Introduction

The reversal in AI-levered equities has accelerated since our 12/14 report, More Than Meets the Eye. That note focused on what we viewed as a healthy rotation into lagging areas of the market—rather than a deterioration in overall structure. Since then, that rotation has intensified, with growth sectors, led by semiconductors, coming under increasing pressure.

Since the start of the month, the majority of sectors are now lower, with only three posting gains. Importantly, most of this damage has occurred after the 12/10 FOMC meeting, where selling pressure became decisively concentrated in technology. The market’s message has been clear: capital is rotating away from crowded growth exposure and toward other areas, not exiting equities wholesale.

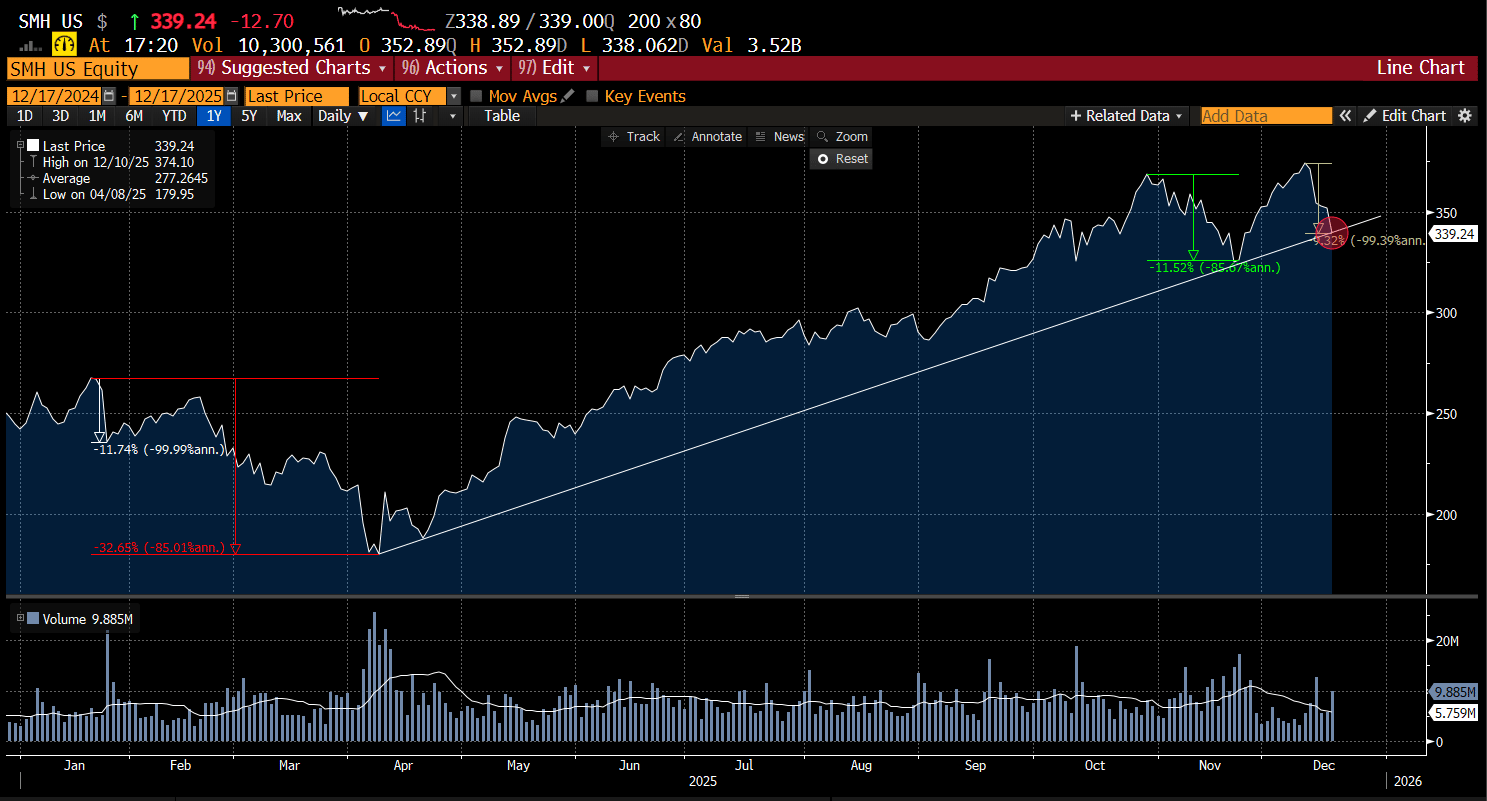

Peel the onion back a few layers and it’s clear that semiconductors are bearing the brunt of the tech unwind, with the SMH down nearly 10% in less than a week.

This move is reminiscent of the DeepSeek reversal, which similarly punished semiconductors in a compressed timeframe. In late January 2025, markets were rattled when China’s DeepSeek released an advanced AI model that rapidly gained traction, reigniting bubble fears and prompting a swift reassessment of competitive moats, capital intensity, and valuation assumptions across the AI complex.

That episode produced an initial ~10% drawdown in semiconductors, which ultimately extended into a ~32% washout following the Trump tariff tantrum. The takeaway is not that semis are fragile—but that they are no strangers to sharp, sentiment-driven corrections. A ~10% pullback is routine for the group, and this now marks the third such correction in 2025.

Technically, semiconductors are once again up against the ropes, testing the uptrend line from the April lows. Bears will argue this confirms a major top. But until that trendline is decisively broken, it remains premature to declare victory. For now, this still fits the pattern of corrective pressure within a broader uptrend—rather than a confirmed structural failure.

That said, the bulls clearly have their backs against the wall. The 50-day moving average was decisively lost on Wednesday on expanding volume, and the risk of a double-top formation continues to grow. Today’s fill of the November gap may prove sufficient to reset sentiment in the near term, but without a swift reclaim of key upside resistance, semiconductors remain guilty until proven innocent.

The recent DeMark Sequential 13 sell marked the peak, and the buy-side count remains roughly five days away.

After Wednesday’s close, MU reported very strong results and is trading sharply higher in after-hours (+8%). That said, the prevailing market regime has been to sell good news, making Thursday’s reaction especially important. The key question is whether MU can help establish a near-term floor for the group—or if strength is once again met with supply.

Why do semiconductors matter so much? Because they have been the primary champions of the 2025 bull market. Every bull market requires leadership, and without it, the weight of the technology complex—roughly 40% of the SPX—becomes a liability rather than a tailwind.

We would like to believe that small caps, financials, or even commodities can seamlessly assume that leadership role. History suggests otherwise. Small caps tend to benefit from bull markets, but they rarely drive them on their own. True, there are exceptions—most notably the 2003–2007 cycle, when leadership came from Energy, Materials, Industrials, and Financials amid China’s industrial boom, global credit expansion, and a commodity supercycle. But that was a fundamentally different environment. Technology participated, yet remained a relative laggard as it digested the aftermath of the dot-com bust.

In contrast, disinflationary, productivity-driven bull markets almost always require technology leadership. That is why the current breakdown in semiconductors matters.

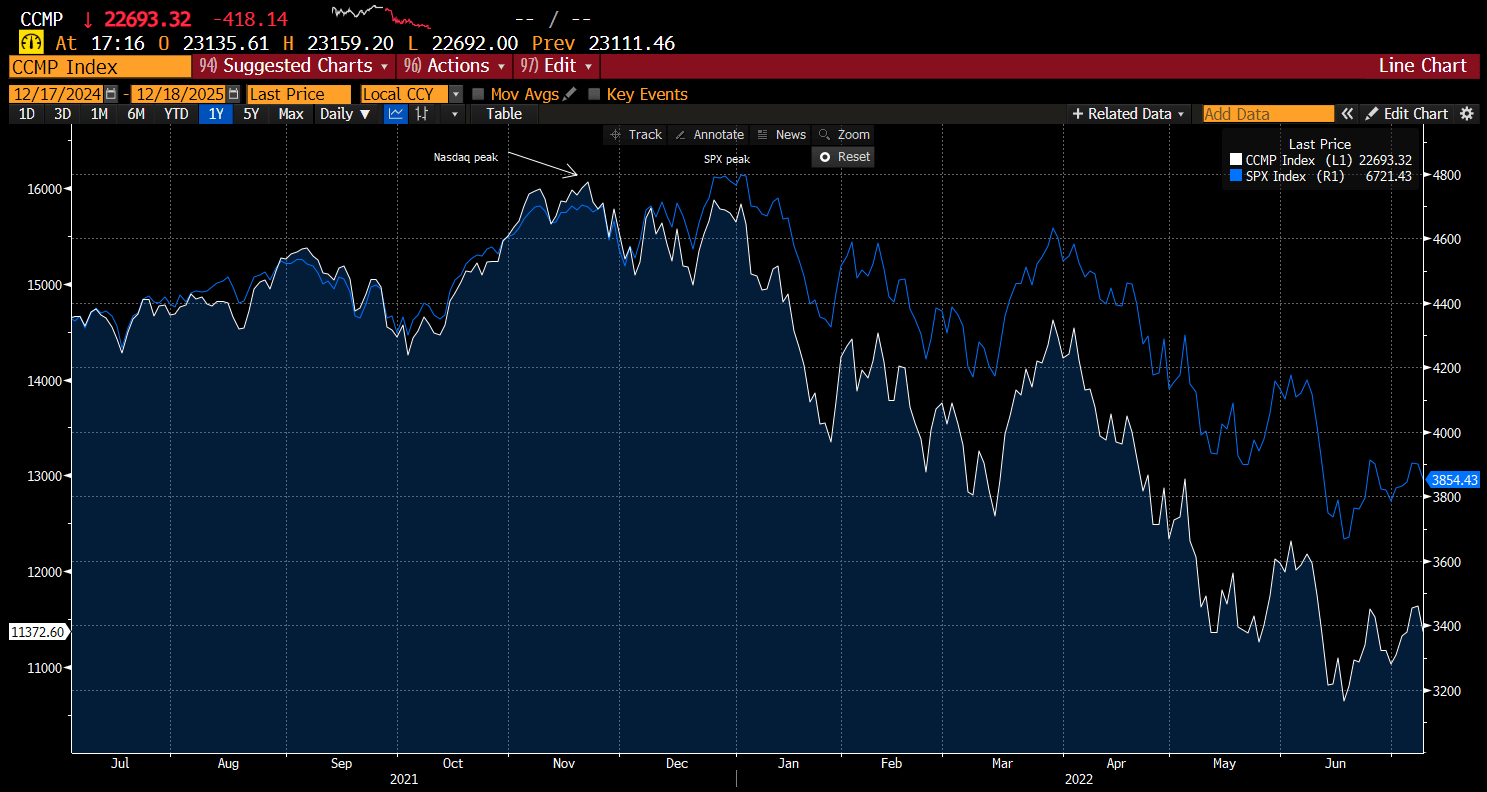

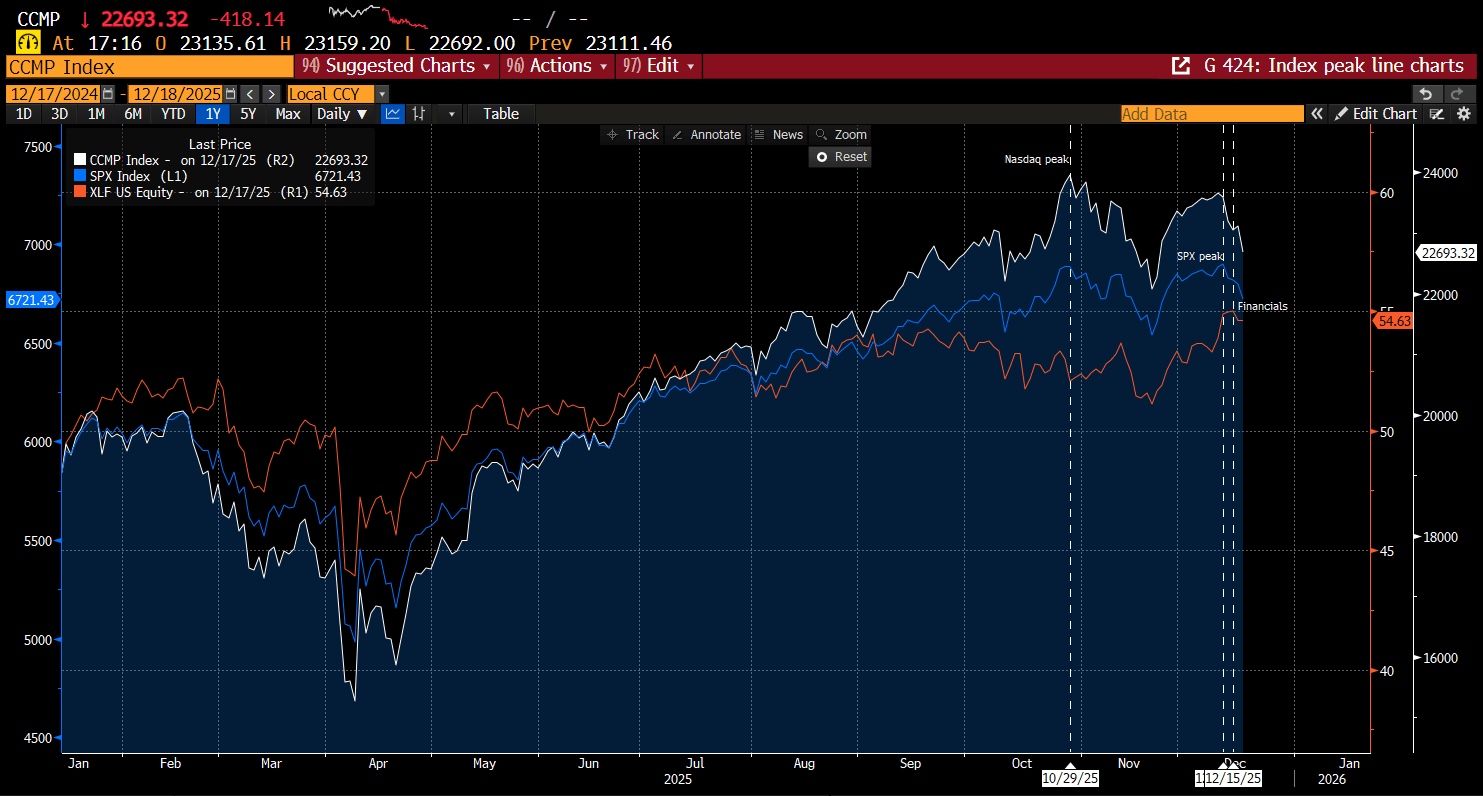

So yes—we are concerned. Several major technical levels across the indexes have been violated and need to be repaired quickly. If they are not, the risk grows that 2026 begins to resemble 2021–2022 more than a clean continuation higher. Recall that in 2021, the Nasdaq peaked in November, while the SPX did not top until January—an early warning that leadership was deteriorating well before the broader market fully rolled over.

That is the risk we are now monitoring closely.

Fast forward to today, and the parallels are hard to ignore. The Nasdaq peaked on October 29, while the SPX followed with a peak on December 11—a separation of roughly two months. The resemblance to prior topping sequences is notable. As Mark Twain famously observed, “History doesn’t repeat itself, but it often rhymes.”

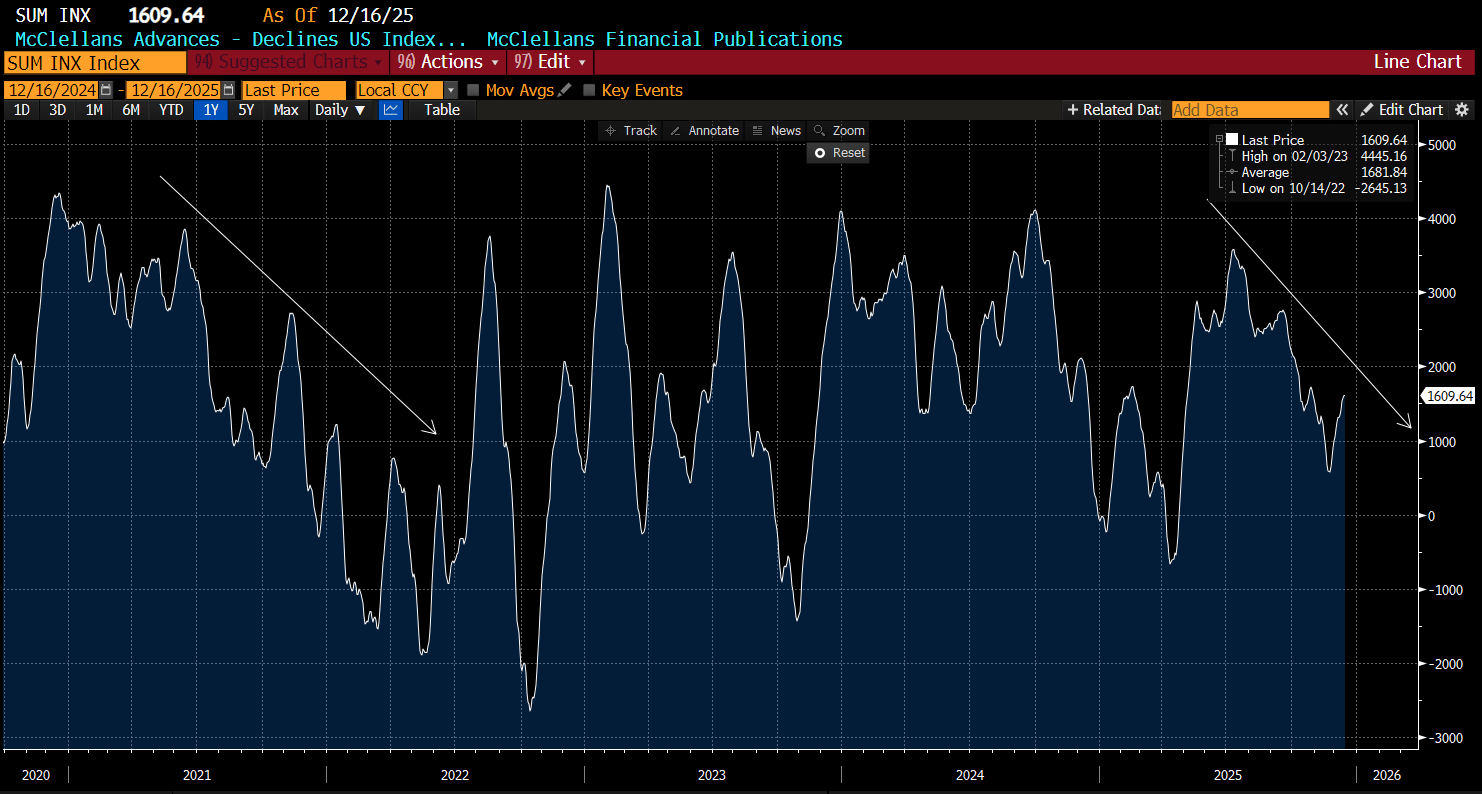

If we look at breadth during that period, the McClellan Summation Index (MSI) also peaked well ahead of the major indexes—a pattern that shares notable similarities with what we’re seeing today.

To further underscore the leadership point, when we overlay the Financials sector (XLF) on the chart, we see that Financials peaked in mid-January 2022, after both the Nasdaq and the SPX had already rolled over.

Fast forward to today, and we’re seeing a strikingly similar sequence, with Financials printing a new all-time high shortly after the SPX peak.

That’s enough doom and gloom. This analysis may ultimately prove inconsequential, but it does require us to remain open-minded to the possibility that the bull market may already be behind us.

Time to check a few more charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade