In our 10/6 report, we highlighted several reasons why being bearish on the stock market was premature. We often emphasize the importance of digging deeper when analyzing indexes, as true insight lies beyond surface-level charts. Drawing lines and arrows may create a visually compelling narrative, but real analysis demands more than sensationalism—it requires sound due diligence to determine the true direction of the market.

At the end of the day, it’s not always that complicated. Yet, people often overcomplicate things with fancy analogs or intermarket relationships that overlook the most critical factor: price.

Price is what matters. It’s what ultimately gets you paid in the stock market.

In that same 10/6 report, we pointed out three ETFs that were on the verge of breaking higher. If those major sectors were poised for further trend continuation, then the stock market’s likely path was clear—up!

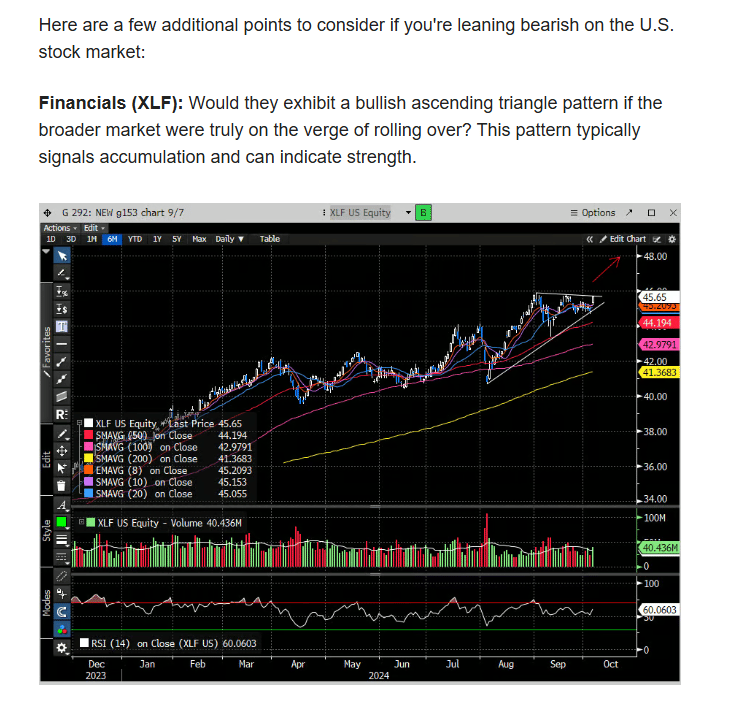

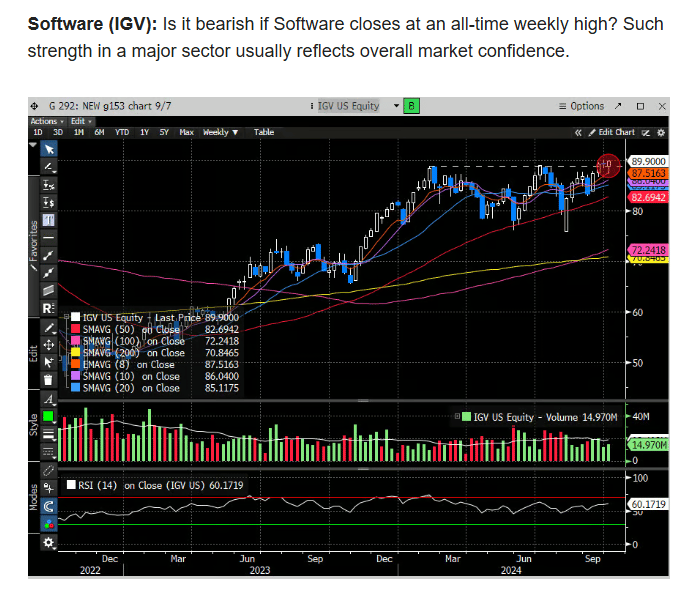

Here are those excerpts regarding (Financials, Industrials and Software):

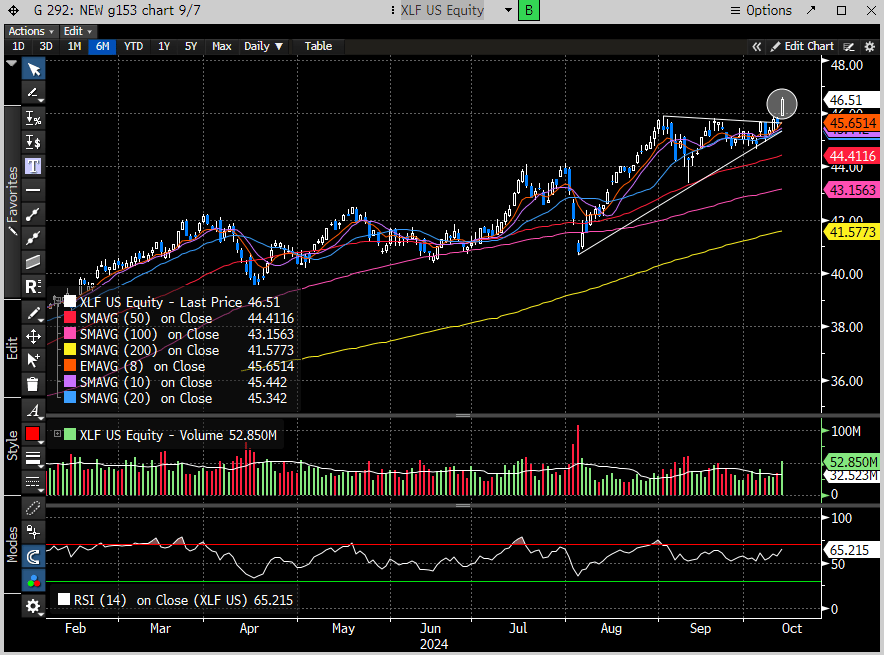

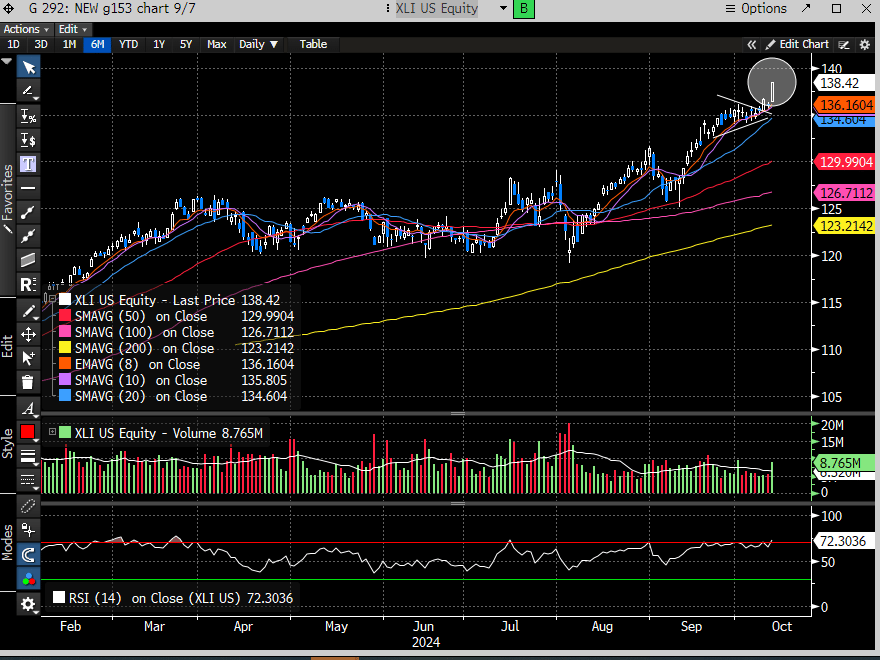

One week later, how are those charts faring?

XLF broke out to new ATH’s:

XLI new ATH’s:

IGV new ATH’s:

Unequivocally, ATH’s are bullish. If three major sectors break out to fresh new ATH’s, isn’t being bearish on the stock market premature? YES! The stock market cannot go down when there are bullish breakouts occurring everywhere. It’s just math.

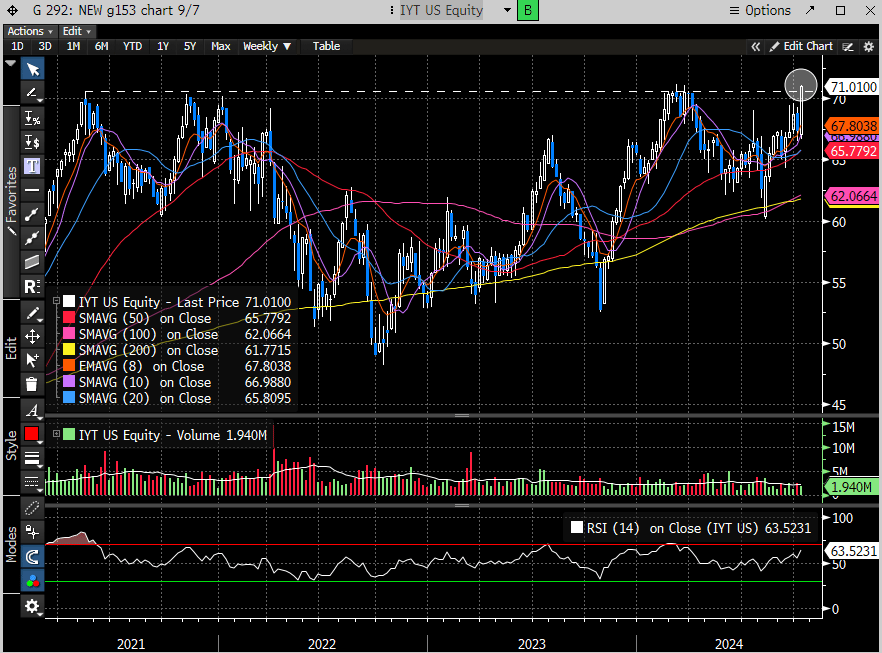

Dow theory suggests that the transports need to confirm the rally. This has been a notable laggard since the rally began. Guess what just closed at a new all-time closing high?

IYT (Transports ETF):

The next time someone tells you they’re bearish on the stock market, it might be wise to walk the other way. There will be a time to turn bearish, but that time isn’t now. The mounting evidence of underlying market strength is undeniable. Those who are bearish today are fighting against the wave of positive trend shifts happening all around. So, whose side do you want to be on? The collective wisdom of major investors or the small group clamoring for a collapse with reasons like: “the stock market is overvalued,” “the Fed won’t cut rates as fast as expected,” or “inflation will make a fierce comeback.” While these concerns are valid, the market’s current message is clear: it's too early to sound the alarm.

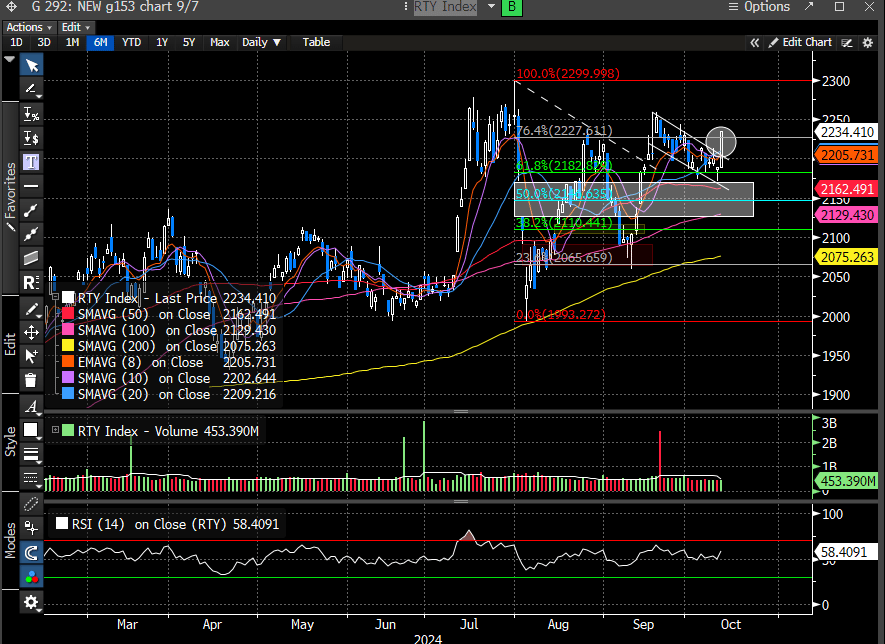

Take the Russell 2000 Index (RTY), which represents the smallest 2,000 companies in the Russell 3000. These smaller firms make up just 8% of the index’s total market capitalization, offering a true gauge of broader economic health, free from the dominance of mega-cap companies. On Friday, the RTY broke out of a three-week bull flag consolidation. These companies in the index, arguably the most sensitive to interest rate shifts, managed to stage a powerful breakout—without any significant yield retracement. As technicians, that’s a telling signal. It could very well indicate that the next phase of this bull market is set to unfold in the small and mid-cap (SMID) space.

The Value Line Geometric Index is an equally weighted index of 1700 companies. On Friday, this closed at its highest level since April ‘22.

Not convinced yet?

The S&P Mid Cap 400 closed at a new ATH on Friday.

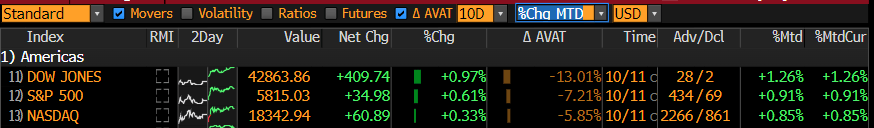

Our goal is to help our readers stay on the right side of the trend. It's much easier to make money in the market when you're not fighting the tape. October is historically a tricky month, especially in a pre-election year, and that seasonality still holds weight. However, this October has caught many flat-footed investors by surprise, defying the usual negative trend. That, in itself, is a bullish signal. When an instrument moves contrary to historical patterns, it’s worth paying attention—because it's often a sign that the underlying strength is greater than many expect.

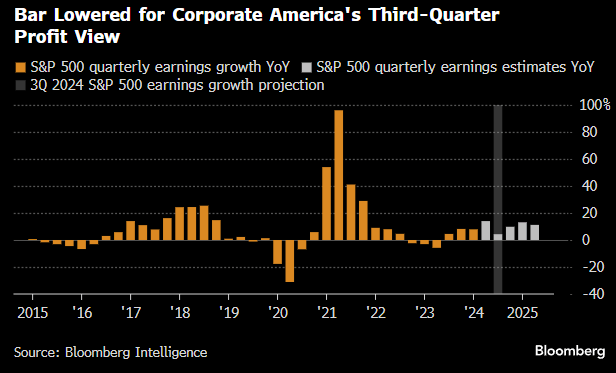

We will get the bulk of the SPX reporting their Q3 in the next few weeks. This certainly can inject increased volatility as companies adjust their outlooks. According to BofA, this reporting season has the largest implied move for single stocks since 2021.

As we have illustrated in previous reports, the earnings bar for this season has been ratcheted aggressively lower—only forecasting 4.3% growth vs. a year ago. In mid-June, forecasts were for an 8.4% rise. Is it possible that the earnings bar has been lowered so drastically that Friday’s index push higher was a positioning bet into a better-than-expected earnings season? We think so.

The bulk of the earnings beats could come from the other 493 S&P companies. That would explain the SMID cap index strength on Friday.

The market setup remains bullish, but as we highlighted in our 10/9 report, the SPX is entering a zone where sellers may appear. Couple that with the potential for pre-election seasonality to emerge, and we must remain vigilant for reversal signals.

Let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade