Table of Contents

We hope everyone is savoring a relaxing and joyful time with loved ones. The end of the year offers a perfect opportunity to reflect on past achievements, reassess goals, and set new aspirations for the year ahead. It's a time for introspection—reviewing what worked, what didn’t, and identifying areas for growth.

As we look back, we also like to remind our readers of the purpose behind our research and how to leverage it effectively. To that end, we’d like to revisit an excerpt from our January 1, 2024, report that captures the essence of our mission:

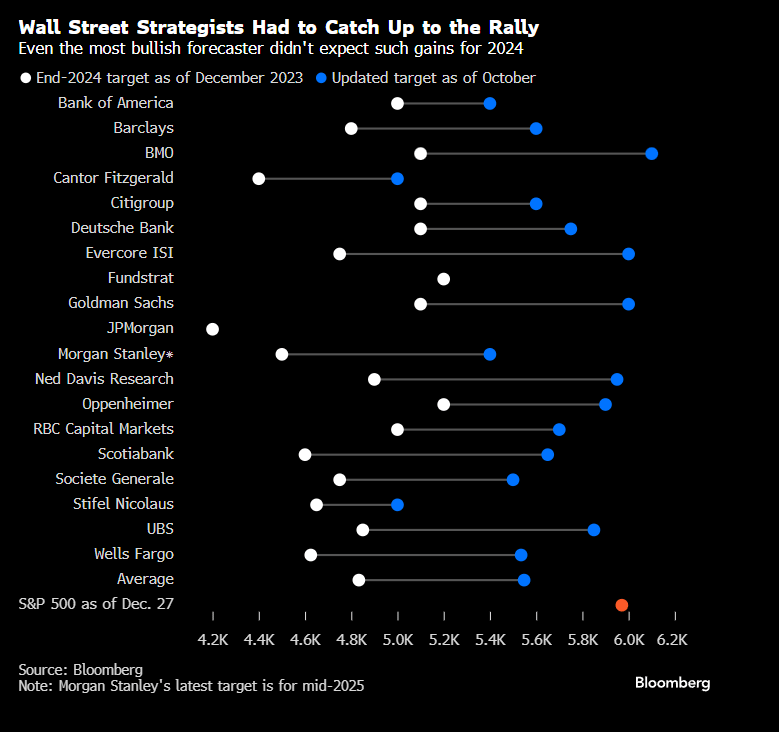

This, at its core, is the goal of each week’s report—to help our readers stay on the right side of the trend. We are not in the business of making grand, long-term forecasts about where the indexes will land a year from now. We’ll leave that to the sell-side strategists who often miss the mark. To illustrate, take a look at the performance of their SPX targets below:

And when aggregating their forecasts for next year, their average tends to be a little better than 10% gains for 2025.

We will continue to focus on what we do best—analyzing the current trend and identifying potential stumbling blocks along the way.

2023 marked the best year in our firm’s history, thanks to several pivotal and contrarian inflection calls that defined the year. 2024 followed with robust performance as well. Let’s take a moment to review:

Below is an excerpt from our 1/1/24 report, where we called for a turbulent January following a highly profitable November and December:

January proved challenging for many investors who entered the year overexposed to the long side. As anticipated, the market experienced turbulence, with highs eventually being eclipsed after three weeks of volatile trading. However, we also recommended buying that dip, forecasting that the SPX would recover and go on to make new highs later in the month—which is precisely what happened.

In our 1/28 report we highlighted the monthly cup and handle pattern break for the SPX was quite bullish. The measured move of that pattern break was around 5700.

The SPX achieved that target in July before seeing an almost 10% pullback into August.

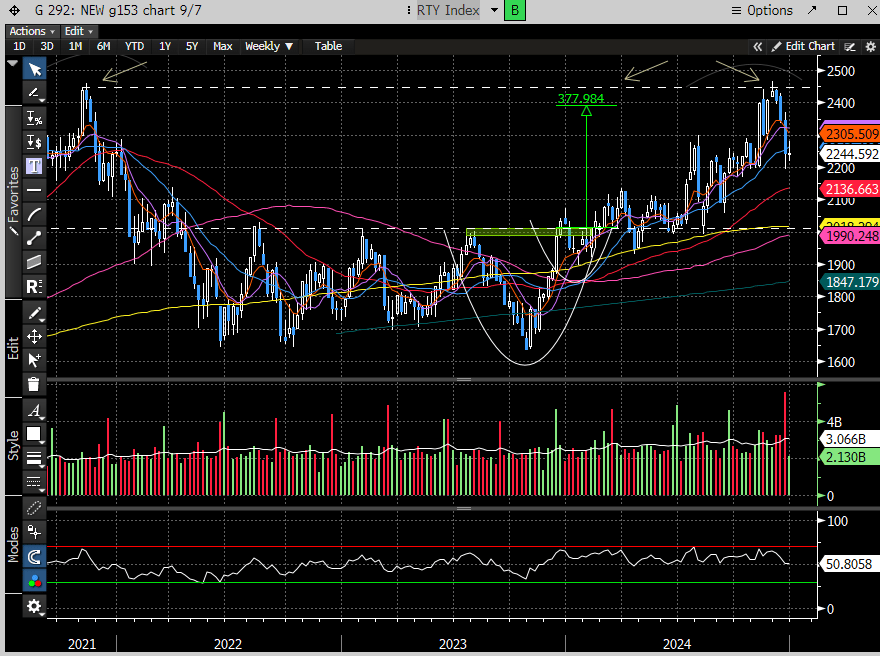

In our 2/11 report we began discussing the bullish potential for the lagging Russell Small Cap Index (RTY), and even began suggesting a break of this cup and handle pattern would yield a test of ATH’s.

That worked out perfectly, with the RTY testing the ATH’s in late November for a ~22% gain before reversing.

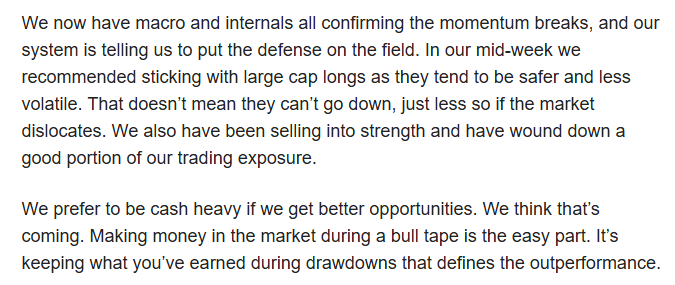

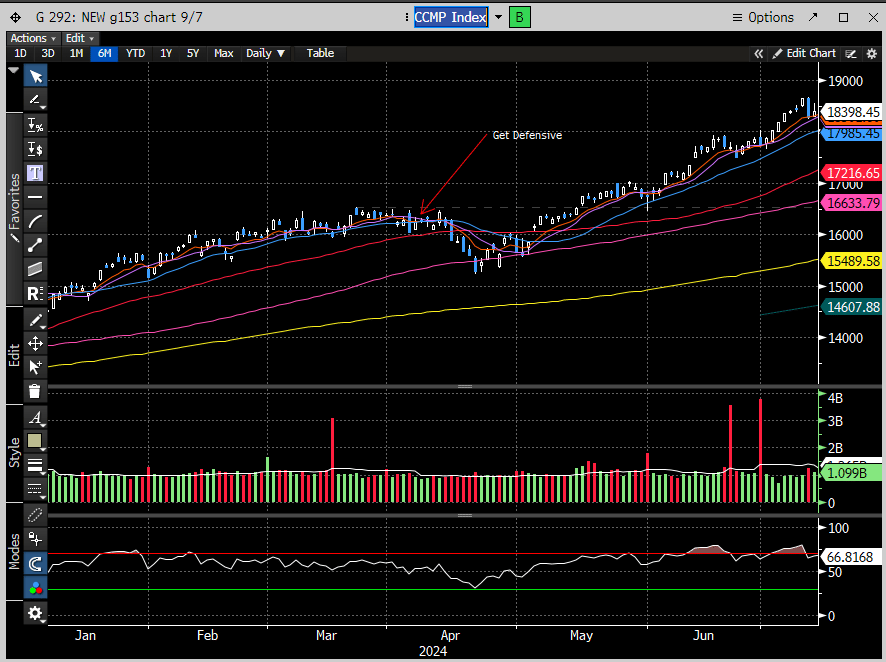

In our 4/6 report we told our readers to get defensive as we believed the market was getting ready to turn down. Here is that excerpt:

The Nasdaq lost almost 7% over the following two weeks.

Our 5/5 report called that correction over. Here is the excerpt:

We remained steadfastly bullish until July when we boldly called to exit large caps in favor of SMID Caps. The SPX gained over 10% in that span.

We wrote this in our 7/10 report:

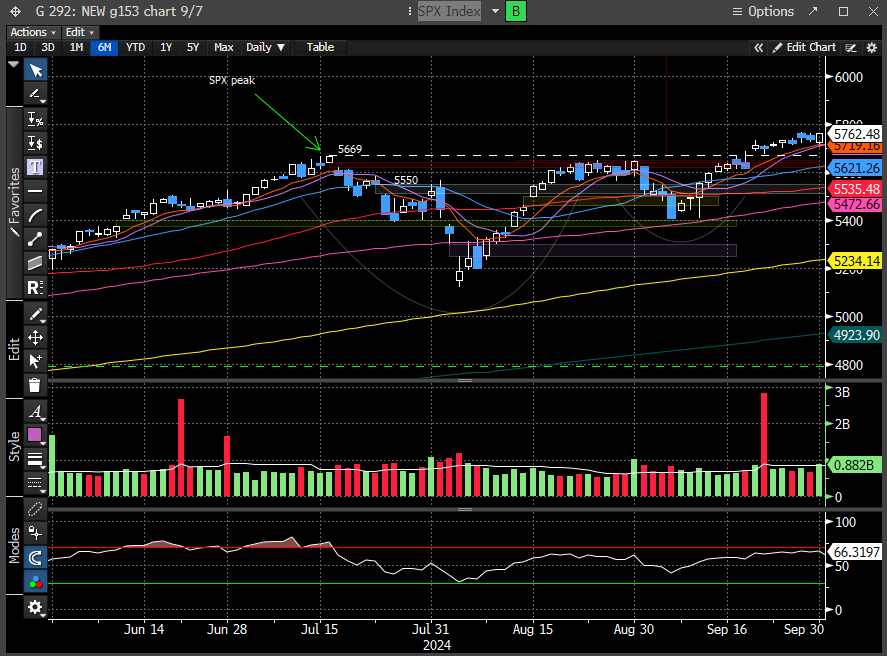

The SPX peaked on 7/15 before losing almost 10%.

In that same report, we highlighted the technical bullish setup for SMID caps (S&P Small Cap 600 - SML).

]

Up until the November peak, the SMID cap indexes grossly outperformed the larger cap indexes.

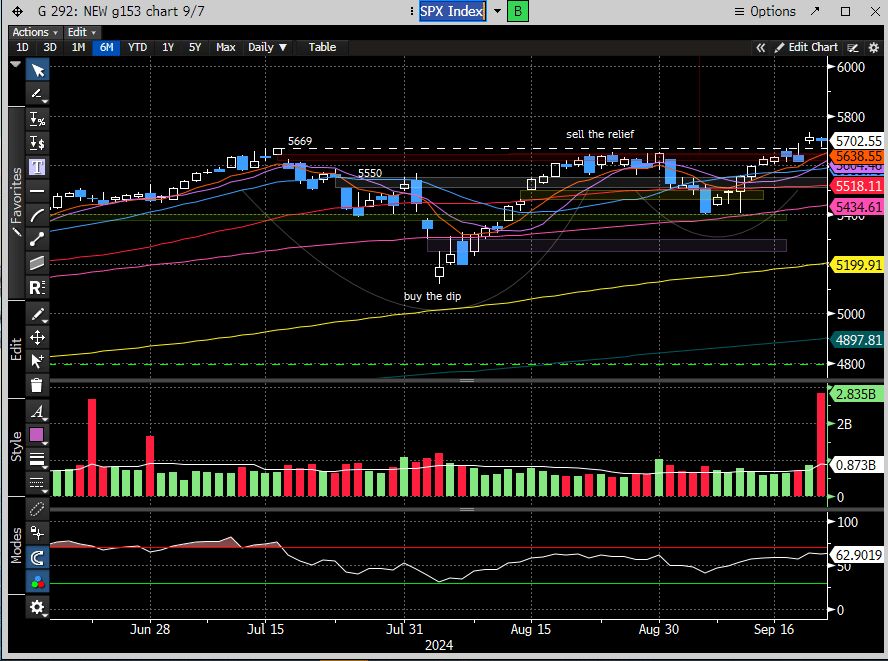

And the Coup de Grace…We suggested buying to dip into the August 5th Japan market crash induced gap down and to sell the relief bounce.

That worked out to be quite the tactical long trade into the Jackson Hole Fed event.

Our 9/11 report discussed the bullish construction changes in the index and the notable Mag 7 strength.

Here are those excerpts:

In that report we also highlighted some of the individual Mag 7 names that looked poised for higher prices. The performance since then has been eyepopping.

We’ll leave it there. Our goal is to provide analysis that not only informs but empowers you to capitalize on pivotal market inflection points that can drive outsized performance. While 2023 was a landmark year for our macro calls, 2024 also turned out to be exceptional upon reflection.

We sincerely hope you’ll continue this journey with us in 2025 as we navigate what is shaping up to be a more complex and challenging market environment. Having a trusted team by your side to help steer through the rough waters can make all the difference in achieving better outcomes. Here’s to another year of prescient market insights and successful stock market navigation!

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade