Stock market tops are a process. While this is hard to understand by many participants in the market, especially the perma-bears who have been calling for some cataclysmic wipeout since the early Jan swoon, the reality is that’s not how markets work.

There is one notable bear who wrote that the SPX would return to 4100 by the 3rd week of Jan. Seriously? Please tell us how many times the SPX has lost -15% in 3 weeks without some sort of exogenous news event that redefined the narrative. Again, this sort of prognostication screams of misplaced anger and remorse for missing one of the biggest rallies in a generation. Not only is it probabilistically incongruous, but it’s also irresponsible. Yet, this individual continues pushing his non-sensical opinions out into the ether.

Back to the real world…The SPX did manage to counter trend rally last week as we suggested was a possibility, but that rally was a bit suspect as it came with deteriorating market breadth. This can be evidenced by the McClellan Summation Index, which continues to trend lower, after reaching the highest level since Feb ‘23.

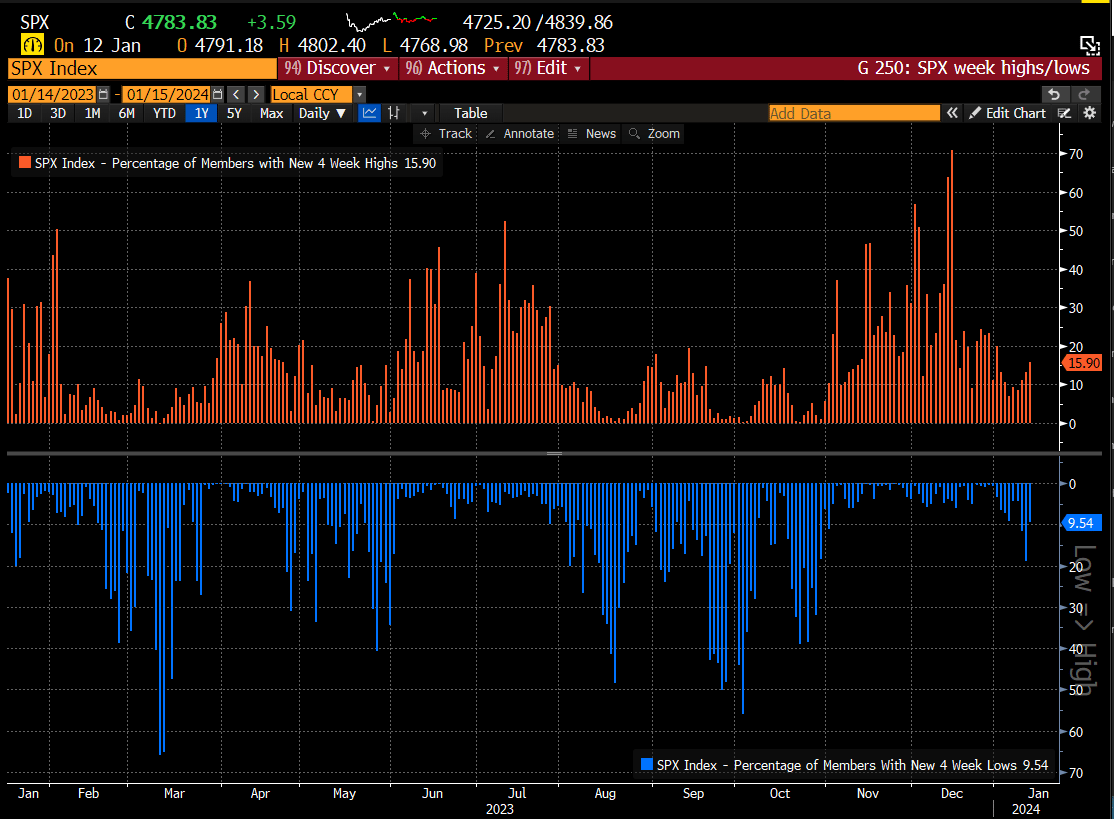

This can be considered a negative divergence and something to be mindful of as we move through the back half of Jan. We are also now seeing 4-week lows in the SPX start to outpace 4-week highs. Is this the start of a protracted turn down for the indexes, or just the beginning of a choppier period?

Choppy would be the expectation, especially during an election year, and something we discussed in our later Dec reports.

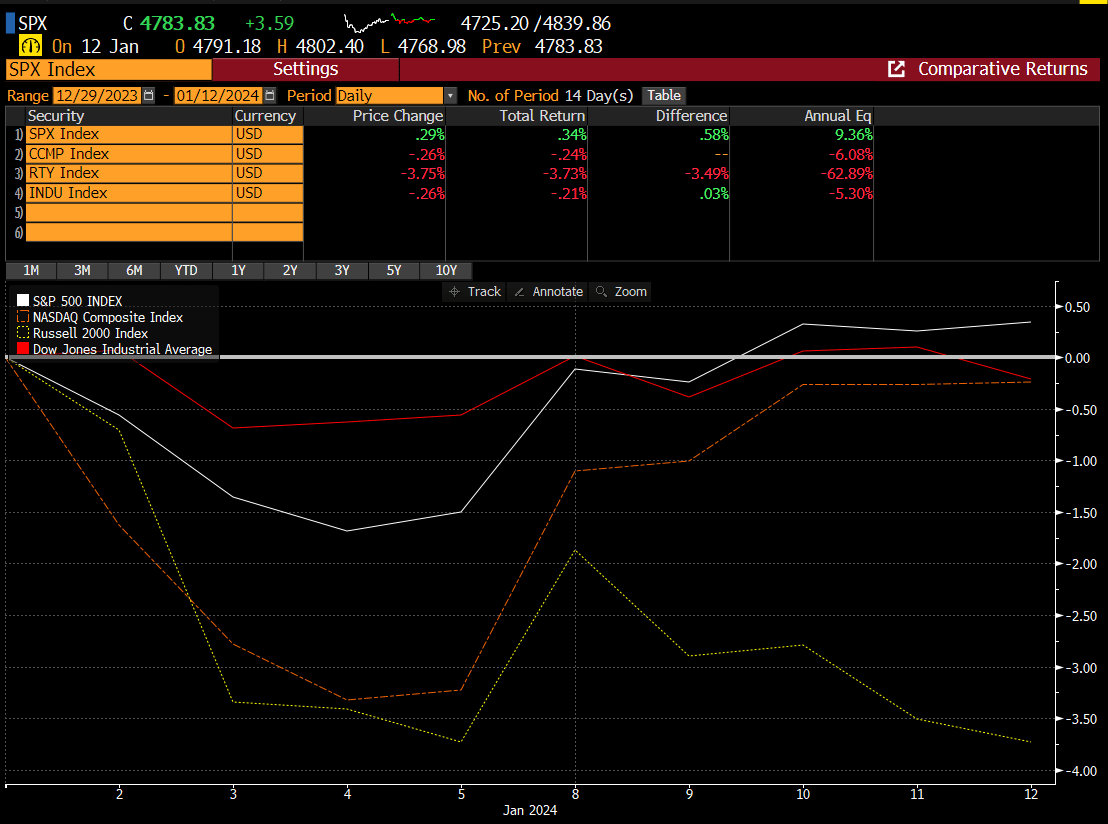

Thus far in Jan, the stock market has done very little when considering index price. The Russell is the only major index that has seen a drawdown.

We would argue that it feels much worse in certain parts of the market, and this is evidenced by the Russell, that does not have the large cap tech names to pad the downside. The Mag7 Index is still hovering near their late Dec highs.

Could this be a function of elevated interest rates continuing to bite into the small to mid-sized companies bottom lines, as the fallout effects of higher costs of capital disproportionately impacts those with challenged cash flows? We think likely.

The CPI report that was released last Weds, only added fuel to that discussion as it tempered some of the enthusiasm for the future pace of rate cuts. The CPI report did come in a bit hotter than we and the Street expected, at 3.4%. This was driven by higher shelter (1/3 of overall CPI) and energy prices. When you exclude energy and food (core), used car prices and apparel were driving the upside. Housing and car insurance rose the most on an annual basis since 1976.

Separately, Thursdays Jobless claims held at a historically low-level, with the number of people receiving benefits falling to the lowest level since Oct. Both of these reports are moving in the wrong direction per the Fed’s dual mandate.

This caused a minor tremor in the balance of the force, with a reaction lower for the indexes, that eventually found buyers. As we wrote in our mid-week, we alluded to underlying strength in the large cap stocks as a tell for where the market possibly wanted to go. Were we hugely convicted in that idea? No. But it certainly kept us from trying to set up short.

Thursday’s candle was a hammer and a good indicator that buyers were not ready to give up. Cue our comment that “tops are a process”…ahem.

Banks kicked off earnings season last week as well and results were somewhat lackluster. Most of the stocks fell as a result. One positive attribute from their releases was the commentary around the consumer, which to no surprise, is holding up well. Spending has shifted more to services vs. hard goods. This was clearly evidenced anecdotally, on our recent trip to Colorado, where the current cost of a ski lift ticket over the holiday was egregiously expensive. We are old enough to remember when ski lift tickets at Vail cost less than $50 in the 90’s vs. today’s price at $300. We recall back then thinking the ceiling for lift tickets would be $100. That prediction was clearly incorrect. The unfortunate reality for excessive inflationary forces, is higher prices, and until the masses decide enough is enough and boycott them, then these companies will keep pushing price. Maybe it’s time to consider another hobby?

Last week was the largest electronics show in the world in Las Vegas (CES), and something we mentioned last week as a potential driver for positive news flow. Unless you have been hiding under a rock, you should be able to guess what thematic was driving most of the buzz. AI not only drove the tech thematic for most of ‘23, but it also likely will do so for the next decade. This is the next mega trend, similar to the internet or the smartphone and no surprise was on full display at CES last week. In fact, AI has become so dominant that most available company resources are now being devoted to developing and cultivating an AI strategy. This trend is still early in the first inning, which means we should expect a significant amount of spending and effort put forth into integrating AI into everything that is sold and consumed. And let’s not discount the amount of innovation that will be spawned as a result. Regardless, we are not AI experts, so we will not opine on this further, as all you need to do is look at a financial projection and a chart of NVDA and decide for yourself.

NVDA’s revenue is forecast to grow over 10X in just 4 years. That sort of growth is unprecedented for a company of this size.

Technically this stock just broke out of a 7 month base with a measured move target of $900.

And if you’ve been following us for more than a year, you may have seen our public twitter post regarding NVDA as an idea consideration in Oct ‘22 when the stock was $118.

Arguably, NVDA is the most important company to this thematic, and the most important when considering the direction of the stock market in the intermediate to long term. How can one be overly bearish if NVDA just did this last week?

But markets do not move in a straight line, and there will be plenty of bumps in the road and opportunities to buy great companies that are leveraged to this thematic.

Please consider subscribing below to further read up on how we see the set up for the stock market in the near term.