Table of Contents

Introduction

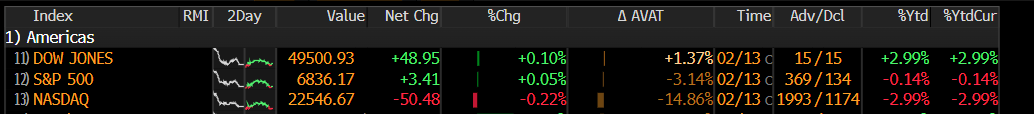

The stock market has been wrestling with direction for months. The S&P 500 has effectively gone nowhere since late October, while the Nasdaq has fared worse, failing to make meaningful progress since September. So what gives?

We could list a litany of reasons behind the lack of upside follow-through—many of which we’ve discussed in prior reports—but our objective is not to obsess over the why, only the what. And right now, the weight of the evidence is shifting.

Back in November, we highlighted a subtle but important divergence: the Nasdaq’s failure to confirm new highs alongside the SPX. That setup was reminiscent of early 2022—an environment where surface stability masked growing internal fragility. At the time, it was a hypothesis. Today, it’s a developing concern.

We’ve spent the last month hammering on the same point: bifurcation is widening and dispersion is accelerating. That’s not a healthy backdrop—and it’s why we’ve leaned into cyclicals as the most reliable source of alpha.

We’ve repeatedly flagged the defensive shift beneath the surface, with the Consumer Discretionary vs. Staples ratio failing to confirm the SPX highs and now breaking key pivot support.

These are just a handful of the warnings we’ve been flagging as we navigate an increasingly difficult market environment. More importantly, we’ve consistently urged restraint in deploying new capital, as risk appetite beneath the surface was already deteriorating. That shift is now beginning to manifest, with two of the major indexes already in the red just six weeks into the year.

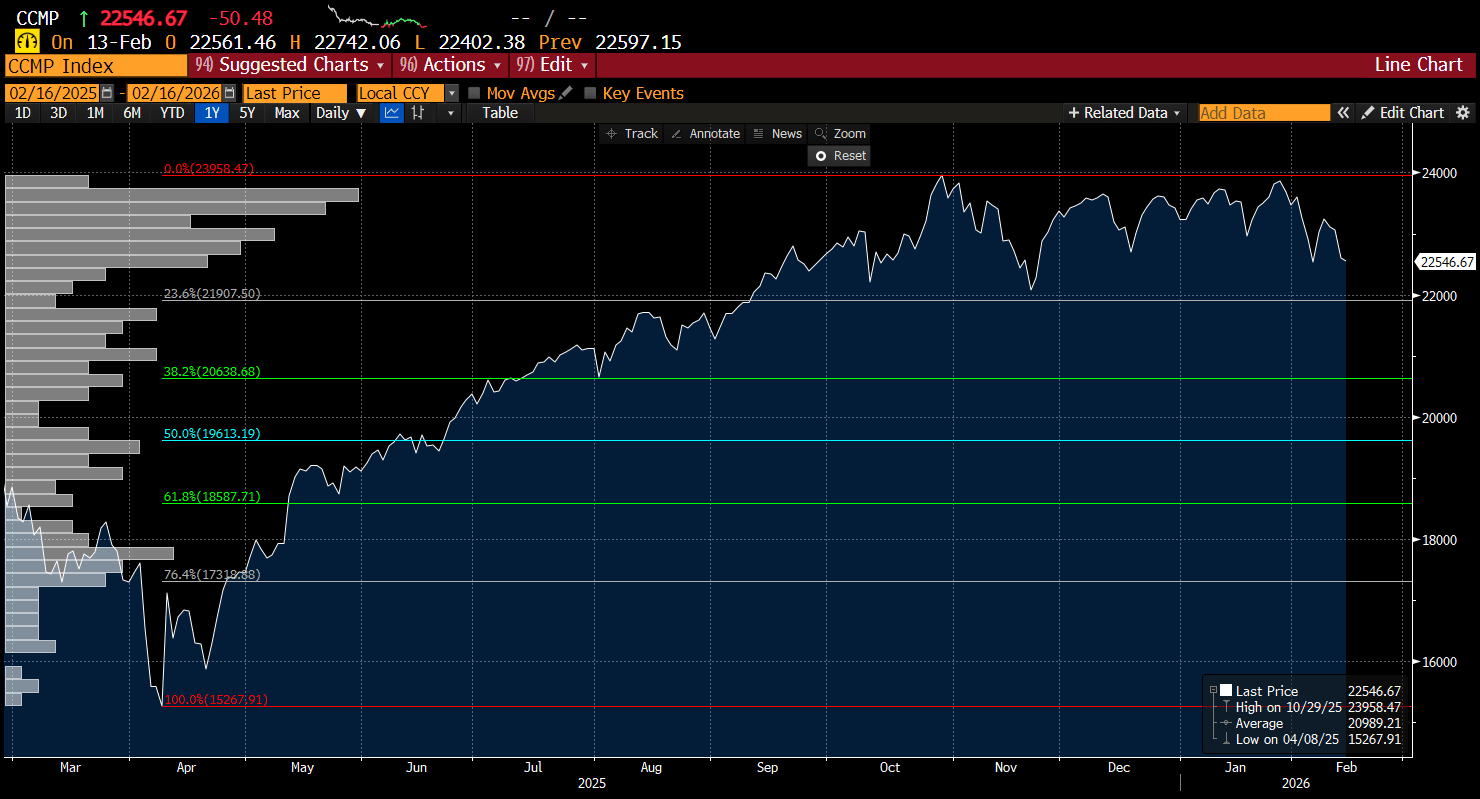

Markets rarely top without a fight, and that’s largely what we’re seeing. The SPX remains just a few percentage points off all-time highs, masking the growing damage beneath the surface. The real deterioration has been concentrated in the Nasdaq, driven primarily by weakness across large-cap technology and the Mag 7 (ex-semis). The index is now down roughly 6% from its peak, retesting the lows from two weeks ago while carving out a lower high and a lower low in the process. That is the early anatomy of a developing downtrend.

Or are we simply stuck in a broad, six-month trading range, bounded by the 23.6% Fibonacci retracement off the April lows? There’s no way to answer that question with certainty. Bears will argue a more severe drawdown is unfolding, while bulls will frame this as nothing more than a bullish consolidation within an ongoing uptrend. We have our own leanings, but as always, we let the weight of the evidence guide positioning—and that evidence is becoming increasingly negative.

Our tactically bullish bias—buy dips, sell rips—has served us well. Markets have oscillated between bullish and bearish regimes for months, creating opportunities to exit positions into strength while selectively adding on weakness in favored sectors. That said, the negative crosscurrents building beneath the surface are becoming harder to ignore.

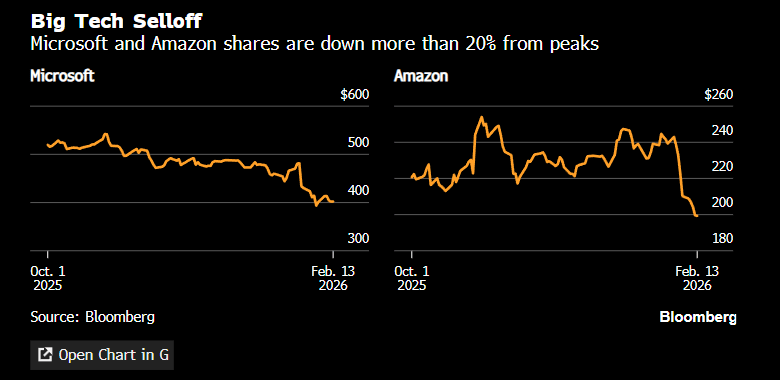

Much of the recent weakness in technology has been tied to AI-driven disruption. What began as a sector-specific concern is now starting to broaden, with investors increasingly de-risking companies perceived to be even marginally exposed to displacement risk.

The latest group to fall under the AI overhang has been trucking and logistics. Whether these fears are ultimately overdone is beside the point—markets rarely wait for clarity before repricing risk. There will be clear winners and losers, but in the meantime, investors are de-risking broadly rather than underwriting the nuances. That indiscriminate behavior will eventually normalize, but the key question is at what level—and on what timeline.

Another issue weighing on the market is growing skepticism around the return profile of massive AI spending. Investors are increasingly questioning explainability and timing, particularly as tech giants like Amazon, Meta, Microsoft, and Alphabet commit hundreds of billions annually to the buildout. According to UBS, this level of capex could consume nearly 100% of hyperscalers’ operating cash flow, versus a 10-year average closer to 40%.

Is this a “DeepSeek moment” part two? It’s starting to feel that way. Markets are increasingly entertaining tail-risk scenarios around AI-driven displacement, with fears that widespread disruption could eventually undermine labor markets and, by extension, consumption. In that scenario, the durability of current AI infrastructure spending would naturally come into question, as weakening end demand would ultimately force a reassessment of capex intensity.

These concerns are not entirely baseless. Recent labor data—including payroll revisions and a broader expansion in layoffs—suggests early cracks that are amplifying investor anxiety. That said, markets have a tendency to front-run outcomes and overshoot in both directions. The reality is likely more nuanced. As investors gain confidence that disruption will be uneven rather than ubiquitous—and that AI can serve as an enabler of productivity rather than a wholesale replacement—the most heavily impacted areas could begin to stabilize. Until then, elevated volatility should be expected.

Importantly, we are already seeing conditions that can fuel sharp reversions. Positioning has become increasingly crowded in perceived AI “losers,” with short interest building rapidly across select pockets of the market. That creates the setup for tactical stabilization and episodic mean reversion, even within a more fragile broader backdrop.

If a turn is approaching, it should begin to show up in the data. Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade