Black Friday Special (20% off annual sub) - Expires Tonight!

We hope everyone had a wonderful Thanksgiving, and if you do not celebrate, we hope you enjoyed a nice reprieve from the craziness we call the stock market. As mentioned in our mid-week report, published on Thanksgiving, we didn’t think we would get much movement on the half day on Friday, and thus our initial conclusions for next week still stand. We will review those in the premium section and expand with more detail.

November has been nothing short of an outstanding month for the US indexes and are currently on pace for one of the strongest Nov’s in history. Imagine coming into this month bearish, expecting the Nov 2nd Fed meeting to push the indexes lower with hawkish rhetoric, and stubbornly holding that view expecting some sort of market crash. That would be a horrible set up to go into what is supposed to be a joyous Holiday of thankful celebration.

Fortuitously, we were prepared to pounce on the late Oct stock market weakness and positioned for the confirmatory treasury move post Powell’s seemingly dovish messaging. While being overexposed to any binary event is not what we do, we were certainly discussing the notion that rates were in the topping process and the Fed meeting could be the nail in the coffin for rates. Thus, when the dam broke, we started getting aggressively long.

Notice how the 10 year broke down the day of the FOMC meeting and never looked back. Ignoring something as simple as this breakdown has spiraled bearish stock positioning to considerable losses. The market is a complicated animal and if you are relying on wave counts, diagonal lines and feelings around a singular instrument, you are simply missing the forest through the trees.

The stock markets major indexes are now posting some very sizeable gains for Nov, while yields have collapsed. Clearly there is an indirect correlation in play and thus to ignore that interplay was clearly at your own peril.

But we digress. As we exit the very bullish seasonal month of Nov, we enter another historically bullish month of Dec. Here is the SPX returns over the last 30 years.

The Nasdaq tends to be a little more bullish.

But the Russell is typically the most bullish.

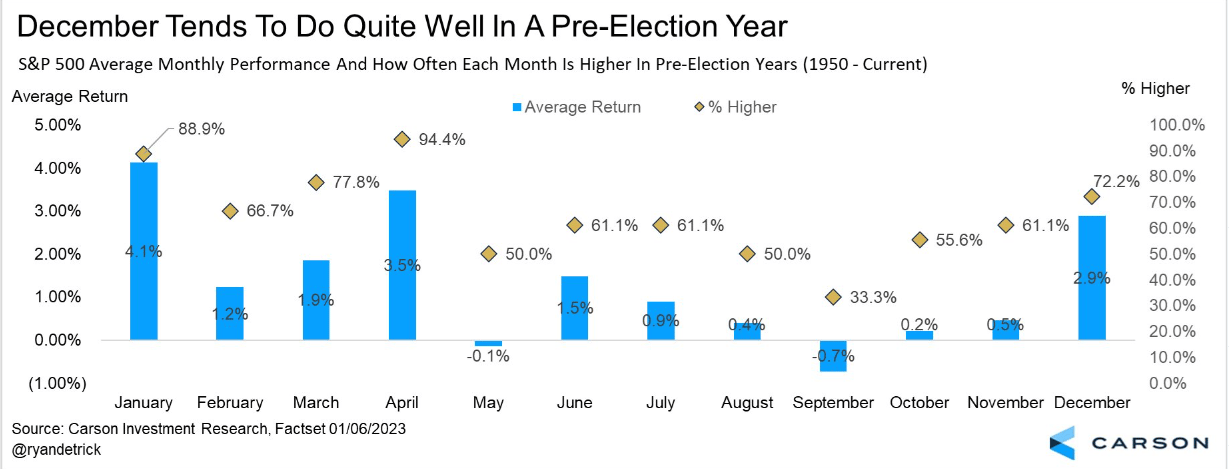

Adding a bit more fuel to the bullish fire, is that in pre-election years, according to Carson Investment Research, Dec is one of the most bullish periods of the year. A big reason for Dec seasonality is that underperforming money managers need to chase performance. We think it’s safe to assume that most professional investors did not expect such a strong Nov, and were likely not positioned for such, thus a chase to some extent, should be expected. According to this chart, the stock market gains in Dec over 70% of the time for an average gain of +2.9%.

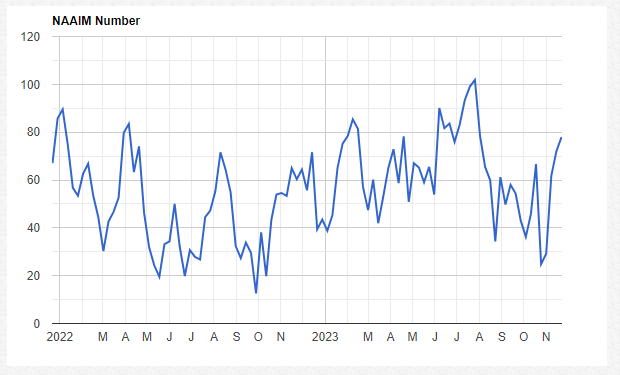

A good indicator at how under-positioned money managers were heading into Nov, is the NAAIM index. We showcased this chart back in late Oct as a reason to start thinking and positioning for future bullish outcomes. On Oct 25th, this index was almost as low as the previous Oct ‘22 stock market bottom, at 24.1% invested. Thats quite extreme, and fast forward to today, this has skyrocketed back up to almost 78%. Thats quite a bit of buying for these managers and why the stock market has presumably done so well. Is there room for this to go higher? Of course, but much of the buying power has already been spent.

Something else to consider. According to DataTrek Research, the end of a Fed Reserve tightening cycle, which we are presumably in, tends to see the SPX gain +17% on average in the year after the last increase (1995, 2000, 2006 and 2018). Considering the SPX is roughly flat since the last hike, that seems to imply we still have considerable runway left.

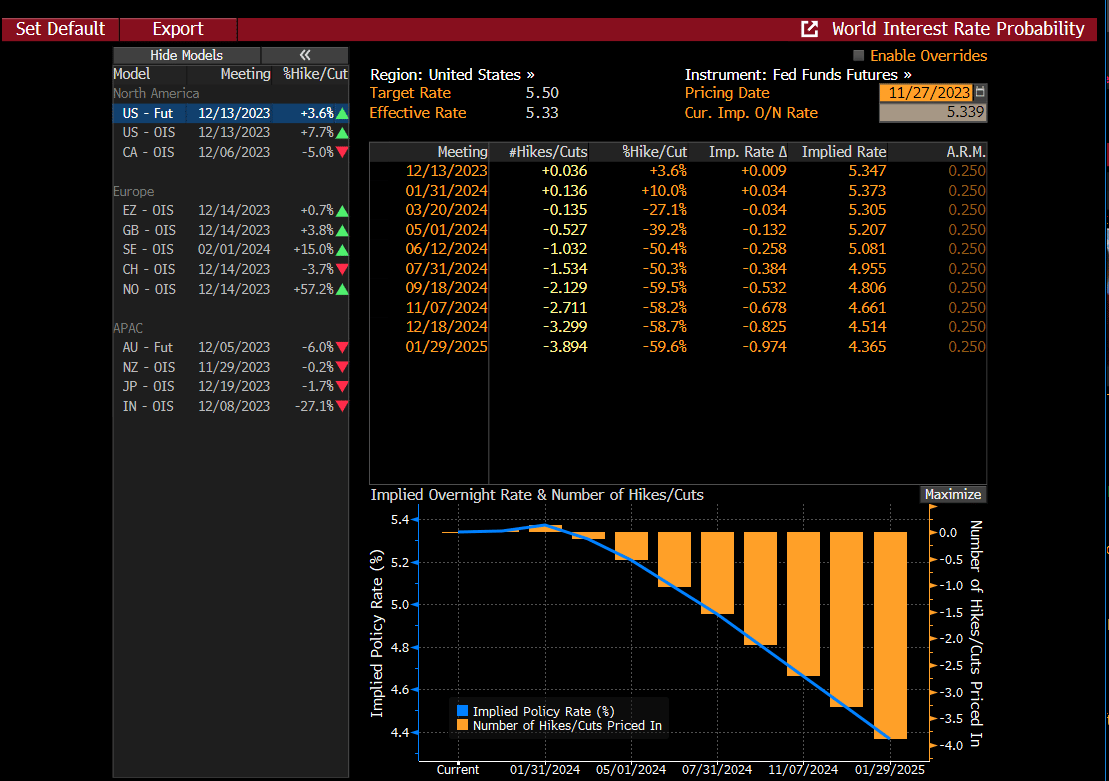

This makes sense if you believe that the Fed is not only done raising rates but will start cutting next year. Currently Fed Fund Futures are forecasting a 50% chance of a rate cut by May.

This is in-line with historicals, as the Fed typically starts cutting rates 9 months after the last cut. Clearly this is what the stock market is attempting to price in. Cutting restrictive rates that are in place to slow down an economy, while seemingly putting the inflation genie back into the bottle, with an economy that is situated on solid ground, could be the goldilocks scenario that stock market bulls are craving. Even Cramer last week on CNBC made the soft-landing prediction. While we put little faith in any CNBC pundit or boisterous Furu, what Cramer is preaching has some merit. Do we subscribe to this soft-landing scenario? We are open to all scenarios and why we stay agnostic while the economists duke out their views. We do think the stock market is probabilistically weighing this scenario, and clearly those probabilities have gone up. This actually poses a risk but might not matter until the seasonal window expires. But, as we always say, the stock market does not move in a straight line, and when the consensus or media starts making bold calls about the future, we have to pay attention and consider these comments as late inning sensationalism. This doesn’t mean the stock market has to revert back down to the Oct lows, it means the easy money off those lows has likely already been made.

There are still plenty of investors who are incorrectly positioned and missed the rally, and it’s entirely possible that they get locked out and will be forced to pay their way in, despite what is seemingly an overbought and overstretched market. This makes the current set up a bit precarious for new longs.

That said, we still see opportunity.

Please consider subscribing below to read the balance of the report. Our Black Friday Sale (20% off annual subs) ends tonight at midnight.

Don’t miss out!

Here is the link to access the sale: