Much has been written in attempts to call the end of this rally, yet the stock market continues to defy the skeptics. This is the classic "wall of worry," where doubt fuels the market’s ascent, and paradoxically, that skepticism helps keep it climbing. There are countless reasons why the market could fall apart, but its resilience remains remarkable. The market is always looking ahead, pricing in what it perceives as the future, and although no one can predict exactly what that future holds, that’s why we focus on price.

Price action reveals much of what you need to know. While price can't predict an unforeseen or massive event over the next six months, our goal is tactical—not forecasting where the SPX will close in 2025. We make probabilistic bets on the short-term trajectory using three core principles: index price construction, macroeconomic inputs, and internal market dynamics. When these align, our path to profits becomes clear. Of course, we love when the conclusions jump off the charts, but markets are nuanced, and no system is perfect—not even ours.

Yet, by analyzing price relationships across instruments, we can enhance our accuracy in gauging direction. Technical analysis helps identify the trend, but we go further, layering in macro perspectives and DeMark analytics to sharpen our insights.

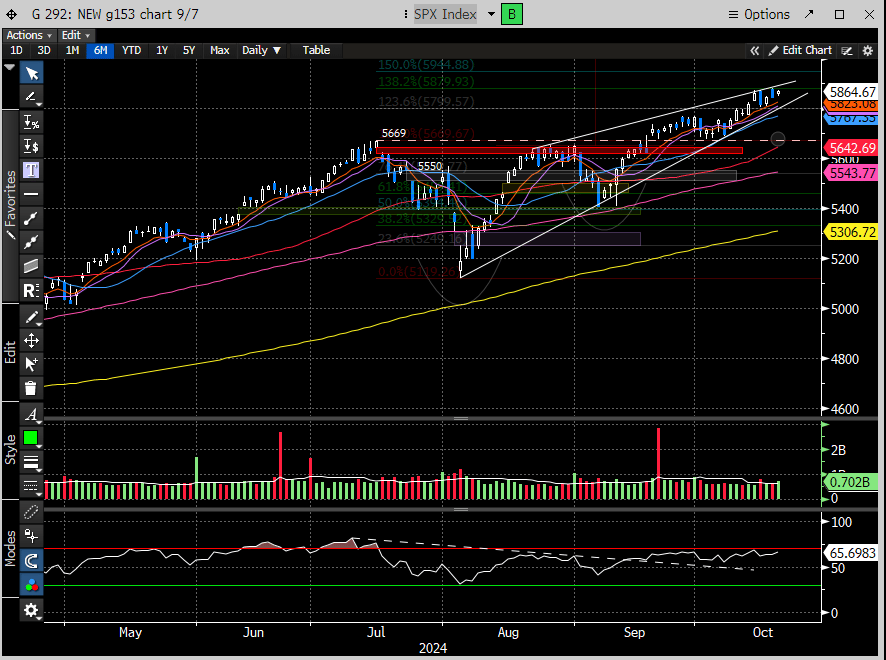

Despite negative seasonality, the SPX has continued to defy expectations, posting gains for six consecutive weeks.

The bearish community points to an expensive market, a Fed that won’t cut as fast as the market expects, sticky inflation, a contentious election, and growing geopolitical insatiability. Technically, bears want you to interpret the recent gains in the SPX as unsustainable, with the relentless increasing prices forming a bearish rising wedge.

However, interpretation without context is irresponsible. The key point to consider is that the SPX already spent three months in a corrective phase, only breaking out of its range in mid-September. When you shift your perspective, the SPX begins to resemble a classic cup-and-handle continuation pattern, which projects a measured move to the 6200 level. As they say, beauty is in the eye of the beholder.

This doesn't mean corrective price action is off the table—in fact, we expect it. But to project a major downturn from a single pattern, simply because one missed the rally and hopes for a deep correction to validate a stubborn bias, is not the path to success in a strong bullish trend. Our core analysis focuses on guiding readers to stay aligned with the trend, identify potential reversals, and weigh probabilities for either continuation or reversion. As we highlighted in our 10/16 report, fighting the current is a losing strategy.

We've maintained a bullish outlook since the October '22 lows. Most notably, we turned tactically bearish in mid-July, particularly on large- and mega-cap stocks, before buying the dip in early August. Since then, we've stayed on the right side of the trend, and we continue to believe the setup through year-end is in favor of the bulls. Dips, in our view, should be seen as buying opportunities.

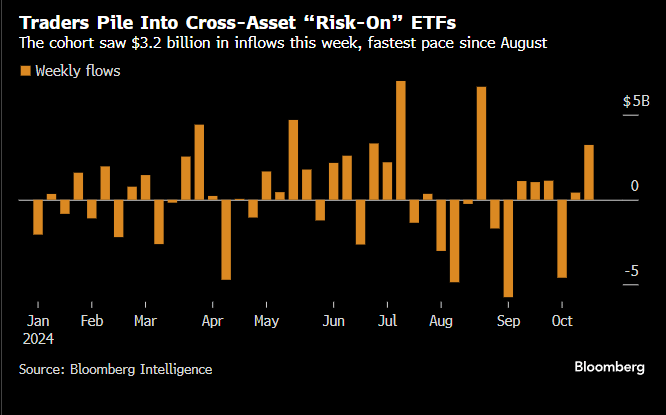

Investor sentiment appears to echo our stance, as cross-asset fund flows point to more upside for the markets.

As we enter the second week of major SPX earnings, the early results are promising. So far, with 15% of the market cap having reported, an impressive 76% of companies have delivered earnings beats. With over 60% of the market cap still set to report in the next two weeks, the outlook remains optimistic. If the next batch of earnings follows the same pattern, the stock market is likely to remain resilient and continue holding firm.

But again, markets do not move in a straight line. Investor positioning seems stretched, with asset managers nearing record long on US stock futures, according to Bloomberg. We certainly have our concerns.

Let’s dig in.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade