*Note* - due to our busy holiday travel schedule, this week’s report will be condensed, and we will forgo publishing the mid-week report. The US markets are closed for Thanksgiving on Thursday, and Friday markets are only open until 1pm EST.

It’s hard being a bear in the stock market. The constant fighting of strong underlying trends must be exhausting. Just when bears think they may have tipped the scales, the market comes roaring back to negate the possible bearish developments. This is why we follow trends, and do not dispute or fight their prevalence. Fight a strong trend at your own peril.

At some point, trends do exhaust and revert, and it’s our intention with our research, to identify possible turning points and capitalize on them, whether through defensive positioning or going short. We haven’t advocated being short the market since the July peak, so we’d say we are quite astute at identifying trend termination. Our analysis requires price confirmation, and while we may grow cautious at turning points, we rarely, if ever commit until we see enough deterioration in our indictors confirming the potential degradation.

What do we mean by that? The construction of the indexes last week had all the markings of a potential top for the stock market. Island reversals in major indexes at their ATH peaks, were exciting even the most latent bears. At the very least, this sort of signal should make any participant concerned, us included.

The issue with singular variable analysis, is that it only shows a provincial angle of the stock markets picture. Global markets are all intertwined, influenced by various inputs, and dissecting and analyzing all of them is required to truly gain edge when making directional calls for the stock market.

As evidenced in our last few reports, we highlighted the importance of tracking the leading cyclical sectors for clues. Rotation away from large cap tech, is not bearish, but that rotation does leave a mark on index prices due to their weight.

Transports (IYT) did see some reversion last week, but was it enough to grow concerned about the overall health of the recent advance? No. The IYT back tested the election gap window, the Feb breakout pivot and the 20 day SMA. That back test was successful and now has broken above the bull flag pattern. Bull flags are continuation patterns, and breaking higher implies higher prices.

Industrials (XLI) have a similar appearance.

Financials (XLF) have been leading the stock market in the second half of this year (coincidentally, this was our prediction in our 6/30 report). Last week this made a new ATH. Financials are a cyclically sensitive sector, and new ATH’s are not indicative of a stock market that is gearing to roll over. This is undeniably bullish.

If you are making a call that the stock markets demise is imminent, wouldn’t it show up here? We’d venture to say yes. We explicitly wrote this in our 11/20 report:

“…from a technical perspective, there lacks significant evidence at this moment suggesting we're on the brink of a major correction. Instead, the market appears to be consolidating after a strong move. Unless there's a clear breakdown in these key sectors, the current picture suggests the bull market is still intact, for now.”

Here is an excerpt from that report on the SPX:

And voila! The SPX bounced aggressively from those levels and reclaimed the red gap window from last week. Reclaiming the gap is bullish and argues for higher prices.

While the lower-level scenarios we outlined in the last report never materialized, the ensuing support tests and gap reclaim, keep the bullish trend alive and well. We are never going to get every wiggle in the market right and only present various scenarios to consider for the short term. Our main focus is to attempt to uncover the dominant trend and stay with that trend for as long as it remains in place. We are not short-term traders but will make tactical suggestions around the edges if the current market conditions warrant it.

The US stock market tends to do quite well after election day, something that we have highlighted multiple times in our reports. The median return from election day to the end of the year is 5% for the SPX, according the Deutsche Bank. But this year is atypical, with the SPX now up 25% in 2025 after gaining 24% in 2024. The index is now on pace for its first back-to-back 20% gains since the 1990’s.

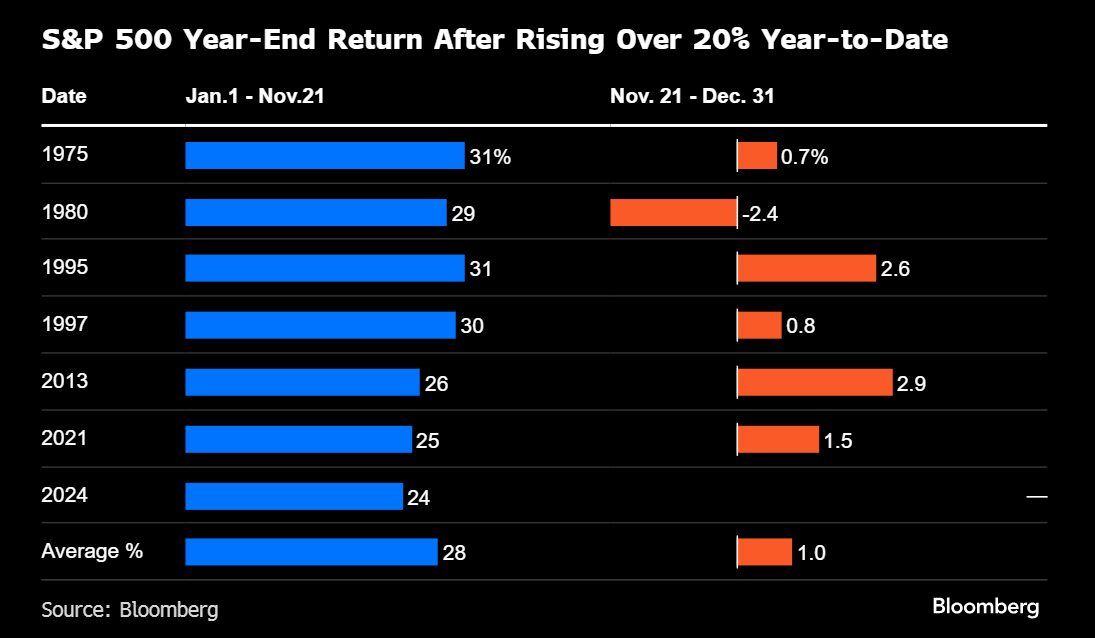

Momentum begets momentum, and the market has a lot of it. Despite a stock market that is seemingly ignoring the current rate complex dynamics and an expensive 22x multiple, the stage seems set for more upside. The stock market is now entering the best 6-month window of the year for further gains. But since 1970, further end of the year gains tends to be somewhat muted after a market that has gained 20% year to date.

According to BofA, sentiment and positioning have grown largely bullish, which may add to less upside for the indexes into year end. This would make sense as the largest weightings in the index (Mag 7) continue to struggle to make headway.

But can upside manifest in other areas of the stock market, while index gains remain subdued? Yes, implying investors need to look elsewhere for alpha.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade