The last few weeks of the stock market should be a warning to those who think forecasting direction is an easy endeavor. It’s not. It’s fraught with risk and uncertainty and being wrong from time to time is an inevitability. We welcome that challenge as we see quite a bit of one-way analysis that is available to consumers. Our favorites are the loud and boisterous on Fintwit that incessantly rant about being right even when they are not. We see no reason to re-hash our views on who they are and what they say, we simply caution those looking for an edge when trading, to choose wisely what you consume and who you listen to. It can be very costly and expensive to be pigeon held to one specific belief, or rationale when deploying your hard-earned capital. Rule of thumb: anyone who uses attention grabbing headlines/titles to garner page views or readership or spends an inordinate amount of time telling everyone how stupid they are, including the participants in the stock market driving prices counter to their belief, are simply reckless, and sensationalistic. Everyone has a choice to what they choose to read and act on and being swayed by anyone who takes an impartial approach to something as complicated as the stock market is usually a big warning sign.

If you have been doing this as long as we have you know that the stock market is a humbling animal. We are humbled by it every day, but we also know when our views are wrong, and we are quick to amend them. Being wrong is ok and to be expected but staying wrong is what will bury you.

Last week the stock market managed to trounce the bears again who thought the difficult 30-year bond auction on Thursday was the end of the recent rally. Some big personalities were calling for a piercing of the Oct lows to follow. Those people couldn’t have been more wrong. The stock market not only reversed Thursdays sell off but managed to eclipse the important 4400 resistance area.

Why was 4400 so important? Because it was the Sept gap down window that started the entire drawdown into Oct. The SPX is now above all major MA’s, after spending some time below the important and widely followed 200 day, this is quite the bullish statement in our opinion.

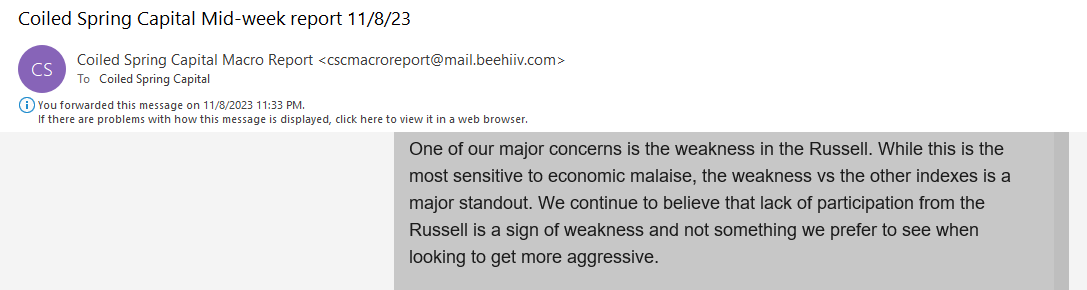

In our mid-week report, we expressed caution into the end of the week as the Russell was grossly underperforming the other indexes. This is typically something to take note of as index discrepancies during a bull phase can be a warning sign.

Here is that excerpt:

And we also painted the picture what needed to hold for the bull phase to have legs (Russel Index):

And guess what? It held to the penny, and the rest of the market rallied aggressively on Friday.

Not everything in the stock market is going to be so cut and dry, as most if it lives in grey areas. It’s important to know where the pain points are, and the Russell is one of those examples. We try to identify those for our readers so they can make better decisions.

Despite what we viewed as short term resistance, we maintained that the indexes would likely break up and dips would be shallow.

From last week’s report (SPX):

“Last weekend we suggested that the upside was somewhat limited on the indexes, despite being bullish for higher….The momentum per RSI is greater…And the MACD is crossing the zero line, so we fully expect this to break up.”

So, while the dip was a bit shallower than we expected, we were not positioning for the end of the rally and we were looking for continuation. Obviously that continuation came faster than we anticipated, but nonetheless we remained on the right side of the market.

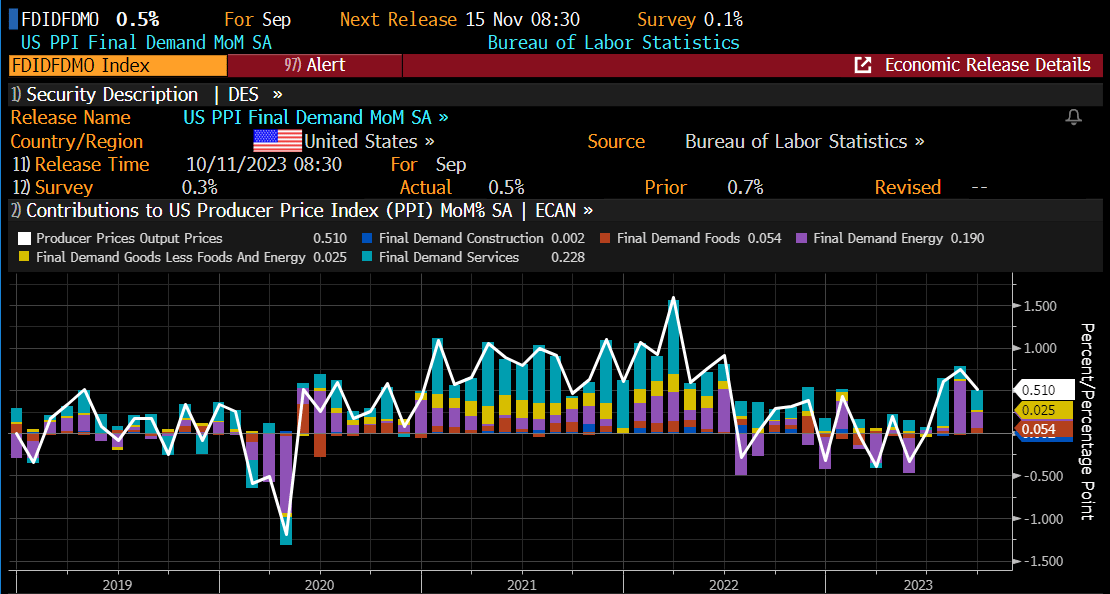

This week is going to be tricky to navigate as we get a number of data reads (CPI is the focus), OPEX and there is the potential for a government shutdown. This means this week is fraught with risk, and at the very least we should anticipate some wild swings.

CPI/PPI are the big Kahuna of data reads this week, as any acceleration could be viewed negatively. That said, if you read our post last week about energy prices, this could be a massive tailwind for future lower inflation readings. Oil prices are embedded in everything, and significantly lower oil prices should provide a nice headwind for inflation. We are not economists, only presenting a possible outlier and likely a big reason why the stock market has been rallying. We are firm believers that collective stock market participants are the best predictors of the future, and last week’s reversal smells like a surprise is coming. This is strictly conjecture and we would certainly not bank on that statement, just something to ponder.

The risk of a government shutdown at the end of the week is very real. A shutdown could spark additional scrutiny from the already wary credit agencies.

While we certainly wouldn’t put too much weight on any outcome around the US’s political dysfunction, given the recent rise in the indexes, risk seems tilted to the downside if a shutdown were to occur. Typically, the specter of one is enough to cause volatility. Couple this with an OPEX week, and taking a conservative approach this week is likely warranted.

So how do we see the set up for this week?

Please consider subscribing below to read the premium portion of our analysis.