Over the weekend, Netflix ventured into live sports streaming with a highly anticipated boxing match featuring Jake Paul and Mike Tyson. The event drew a staggering global audience, peaking at 65 million viewers, but wasn’t without its flaws. Over 100,000 viewers reported slow buffering issues, marring what was supposed to be a seamless streaming experience. Adding to the disappointment, the fight itself failed to live up to its hype, ending without a knockout after eight rounds, with Jake Paul declared the winner by unanimous decision.

While the match felt more like a publicity stunt than a serious sporting event, Netflix achieved its likely goal of sparking attention for its budding advertising business. Regardless of how one views the event, it succeeded in dominating headlines, even briefly overshadowing the aftermath of the contentious U.S. election results.

The lackluster boxing match serves as a fitting metaphor for the ongoing battle in global markets: the stock market versus the bond market. The bond market, long the heavyweight champion of global finance, typically dictates the narrative around risk. Meanwhile, the stock market, bolstered by its love affair with mega-cap tech and an AI-driven technological revolution, has emerged as the flashy newcomer. The divergence between the two has been striking, with equities vastly outperforming bonds since the COVID crash lows—a performance gap that continues to capture our attention.

At some point, you’d expect this relationship to mean revert—a potential wake-up call for pensions and 401(k)s heavily weighted toward equities. A growing chorus within the investment community believes this divergence could pose challenges for equity fund flows and, by extension, the broader stock market.

As we noted in our previous report, the equity risk premium has recently turned negative, signaling a shift in the risk-reward dynamics that typically support equity markets. This development adds another layer of complexity to an already tenuous backdrop and raises questions about how much longer the current trend can persist without broader repercussions.

However, this doesn’t necessarily spell doom for the stock market. As highlighted by Sentiment Trader, the equity risk premium was similarly unfavorable during the 1980s—a period that saw one of the most powerful bull markets in history. This historical precedent reminds us that while certain metrics can raise concerns, they don't always translate into immediate risks for equity markets. Context and broader market dynamics often play a more significant role in determining outcomes.

From 1982 to the internet bubble peak, the SPX gained over 1400%.

While both periods share themes of inflation-fighting and economic resilience, today’s landscape is more complex due to high debt, demographic challenges, and elevated market valuations. However, like the early 1980s, today’s market could transition into a sustained bull market if inflation continues to decline, the Fed pivots, and productivity gains materialize.

What does this mean? It means the risks to the recent bull market are increasing, particularly as valuations appear stretched. However, let's not forget that the stock market is perpetually navigating risks—it's the nature of the game.

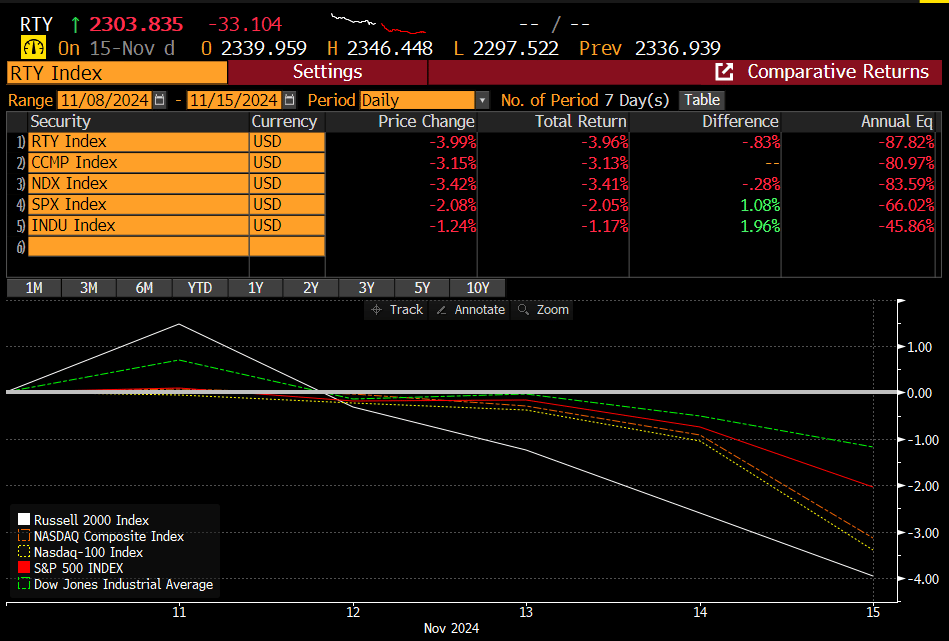

Last week marked the first significant warning sign for equity bulls since early September, as the major indexes posted their worst weekly performance in months. The Russell Small Cap Index (RTY) and the Nasdaq 100 (NDX) took the hardest hits, with declines of 3-4%. These moves highlight growing pressure on the rally, raising questions about whether this is just a temporary pullback or the start of a deeper retracement.

These are significant moves for major indexes, erasing a substantial portion of the post-election rally. So, what’s driving this reversal?

The primary culprit: rates are not relenting. This has been our top concern for the equity markets since early fall. The latest Fed Funds Futures are now pricing in less than a 60% chance of an additional rate cut at the December meeting, a stark shift in expectations. This persistent pressure from rates is weighing heavily on sentiment, creating a challenging backdrop for equities to maintain their momentum.

Adding to market uncertainty, Trump's recent administration appointments are creating confusion and potential roadblocks. Several nominations have sparked controversy, threatening to delay the rollout of his pro-growth initiatives. One notable example is the nomination of Florida Rep. Matt Gaetz for attorney general. According to Polymarket, the prediction site that accurately called Trump’s presidency, Gaetz’s confirmation odds stand at just 29%.

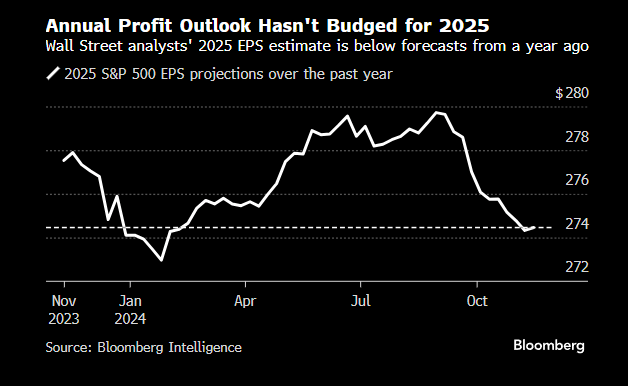

A prolonged confirmation process could significantly stall Trump’s tax reform agenda, dampening the current enthusiasm for future corporate earnings. This is particularly concerning for a stock market already trading at a stretched 22x forward earnings. Compounding the issue, SPX earnings estimates for next year remain stagnant, notably lower than both last year’s forecasts and the peak forecasts reached earlier this summer. This combination of delayed policy implementation and underwhelming earnings growth could put additional pressure on an already precarious market.

Then there’s the looming threat of new tariffs, which Barclays estimates could shave 3.2% off SPX earnings in 2025. Equity bulls have largely dismissed this risk, arguing that Trump’s pre-election rhetoric is more bark than bite. They contend that he’s unlikely to push policies that would significantly impact the stock market, a key scorecard for his administration as seen during his first term. Whether this optimism is warranted remains to be seen.

The bottom line is that the stock market is facing a fresh wave of uncertainty precisely when it was primed for a pullback. Sometimes, markets just need a catalyst to trigger reversion. As we outlined in recent reports, this setup was already on our radar.

The title of our 11/13 report, “Is SPX 6K the Top?” wasn’t a definitive call for a peak, but it’s looking increasingly prescient. Was last week’s sell-off an early signal of broader weakness, or merely a function of positioning around OPEX?

It’s worth noting that the negative seasonality window struck once again, accurately forecasting the timing of elevated market volatility. This reaffirms the importance of paying attention to these seasonal and technical cues in navigating market shifts.

Here is an excerpt from that report:

While the timing may have been off by a day, our 11/10 report accurately anticipated a pause or retracement from the SPX 6K level. The key takeaway? Our readers were well-prepared for this development.

On Friday, the SPX tested our identified downside levels and now finds itself in a precarious position. This is a critical juncture where buyers are expected to step in and defend the trend. Whether they succeed will set the tone for the near-term market trajectory.

Here is the excerpt from the 11/13 report detailing the levels to consider for a pullback:

"Downside targets if the market wants to retrace are in the 5781-5870 range."

And where did the SPX close on Friday? 5870. This isn’t a coincidence.

So yes, we called for a retracement with precision, and so far, we’ve seen the market test our support levels. The big question is: Will the stock market rebound from here and push toward new highs, or have we already seen the highs for the year? Time will tell, but the next move from here will be crucial in determining the ultimate direction.

Let’s dig in…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade