The “venerable Holiday hangover.” Most of us know this all too well. Whether it be from excessive drinking, eating or spending, it’s easy to exit the holidays feeling a bit exhausted and spent. The question for us, is the stock market setting up for its own hangover post the recent pivot from the FOMC last week?

There is quite the debate going on as to why Powell decided to pivot last week. We clearly haven’t won the inflation battle, nor has employment backed off much. Thus, the dual mandate he expressed when attempting to tackle the seemingly incessant inflation trajectory, has not been met. So that begs the question, what instigated the sudden about face? Only a few weeks prior he advocated that it was too premature to talk about interest rate cuts. Naturally this has sparked a number of conspiracy theories, the most obvious one being that Powell is trying to pave the way for Biden to reclaim the presidency. Maybe, but we don’t ascribe to these sorts of theories, only because it just clouds our process. Anything is surely possible, but we prefer to follow price.

For us we are more concerned with the “what vs the why.” We will let the serial underperformers and the incessantly wrong market prognosticators detail their version of the scapegoat for missing the biggest stock market rally since the Covid crash recovery. As we mentioned above, we follow price, and despite what our feelings were telling us all year, we have caught every major swing (up and down) in the stock market since getting bullish in Oct ‘22. But if you would rather listen to someone who gets it right 30% of the time, then please be our guest. We prefer our hit rate to be well in excess of that.

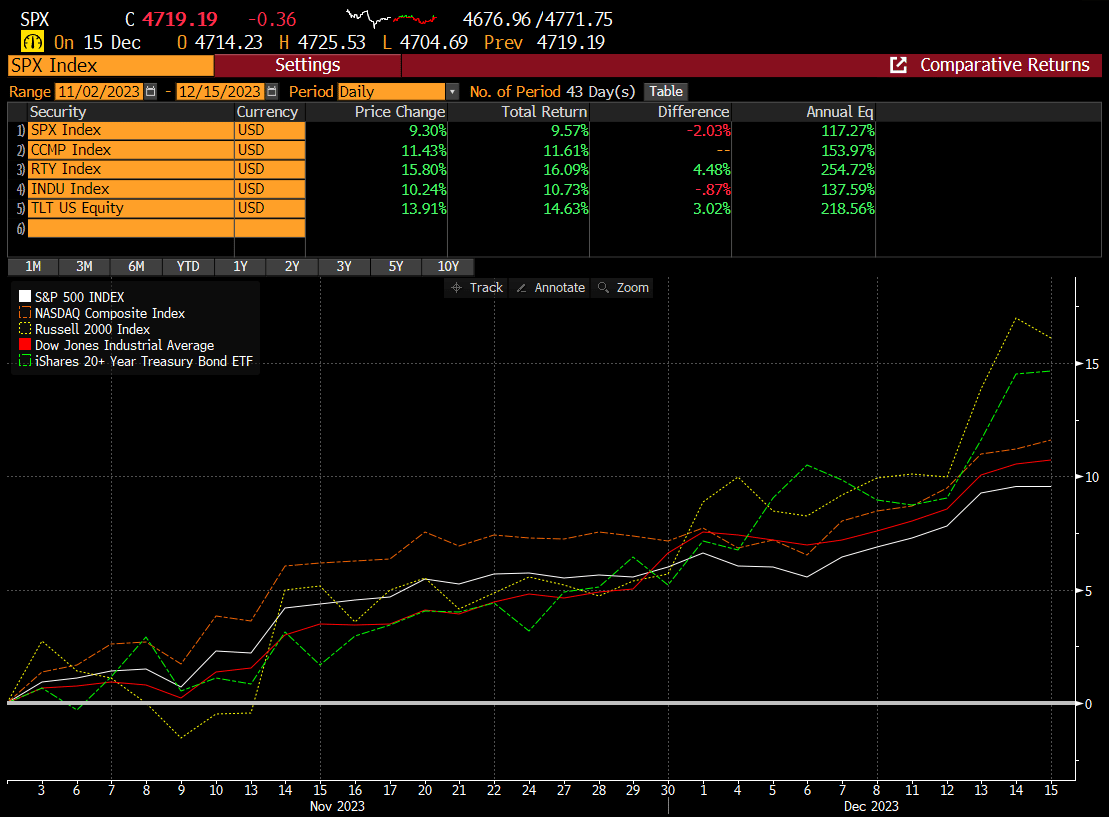

Price was telling us in early November, that a strong undercurrent was forming in the market. It started with the FOMC meeting on Nov 2nd. But there were signals prior, that we were tracking suggesting the potential for a major shift. Sometimes that shift never occurs, as not every signal we track works 100% of the time, and why we have a weight of the evidence approach. Regardless, confirmation of that undercurrent presented itself and we went all in on the stock market. This culmination of the recent bullish trend was solidified with the Powell pivot last week. As we suggested in our mid-week report, this undercurrent was effectively born on the belief that Powell would eventually pivot. We didn’t know this at the time and is the reason we don’t care about the “why.” We don’t need a reason to capitalize on price action. It’s nice to put a pretty bow on things to explain why something is happening, but by the time everything is known and publicized, most of the money has already been made. The market is the best predictor of the future, and usually always moves before the “why” is fully understood.

Since the Nov FOMC, the market has screamed higher. Not only were we long the stock market with multiple single stock ideas (mainly SMID caps), but we were also long bonds ($TLT). Not a bad way to end the year.

Our biggest concern for ‘24 is whether or not this exuberance for a soft landing, will lead to a hangover. Remember, the stock market is a game of probabilities, and the probability at the end of Oct regarding a soft landing, was quite low. In the last 6 weeks, those probabilities have risen significantly. This implies that the margin for error is now much less and prone to disappointment, should a soft landing not occur.

We know seasonality is quite strong heading into Christmas, so any potential disappointment likely doesn’t occur until sometime in Jan, hence the “hangover.” This means we very well may power higher in the next few weeks, despite some excessive enthusiasm, being heavily overbought (OB) in some indicators, and signal alignment. Maybe that catalyst is re-accelerating inflation or a future payroll report. It’s hard to say but it is certainly something to be mindful of.

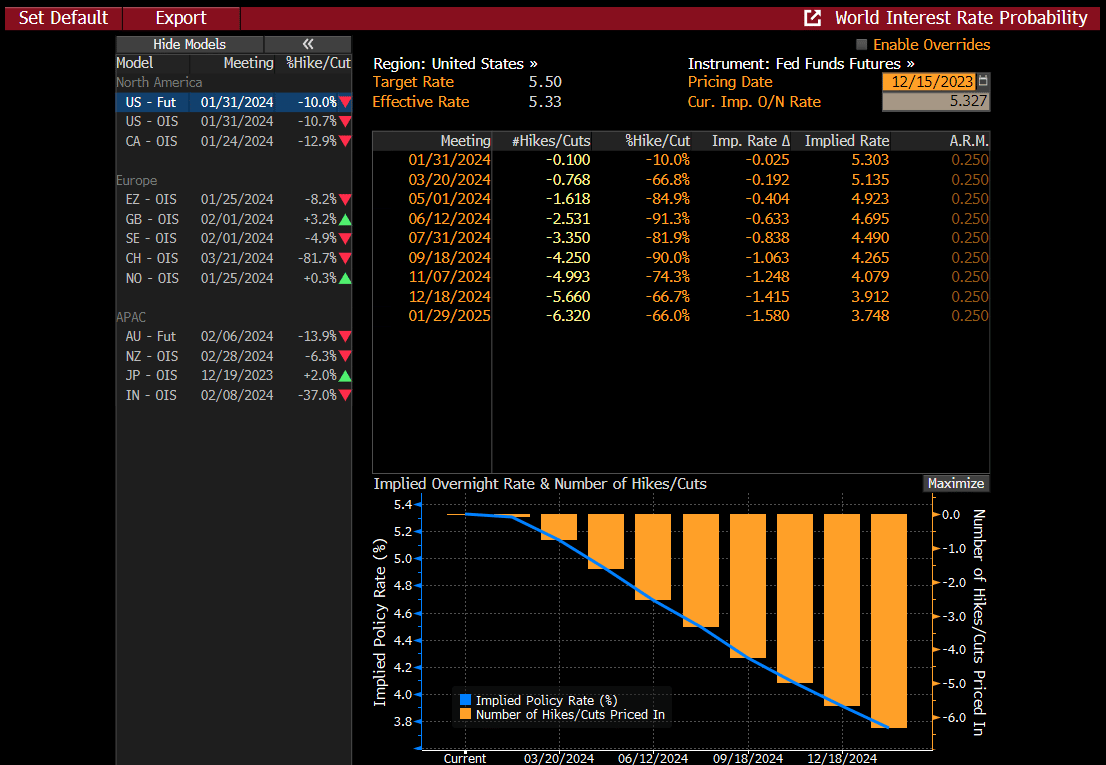

One of the other theories for the unexpected Fed Pivot, is a potentially weakening economy or rising financial risk. This is certainly conceivable as the lag of monetary policy is still inflicting damage on parts of the economy. Recall that Powell is forecasting 3 rate cuts next year, but the bond market is pricing in 6.

Does this imply that the bond market is forecasting a much tougher economic slide than the FOMC. If that comes to fruition, we can’t imagine the stock market will hold its current trajectory. This is certainly a risk as we turn the calendar.

Our goal is to make sure that when the trend changes, we identify it for our readers, exit our long bias, and get tactical.

If you are interested in catching the next big swing in the market, please consider subscribing below.