We want to wish all of our readers a very Happy Holiday! We feel blessed to have such a loyal and appreciative subscriber base. As we mentioned in our mid-week report, this weekend’s note will be abbreviated given today is Christmas and we are currently on vacation in Colorado.

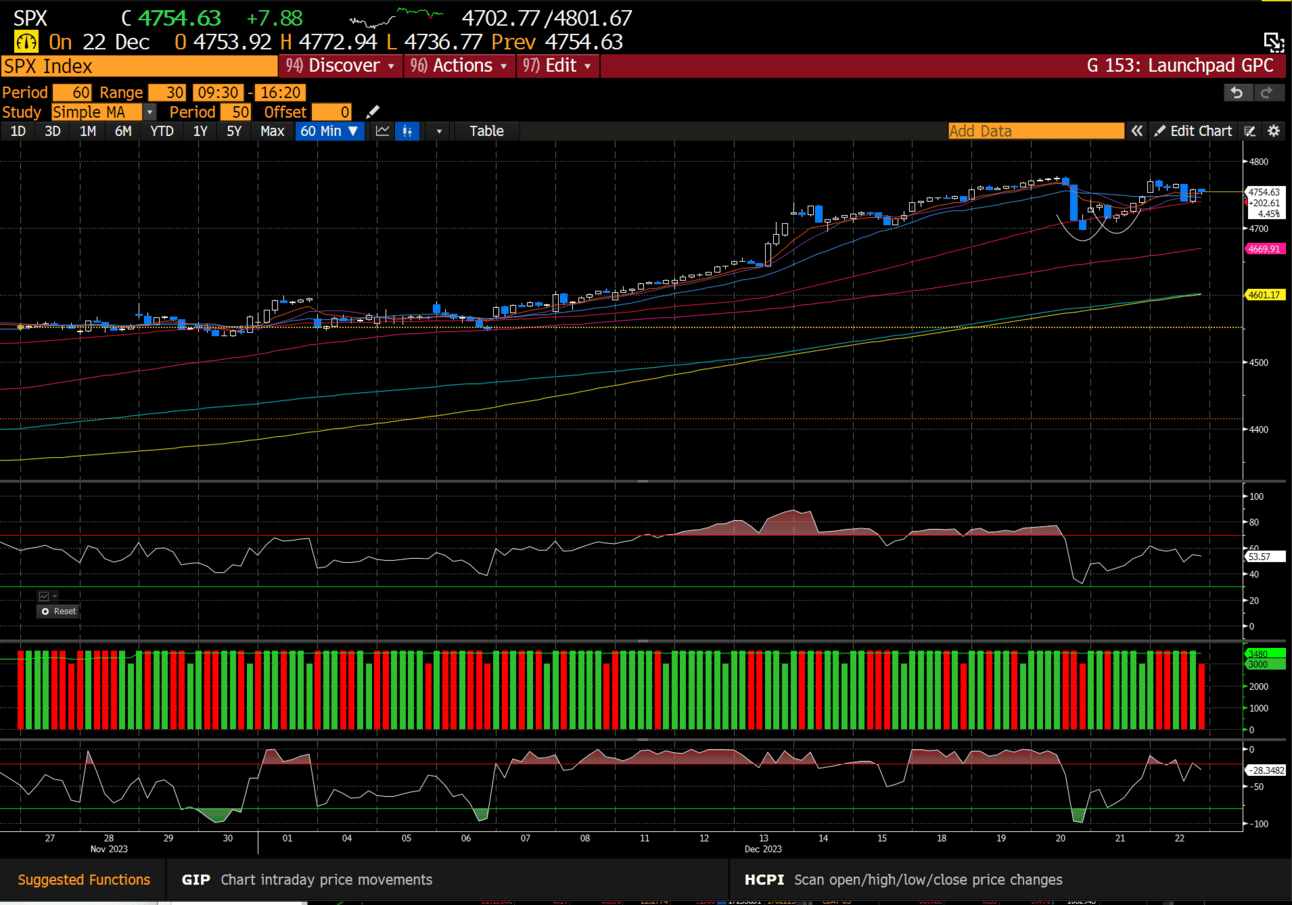

Last Wednesday, we saw the first bout of real profit taking in the stock market after a torrid December. While there was zero downside follow through for us to capitalize on, the dominant bull trend exerted its dominance, with an up open on Thursday and an ensuing higher low.

Our assumption that weakness would get bought in front of a potentially cooler PCE was correct, although our thinking for more follow through weakness did not occur. Regardless, the structure remains bullish, for now.

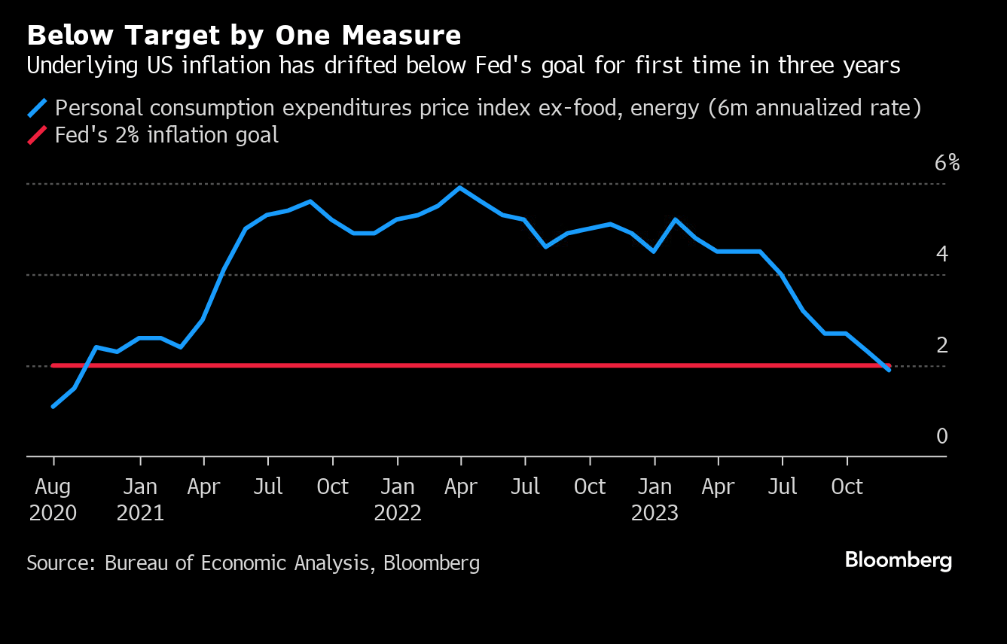

Friday’s PCE did come in cooler as we expected, and now trending below the Fed’s inflation target, on a 6 month-basis (1.9%).

The month/month degradation is the highest since Covid.

For those that believed the stock market has been on its recent upward trajectory because of ODTE options, or false hopes around a Fed Pivot, well, have a Hot Toddy on us. The stock market remains the best predictor of the future, and not only did the post Nov FOMC stock market reaction signal a Powell pivot was coming, but the recent Dec stock market performance was also discounting these surprise inflation readings.

Bolstering the case that the Fed has secured the fabled soft-landing scenario, is that personal spending remains robust (+.3% for Nov), with real disposable income climbing the most since March. A sustained easing of price pressures and resilient household demand, can be considered “Goldilocks.” Easing inflation now gives The Fed cover to cut interest rates over the coming year.

So, the prevailing bear narrative that the Fed won’t cut rates, or inflation will remain sticky, was simply incorrect. But with every failed prediction, comes new bear narratives that surface: Inflation will re-accelerate, recession is still a real risk with lagging interest rate impacts, a credit event will occur with stressed regional bank balance sheets, etc. Don’t ever count out the perennially wrong to find a new reason why their forecast will eventually come to fruition. The thing is, we actually don’t really care how this all unfolds. We follow price first and rely on our analysis to sniff out major trend changes. Just like we nailed the stock market rally for ‘23, largely avoided the correction in Aug-Oct, and have been aggressively long since, we are confident that we will stay on the right side of the market, regardless of the narrative, environment, or economic landscape. Remember, all one-way directional analysis/forecasts will have their day in the sun, as markets do not move in a straight line. The real value is found in those that can define a trend and stay with that trend for as long as possible. This is where real money is made.

We love this chart because it showcases how important it is to be on the right side of the market. If you missed the 15 best trading days of the year, you actually lost money. Thank goodness the hallmark of our analysis is quite precise in defining those changes for our readers.

It’s been an incredible and profitable year for us at CSC, and we can’t wait to deliver market trouncing returns in ‘24.

Please consider subscribing below.