At the close of Q2 in June, we shifted our focus from large-cap/Mag 7 stocks, advising readers to sell into any early July strength and rotate into more opportunistic plays. At the time, this may have seemed unconventional, but in hindsight, it was a well-timed call. We noted that mega-cap earnings growth was set to decelerate, while the valuation gap between SMID Caps and large-caps was primed for convergence.

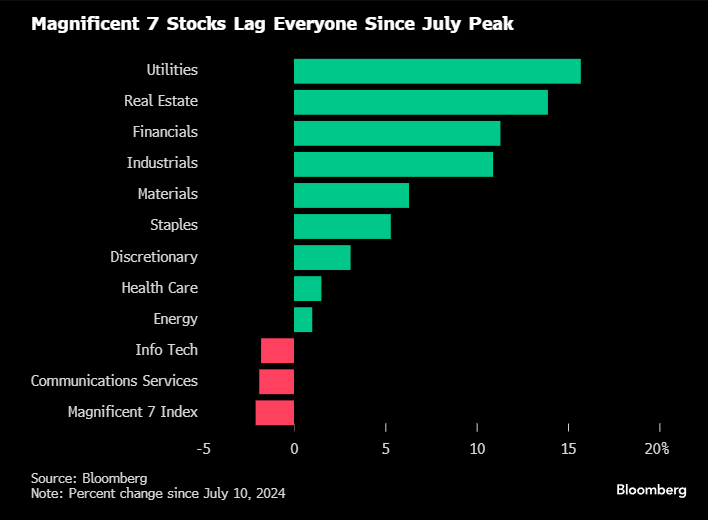

Here’s a chart illustrating the performance of Mag 7 stocks compared to other sectors since the July peak:

A significant part of our thesis, at the time, was the eventual reduction of interest rates that would help improve valuations for the riskier segments of the market that rely on cheaper costs of capital to thrive. The top three performing sectors in the chart above are also the most interest rate-sensitive; thus their outperformance makes sense. Utilities are the outlier, of course, which have carried the torch for their perceived leverage to data center growth surrounding the AI initiative.

Since the previous July peak for the SPX, the rate complex has recaptured more than half of the post-July CPI report breakdown, despite the FOMC cutting 50 bps last month and seemingly on the cusp of additional cuts.

There is a rising belief that the Fed's rate-cutting approach may have been premature, potentially stoking inflation. Notably, the U.S. isn’t alone in this move—Europe, China, and Canada are also cutting rates and injecting liquidity. In fact, Business Insider projects as many as 152 global rate cuts in 2024, the highest in years, signaling a significant shift toward monetary easing. This influx of liquidity often flows into financial markets, hard assets, and commodities, with inflationary effects. The bond market is already pricing in fewer future cuts from the Fed, reflecting a growing concern that aggressive cuts could undermine inflation control efforts and force the FOMC to halt cuts—or even hike rates, as happened in the early 1980s. Under Fed Chair Paul Volcker, the Fed ultimately raised rates to a historic 20% in 1981 to curb inflation, leading to a deep recession.

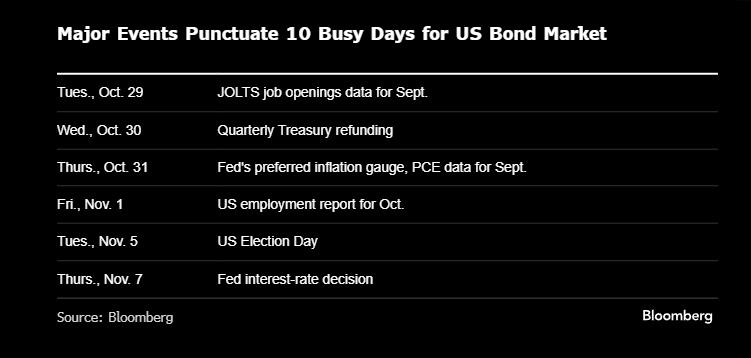

This situation adds complexity to the markets over the coming weeks. Alongside earnings reports from five Mag 7 companies, a U.S. presidential election in 10 days, and a crucial FOMC meeting on November 7th, market volatility may surge.

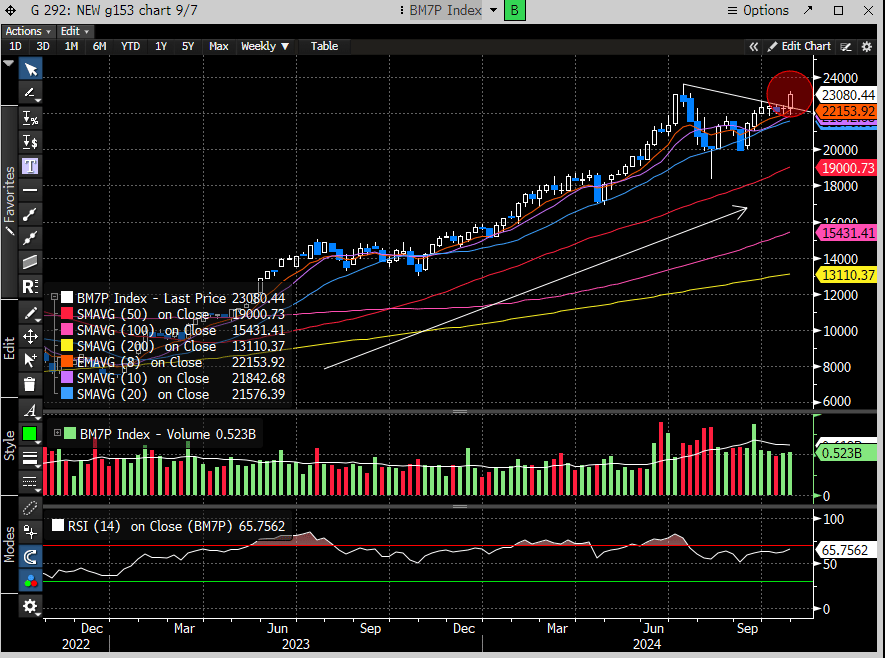

Historically, the Mag 7 stocks have outperformed in periods of rate uncertainty. These companies boast fortress-like balance sheets, minimal interest rate sensitivity, dominant market positions, and stable growth, making them safe havens for investors. As we noted in our 10/20 report, the Mag 7 chart was at a critical juncture and would likely dictate broader market direction. We suggested a potential breakout and warned against turning overly bearish. Interestingly, we made a similar call in our 9/11 report, which preceded a 7.5% gain for the Mag 7.

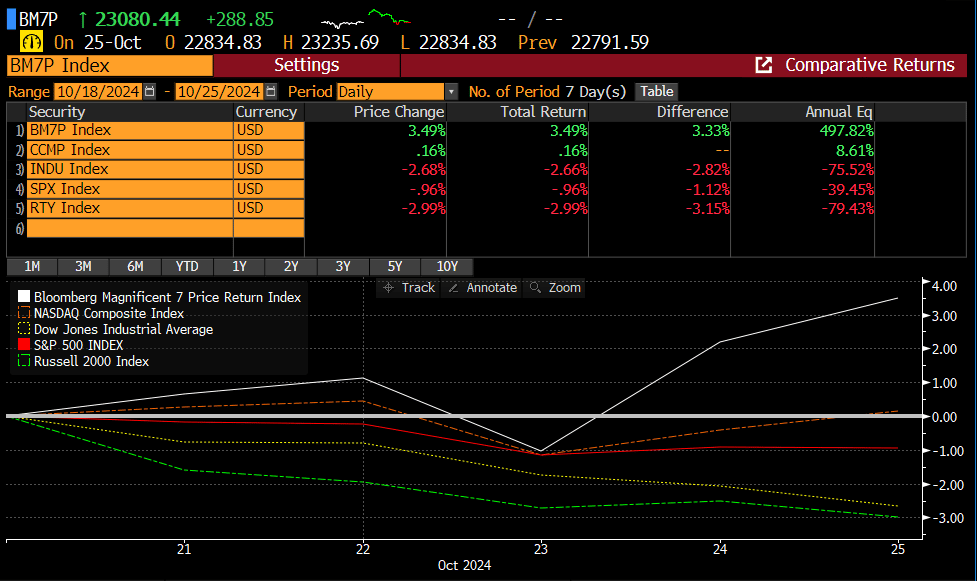

One week later, the Mag 7 has indeed broken out of its bullish consolidation, gaining 3.5% for the week. This momentum could set the stage for another rally if earnings continue to exceed expectations.

Last week, we also discussed the “4-weeks” tight pattern for the Mag 7 index as typically bullish—bingo!

Skeptics may argue that last week's gains were due solely to TSLA and that this week could see a reversal, given that the rest of the Mag 7 carries far more weight. That’s a fair point; earnings are always a wildcard. But we focus on price action, and TSLA’s strong performance despite a relatively lackluster earnings report is telling. Hedge funds have been net sellers of Mag 7 stocks for months, with only a slight uptick in October, leaving net long positions at one of their lowest levels since mid-2023, according to Goldman Sachs. This setup hints that the pain trade could still be to the upside.

However, the major indexes didn’t end the week on a high note. Despite an initially bullish opening on Friday, gains were erased, and indexes closed near the lows. This aligns with our 10/23 report, where we cautioned that the stock market might finally be "catching a cold." Notably, the major indexes would have seen deeper declines without the support from TSLA and other mega-caps. As we pointed out in our 10/20 report, the SPX was unlikely to post a 7th consecutive week of gains—and indeed, it closed the week down almost 1%.

Economically sensitive stocks were the worst hit. Retail, banking, and industrial stocks all fell between 2% and 3%. The main culprit for this is what we have been discussing for weeks as a major risk factor: a higher rate complex. Current Fed Fund Futures are forecasting a 95% chance of a rate cut on the Nov 7th FOMC meeting and only an 80% of an additional cut at the December meeting.

In stark contrast to the expectations following the last Fed meeting in September, when markets were fully pricing in a rate cut in November with a 50% likelihood of an additional cut, sentiment has shifted considerably. Back then, markets were even forecasting a near-certainty of two cuts in December and a 96% chance of a third. Now, however, the December forecast has been pared back by one 25 bps cut, and there's an increased likelihood that no further cuts may happen at all. This shift underscores the potential market-moving impact of this week’s PCE and Payroll reports, as any surprises could further sway these revised expectations.

Below is a list of the major events that could move the bond market.

This implies that the bond sell-off we’ve seen over the last month could gain steam if the macro releases are too hot. Any way you slice it, the next two weeks are packed full of time bombs to disrupt the stock market equilibrium, and last week’s stock market retracement may have just been the amuse-bouche.

Let’s see what the charts have to say…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade