Table of Contents

Introduction

"Being early is the same as being wrong." It’s an old Wall Street adage—and a reminder that Timing is Everything in markets. The good news for our readers? That’s exactly what we focus on.

Contrary to what you've been told, market timing is not a fool’s errand. That myth persists mostly because the people repeating it either:

Don’t have the skill to do it with any consistency, or

Benefit from keeping you invested at all times, often via fee-based models where the priority is not returns, but asset retention.

To be clear, we’re not dismissing buy-and-hold. It works. Just look at the SPX—up nearly 10x since the GFC lows. But we believe there’s a smarter way to navigate markets: one that balances risk and reward through timing, positioning, and a tactical edge.

But if you’ve been following us for any length of time, you know that’s not our game. We don’t chase headlines or throw out arbitrary SPX targets—except in the context of clear, pattern-based terminations. Our real objective is helping readers navigate volatility and stay aligned with the market’s true trend.

Markets don’t move in straight lines. The swings—if timed well—can be highly profitable. That’s where we focus. For example, we turned cautious in the second half of February, just before the market declined nearly 20%. Then, on April 6th, we turned bullish—one day before the SPX bottomed. That’s not luck. That’s experience. Years of studying the rhythm of markets, understanding how key instruments interact, and knowing when probabilities shift.

A major part of that edge comes from DeMark analytics, which we rely on to pinpoint where trends are likely to change. Tom DeMark has built an entire firm dedicated to the science of market timing, and his tools help identify inflection points with precision across virtually any tradable asset. It's an incredibly powerful framework—and one we’re proud to incorporate into our work.

As a reminder: a DeMark Combo 13 buy signal printed on April 8th—just one day off the ultimate low.

Just last week, we made two high-conviction calls—long Oil, short SPX—both outlined clearly in our prior week’s report.

In our 6/8 report, we wrote:

“Oil has sprung back to life and is now threatening to reclaim the key $65 pivot. A successful reclaim would mark a failed breakdown—such failures often trap sellers and can trigger sharp, rapid price moves… Oil is also forming a classic cup-and-handle pattern… The measured move target on a successful breakout is around $75. We would consider initiating a long position on a decisive break above the $65 neckline pivot.”

On Friday, Oil traded as high as $78, completing the bullish pattern before settling around $73—a nearly 20% move in a matter of days.

Some might argue that the move was “luck,” driven by the sudden escalation in Iran-Israel tensions. That’s a misread of what actually happened. Price had already been telling us that something was brewing. The structure was there, the reclaim was real, and the setup was clear. It’s a reminder that markets move before the headlines. Israel’s actions were not decided overnight—someone knew, and that information expressed itself in the instrument most sensitive to Middle East risk: Energy.

We didn’t know why it was moving—we only knew that it was moving, and that's exactly why we follow price over opinion.

Similarly, in our 6/8 and 6/11 reports, we highlighted a clear confluence of DeMark sell signals across global indices, alongside building divergences and major U.S. indexes nearing our predefined sell zones. Did we know that geopolitical stress would be the catalyst? No. But, as we’ve said many times: DeMark signals often flash before the market finds its “reason.”

We even titled our 6/11 report, almost prophetically:

“Sometimes We All Need a Push.”

We were talking about the market.

Here’s a quote from that report:

“Sometimes the market just needs a push— whether it’s unexpected geopolitical news, a macroeconomic release, or the end of OPEX — to trigger a reversal.”

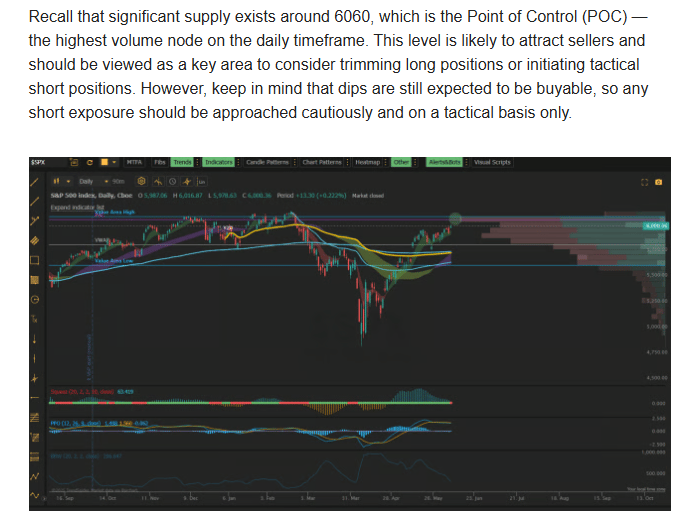

If you fancy precision, here is an excerpt from the 6/8 report:

The SPX topped last week at 6059, one point shy of our tactical sell target.

We work with a wide range of investors—from casual traders to some of the most sophisticated hedge funds and professional money managers in the world. No matter where you fall on that spectrum, there’s a place for our research in your process if you’re involved in the markets. We hope you’ll agree.

Over the past 48 hours, the conflict between Israel and Iran has escalated and shows little sign of resolution. As a result, volatility is likely to rise, just as we anticipated in our 6/8 report.

Here’s an excerpt from that report, where we discussed our expectation for a spike in volatility:

The VVIX was up 10% on Friday and up 31% for the week.

The VIX was up 15% on Friday and also up ~31% for the week.

In addition to rising geopolitical uncertainty, all eyes will be on this week’s FOMC meeting, where policymakers are expected to update their interest rate outlook. The release of the updated Dot Plot could reveal a shift from the previous guidance of two rate cuts this year to just one, reflecting the evolving economic landscape.

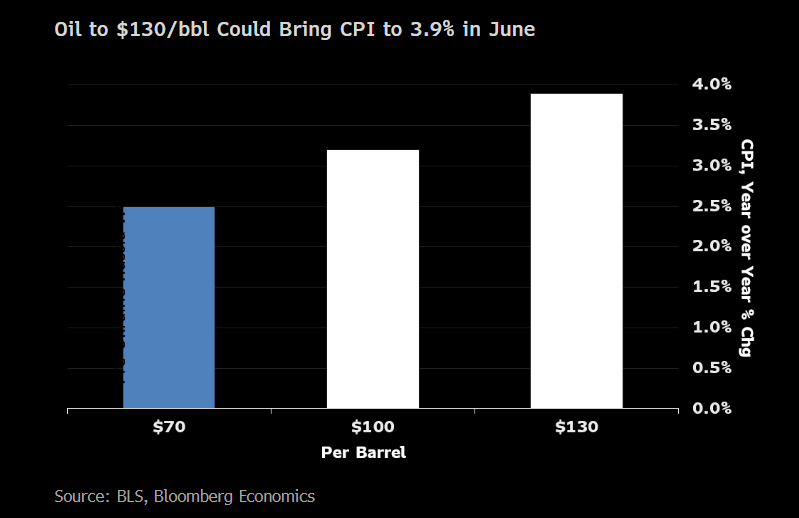

Bloomberg notes that a sustained rise in oil prices could complicate the inflation outlook, potentially delaying the Fed’s rate cut trajectory. This would almost certainly muddy the Fed’s messaging and keep Chair Powell cautious in his forward guidance. Could a more hawkish Powell inject additional volatility into an already fragile market setup? It’s certainly a risk worth considering.

Interestingly, the bond market appears to be front-running this risk, with the 2-year yield rising on Friday despite heightened geopolitical tensions—an environment that typically triggers a flight to safety into Treasuries, not out of them.

Markets are constantly navigating through a storm of challenges—and that’s where we come in, helping you stay on course. With heightened volatility and shifting macro dynamics this week, expect some compelling setups. We’re ready to help you capitalize.

Now let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade