The illustrious Fed week is upon us and typically sets up for an event heavy week. Although we do not believe the Fed will do much of anything and will keep rates on hold, while likely addressing the obvious risks facing the global economy and a resilient US economy that cannot squash the inflation boogeyman.

This likely implies the event is more of a non-event when thinking about the potential stock market impact. Below is your weekly dose of Fed Fund Futures which have an almost 100% chance of no hike, and only a 27% chance of another hike this cycle. The futures are still forecasting 75 bps cuts by the end of next year.

Post the event, the most likely driver of stock market direction as it pertains to interest rates, is how long the duration of restrictive rates will be present. If the pace of cuts gets pushed out further, that could drive stocks lower. Conversely, if they are to increase, we could start to see a massive counter-trend rally. While we do not like to make predictions around FOMC events, we don’t think much will come out of it, as we alluded to above. The Fed has no intention of talking up the markets as it runs counter to their inflation reduction narrative.

Friday also saw some re-acceleration in their preferred inflation metric, PCE, which is now at a 4-month high, on the backs of a strong consumer.

The resilient household demand paired with a pickup in inflation argues for momentum into Q4. This is the opposite of what the Fed wants to see. This keeps every meeting somewhat live as inflation not subsiding typically means another rate hike is not off the table. The most important support for more household spending is the strength of the labor market, which still remains quite healthy. This coupled with record household wealth and lingering pandemic savings is keeping this well bid.

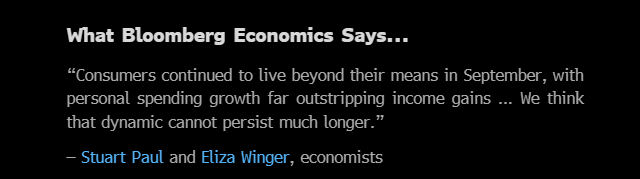

Although Bloomberg economists believe the trajectory of consumer spending is about to turn down.

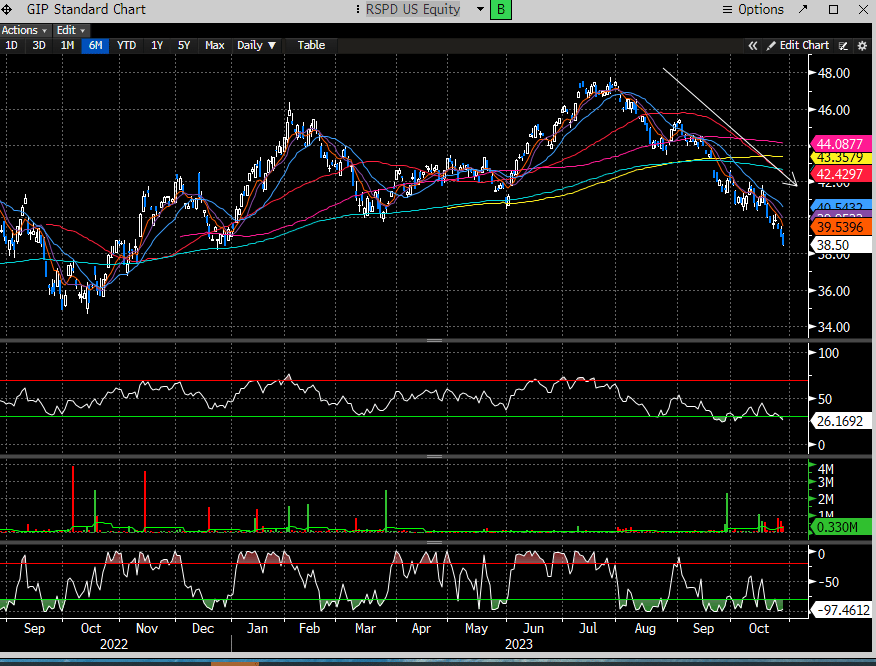

It seems the stock market agrees as the equal weight consumer ETF ($RSPD) is approaching 52-week lows.

This is a tough backdrop for GDP which just trounced expectations last week. GDP is a lagging indicator, and the stock market is a leading indicator, thus the stock market is trying to price in a degrading picture of the future. GDP is also 70% leveraged to consumer spending and would imply the recent +4.9% report has a long way to fall.

This a microcosm of the issue the stock market is facing. Rate of change in macro data and earnings usually means to expect negative market pricing. This occurs before the data becomes evident and seems to be happening now.

That begs the question, when will it stop? It will stop when assets get cheap enough (not there yet as we discussed in last week’s report about fair value) or there is evidence that an economic turn is coming in the intermediate future. Some like to say that the stock market will reprice for 6 months in advance. If that’s true and if we are to see a sustainable bullish advance, then we have to believe that a bottom in the macro data will occur sometime between now and the end of the 1st Q ‘24. Thats hard to fathom given the Fed’s path of hikes is not to reverse until late next year. Does that mean it’s not possible for the macro data to bottom before that? Of course not.

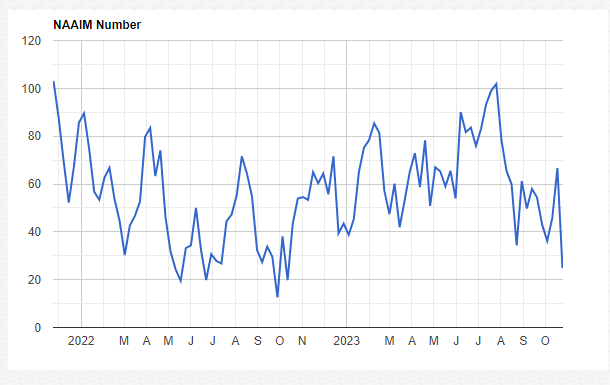

Even Steve Cohen (founder of Point72) is suggesting the US economy can fall into a short-lived recession this year before rebounding the 1st Q of next year. This was revealed last week at the Robin Hood Investor Conference on Weds. Steve thinks the US economy is still in good shape and expects economic growth to jump next year and equity markets to rally +3-5%. This is actually at odds to some of his Hedge Fund titan peers, as Paul Tudor Jones thinks the US is in its weakest position since WW2 and that he expects a recession in the 1Q of ‘24. Certainly, a confusing time but Steve is an outlier and has a contrarian viewpoint. Everyone is bearish and becoming increasingly so, thus any bullish trading action will take most by surprise as very few are positioned for it. As we all know, the stock market likes to make fools out of most people, and bearish opinions seem quite lopsided presently.

This is evidenced in the new NAAIM readings. This now stands at 24% invested. This is approaching the lows of last Oct before the massive rally. The pain trade from here is definitely higher.

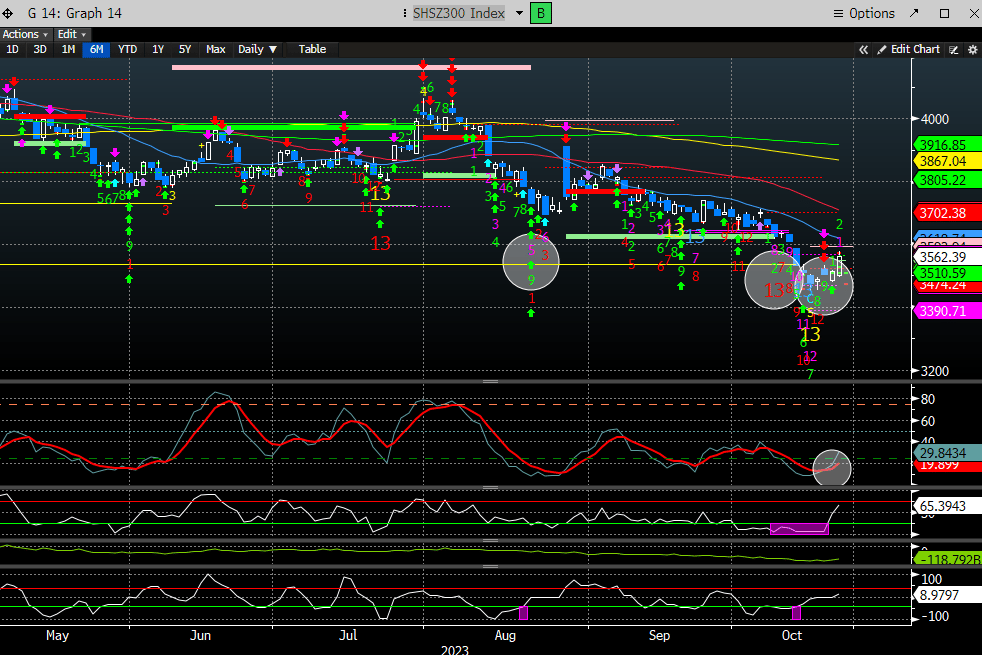

Where can the global economy surprise to the upside? We actually think it could come from China. As we have written many times the PBOC is inflating and pumping liquidity into their economy. This is the exact opposite of what is happening in the US. Economies thrive on liquidity and it’s only a matter of time before we see that liquidity start showing up in consumption trends. In fact, much of China’s macro data releases seem to indicate that growth bottomed in the 2Q. China is the 2nd largest economy in the world and has been a big driver of global economic trends in previous cycles. While its difficult to ascertain whether their growth will be strong enough to offset much of the world’s economic malaise, it could certainly put a floor under it.

Last week the Shenzen completed its DeMark 9-13-9 buy pattern and now on day 2 of a flip up.

This also occurring with a stop and reverse RSI breach on expanding volume.

While its MACD is starting to curl up from a depressed level.

Can China be the white night for the global economy? It has happened before and something that warrants attention.

Please consider subscribing below to read the balance of our analysis on the stock market set up and near-term trajectory…