Table of Contents

Introduction

Bullseye! Our tactical upside targets for the SPX have now been achieved. Since early April, we have consistently advocated for adding long exposure (4/6 report), where we stated:

“…we expect a sizable counter-trend rally to begin this week and will be adding long risk for a tactical bounce.”

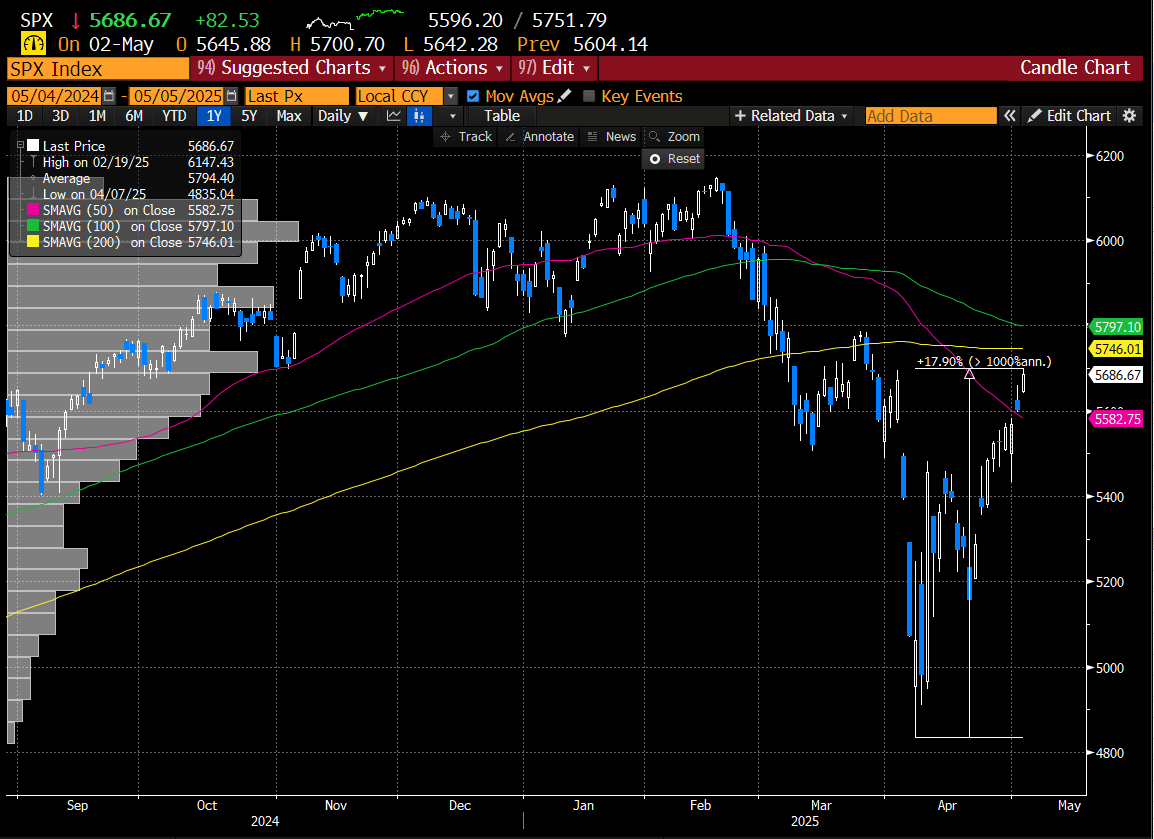

The SPX bottomed on April 7th and has since rallied approximately 18%.

We didn’t just anticipate the rally—we also suggested it would consolidate after the April 9th tariff pause, with any pullback presenting a buying opportunity.

On 4/9, we wrote:

“Our view is that this zone is likely where the SPX will pause—if not stall—on the initial move higher, setting the stage for a period of consolidation.”

The SPX subsequently pulled back nearly 7% from April 9th, offering traders and investors a prime opportunity to buy into weakness.

Reaffirming our stance on 4/13, we said:

“Our tactical view remains supported: extreme dips should be bought, as we anticipate a potential move into the resistance zones we’ve outlined.”

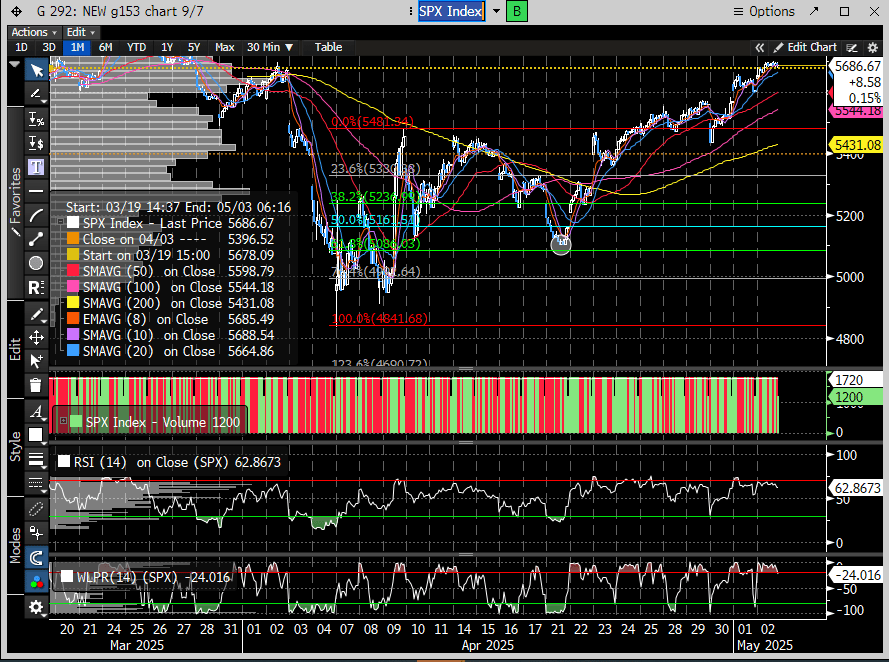

Where were those resistance zones outlined in the 4/13 report?

“The first level of resistance is the confluent zone 5490–5570 (white gap window/50% retracement and 20-day SMA). We suspect this zone will find sellers, at least initially. The next more formidable confluence zone to consider is 5646–5750 (61.8% Fib/5650 pivot/red gap window/200-day MA).”

Where did the SPX top out on Friday? 5700 — right in the heart of our projected upside range.

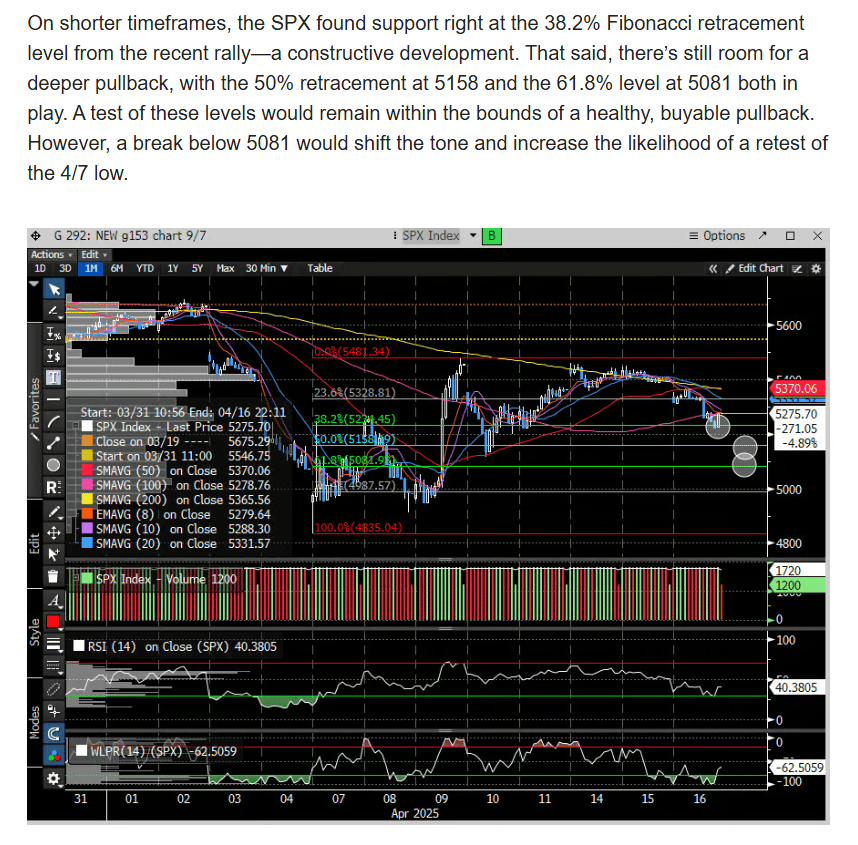

In our 4/16 report, we also provided clearly defined levels where traders could consider adding exposure on weakness. We wrote:

“…there’s still room for a deeper pullback, with the 50% retracement at 5158 and the 61.8% level at 5081 both in play. A test of these levels would remain within the bounds of a healthy, buyable pullback.”

Below is the full excerpt along with the accompanying chart:

Where did the SPX bottom on 4/21? 5100 — right in the middle of the buyable range we outlined.

So yeah—Bullseye!

Over the past week, stocks logged their best win streak in 20 years. All the losses since “Liberation Day” have been completely erased. Being overly negative at the lows comes at a cost—not just in performance, but in missed opportunity. No one has a crystal ball, but we deal in probabilities, and when they stack in your favor, it’s time to act, not freeze.

Our goal is to provide a clear, actionable roadmap for navigating the market—and frankly, we believe we do it better than anyone. Year after year, we’ve delivered alpha across all types of environments, and our performance speaks for itself. (And yes, we were negative in late February, calling for more downside in the indexes just ahead of the "Liberation Day" selloff.)

What’s even more interesting is how bearish the so-called "professionals"—pundits, investors, and Wall Street strategists—continue to sound. Just look at this week’s Barron’s cover story:

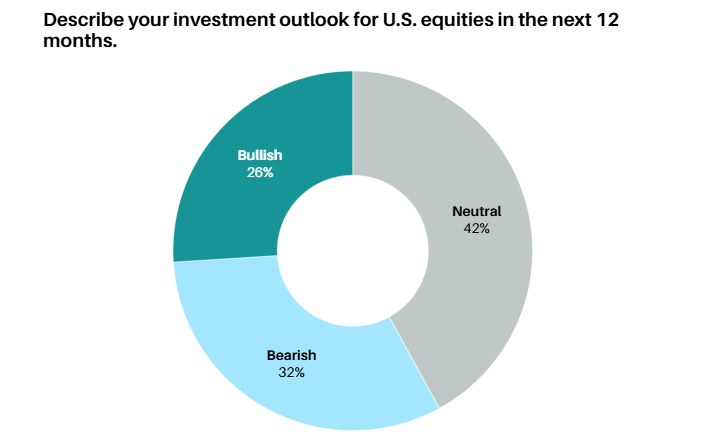

You honestly can’t make this stuff up. Last fall, 50% of managers were bullish and only 18% were bearish. Fast forward to today, and their new outlook is shown below:

The article also notes that managers' clients are even more pessimistic than the pros themselves: 56% say their clients are bearish.

Sentiment is a powerful tool — we talk about it every week. When too many investors pile onto one side of the boat, it usually capsizes. What’s even sadder? If prices keep levitating, all these bearish responses will inevitably flip bullish. Price has a funny way of changing minds.

The reality is, not much has fundamentally changed in the last month to cause this stock market reversal — except for the 90-day tariff pause. No actual trade deals have been announced, just a lot of hype about "progress." We specifically called out the April 7th lows as the point of maximum uncertainty and argued a tradeable low had been established after Trump’s tariff pause.

The so-called “pros” who missed the bottom are now doubling down on their bearishness, claiming the rally is overdone and the economic damage hasn't filtered through yet. They’re probably right about the damage — but stocks don’t have to follow the economic script. This is exactly why we follow price: because opinions are dangerous.

Price told us the bottom was close as stated in our April 6th report.

Price confirmed a tradeable bottom on April 7th.

Price is why we ignored the doom and gloom headlines that dominated the landscape.

If price isn’t part of your investment process, it’s time to reconsider. Stubborn bias has no place in the stock market. Opinions don't make money — price does. When we’re wrong, we change course immediately, without hesitation.

We can debate endlessly whether the rally off the lows is justified. But price leads news, and we’ve been arguing all last month that the stock market was discounting a resolution. That means the rally should continue until either expectations shift, or the news is officially reported.

This weekend, we saw even more conciliatory signals from Trump, including talk of lowering tariff rates with China. As we move closer to the expiration of the 90-day pause and toward potential trade deals, we need to prepare for a narrative shift back toward the economy — and the damage already done by tariffs.

We’re already seeing significant degradation in port data, with reports that Chinese overseas freight traffic is down by as much as 60%. It’s unrealistic to expect a collapse of that magnitude not to have serious economic consequences. But will investors look through it toward normalization?

Fortunately, we don't have to guess — price action will tell us, and we’ll continue keeping you one step ahead of the market’s next major move.

Now let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade