Is it time to bust out the Champagne? All-time highs in the stock market were reached this week. This is something we thought would happen in the early part of the month vs the OPEX week, but nonetheless has occurred despite all the drum beating for a recession/hard landing, stickier rate cycle, geo-political risks, re-accelerating inflation, China economy in the dumps, expensive stock market valuations, large cap tech concentration, etc., etc. This is a lesson for all those who think the stock market should follow some script because the media, self-proclaimed pundits, FURU’s are all shouting from the roof tops that the Nov-Jan rally was all a hoax. Maybe it’s because of the armies of 0DTE option traders that have managed to distort natural pricing discovery and push the market by billions of market cap? Maybe it’s because retail has enough heft now to squeeze the institutions to cover all of their shorts? Maybe it’s because all the bulls are delusional, and the bears will eventually prove themselves, correct?

Our question is, why does it matter? The market isn’t about being right, it’s about making money. Anyone who tells you differently, is trying to excuse their own inadequacies for being incessantly wrong. We are not always right, as the prediction business is fraught with incredible uncertainty and prone to failure. We understand this, and we have no problem changing our tune if we see enough evidence that the music is changing. That is the quintessential difference between those who make outsized money in the stock markets and those that perennially underperform. Even Stanley Druckenmiller (one of the most successful investors in history) agrees that “when you make a mistake, you’ve got to admit you’re wrong and move on.” Now ask yourselves, how many of these big personalities ever admit when they are wrong and move on? Not many.

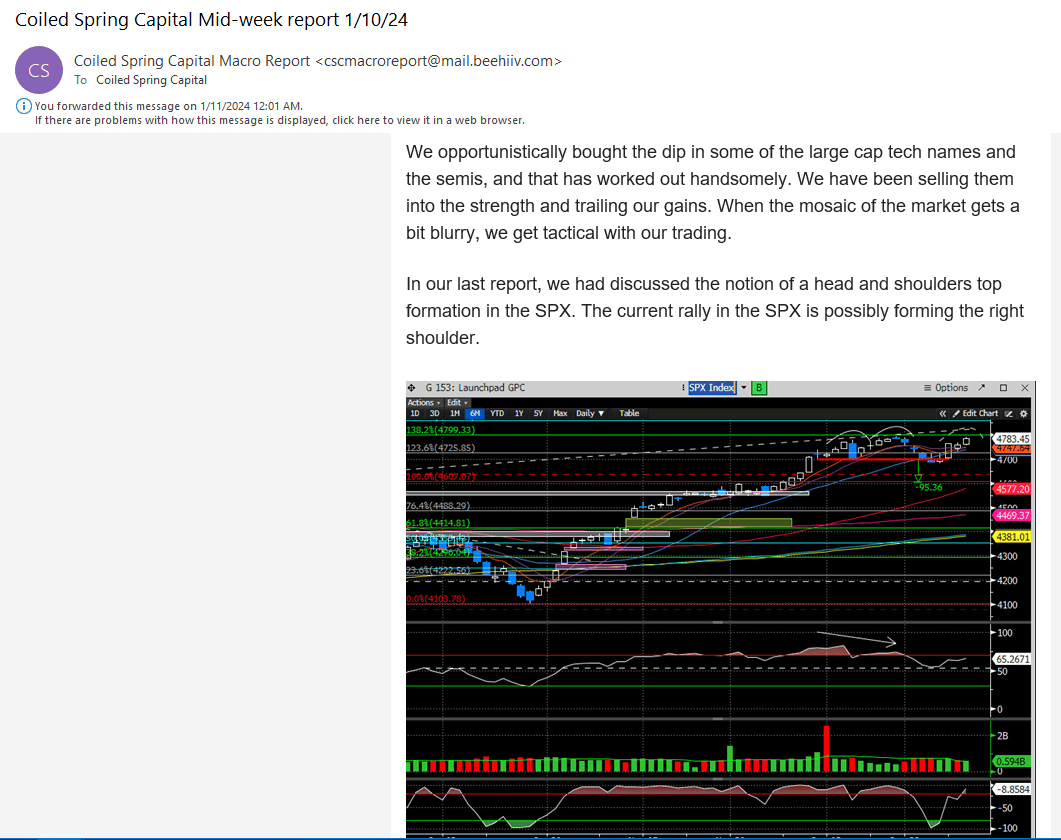

Let’s be completely transparent to illustrate this very example. Two weeks ago, we were floating the idea of a head and shoulders top area and where we would consider taking a bearish position in the SPX. We were notably concerned over the deteriorating picture in the underlying metrics in the stock market.

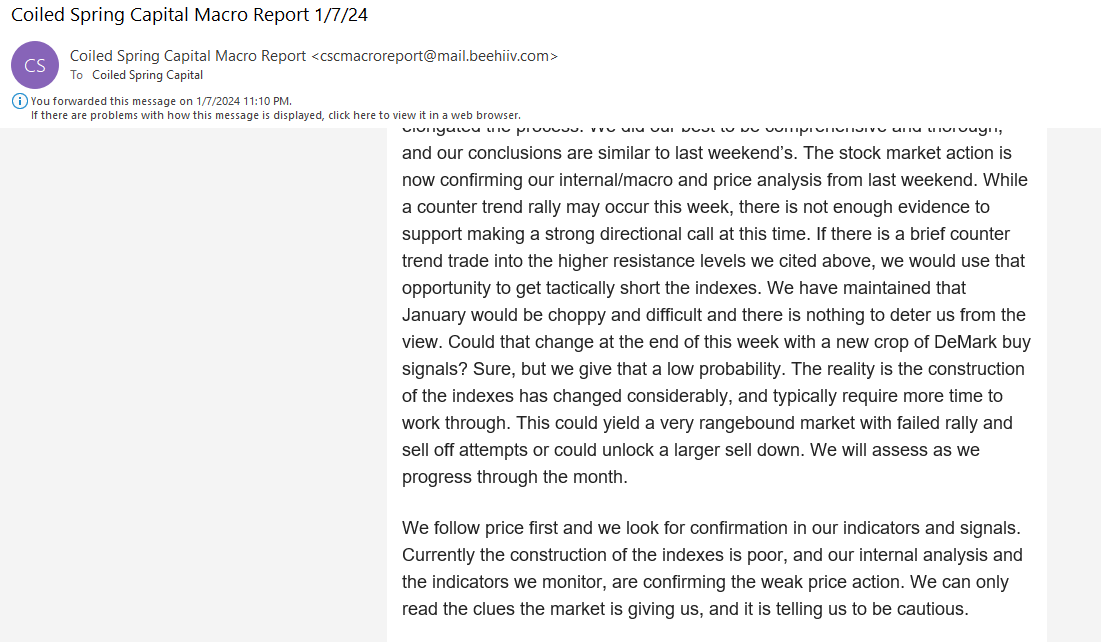

Here is that excerpt from Jan 7 discussing our increasingly cautious view.

“If there is a brief counter trend trade into the higher resistance levels we cited above, we would use that opportunity to get tactically short the indexes.”

For this reason, we decided to only stay tactical with our positioning, and mainly focused on the large cap tech space, which arguably was showing the most resiliency to the recent volatility.

Here is our Jan 10th report discussing the notion of being tactically long with large caps and Semis.

The SPX area we had cited for a potential short was reached, but the price action in some of the large cap stocks, suggested it was premature to think about shorting the indexes. It is ok to believe a certain outcome is going to occur, but predictions require confirmation, as we follow price first, and we were not getting enough confirmation that the major indexes were ready to retrace.

We discussed the notion of NVDA breaking out as a reason to reconsider any bearish stock market outcome. Here is an excerpt from the same report:

We also wrote this about META.

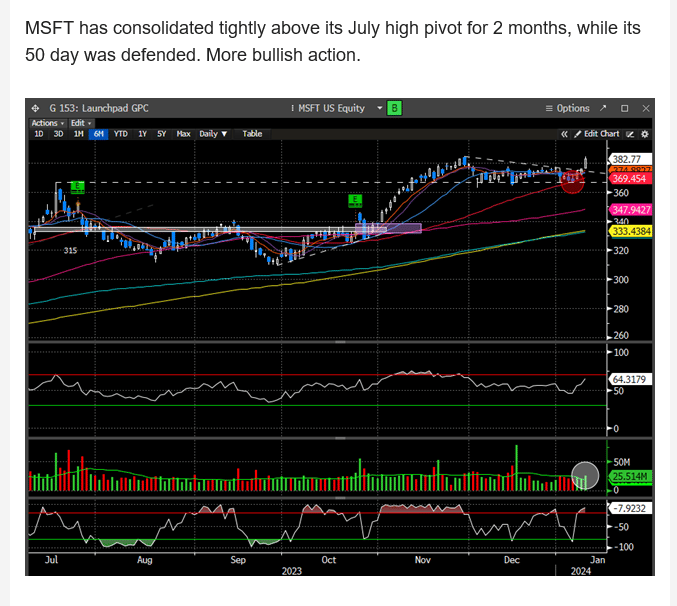

How about MSFT?

We concluded that the set up to be short, was simply not there. Did we stomp our feet and throw a tantrum that we were wrong? No, we did what any unbiased trader/investor should do, use our analysis to make better decisions. We refrained from setting up short and bought large caps. How did that fair?

We trounced the index returns, again.

This past week of trading went a bit different then we had considered. We thought OPEX week would produce more volatility and admittedly we did not expect the massive Friday rally to new ATH’s. So, while we can hear the grumblings of readers saying we were cautious this week, the reality is we were not caught on the wrong side of the market and still exposed to the long side. Do we wish we were aggressively long? Of course, but we have to rely on our analysis to give us that conviction to bet big, and that has been absent all month.

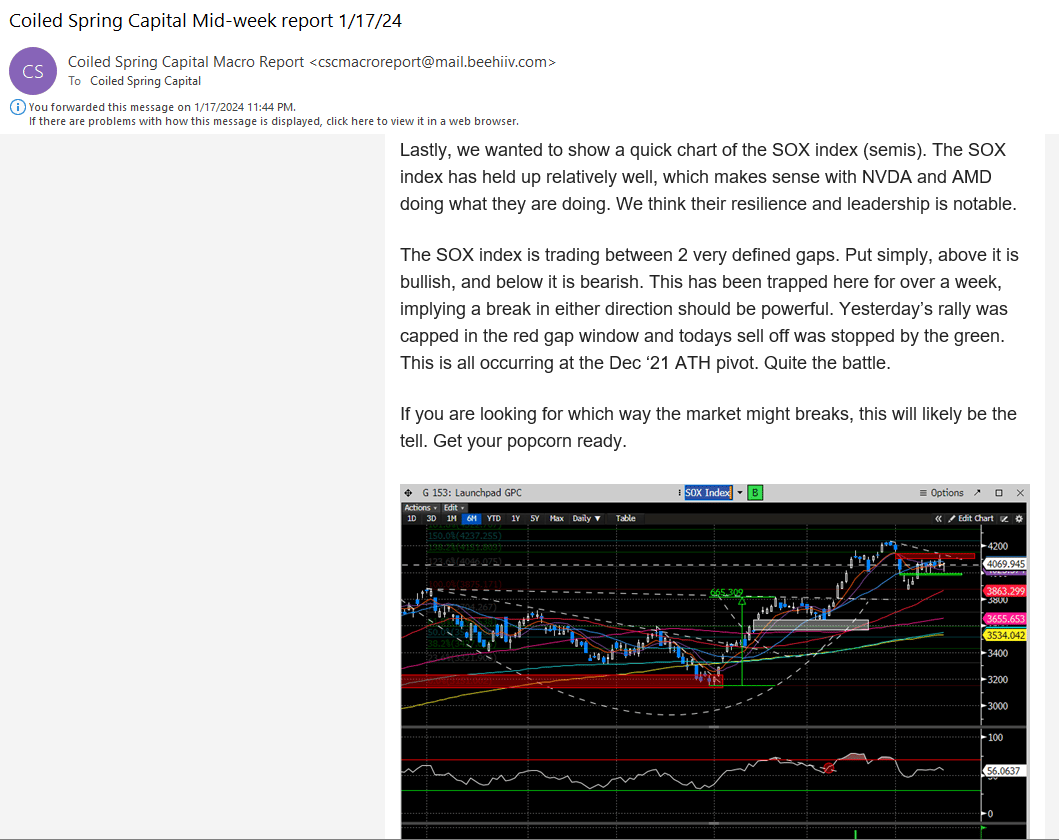

We also showed the Semi chart (SOX Index) in our mid-week report as something to watch for clues on market direction.

“If you are looking for which way the market might break, this will be the tell.”

The SOX index gapped up the next morning and never looked back. Why would one of the most important sectors in the stock market break in such a fashion if the market was ready to turn down? Short answer, its wouldn’t.

The clues for a continued stock market rally were presenting themselves.

So where does that leave us for the upcoming week? We are now entering the thick of earnings season with over 70 companies reporting this week and 25% of the SPX reporting the following week. This week we will get another inflation reading (PCE) before the next FOMC meeting on Jan 30-31.

Currently, the Mag7 are expected to deliver combined profit growth of about 46%, and down slightly from Q3’s 53% expansion. We know how important these companies are for the overall market and its health (and why we opted to follow their lead in the example above), and their earnings reports are most likely going to decide the next directional wave in the indexes. We can’t tell you with any precision how these will go but we suspect they will be quite good. The question is, will they be good enough?

Fun fact: NVDA is forecast to grow Q4 profits of more than $10B up from $1.4B a year ago. If you removed NVDA’s Q4 profit growth from the S&P Info Tech sector projections, it would be cut in half, according to Bloomberg.

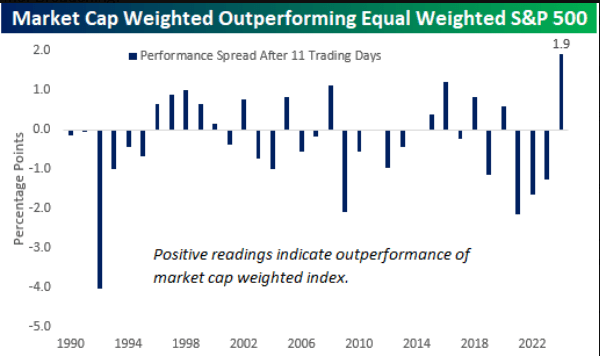

These stocks are doing most of the heavy lifting this year and the reason we broke out to new ATH’s on Friday. This chart depicts the excessive contribution of the largest stocks in the indexes.

So, there should be no surprise that these stocks are garnering most of the fund flows. These companies are so large and generate so much cash, that they are relatively immune to economic cycles when compared to the rest of the investing universe.

But overcrowding of investors into this area of the market does add quite an element of risk, especially holding them into their respective earnings reports. And according to Stifel, the options market is pricing in virtually no risk for mega cap stocks. Thats worrisome for sure, and why taking earnings risk for any stock is not something we typically do unless we are taking duration.

Positioning of overcrowding is evident.

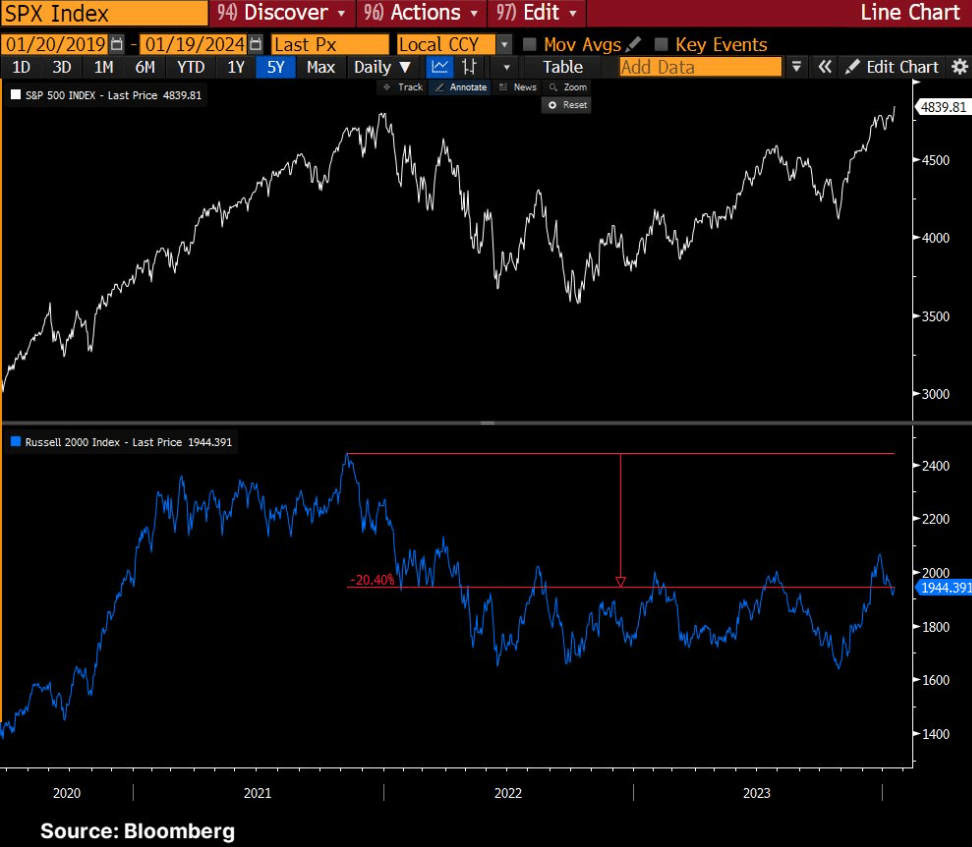

The other big risk for the markets is the pace of interest rate cuts and so far, those expectations at the end of last year are looking a bit too rosy, at least the bond market thinks so. The macro data we have seen this month is supportive of a stronger and more resilient economy, which in turn could lead to less cuts than expected. Less rate cuts could force a revision in multiples paid for tepid earnings growth. This is evident in the SMID cap area, where the Russell had already reversed by 8% into last week’s low. This will be exacerbated if sales growth this year starts to fall under the weight of lagged interest rate hikes. For now, we’ll have to see how the reporting season goes to better assess.

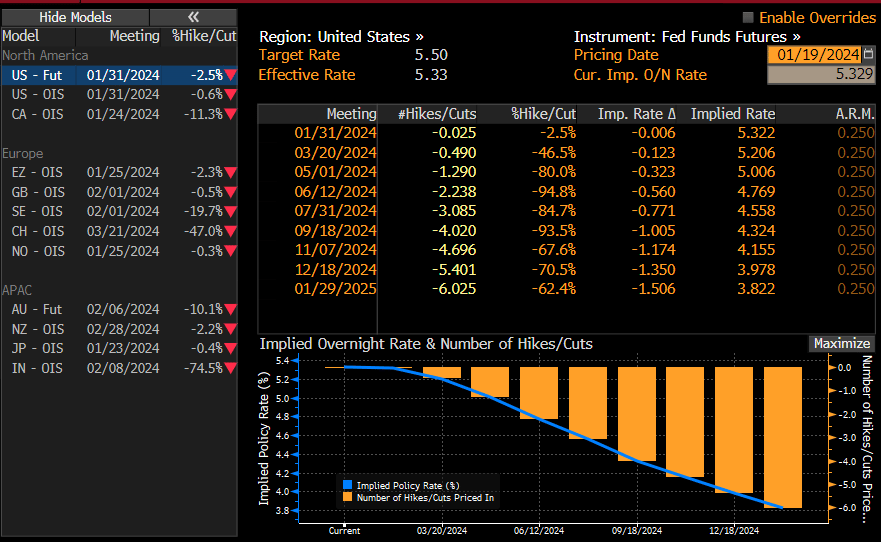

Currently the bond market is pricing in <50% chance of a cut at the March meeting vs 100% at the end of Dec.

We suspect that Powell at the next FOMC meeting will echo data dependency and may even dial back the rate cut rhetoric if the PCE this Thursday reaccelerates. This implies Thursday could be a bit binary and inflation reaccelerating will undoubtedly increase stock market volatility as we move into Feb, which historically is a difficult month.

Never a dull moment in the stock market, which requires those that are active in trying to trade the ebbs and flows, to always be on your toes. Let’s dissect further in the premium section…