Decentraland 2.0 is now live

Decentraland is a virtual social world where you can meet new friends, join events, and make memories—no matter where you are. Whether exploring the open, community-built landscape, partying on the dancefloor, or watching a binary sunset on the beach, Decentraland is where people from everywhere come together.

Investing and trading are undeniably challenging pursuits. The glamorization often portrayed by news pundits and social media is both misleading and irresponsible. Successfully navigating the markets profitably is far from easy, even against the backdrop of the stock market's long-term upward trajectory. For every winner, there is a loser; if you’re thriving, someone else is inevitably on the losing side, and vice versa.

Consider those who bought Mag 7 stocks a decade ago and held them without selling a share—they’ve achieved remarkable returns. But this scenario represents the exception, not the rule. The top-heavy nature of the US stock market makes it incredibly difficult for the average professional investor to outperform the indexes. Most are constrained by diversification requirements, forcing them to hold a broad basket of stocks rather than concentrating in a few high-performing names.

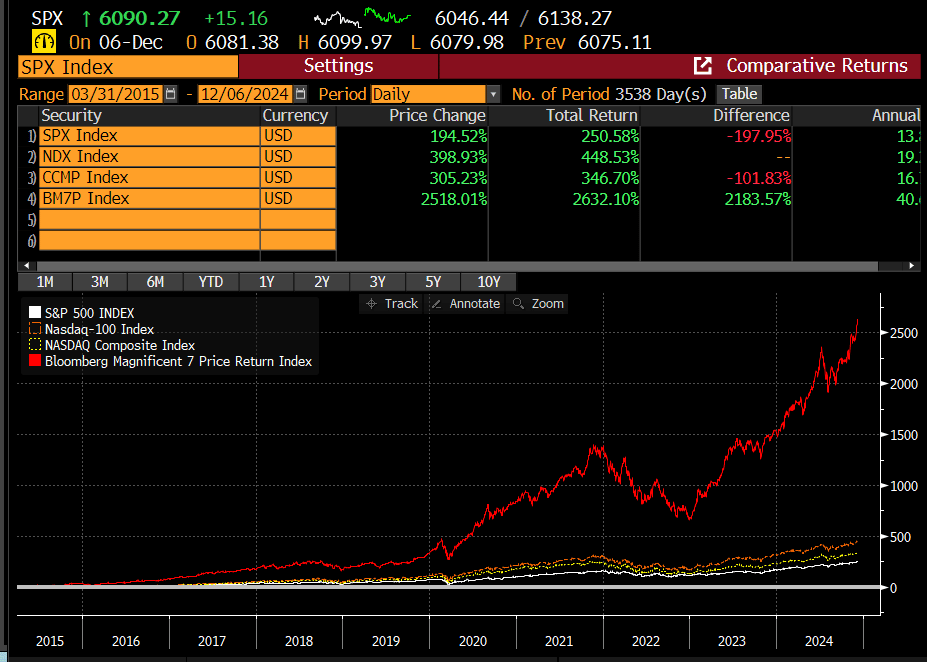

The performance chart over the past decade underscores this dynamic. The Mag 7’s returns have been nothing short of extraordinary, outperforming the major indexes by 6 to 12 times since Bloomberg data became available on 3/31/15. This disparity highlights the challenges and opportunities unique to modern market dynamics.

We often hear this question from our institutional clients: Why do you always include Mag 7 charts in your analysis? The answer is simple: these stocks are critical to understanding the broader market’s behavior. The stock market struggles to make significant headway when the Mag 7 are underperforming. This elite group offers unique insights into the prevailing risk appetite and sentiment embedded in the market.

The Mag 7 stocks serve as invaluable indicators of the investing regime—whether the market is in risk-on mode or adopting a defensive posture. While the precise reasoning behind their influence may not always be apparent, their outsized role in shaping market dynamics is undeniable. Ignoring their interplay with the broader market when analyzing index direction and the investment environment is, in our view, a critical oversight.

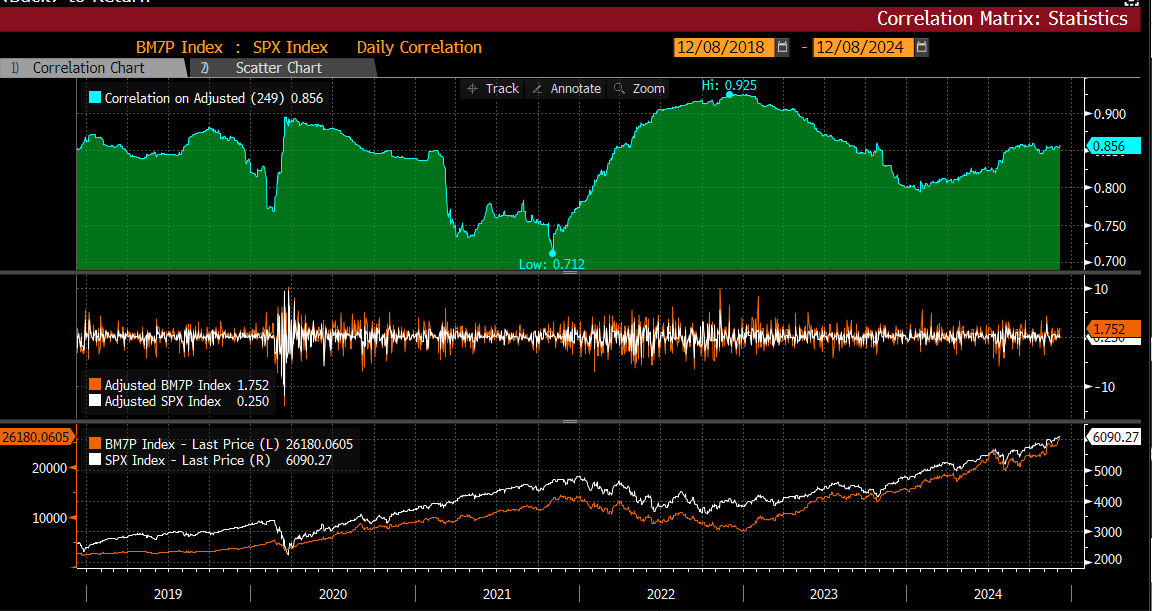

The chart below demonstrates this relationship, showing the correlation between the Mag 7 and the SPX since December 2018 (the earliest data Bloomberg provides). The correlation is typically quite high—around 80%—which makes sense given the Mag 7's substantial weighting within the index. Understanding this interplay is essential, regardless of whether your portfolio strategy is broad-based or narrowly focused.

The correlation reached over 90% in 2022, when most stocks were still struggling with the weight of higher rates.

The best time to be a stock picker is when the correlation declines, as evidenced in 2023, when the correlation dove back to 80%. It should be no surprise that the rate complex peaked in 2023 and started declining in 2024.

The correlation is even more pronounced when comparing the Mag7 to the equal-weight version of the SPX (SPW index).

This isn’t groundbreaking analysis—most investors understand the significant influence interest rates have on stock direction. However, the takeaway here is that macro inputs like interest rates are essential to understanding market flows. Ignoring them would be a misstep.

Back in October 2022, we called for a top in interest rates, a prescient call that aligned with the stock market’s bottom that same month. Since then, the SPX has delivered an impressive 75% return.

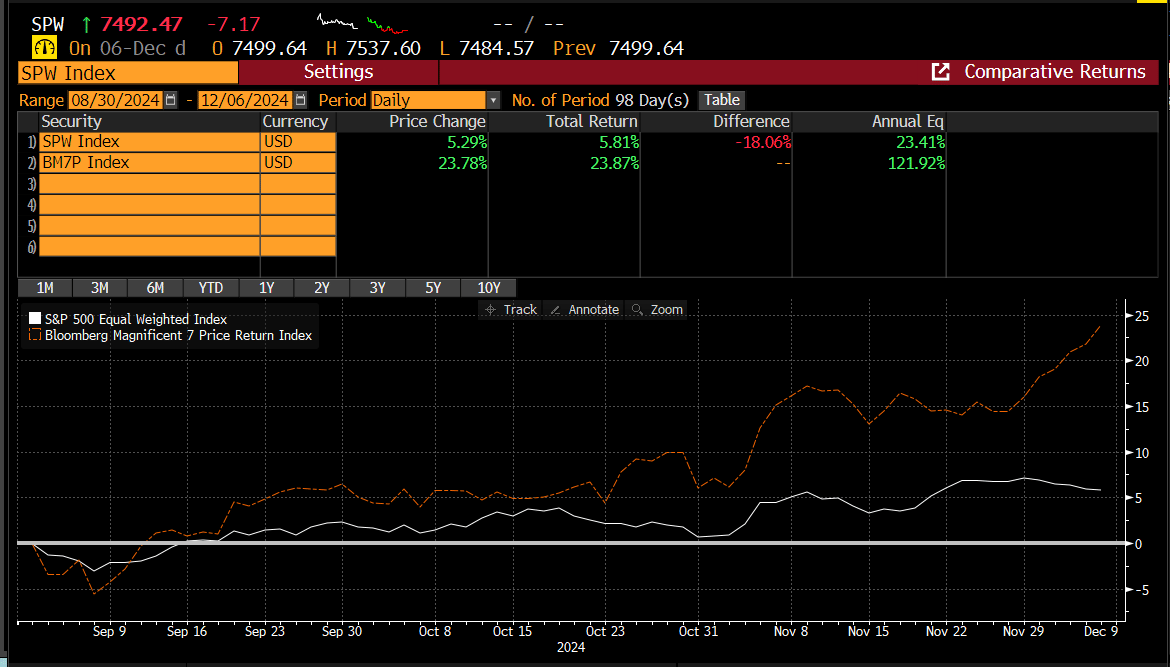

For much of that time, the Mag 7 dominated the rally. It was only recently that the broader market, represented by the other 493 stocks in the SPX, began to outperform. Unfortunately, this shift was short-lived. The breakout of this relationship (SPW vs. SPY) sharply reversed at the end of November, hitting a new five-month low. The implication? Leadership has swung back to the Mag 7 and large-cap stocks, reclaiming the market’s momentum.

We believe much of this reversal stems from bond market apprehensions that the Fed may have eased policy prematurely, particularly with the prospect of a new administration potentially introducing inflationary policies. From the September lows, the 2-year Treasury yield surged 25% into November before recently pulling back. Despite this, the correlation between the SPW and the Mag 7 has remained stagnant, while the correlation between the Mag 7 and the market-cap-weighted SPX has been steadily improving. The takeaway? The Mag 7 is reclaiming market leadership.

Since the September bottom in rates, the Mag 7 Index has outpaced the broader market by an impressive 5x. This outperformance has only accelerated as we’ve moved into December.

Could institutions be positioning their portfolios for a potentially challenging year ahead, seeking refuge in the perceived safety of the Mag 7 stocks? It’s certainly within the realm of possibility.

Historically, the first year of a new presidential cycle—especially when the president is not the incumbent—tends to be turbulent for equities. Policy uncertainty and potential shifts in the regulatory or economic landscape often compel investors to adopt a more cautious stance. While the first year of Trump’s presidency delivered strong returns, it’s important to note that the market then was emerging from a relatively flat year, unlike the current scenario where the SPX has logged consecutive annual gains exceeding 20%.

The chart below, courtesy of McLellan Financial, illustrates the typical market trajectory in the first year of a new presidential term, providing further context for this historical tendency.

According to the Stock Trader’s Almanac, the 1st Q is the worst for the SPX when a new president is in office.

According to Ned Davis Research, negative returns are probabilistic following a year that recorded at least 50 new ATH’s.

We’re not in the business of making sweeping predictions about where the stock market will land by the end of 2025. Instead, our aim is to provide thoughtful scenarios for consideration as we step into the new year. Our approach is rooted in staying attuned to what the market communicates in real time, making data-driven determinations, and delivering tactical calls that adapt to market movements—all with the goal of enhancing your portfolio’s alpha.

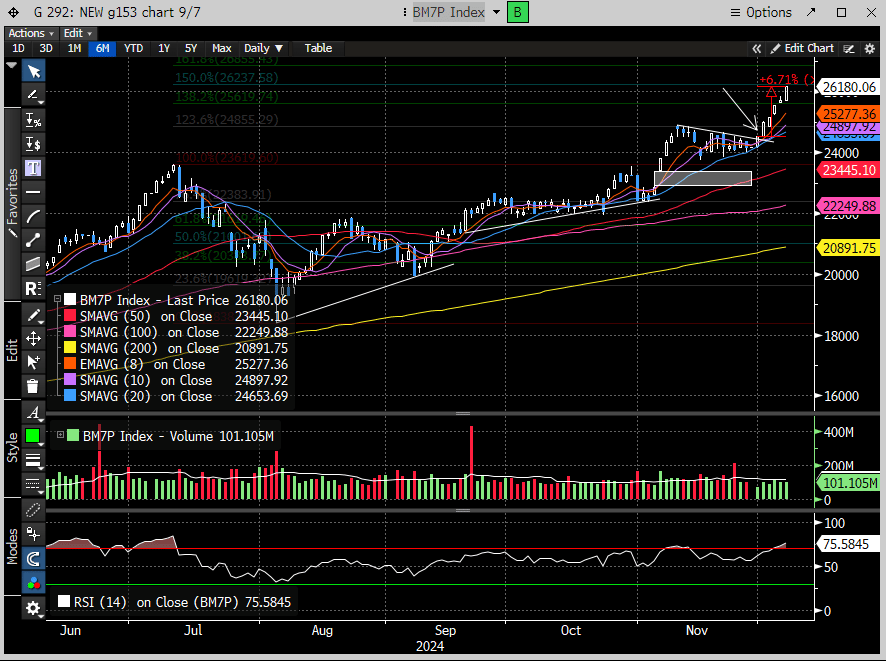

A prime example of this approach is our December 1st analysis, which highlighted the Mag 7 Index as being on the cusp of a breakout. Since that report, the Mag 7 Index has surged nearly 7%—a result worth celebrating!

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade