On June6th we wrote in this newsletter to be cautious with oil and oil stocks. That proved to be quite prescient as both got obliterated (WTI -17% and XLE -25%). We then flipped around last week (Jun 23rd) and suggested to play this trade from the other side. There was quite a bit of confluence and the DeMark signals had flipped to buy.

That trade returned +10% for WTI and XLE until yesterdays intraday reversal.

The market is still in a bear trend and why we always suggest to leg out of counter trend trades as they work and raise stops on residuals. In fact in our last weekend report we were quite adamant about this last rally attempt likely being a bear market rally. We explicitly wrote these exact words. Here is the excerpt:

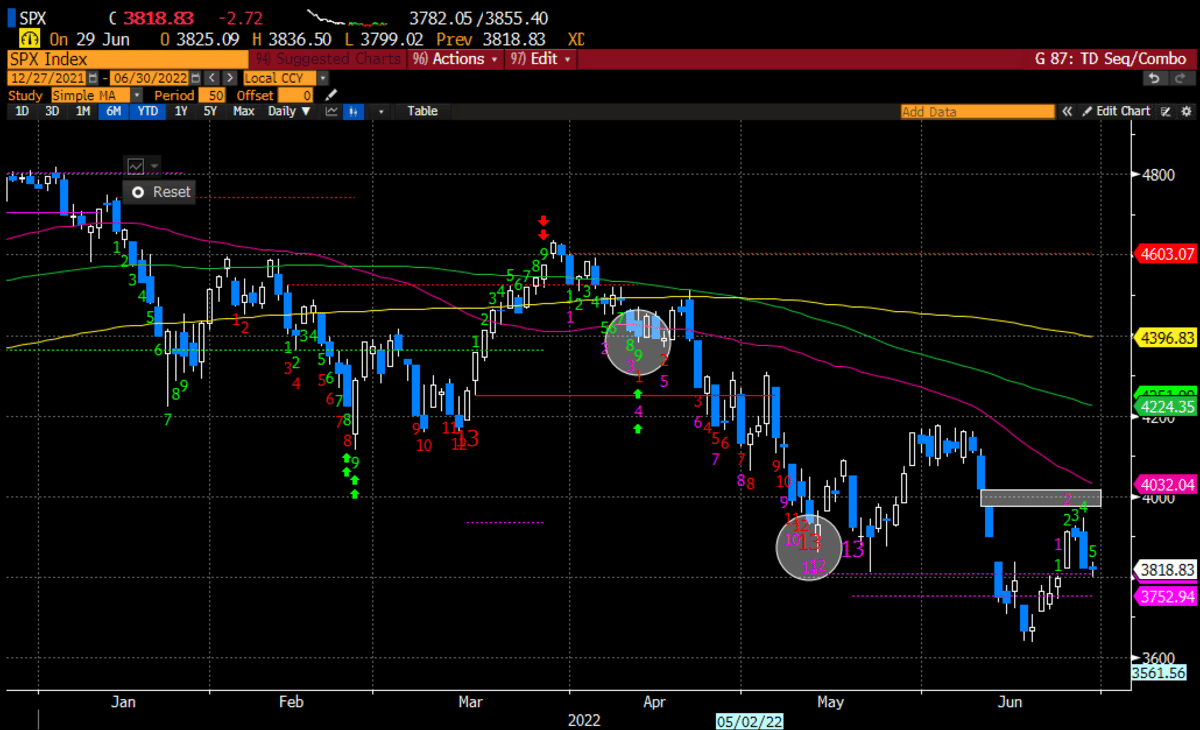

We had been targeting SPX levels in the 3900-4K range for the counter trend rally. The SPX got as high as 3950 and rolled. We didn't have enough juice to meet the 2nd gap target and why it's important if playing counter trend moves, to adjust residual stops higher.

The Nasdaq also hit our gap target and rolled over, so the desired countertrend bounce did occur into very defined levels.

As we write this, SPX futures are getting hit quite hard as the macro data continues to muddy the picture. It's hard to make a case that this will abate anytime soon, in fact, we can see it getting much worse. The bigger question is how much of this is being priced in?