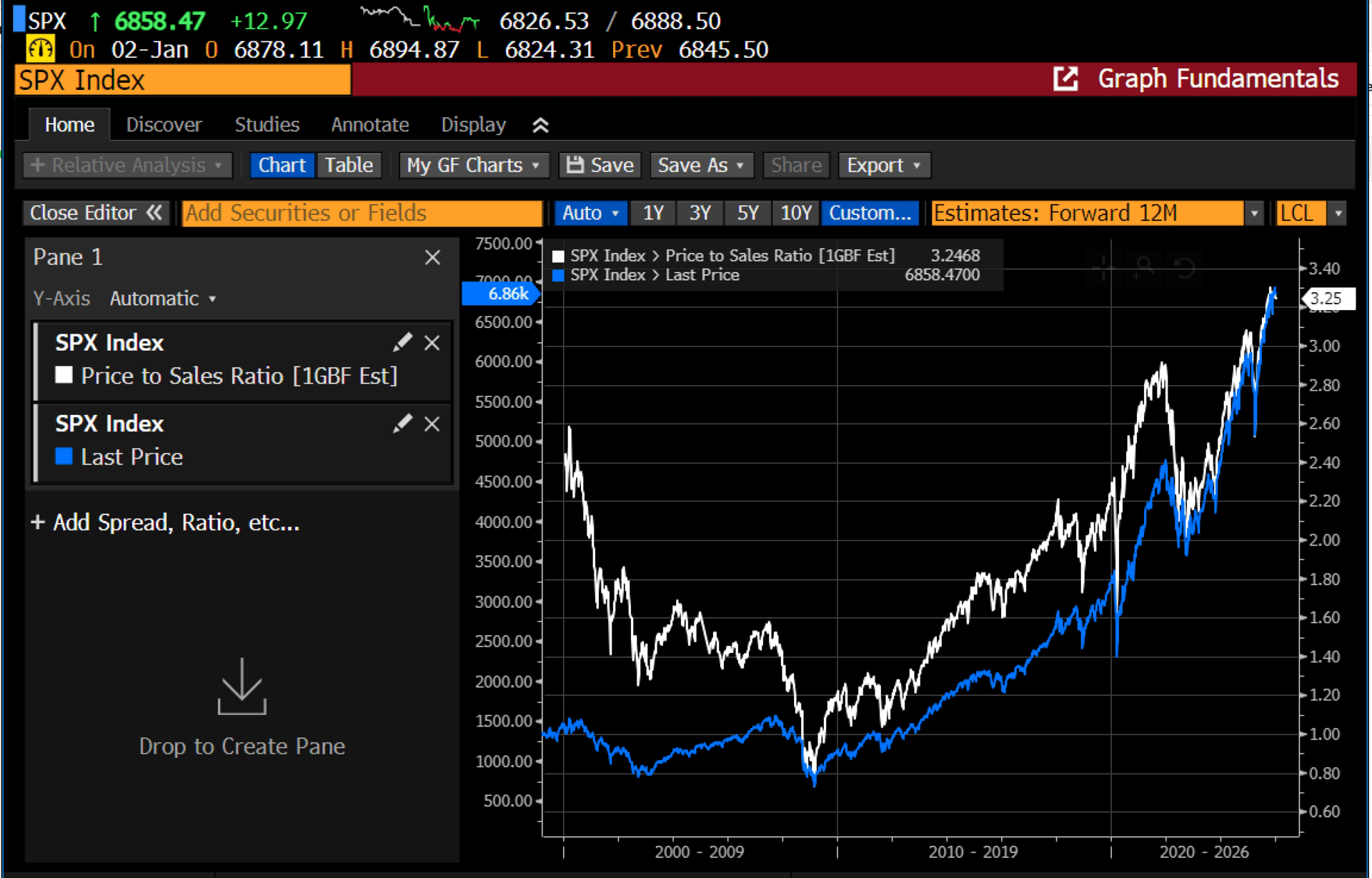

On a price-to-sales basis, the S&P 500 is now trading at levels above any point in the past 25 years—including the peak of the internet bubble.

It’s important to note that we do not use valuation as a primary input for forecasting near-term market direction. That said, we would be naïve to suggest that valuations do not matter. They do. Valuation may be less consequential in the short run, but it always matters over the long term—particularly when the business cycle turns or when major dislocations force a repricing of risk assets. The higher the starting valuation, the greater the downside required to restore equilibrium once risk appetite shifts.

Is the fluid situation in Venezuela the catalyst that ultimately reprices risk? We doubt it—at least initially. However, military campaigns are notorious for producing unintended consequences, and at a minimum, this introduces another layer of uncertainty that investors must contend with as we enter the new year.

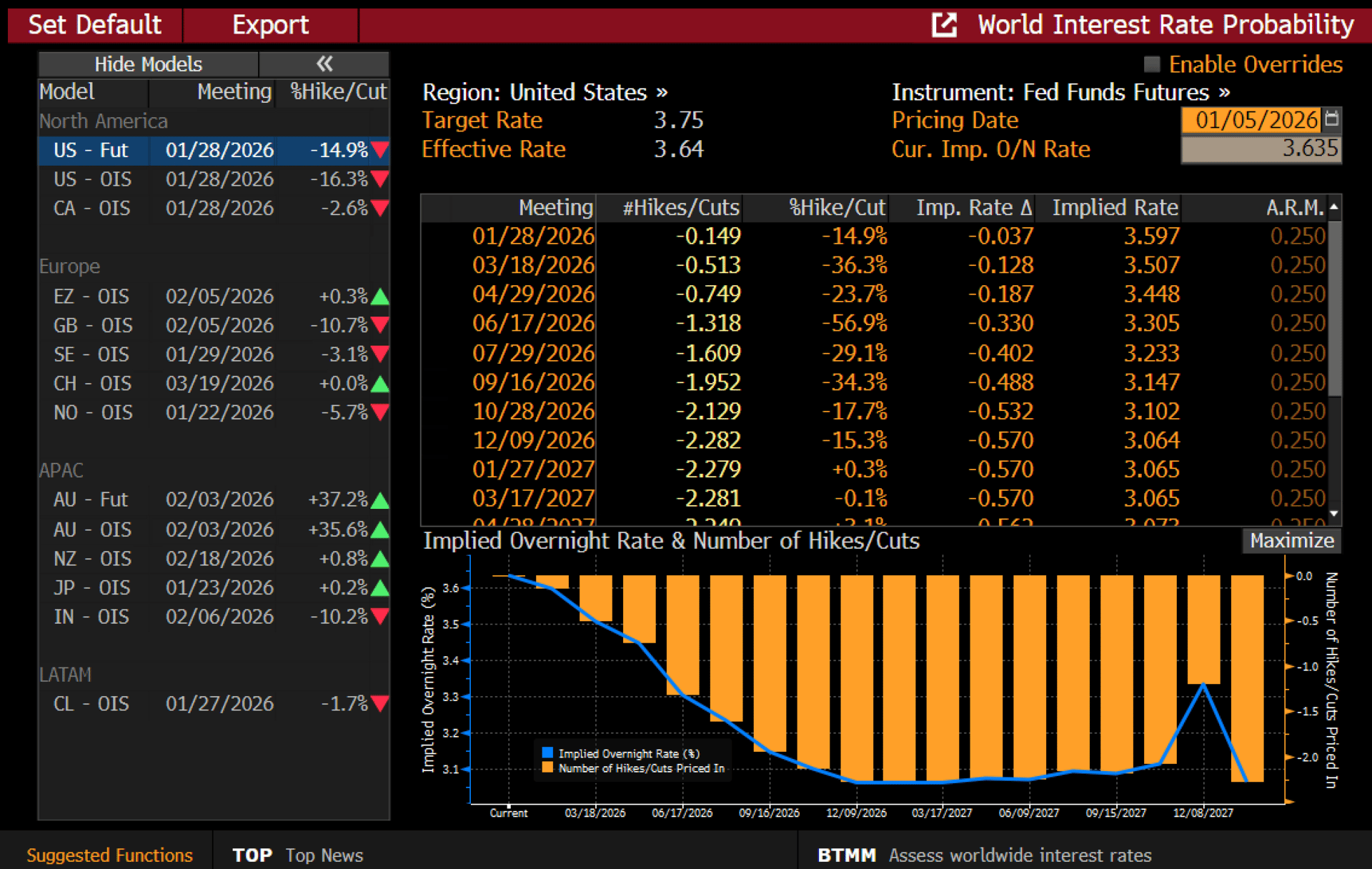

Setting aside the usual Trump curveballs, the market otherwise appears positioned for increased accommodation from the Federal Reserve this year. A more accommodative Fed is generally supportive of risk assets and should disproportionately benefit the areas of the market that have lagged, burdened by investor anxiety around policy missteps and a slowing growth backdrop. With the Fed now seemingly back in the market’s corner, we believe the path of least resistance remains higher—ex-geopolitical risk—as liquidity improves, the cost of capital declines, and inflation continues to move further into the rear-view mirror.

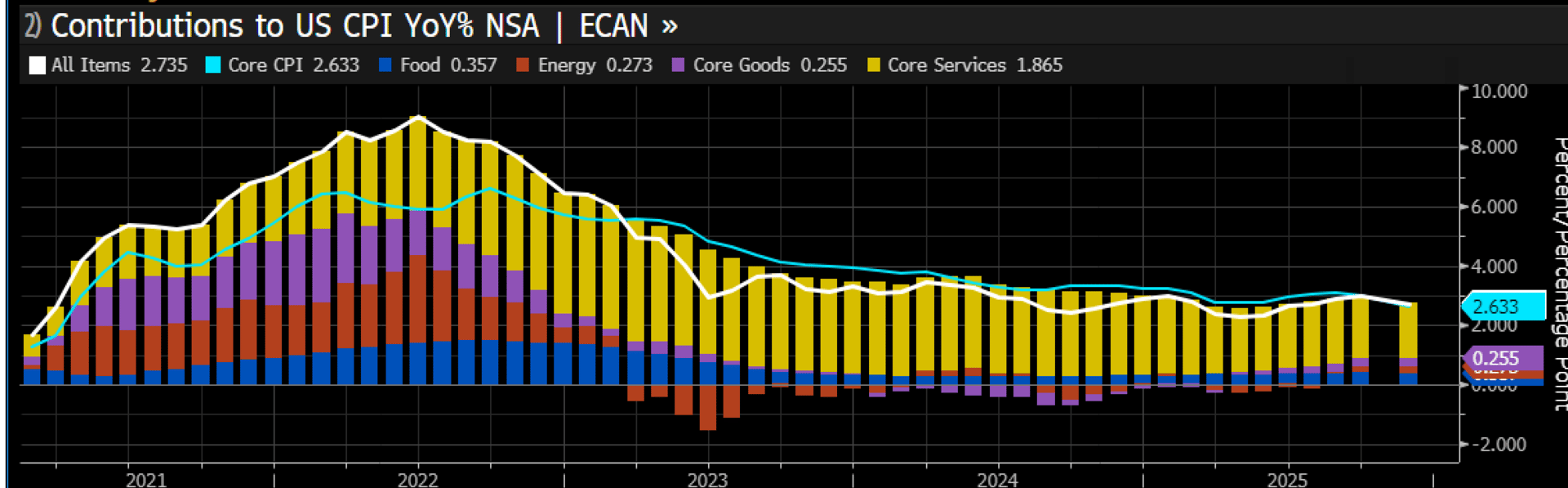

Oil remains the single most important inflationary input, albeit indirectly. It is the dominant marginal driver of broad-based inflation, sitting upstream of transportation, production, and distribution costs across nearly all goods and services. Oil prices have been declining throughout the year and, in our view, should continue to face downward pressure given Venezuela’s vast reserve base—the largest in the world—which the administration has openly stated it intends to exploit. Lower oil prices translate into lower costs for goods and services, increased disposable income, and stronger consumption. Given that roughly 70% of U.S. GDP is driven by consumer spending, it’s difficult to argue that this dynamic is anything but supportive for the U.S. economy.

The next CPI inflation report, due on January 13th, could prove important, and we suspect it may surprise to the downside.

If so, rate expectations could shift from the two cuts currently priced in toward three, a development that should be well received by markets—particularly by rate-sensitive instruments.

If this assessment proves correct, 2026 may mark the beginning of a SMID-cap resurgence. While it is far too early to draw firm conclusions, the first trading day of the year offered an early glimpse of this dynamic, with capital rotating out of large caps and into smaller-cap exposure. The Russell 2000, which represents the 2,000 smallest constituents of the broader Russell 3000 and largely strips out large-cap influence, gained roughly 1% on Friday, even as the Nasdaq finished lower.

The major indexes are heavily populated by the Mag 7 and are cap-weighted, giving these stocks a disproportionate influence on overall index performance. On Friday, that concentration effect was evident, with the Mag 7 (FANG-type stocks) down roughly 1%, exerting meaningful pressure on the broader indexes.

Is this dichotomy a harbinger of what’s to come in 2026? We think it could be, particularly if the Fed remains on its current path and continues to incrementally accommodate markets as we expect.

Of course, conditions can change quickly, and we reserve the right to adjust our view as the facts evolve. With that, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade