Our thesis for a choppy start to October, a historically negative month, has played out as expected. However, to the disappointment of the bearish crowd, the week ultimately ended right where it began.

The market's trajectory was largely negative until Friday’s better-than-expected payroll report. This exemplifies the macro whiplash we've been highlighting all summer. Monday’s weak ISM report reignited hard-landing concerns, only for the strong payroll data to reverse the downward momentum by week’s end.

Here is the excerpt from our mid-week report (10/2):

For the past two weeks, we've advocated for a more defensive stance in the stock market as we navigate poor seasonality, volatile macro releases, and DeMark sell signals across the indexes. Our strategy has been to remain opportunistic, focusing on dips to key support levels. Notably, the support areas we highlighted in previous reports have been vigorously defended. When buyers consistently show up at crucial levels, it signals underlying strength—this is a bullish sign.

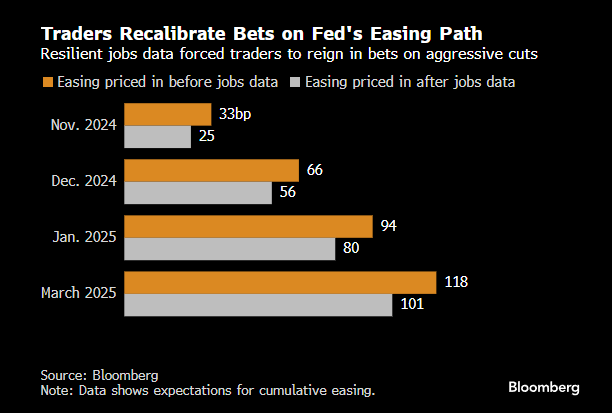

However, this doesn’t mean we’re out of the woods. Market equilibrium is always subject to disruption from emerging concerns. Friday's stronger-than-expected payroll report, for instance, surprised many and led traders to reduce expectations of another significant rate cut at the next FOMC meeting in early November. Some economists are even calling for a pause in rate cuts. The forecast from the Fed Fund Futures has shifted sharply, reducing the probability of a 50 bps cut from 50 % last weekend to 0% today.

This shifting outlook introduces new uncertainty into the market.

We've consistently advocated that a steady, predictable approach to interest rates is preferable to large, unexpected shifts. Friday’s payroll report, along with the sharp reduction in rate cut expectations, merely aligns the market's outlook with the Fed’s Dot Plot. A resilient economy, as reflected in the stronger data, isn't necessarily negative for the stock market. Stability in the rate trajectory coupled with solid economic fundamentals can provide a supportive backdrop for equities, even if the pace of rate cuts slows.

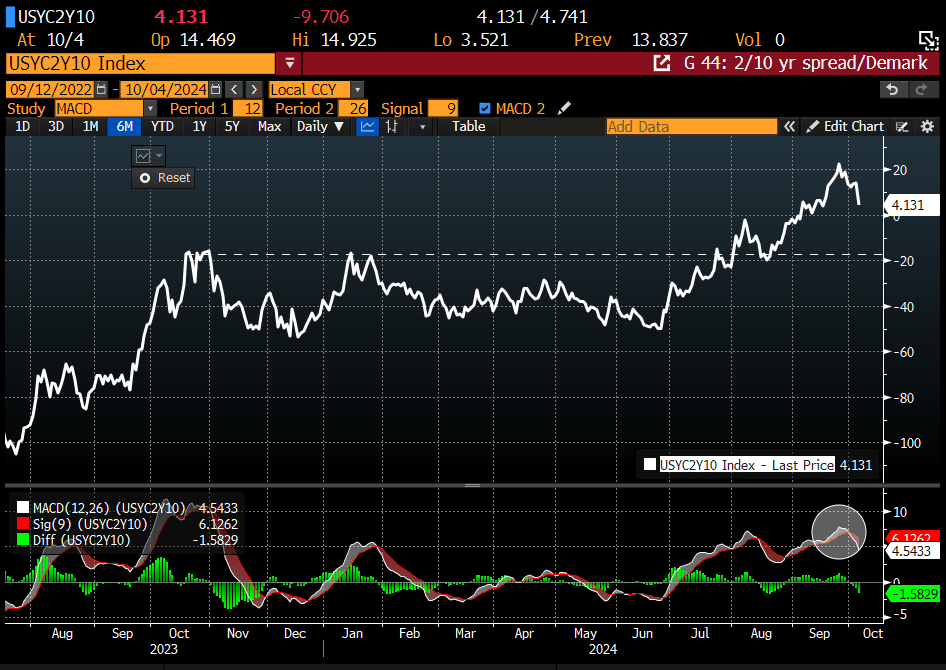

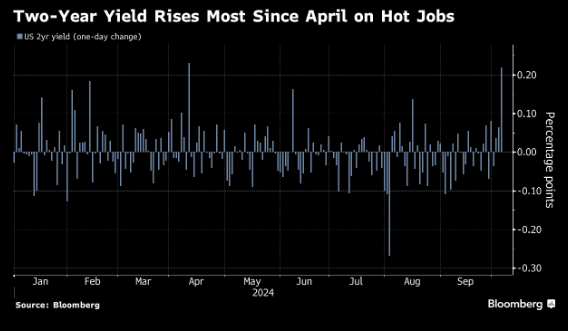

The payroll report has also tempered the bull steepener positioning we mentioned in our last report. Some of the rate cut speculation is being pulled out of the bond market, as seen in the 2/10-year yield curve, which is now reverting toward neutrality after peaking at 23.5 bps recently. This pullback indicates that the bond market is adjusting to the reduced likelihood of aggressive rate cuts, further aligning with a more stable interest rate path.

This is occurring as short-term yields reprice higher.

The biggest question now is what happens at the upcoming Fed meeting on November 6-7, right after the U.S. election. With the labor market showing resilience, will the Fed shift its focus back to inflation? Oil prices have surged nearly $10 per barrel since the September lows, driven by escalating tensions in the Middle East. While this won’t reflect in this week’s CPI report, it’s likely to catch the Fed's attention, especially if inflationary pressures resurface as a result. The balance between a strong labor market and rising inflation will be pivotal in shaping the Fed’s next move.

The Bloomberg Commodity Index has surged 10% since its September lows, a trend likely to be further amplified by China’s renewed efforts to reflate its economy—the second largest in the world. As China ramps up stimulus, this could add additional pressure on global commodity prices, reinforcing inflationary concerns. The combination of rising oil prices and strengthening commodities will certainly be on the Fed's radar as they evaluate their next policy move.

The upcoming CPI report this Thursday is not expected to be a major market mover, as the recent pressures from rising oil and commodities will take time to flow through the broader economy. The CPI is forecasted to rise by just 0.1% for September, marking its smallest increase in three months. On a year-over-year basis, it’s set to reflect a sixth consecutive month of declining inflation. While we aren’t economists, a tame report like this would likely reinforce the current market expectations, keeping the forecast for a 25 bps rate cut at the November Fed meeting intact.

Here is the comment from the Bloomberg Economist team, echoing that sentiment.

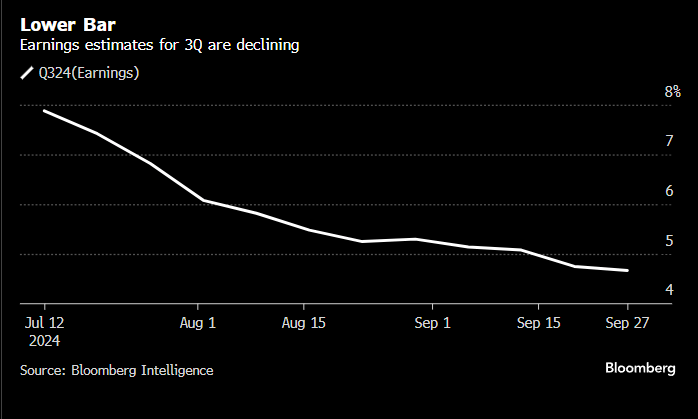

Lastly, this week is the unofficial start to Q3 earnings. Companies in the SPX are expected to report a 4.7% increase in quarterly earnings from a year ago, according to Bloomberg Intelligence. As pointed out in our last report, these expectations have almost been cut half.

Earnings season is generally favorable for the stock market, particularly when expectations have been lowered as dramatically as they have this time around. While this doesn’t guarantee a positive outcome, historical probabilities lean in that direction. Given the uncertainty surrounding geopolitics and the upcoming election, it’s unlikely that companies will offer overly aggressive guidance. We believe they’ll stay cautiously optimistic.

We also noted last week that systematic fund pressure remains a concern for the rest of the month. Goldman Sachs has suggested that Commodity Trading Advisers (CTAs) could become net sellers of equities if indexes fail to make decisive moves. Adding to this, historical data from Bespoke shows that when the S&P 500 has gained 20% through the first nine months of the year, October tends to be a down month 70% of the time.

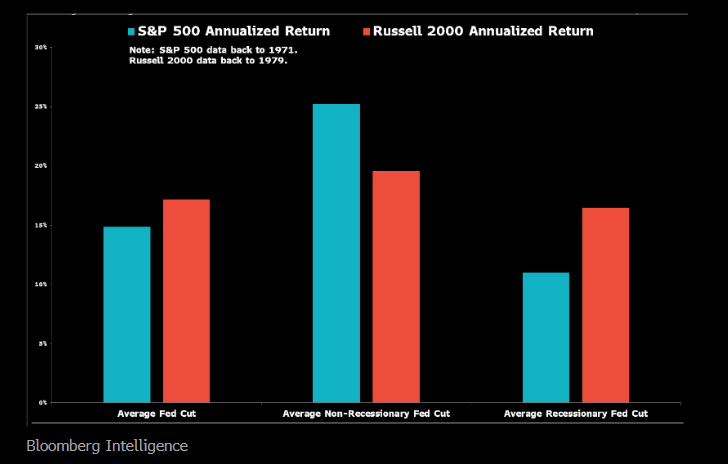

In sum, the setup remains mixed as we enter earnings season, but the long-term outlook following Fed rate cuts is still bullish. This reinforces our view to stay opportunistic—a stance we’ve held for the past couple of weeks.

It seems like buy the dip is still very much alive and well.

Let’s examine the charts to see if much has changed since our last report.