Last week was a decent week at CSC. We correctly called the day and area for the stock market bounce on 10/4 and we also highlighted in our mid-week report that selling into residual strength into the first area of resistance made sense.

Here is a snapshot of that report indicating such:

“we thought a counter-trend rally would find some resistance in the 4375-4400 area. The high yesterday was 4385. The 50 day now stands at 4410, so quite a bit of confluence to consider selling longs on any shot up to those levels.”

Thursdays high was 4385 and Friday the market saw a bit of dislocation. The Nasdaq never quite hit our levels.

The bigger question is, was Friday’s sell-off a pre-cursor to something more sinister? Let’s unpack that.

We know that the safety trade was on Friday. That means, during times of uncertainty, much like an escalating and unpredictable Middle East situation, especially before a Friday, flows tend to be risk-off in nature. This means, sell growth, buy Gold, buy Treasuries, buy $USD or safe-haven currencies, and oil.

The performance of their 1-day move is below:

The bottom line is that the Middle East situation is fluid and difficult to handicap and thus flows into safe haven trades make sense. Nobody wants to come out of a weekend overexposed as gap down risk is real if matters escalate materially.

Could the Middle East situation tip the globe into a recession? Certainly, larger economies are in fragile shape after recent central banks have been tightening the grip on liquidity.

The fear associated with the unknown can be visible in the VIX, which was up almost +16% on Friday. There is plenty to be worried about as confusion over the trajectory of interest rates, a weakening economy and now a volatile Middle East situation is something we must contend with. Oct seems to always bring about global events that can seemingly tip the scales for economies and stock markets. Unfortunately, we cannot tell you with any precision how this unfolds. Nobody can because nobody knows. All we can do is interpret what’s infront of us and make determinations about the future.

We know Friday’s volume was nothing to get alarmed about. In fact, it was quite light considering the level of dislocations.

This smacks of a lack of buying vs. real selling.

Oil is the biggest wildcard because escalation in the Middle East could impact oil supplies, thus energy prices can sky rocket given the dwindling supply situation in the US. Oil seemed quite weak and heading lower the last time we wrote but Fridays trade seems quite bullish. +$100 oil will likely not be received very well by the stock market.

Oil is part of our “Three Horsemen” indicator and can impact the trajectory of equity prices.

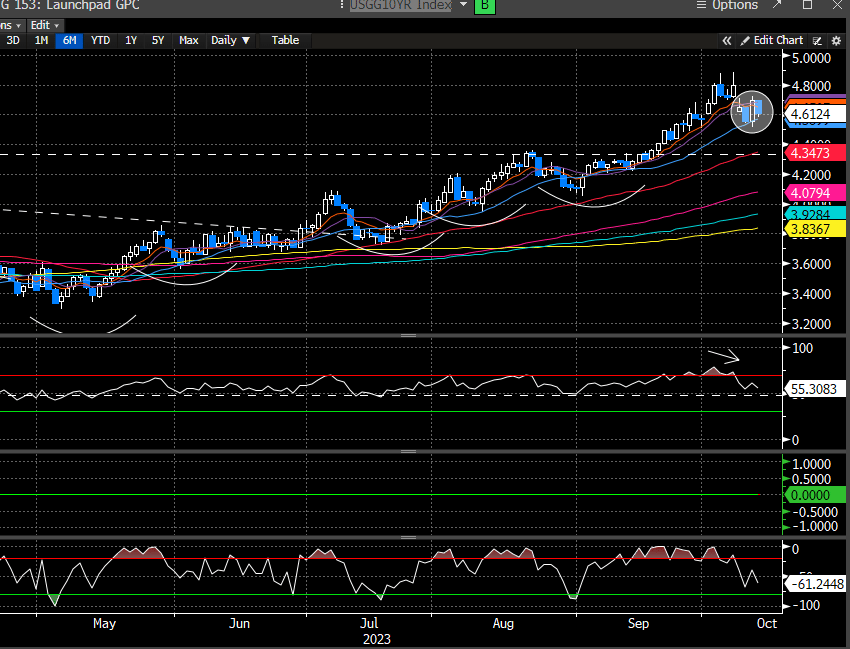

Treasuries are also part of that equation, and which took quite a hit on Thursday after the CPI was reported and post a bond auction that didn’t fare so well. This was somewhat reversed on Friday as safe haven buyers scooped up the weakness.

How this plays out from here will be quite telling. The 10 year posted an inside day on Friday, following the bullish engulfing bar on Thursday.

Currently Fed Fund expectations for another rate hike have become more subdued, even after the inflation reports last week showed some mild acceleration. There is now only a 24% chance of another hike.

We think this week’s focus will shift to corporate earnings. Banks were the first out of the gate last week and surprised to the upside. But banks are a small % of the overall SPX. Large cap tech earnings will begin on Weds with TSLA and NFLX. Followed by GOOGL, MSFT, AAPL, META, AMZN the following 2 weeks. This group now makes up 30% of the SPX market cap and 16% of earnings. These companies have the ability to make or break the year as their importance cannot be understated.

The recent lift in oil prices will not impact overall earnings this go around, despite what logic will tell you. Yes, Oil prices are up since Jun, but they are still down 10% from a year ago. This implies that oil prices should not be a drag on comparables.

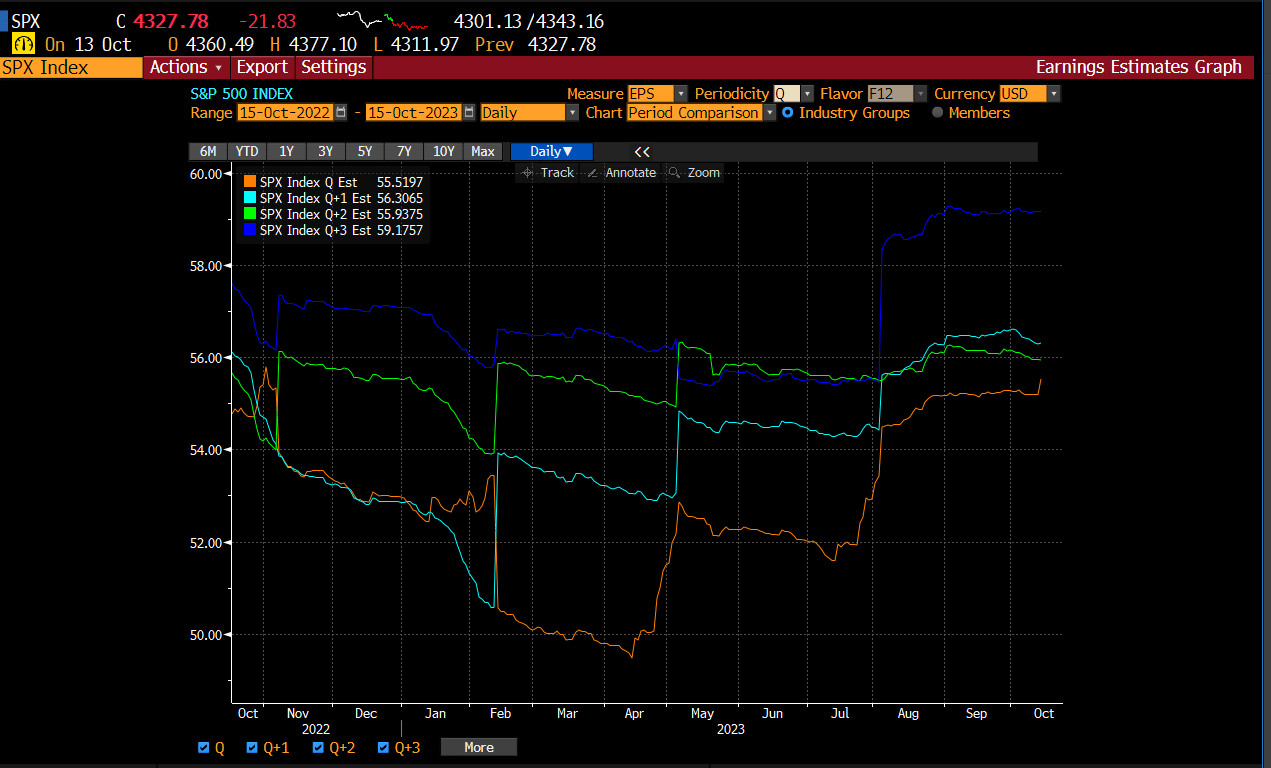

A few weeks ago we wrote that earnings estimates have been rising as we head into earnings season. This compared to cuts heading into the 1st and 2nd Q’s. Does this pose a risk or should we think its bullish? We think the answer is both.

Currently the earnings estimates are for zero growth on a weighted basis. Over the past 10 years, company earnings have surprised to the upside nearly ¾’s of the time, by an average of 6%. But because estimates are moving higher into the event, we see the risk of disappointment or muted beats to be higher.

So far 21 companies have reported and more than ¾’s have surprised. Bank of America finds a 70% correlation between the number and the proportion of upside surprises for all companies.

As we mentioned above the 3Q earnings seasons success is going to rely on the large cap tech companies, who's Big 5 represent 34% of the indexes profit growth.

There is usually a trickle-down impact from the largest companies posting robust results. If they can set the stage and deliver, then a typical seasonal year-end rally seems more plausible. Get your popcorn ready!

Consider subscribing below to read the balance of our analysis.