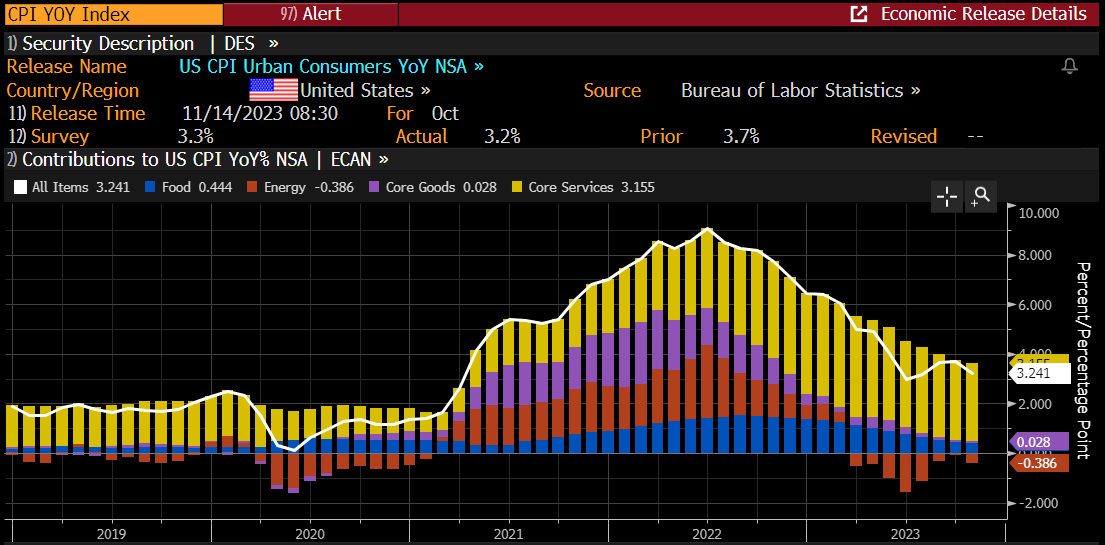

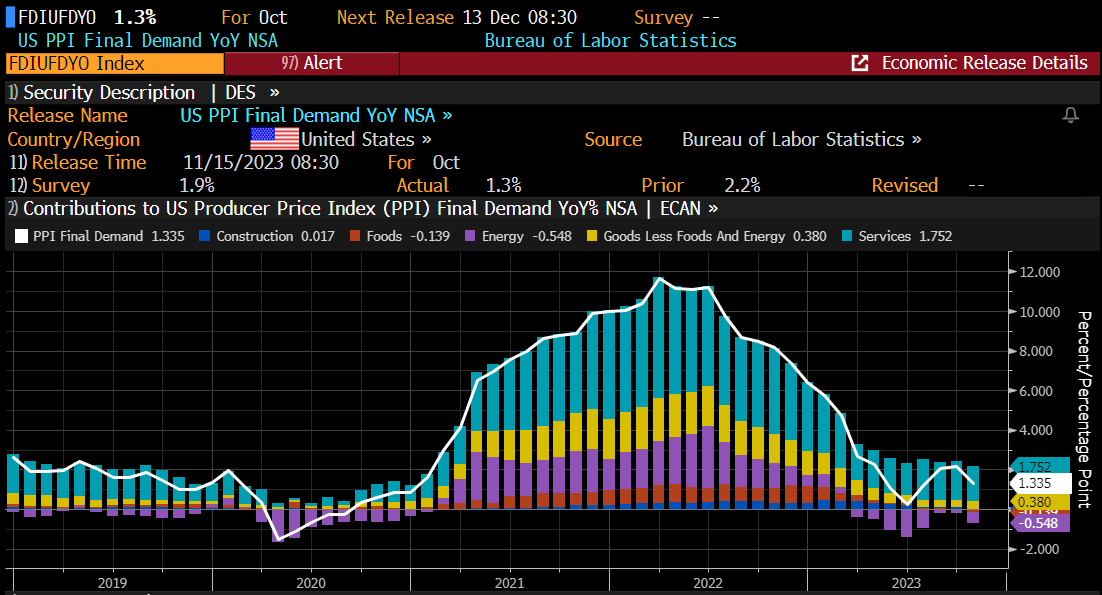

The stock market posted another very solid week, triggered by softer than expected inflation prints. It feels good to be long.

The CPI was argued by many as a fabrication of the government reporting mechanism. Hmmm. Sounds like we have some bitter bears who either got it wrong in their forecast or were positioned incorrectly. While taking the government reports must always be done with a certain level of skepticism, this is the world we live in, and the stock market is going to take their cues off the reports it is given.

The beauty of our system is we actually do not care what gets reported. We, of course, take appropriate caution into seemingly binary events, but we did not back off from our bullish stock market stance into this week’s inflation readings. Some have asked, how can we be so sure? The simple answer is, we can’t. There are no certainties in the game they call the stock market, all we have to rely on is our analysis that defines probabilistic outcomes. We take a weight of the evidence approach to making conclusions about the stock market trajectory. We weight those conclusions against our own theories, but the reality is we let our work speak for itself. If it says the market is set up to be bullish, we set up bullish. Conversely, if it screams bearish to us, we get bearish and defensive. Sometimes, our analysis doesn’t conclude much, and we wait for more information.

We are firm believers in letting the global markets be our guide, and while we cannot track every correlated instrument, we do track 100’s which will typically tell a story. What better way to predict the direction of the stock market, than by interpreting the actions of millions of professional investors across the globe? Clearly, they are better manned and better resourced than we are, so why not use their collective wisdom to make better decisions in the market’s instruments.

This makes us sound like we are strictly trend following analysts. This is only partly true. We are rooted in CMT theory, and thus we are believers that instruments trend. Defining that trend is important, but discovering a trend as early as possible is game changing. This is where our unique blend of DeMark analysis, combined with traditional technical indicators, and a dose of fundamental logic come into play. The results even amaze us. Not only were we bullish for most of the year, but we sold the July highs, and were buyers into the end of Oct weakness. Thats quite precise by any standard and we are proud of the results that our analysis yields. But we are even more pleased at the resounding gratitude we get from our readers, not only for the money we have saved them from being on the right side of the market but also being able to capitalize on the market swings. Markets do not move in a straight line and there are always opportunities long and short in any given year. It’s our purpose to define those trends so our readers can capitalize on them. We are not an alert service, but we do offer our readers idea suggestions from time to time.

At the conclusion of this report, we will offer a number of ideas to consider. This will only be available for premium subscribers.

The type of ideas differs from single stock ideas, commodity plays, Crypto’s to index ETF’s. Basically, wherever we see opportunity.

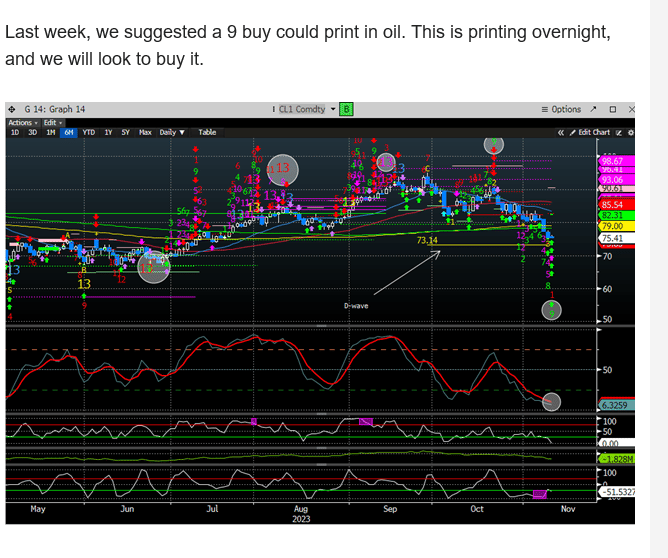

Here are a few snapshots of recent ideas:

We positioned for trading Oil in our 11/8 report for +$3-$4.

Excerpts from that report:

Oil traded precisely as we suggested it might. Traded up $3-$4 from the 11/8 close and failed.

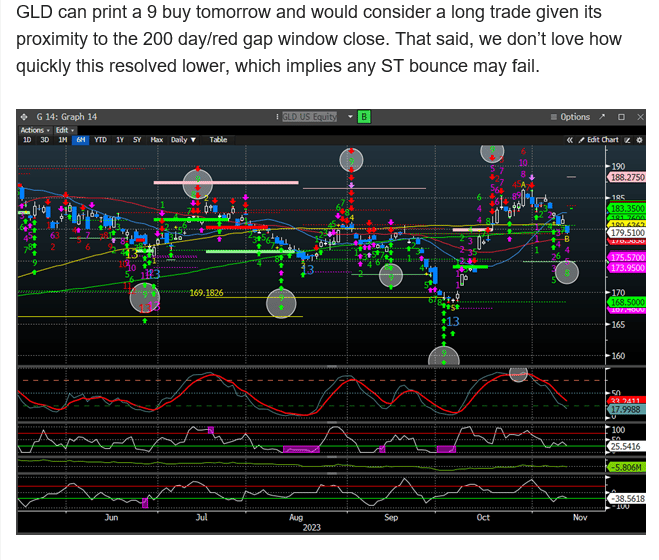

Last weekend we suggested a long call on Gold ($GLD) on the recent 9 buy, which coincided with the 200 day MA, as well as the gap window from 10/18. So far, this bounce has produced +$4.

We positioned for GLD for +$4 in our 11/12 report:

Here is an excerpt from that report:

In our 10/22 report we highlighted the extreme nature of the Russell, and that we would be interested in trading the long side should we test the 1640-1650 level. On 10/27 the Russell traded to 1633 and traded as high 1830 last week.

We positioned long the Russell Index ($IWM) for +7-11%.

Here is an excerpt from that report:

The bottom line is, we zig while others zag. That is the power of our analysis, and we hope you will join us as we explore a number of single stock ideas to consider into the end of the year.