Benjamin Graham’s famous quote, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine,” feels especially relevant in the lead-up to the US election. As early votes pour in and polling centers clamor for relevance, we’re reminded just how refreshing the stock market can be by comparison. Stocks don’t fill your feeds with ads or flood your inbox with campaign pleas. They don’t rally for support or pick sides. They simply allow you to place your bet, then move in black-and-white precision—you make money, or you don’t.

This simplicity is a breath of fresh air. Every day, the market votes on winners and losers, and in the short term, volatility creates opportunity. Our task is to sift through the noise and identify those opportunities. And as contentious as the election has been, we can’t wait to move past it, to focus on a place where no insults are traded and every position is as simple as it gets.

Moving on…

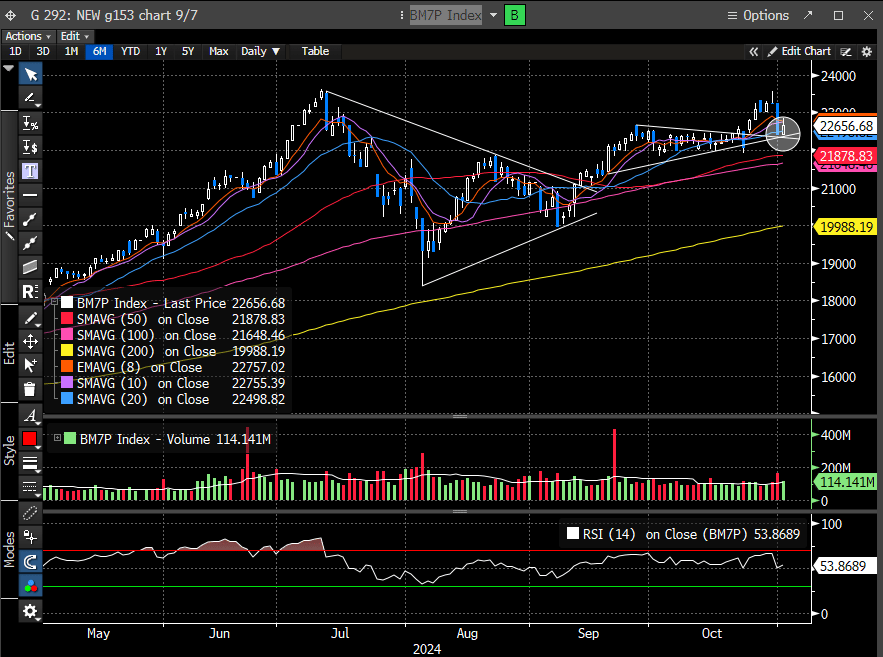

We have been warning for weeks that the stock market was weakening under the surface. We explicitly wrote multiple times that the setup for the second half of October would likely produce better entry points.

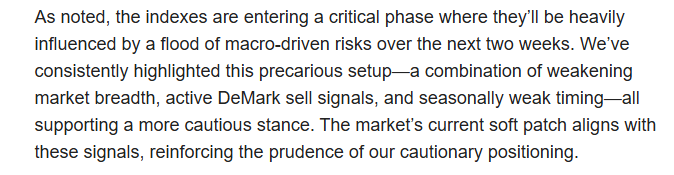

Here is the excerpt from our 10/30 report highlighting our cautious stance:

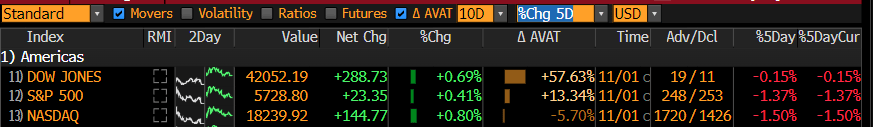

The major indexes all posted a down week. The Nasdaq posted its first weekly loss of eight.

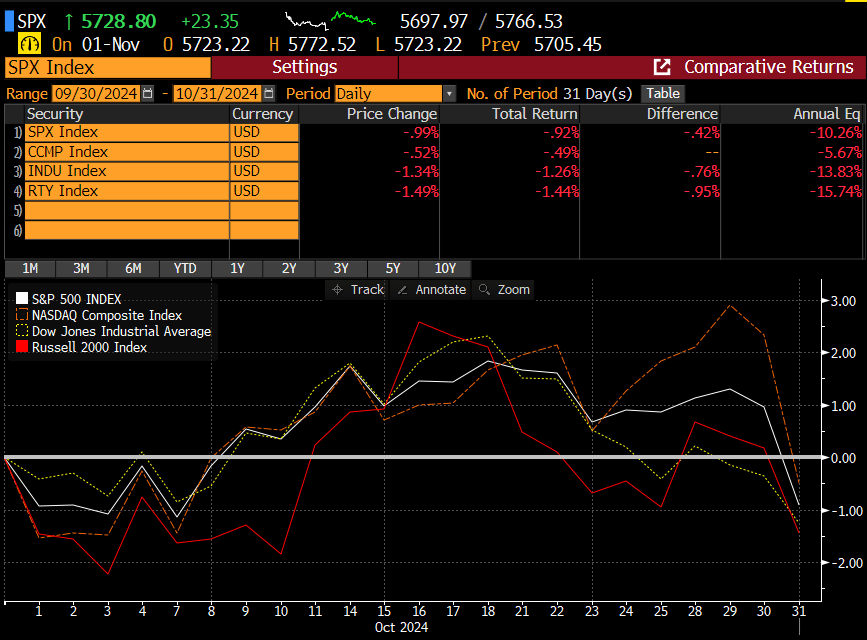

And finished with a down month.

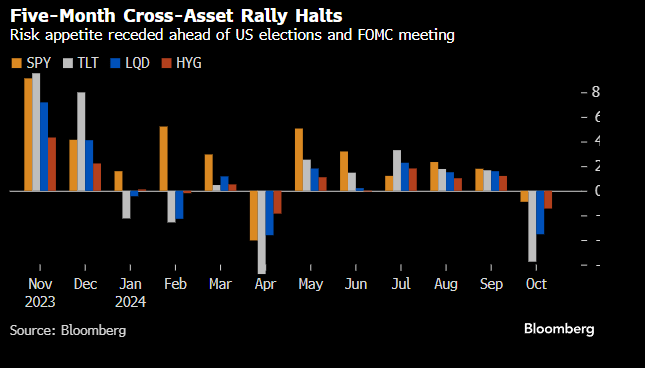

Capping off a five-month positive trend of cross-asset performance.

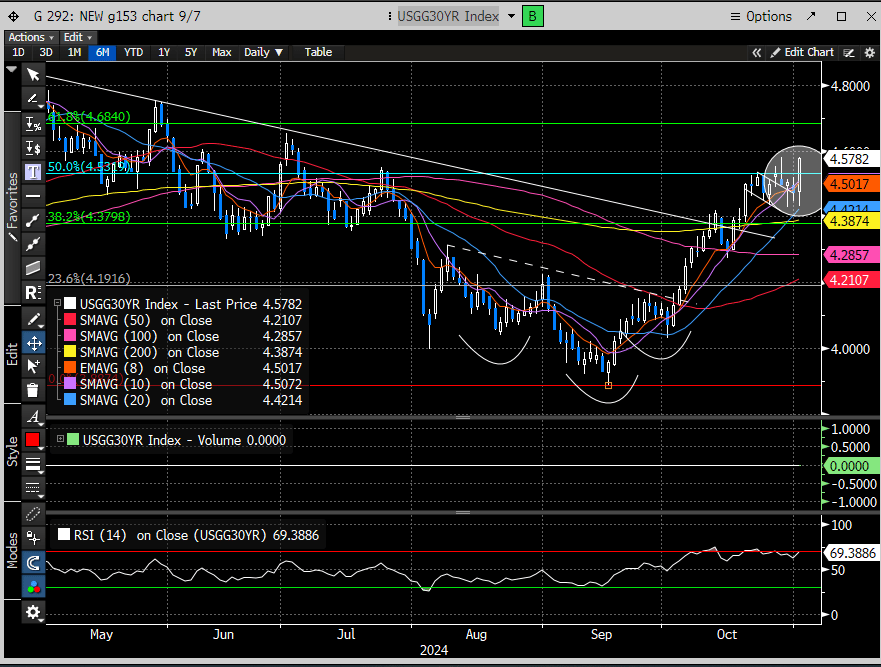

The stock market is often set up to revert but needs a catalyst. That catalyst was the poorly received Mag7 reports last week and the relentlessly appreciating yield complex. Our second support zone for the SPX, which we highlighted in our most recent support, is being tested, and the Nasdaq is hovering above.

The poorly received Mag 7 reports this past week have reversed all of the prior week’s goodwill, leaving it at a precarious but identifiable juncture.

Meanwhile, the rates complex continues to forge new swing highs.

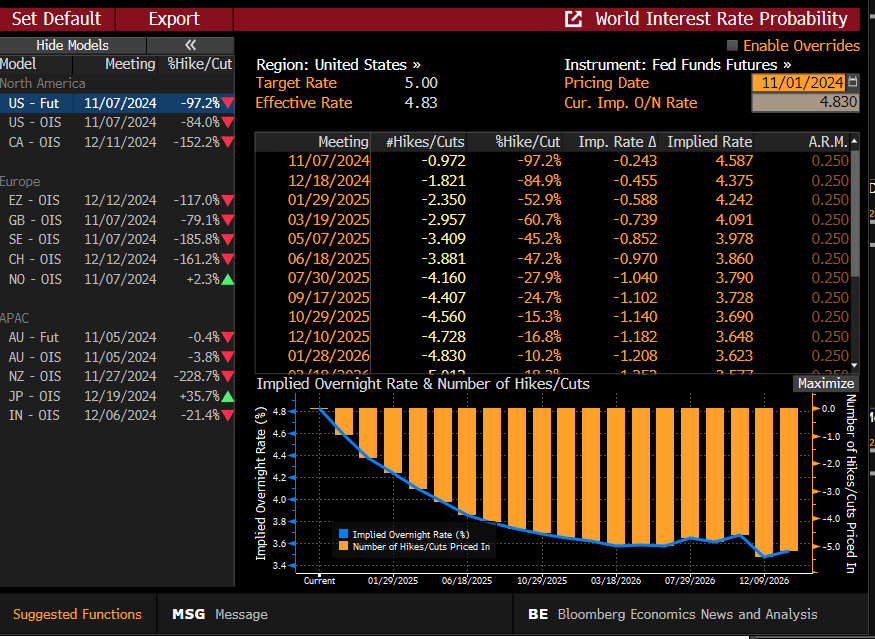

Last week’s marginally higher PCE and softer payroll report didn’t do much to deter the bond market from changing their opinion about next week’s FOMC meeting. The Fed Fund Futures are pricing in a 97% chance of a 25 bps cut and 80% chance of an additional cut at the December meeting.

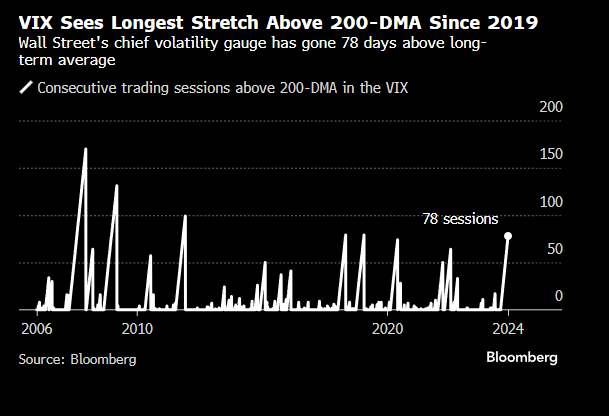

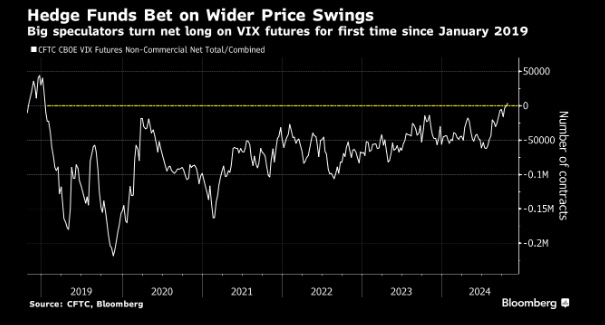

This doesn’t mean the forecast will remain that way. This week’s FOMC can still surprise the market if they turn more hawkish. There is no shortage of predictions on how this week will trend. Heightened risk is being priced into the stock market between the Election results (potentially a disputed result) and the FOMC. This is evidenced by the VIX, which measures 30-day SPX volatility.

Volatility bets for this week have pushed speculators to be the most net long volatility since January 2019.

Interestingly, this is all taking place around a stock market at ATH’s. This is a rare phenomenon and is typically associated with dislocating markets.

This level of anxiety will undoubtedly need to be unwound and will likely play a role in our unfolding thesis and setup for the stock market.

Let’s review the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade