Introduction

We’ve maintained a measured approach to October, advising readers to sell into early-month strength and raise cash in anticipation of a typical pickup in volatility during the back half of the month. That call proved timely: the VIX surged nearly 80% from its October lows. As we noted in our 10/19 report, while the peak in volatility appeared to be in, that didn’t mean volatility itself would subside immediately—and we’re now seeing that play out as portfolios rebalance and churn into month-end.

In our 10/17 report, we argued that the 10/10 lows likely marked the bottom of the recent corrective phase. Even after the inflammatory Trump post and renewed regional bank contagion fears, the S&P 500 held firm above those lows—a bullish development in our view. Since then, the major indexes have rebounded to challenge their all-time highs, consistent with our broader thesis.

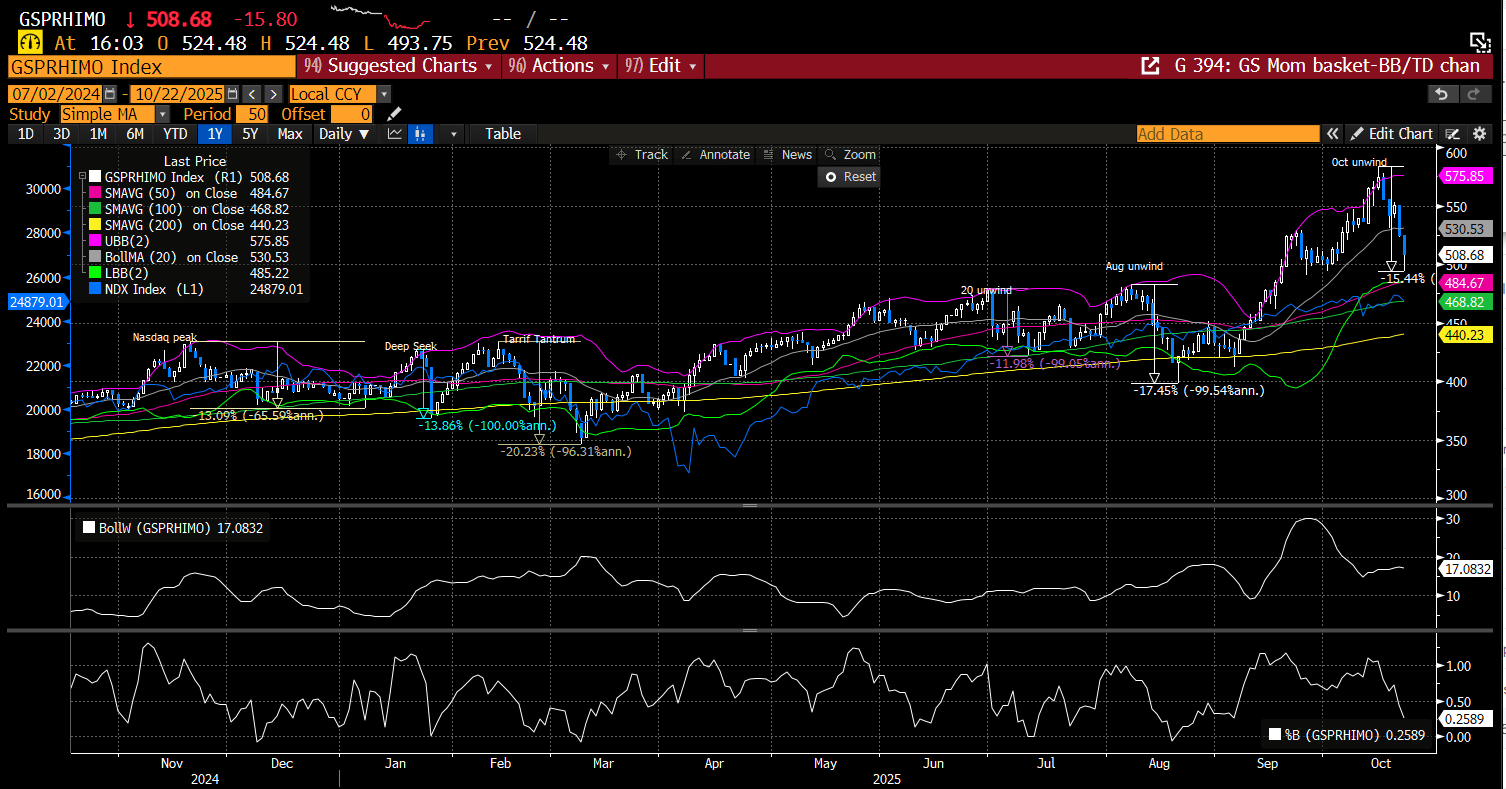

Beneath the surface, however, single-stock volatility has exploded, particularly in the speculative corners of the market. The Goldman Sachs Momentum Basket serves as a useful proxy: its -15.44% drawdown mirrors previous deleveraging episodes. Could it worsen? Certainly—but a look at the lower Bollinger Band suggests that most declines tend to stabilize near that level. This implies another 3–4% downside before volatility abates and stabilization sets in, signaling we may be approaching the final stage of the deleveraging event.

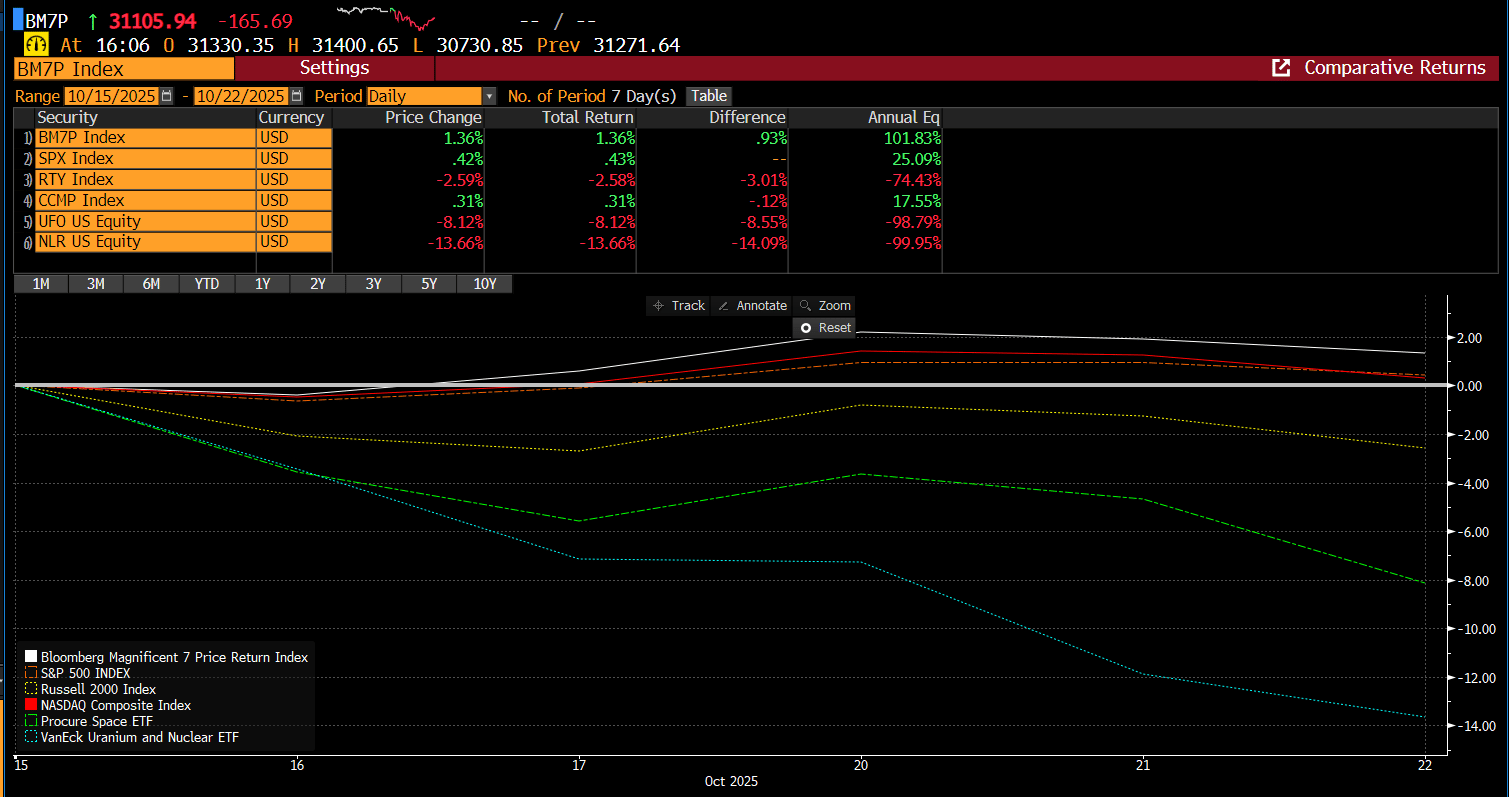

The more speculative pockets of the market have experienced sharp drawdowns over the past couple of weeks. In our 10/15 report, we highlighted two areas that were exhibiting unusual relative strength at the time. One of those, nuclear stocks (NLR ETF), has since been decimated—down more than 18% from its peak shortly after that report was published. This underscores the aggressive unwinding of risk taking place beneath the surface, even as the major indexes appear stable.

Similarly, space stocks (UFO ETF) have fallen nearly 11% since that same report, further illustrating the broad-based pressure on speculative themes. Together, these moves highlight how risk appetite has narrowed considerably, even as headline indexes continue to mask the underlying volatility.

To be clear, we were not advocating short positions or suggesting investors sell these names, but rather highlighting where momentum had been concentrating. Are these stocks “dead”? We don’t think so—but for now, they’ve certainly lost their mojo.

What’s more interesting to us is determining whether capital is actually leaving the market or simply rotating into other areas. We believe it’s the latter. As we noted in our 10/19 report, the Mag 7 stocks have continued to show impressive resilience, which remains a key reason why we’ve maintained a bullish bias on the broader market.

Here’s that excerpt:

It’s becoming increasingly clear where capital is rotating. While earnings season is still underway for this group—Tesla reports tonight—the Mag 7 stocks continue to show the greatest resilience amid the current deleveraging phase. These names have consistently held up best while speculative segments unwind, and we would look to allocate incremental capital toward the Mag 7 leadership cohort as the rotation continues to unfold.

The Mag 7 has been consolidating within a defined range for the past five weeks. Should this pattern resolve to the upside, we believe the resulting move could be powerful, likely triggering a year-end chase as investors rush to reestablish exposure. Such a breakout would almost certainly pull the major indexes higher, reinforcing the leadership strength that has underpinned the market throughout 2024.

There’s nothing easy about navigating markets. It’s a constant tug-of-war between greed, rationality, and gravity. Being overexposed to momentum factors feels exceptional when they’re working, but when the tide turns, it’s easy to get swept back out to sea. A disciplined approach remains the best defense, and recognizing when the game is changing is what sets us apart.

We were right to suggest that the market was bottoming last week and reaffirmed that view in our weekend report. Still, a rising tide doesn’t lift all boats—success requires knowing where to look for alpha and when to fade momentum.

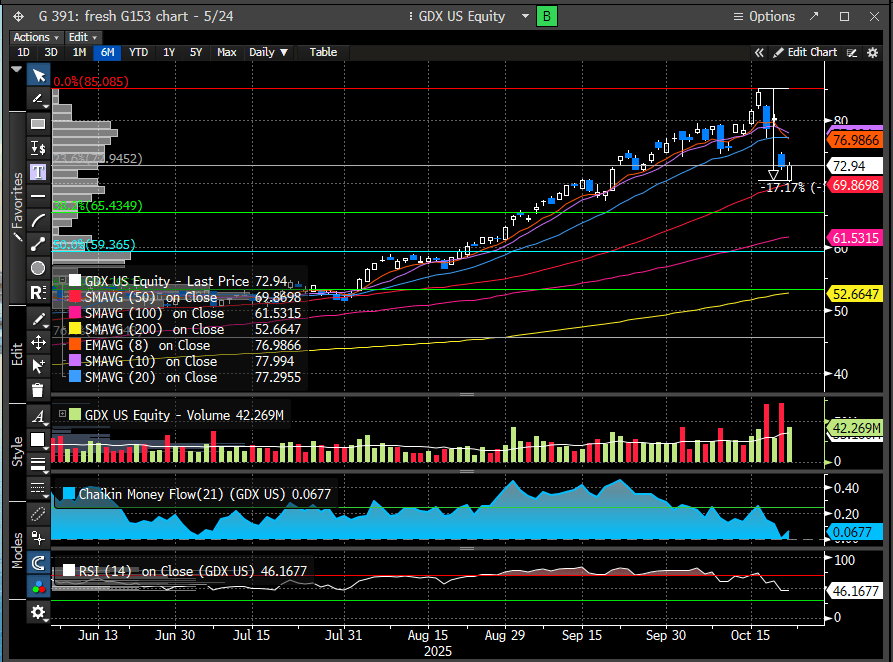

For example, in our 10/15 report, we detailed why gold appeared poised for a short-term top. That call proved timely—gold peaked the very next day and has since declined roughly 9%, validating our technical framework and disciplined approach.

Gold miners (GDX) have fared even worse, down roughly twice as much—about 17% from their highs. It’s a clear reminder that momentum cuts both ways—what fuels outsized gains in one phase can just as quickly magnify losses in the next.

We still have the bulk of earnings season ahead, along with the CPI report on Friday, both of which set the stage for a volatile couple of weeks. Our expectation is that headline CPI will show a modest month-over-month deceleration, with core CPI also exhibiting some further softening. Such results would likely ease inflation concerns and help stabilize momentum-oriented trades, as the backdrop for additional Fed rate cuts remains intact.

It’s worth recalling that this week is historically one of the weakest of the year, so the choppiness and single-stock volatility we’re seeing shouldn’t come as a surprise. The question now is simple—is it over?

Let’s turn to the charts to find out.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade