We have always maintained that calling tops in markets are a lot more difficult than bottoms. Much of this has to do with emotion. While rising trends are constantly being dissected, with persistent bears focusing on what fits their narrative to determine the eventual destruction of the rise, most uptrends are slow and methodical. Thats bullish, as money that enters the market is typically patient. Money that exits the market is emotional, swift and ridden with panic. This is why gaps are important, because gaps are repricing’s. And as our readers can attest, those repricing’s typically imply a lot of offside and underinvested/overinvested market participants. Why do market participants all of a sudden shift their narrative? Typically, because of a news item. Whether that’s a shift in monetary policy, macro news or some black swan event. The reality is, it’s not “the what,” but the reaction, which is of most important. Gaps simply tell a story. We admit that we are no better at forecasting the future as the next analyst, but our ability to read the markets mosaic, is what sets us apart.

One simple example would be this recent post on Twitter in early Nov as a consideration to start leaning bullish on the stock market. Since its first gap, $IWM’s are up +11%.

What did most bearish viewed analysts do after those gaps appeared? They dug their bearish heels in further. Ignoring simple market structure changes is why these analysts/strategists/money managers consistently get direction wrong and underperform the market. Let’s use our favorite perennial bear, “Diamond Mike,” as an example. We are not trying to pick on him, as we actually think he writes fairly insightful things that make us think and question our position. This is what good analysis should do, and as one who analyzes the market, we are always looking for reasons to challenge our thesis. Unfortunately, “Diamond Mike” is a victim to his own bias. He ignores these simple signals and digs in further on his bearish directional thesis. He literally has been writing every day for 6 weeks, that the SPX is going to retest the Oct lows. Before that, he spent the better part of the year telling everyone why we were going to test the previous Oct lows of 3600. Those goal posts moved up to 4100 sometime over the summer. Meanwhile, the SPX is up +20% this year almost +10% since the start of Nov. Thats not a little wrong, that’s horrifically wrong.

The game that is the stock market is about making money, and professional analysis is supposed to help you maximize your returns. Listening and acting on this sort of analysis is simply depressing and agonizing for those that follow. Trust us, there is a better way.

In our previous reports and most recently in our mid-week report, we highlighted that the 1H Dec seasonality was typically quite choppy. Couple that with our signaling methodology screaming caution, with extreme zones in certain indicators we track and ebullient sentiment, the set up to pause, chop or even retrace was present. Since Thanksgiving, the SPX is only up +1%, with roughly half of that gain, being posted on Friday.

Our call since then was to focus on laggard/catch up plays, which is representative of the Russell 2K index. Since Thanksgiving, the Russell has outperformed by almost +400 bps.

As a courtesy to our readers, we also offer ideas from time to time to consider if we feel the set-up is right. If we think the tape is bullish, as we have since late Oct/early November, then we want to capitalize on that potential money flow coming into the market. Picking stocks in an up-trending environment is much easier and far more lucrative. Get the direction of the market right, and deploying capital opportunistically can be quite fruitful.

Since last Oct, here are the plethora of idea suggestions we presented for our readers to have considered and managed on their own (keep in mind that we are not an alert service).

$DLTR 11/5 idea suggestion +10-16%

$XLF 11/8 idea suggestion +7.4%

$XBI 11/8 idea suggestion +13%

$JETS 11/19 idea suggestion +10%

$CHWY 11/19 idea suggestion -5%

$TSM 11/19 idea suggestion +3%

$SQ 11/19 idea suggestion +19%

$FFTY 11/17 idea suggestion +6%

$ARKK 11/17 idea suggestion +14%

$BABA 11/19 long term idea suggestion -7%

$AMD 11/22 idea suggestion +5%

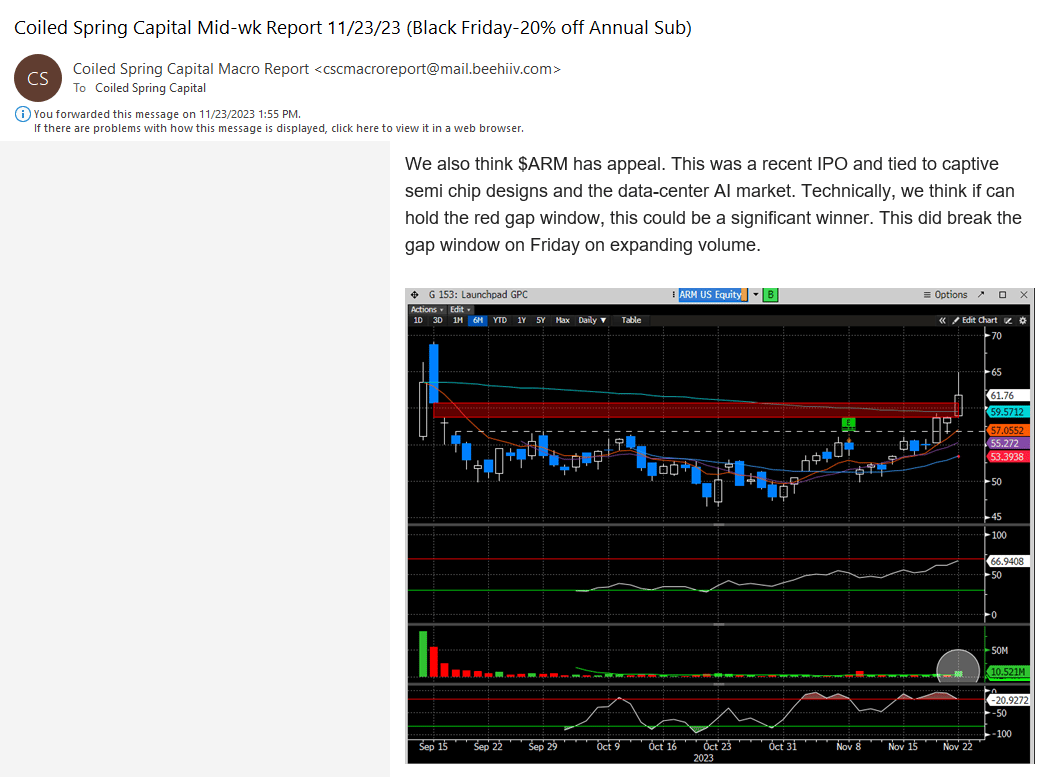

$ARM 11/23 idea suggestion +9%

$BIDU 11/23 Long term idea suggestion -5.5%

If it weren’t for our longer-term China interest, we would be batting close to 1000% on these recommendations. We view the China thematic as more longer-term positioning because we are not fully convinced that their economy is ready to turn. Maybe a 2024 event?

In summation, outside of being outright long the indexes, this is quite the strong showing. $10K hypothetically invested in every idea would yield +80% cumulative return.

Our premium analysis is available for only $24.95 month. Thats quite the ROI (Return on Investment).

At the end of this report, we will highlight a couple more idea suggestions.

We hope you will join us. Our Black Friday sale has expired, but for 1 day only, we will invite you to be an annual subscriber for the same rate.

Here is the link: