Let’s begin this week’s report sharing the goal for our analysis of the stock market for our readers. We wrote this in the last mid-week report:

“The world was positioned for a stock market crash and what happened? The exact opposite. Being loaded on one side of the boat rarely works out. Our analysis is designed to help our readers identify major tuning points in the stock market. Sometimes not being on the wrong side of the market is just as good as calling the low.”

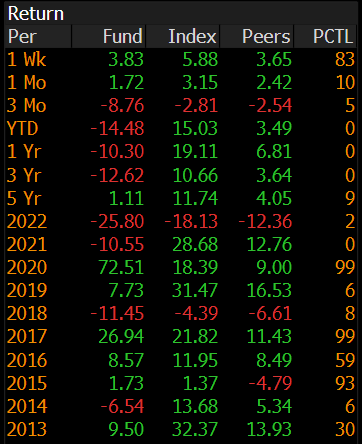

How did those stock market crash-mongers do this week? Not so good. There is a certain boisterous personality on “X” that has been aggressively telling everyone how F%$@!# they are and that last week we would see a limit down in the indexes. Seriously? Could he have been more wrong? Bold statements like that are meant to sensationalize, sell subscriptions, and induce fear. We could care less how much analysis this person has done; his approach is completely flawed. If he really was some mathematical genius that figured out how markets are correlated, his fund would have more than $60M in AUM. No doubt does this individual produce some interesting work, but to scream from the top of the rooftops how nobody knows anything, and they are all doomed, is preposterous. Maybe he should become a subscriber and his fund wouldn’t be underperforming the SPX by -2900 bps. Here is his dirty little secret: his performance over the life of the fund has only outperformed the index 3x in 10 years and one of those years was by a delta of .4%. Peel the layer some more and you will notice that his big outlier was in 2020, when the stock market crashed because of Covid. Now do you understand why he is always out there telling the world that the stock market will crash? He only sees outsized returns when it does.

Here is another way to look at it (SPX in blue/Fund in white). Outside of pure comedy, why would anyone listen to what this guy has to say regarding stock market direction?

We could go on and on pointing out the inconsistencies of some of the big personalities out there offering their opinion on the stock market, but we won’t. They know who they are and if you follow them blindly, well, then you deserve what they are giving you.

We have been driving home the theory that the stock market needed to see a reversal in our “Three Horseman” indicator for the indexes to sustain a rally. If ever there was evidence of this, look how they all performed last week and the accompanying index performance.

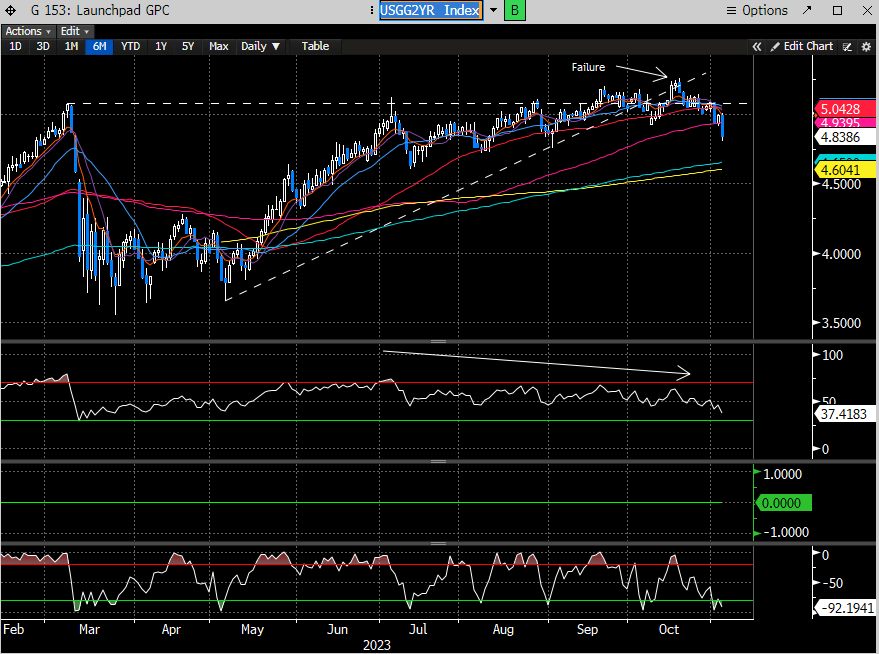

We have been tracking these incessantly for months, waiting for weakness to reveal themselves in these instruments before getting aggressive. We have been writing for weeks that certain indicators and structures were finally starting to crack and that an expectation for them to rollover was growing. Tops are a process in a strong trend, and while the growing weakness was evident to us, sometimes they need a push from some sort of news event or macro data. That came last Weds when Powell seemingly backed off the aggressive rhetoric for further rate hikes and the softer than expected employment report on Friday was the cherry on top of the sundae.

In our last mid-week report (11/1) we highlighted why we spent so much time and effort analyzing the rates market in the last Macro report. Here is that excerpt:

“We have been driving home the “3 Horsemen” indicator as the leading reason to be bearish or bullish. We have been tracking them every day for months. Was today the final crack that will get us back into the stock market? We wrote about treasury rates at length in our last weekend report. We literally included 14 slides talking about treasury rates across the curve and placed them near the top of the report. This was absolutely by design. We don’t believe we have ever included 14 charts on treasury yields. Why? Because we have mentioned many times that of the 3 indicators, the market could not sustain any rally with relentlessly climbing treasury yields. Last weekend, we felt the end of their rise was near. We actually wrote in early Oct that the FOMC could be the catalyst to finally crack their trajectory.”

Interestingly enough, the 2-year remained strong post the FOMC, but after the softer employment report, it nosedived. Why is this important? Because it is highly correlated to the future direction of interest rates. With Fed Funds stuck in the 5-5.25% and the 2-year trading closer to 4.83%, what’s that tell you about where the bond market is projecting the direction of interest rates over the next year? Lower.

There is now an almost zero probability that the Fed will raise rates again, per the Fed Fund Futures market. Equally as important is the forecast for cuts have gotten closer and larger. There are now 4.5 cuts being predicted by Jan ‘25 which equates to over 100 bps off the current Fed Funds rate or 4.21% implied.

The bigger question we have is whether those cuts will occur because the Fed is too restrictive, and the economy is slowing down too rapidly or simply because the Fed actually orchestrated a soft landing. We'd say its somewhere in the middle, which implies there is still a large element of risk to contend with in ‘24. This is something we have been writing about, as a headwind for the stock for the next year. Earnings estimates seemed a bit high coming into this earnings season and so far, that has wrung true as companies have been tempering forward guidance.

We’ve also written that more realistic expectations for next year are actually bullish as it sets a lower bar to outpace those estimates, as long as there remains a belief that they are low enough. Estimates for next year have been declining since September, but currently still calling for almost +11% growth year on year. Whether this is achievable remains to be seen but growth year over year is bullish, it’s what you pay for that growth which is debatable.

If you are an aggressive bear, then you believe that these estimates are too high and need to come down, or you think some exogenous impact will send them spiraling lower. Both are possible as nobody can accurately predict what will happen over the next year.

We on the other hand, have our views, but our actions are 100% backed up by our analysis. If our analysis tells us otherwise, we will shift gears. Until then, we stay the course.

What course is that? Sign up below if you need help challenging your thinking and want to probability stack being on the right side of the market.