We always tell our readers that we follow price first. What exactly does that mean? It means that the direction of market instruments is the collective wisdom of trillions of $’s in capital, and when certain price patterns reveal themselves, a technical trader pays attention. Put simply, when price does something unique or special, we must adjust.

Let’s review the simplest of price patterns that occurred last Oct after the CPI print. We have written about this extensively so we will keep this brief, and if interested in learning more please review our reports from that time period.

The candle from that day in Oct marked the exact low of the bear market. This was a bullish engulfing candle after a hot CPI print.

This rally occurred in the face of a horrible news cycle, another hot CPI print, with the Fed still aggressively raising interest rates, and the upcoming earnings reports slated to be a disaster. Yet the stock market began to look past it as it always does. We do not know when or why this is happening in real time. But we pay attention, look for confirmation, and adjust our thinking. Being flexible in the stock market, that has a historical tendency to do the opposite of what the consensus believes should happen, is of utmost importance.

Here is a snapshot from a Bloomberg News article that Oct week, which should give you a flavor for what was being expressed in the media:

One word described the tone: depressing. While most market participants were calling for the end of the world, we took the opposite tact and started taking bullish positions in Oct. This worked out wonderfully as the market rallied into year end. We got even more aggressive with our long positioning in late December and sold everything into the Feb peak.

Fast forward to the middle of this year, when all the market naysayers were calling for a revisit of the Oct lows, we got aggressively long. Why? Because the 4200-pivot formed a very standard cup and handle break, with a measured move target of 4600. Where did the SPX stall out last week? 4607.

We just showcased two very standard technical patterns that could have yielded stubborn bears, very sizeable returns, if they had paid attention, instead of arguing their case that the market is overvalued, that this is a bear market rally, and will eventually revert back to those Oct lows. Meanwhile the SPX is up over 1000 points and those bears have officially been left behind.

Maybe this is just one large bear market rally, and we will revert back to the lows. Maybe it is and they will be vindicated. But what if it’s not? Our analysis is designed to keep our readers on the right side of the market, regardless of how we think about the economy’s fundamentals. If the market wants to revisit the lows, there will be very identifiable patterns and thresholds broken indicating such. Meaning we will participate on the downside because the price action will indicate it wants the market wants to sell down.

Last week, we discussed that tops in the stock market are typically a process. Meaning, absent some exogenous news event, there will be a series of weakening patterns that could flip the structure of the market to negative. We have been on record talking about the “easy money in the market” has already been made. This doesn’t mean you can’t make money long going forward, it just means we have to be more tactical about allocating capital.

We pride ourselves on being early into large rotations or even certain single stock ideas. We attempt to catch a trend before it begins. Most technical traders are always looking to follow a trend for as long as they can but do not have the fundamental logic to consider out-of-favor sectors. Recall that we come from a fundamental background, so we understand this better than most traders. We combine our fundamental views and proprietary analytics to accumulate sectors before the masses decide they are worth considering.

Our early work around the Chinese ADR’s blasted on to everyone’s radar last week. Fortunately for our readers, we discussed this thematic in our Jun 15th, report.

Here are some excerpts:

“we do think there could be a mini bull starting in China”

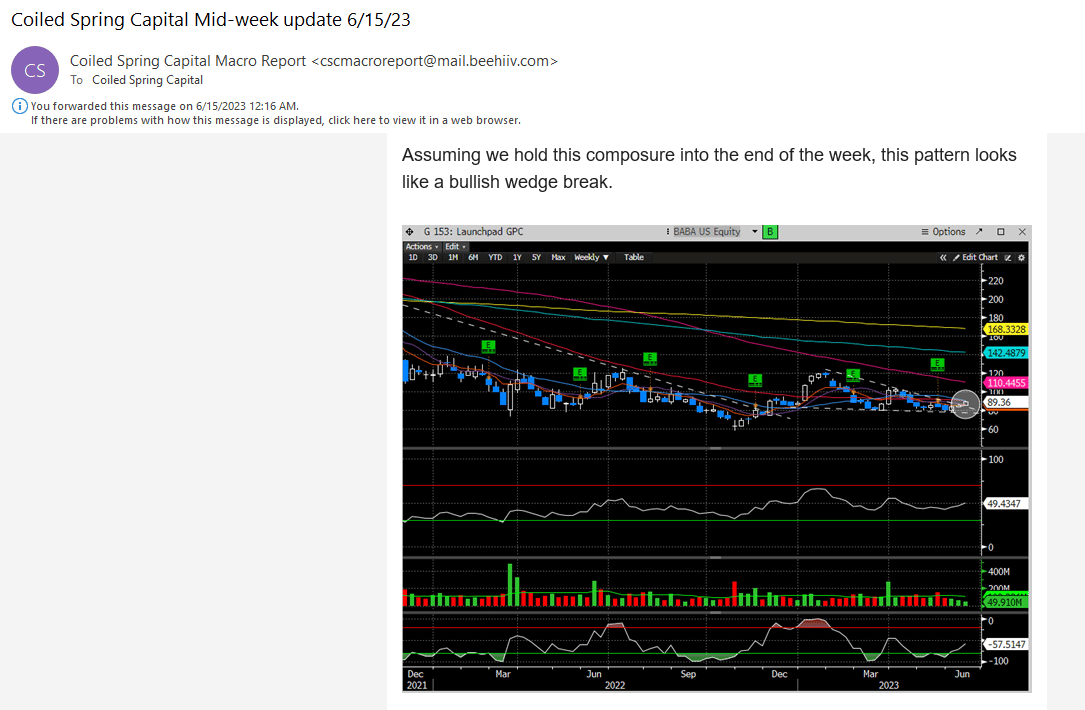

$BABA idea presented:

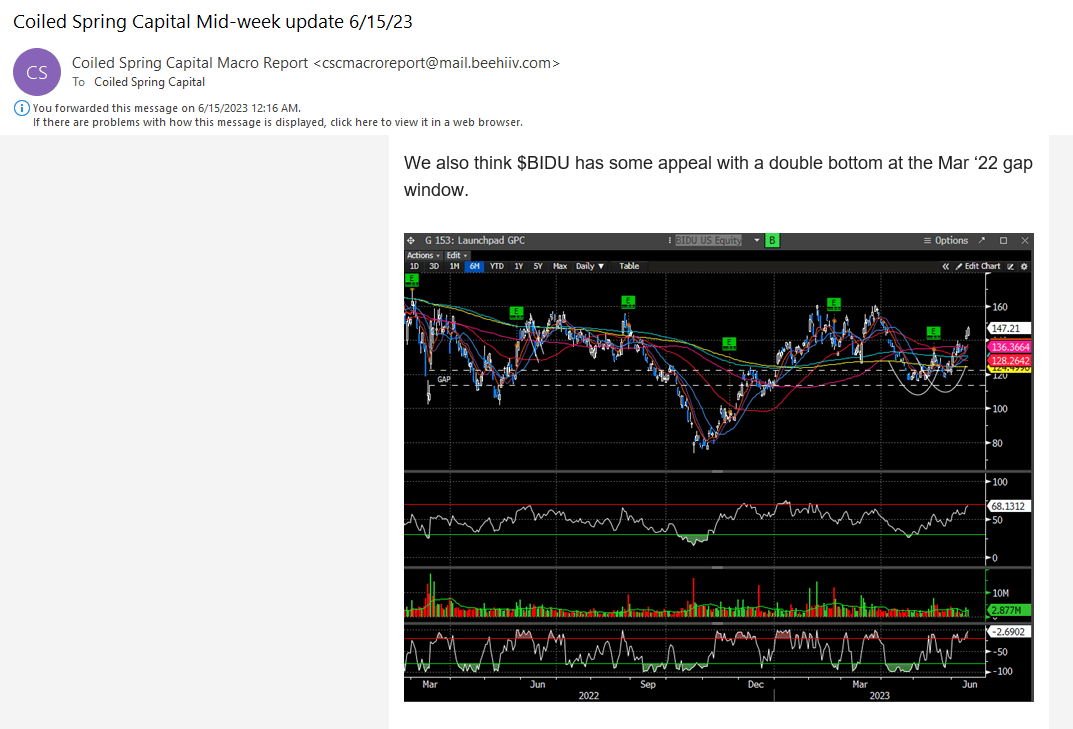

$BIDU idea presented:

$NIO idea presented:

$PDD idea presented:

Performance of these ideas since this report:

$BABA +12%

$BIDU +5.4%

$NIO +65%

$PDD +14%

We are not an alert service, but we present ideas for our loyal subscribers to consider trading for themselves. Our newsletter is very affordable and designed for people to consider a different perspective when trading or investing in the stock market.

We think we provide more than enough value for the price. We hope you agree.