Last week’s Macro Report highlighted the potential for a mid-week rebound for the stock market as we had alignment with a number of our indicators. Right on schedule the SPX made its low on Weds.

From the report:

“The bigger inflections could come towards the middle of the week when DeMark signal alignment is at its peak.”

Fortunately, we have been cautious on the stock market since selling the peak in July. That has worked out quite well as the SPX traded down -8% into the low this past Weds. -8% is considered a healthy correction by most standards. We have been quite patient in waiting for a good set up and it remains to be seen if last week’s action was the precursor to a larger counter trend move.

The upcoming week will likely be pivotal in determining if Weds was the ultimate low for this swing or if more weakness is in front of us. We have been quite clear where we thought the SPX could bounce and last week it found support in our buy zone.

This bounce was occurring while quite a bit of worry was hitting the markets (Fed hawkish pause, potential government shutdown, rising bond yields, jump in oil prices, student loan moratorium ending, UAW strike, etc). And while many like to think this negative news cycle could topple the markets, we believe it’s the fuel that can lead a bull move. The bearishness that is out there is palpable and with a good reason, as we are equally as concerned about the macro. But markets like to climb a wall of worry, and we think there is plenty to be worried about.

This bearishness was being reflected in the market, as Sept performance was quite poor, where most of the indexes remained consistently under pressure. But all is not lost, as this type of selling is typically followed by a countertrend move, as per Bespoke:

But for this to occur, we think certain conditions need to abate. We have been writing about the “Three Horseman” for weeks, and how important they are to the overall trajectory to the stock market. They are Treasury Rates, Oil and the $USD.

Put simply, these need to stop going up for the stock market to recover meaningfully.

The 2 year treasury is a good proxy for determining where interest rates are headed. Recently this eclipsed 5% and seemingly broke out of this large ascending triangle. Friday, this broke back down and now testing the bottom part of the pattern. Should this break down, that should give the bulls some wind at their backs. Conversely, if this breaks back up, it will undoubtedly cause more volatility.

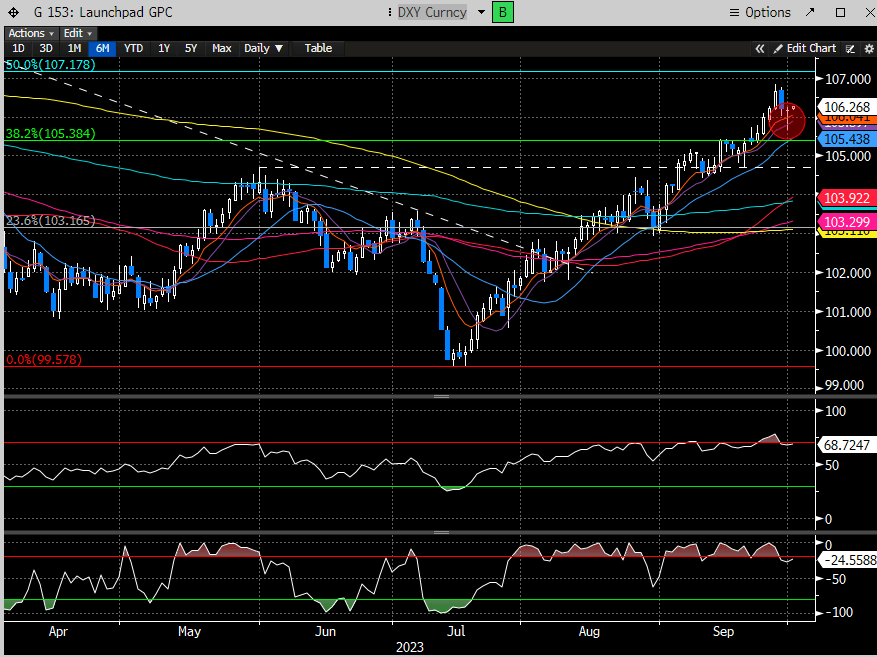

The $USD with a reversal candle mid-week but found buyers on Friday. Despite being OB per RSI, this doesn’t look like it wants to roll over, yet.

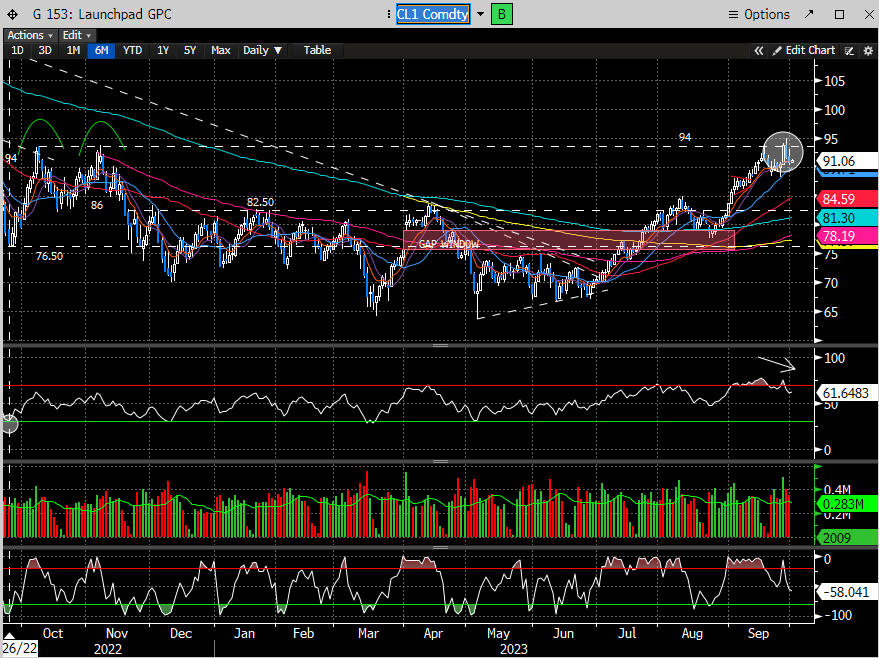

Oil did manage to back off again from our $94 pivot for the 2nd time. While this seems the weakest of the 3, its construction is not overly bearish. We will expand more on this in in the premium section below.

Last week was the end of the 3Q, and the end of a notoriously difficult 2 week stretch for the markets. October also marks the beginning of positive seasonality. Here is a decent study from Wayne Whaley, looking at performance after a strong 1H, followed by a weak Aug/Sept. Oct -Dec was up in all 8 occurrences since 1950.

While seasonality and cycles are something we pay attention to, we must see the “Three Horsemen” start to revert. We cannot see the stock market maintaining any momentum unless these 3 back off.

To read the balance of the analysis please consider subscribing below.