Bull markets move fast, often leaving those waiting for the "perfect" entry point regretting their caution. They reward conviction, and that's why having a technical view is essential for successful investing and trading (yes, we admit our bias). At its core, technical analysis is about keeping investors on the right side of the trend—holding positions longer, seizing opportunities when they arise, and knowing when to challenge or strengthen one's convictions. Remember, the stock market isn’t wrong; it's often those who resist it who miss out. Yes, the market can be noisy in the short term, but in the broader picture, its forward-looking accuracy is remarkable.

Think back to October 2022, when pervasive bearish sentiment predicted a U.S. recession in 2023. It never happened. And who was right about the economy avoiding that downturn? The stock market. In 2024, many doubted that inflation would cool as quickly as the Fed anticipated, expecting prolonged higher rates. But again, the stock market was ahead, suggesting those assumptions were flawed.

Now, the belief is that the Fed can’t keep inflation in check, and that Trump’s pro-growth, protectionist policies might spark an inflation resurgence—all while the market trades at an above average valuation. Sounds ominous? Maybe. But maybe not. We’ve stuck to our SPX target since the summer, understanding that hitting it doesn’t necessarily mark the ultimate peak. It might simply be a rest stop—a consolidation phase before the next advance. Think of it like refueling on a road trip; markets need pauses to gather strength.

There’s also talk of a possible "melt-up," similar to the unsustainable rise of the internet bubble. While anything is possible, no one truly knows how this will play out. What we do know is that we’ve held a bullish stance since the October 2022 lows, with only strategic, tactical adjustments along the way. Yes, we’ve taken some well-timed opportunities to sell or short, but our primary role is to help you navigate market volatility—and we believe we do that exceptionally well.

What does this mean for you? It means you have us, always on watch. When the trend shifts decisively, we’ll be here, ready to reverse course if needed. Until then, keep riding the wave.

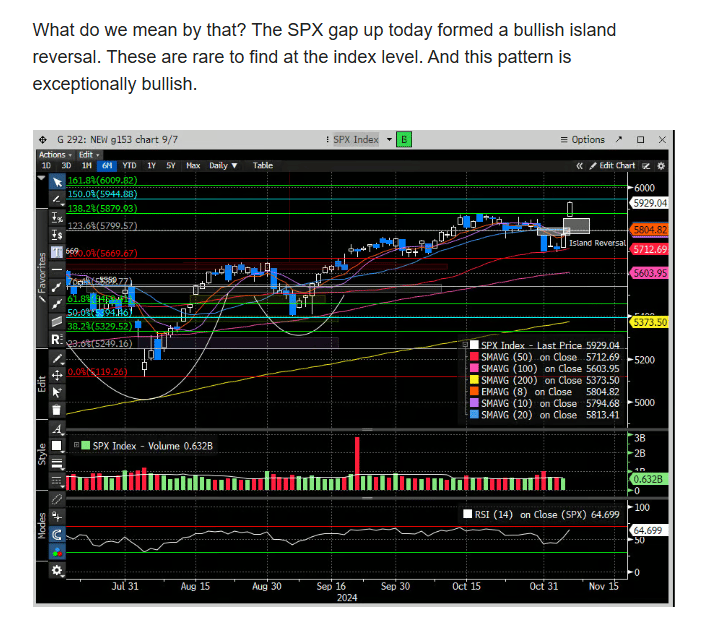

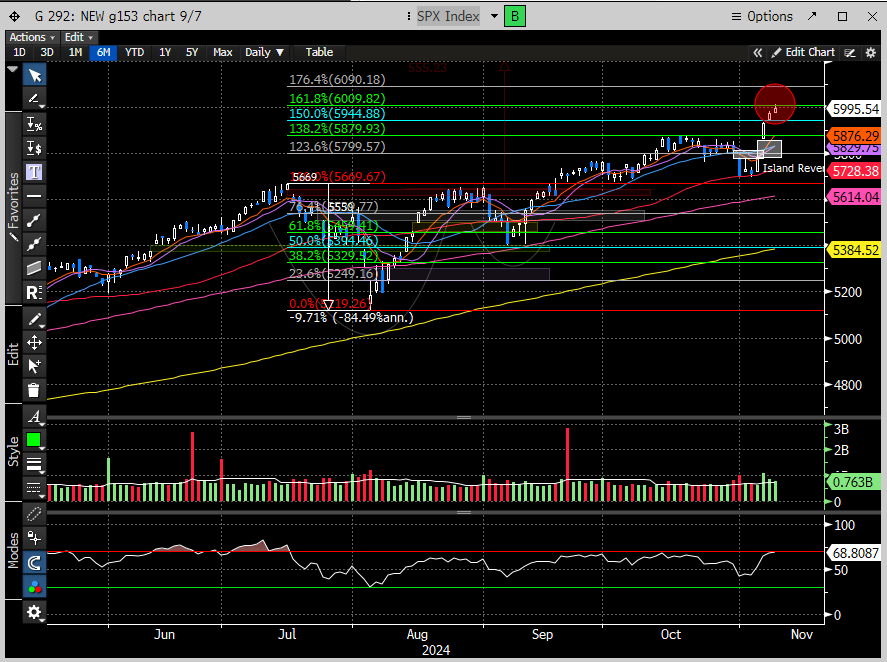

In our 11/3 report, "Trump Pump," we highlighted the structural shift in the market following last week’s election. The Halloween gap-down, reminiscent of July’s ATH gap-down that led to a 10% correction, resolved differently this time: after the election, the SPX surged past the gap-down level, forming a powerful Island Reversal pattern. Ignore such strong technical signals at your own risk.

Here is an 11/6 report excerpt:

The rest of the week powered higher into our initial resistance zone (161.8% extension) at 6009—Friday’s high was 6012.

After Wednesday’s close, post-election, the stock market rallied another 1.5%, reinforcing our view that continuation was likely. This capped off the best weekly gain in over a year for the major indexes, with the Russell Small Cap Index (RTY) leading the charge at 8.6%. Our call for rotation into SMID caps back in early July has proven spot on, making last week’s surge particularly rewarding. The market’s gains last week are over half of the SPX’s average annual return—if you didn’t use October’s choppy action to buy opportunistically (as we recommended), you missed a significant opportunity and may now be forced to chase to bridge performance gaps.

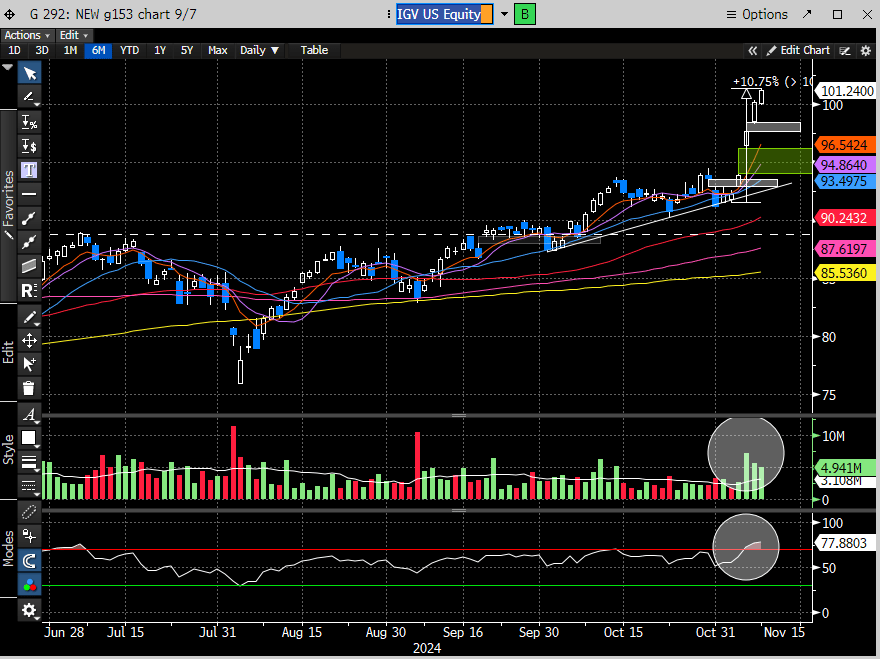

Last week’s moves clearly demonstrated this dynamic, especially in the Software Index (IGV), which jumped nearly 11% with two major gap-ups, highlighting the rush of underexposed investors back into the market at elevated prices.

This is occurring while the largest software company in the world and the third largest weighting in the IGV, continues to struggle. Impressive, to say the least, and speaks to the market broadening out.

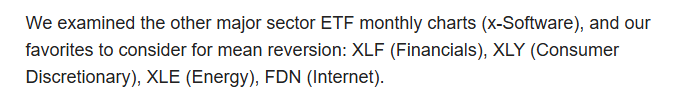

In our June 30th report, we took a stab at which sectors might benefit the most from the rotational trade.

Here is that excerpt:

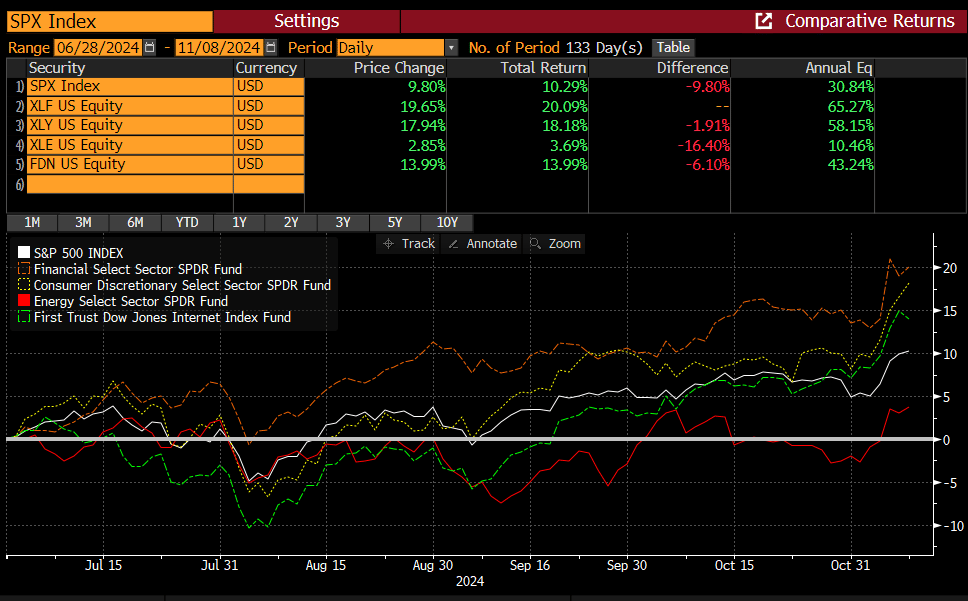

Since that report, how have the sectors performed? Quite well, we might add. Three rounded out the top four outperformers (XLF, XLY, FDN), while XLE (energy lagged). Internet (FDN) is more of a subsector so comparing them apples to apples might not make as much sense, but the group’s outperformance in its totality is notable. Financials (XLF) have been the number one outperforming sector.

Here is their performance vs. the benchmark (SPX). XLF has returned more than twice the SPX.

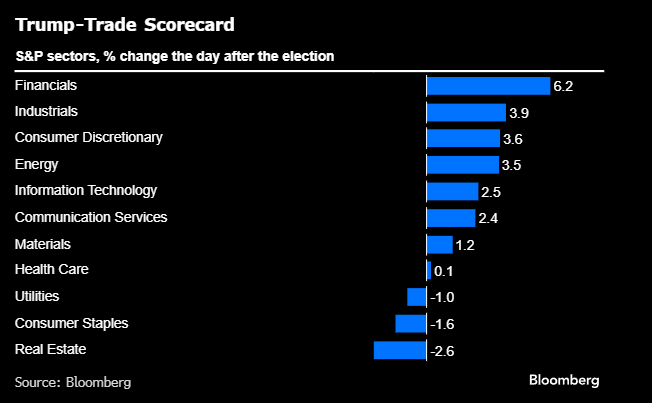

Was some of this luck? Of course, but sometimes, ultimate success comes with an element of luck. The Trump pump is certainly helping our cause:

The bottom line is you must be “in it to win it.” And by our record, we win way more than we lose—winning is how you make money in the market.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade