We have to admit, we are very proud of our recent rotational thesis call. We think this is one of the best stock market inflections calls we’ve made in recent memory. While our analysis is designed to keep our readers on the right side of the market, figuring out inflections and rotations within the market structure can be very challenging.

Not only did we get bulled up on the stock market towards the end of Oct, and aggressively so after the FOMC on Nov 2, but we started making a call for rotation into laggard plays in mid-Nov. This was not a call anyone was willing to make as far as we can tell as we were calling for rotation out of the Mag7 into laggard plays. This can be expressed through equal weight versions of the index, the Russell (SMID caps) or single stocks.

Here is an excerpt from our 11/12 Macro Report regarding the equal weight Nasdaq:

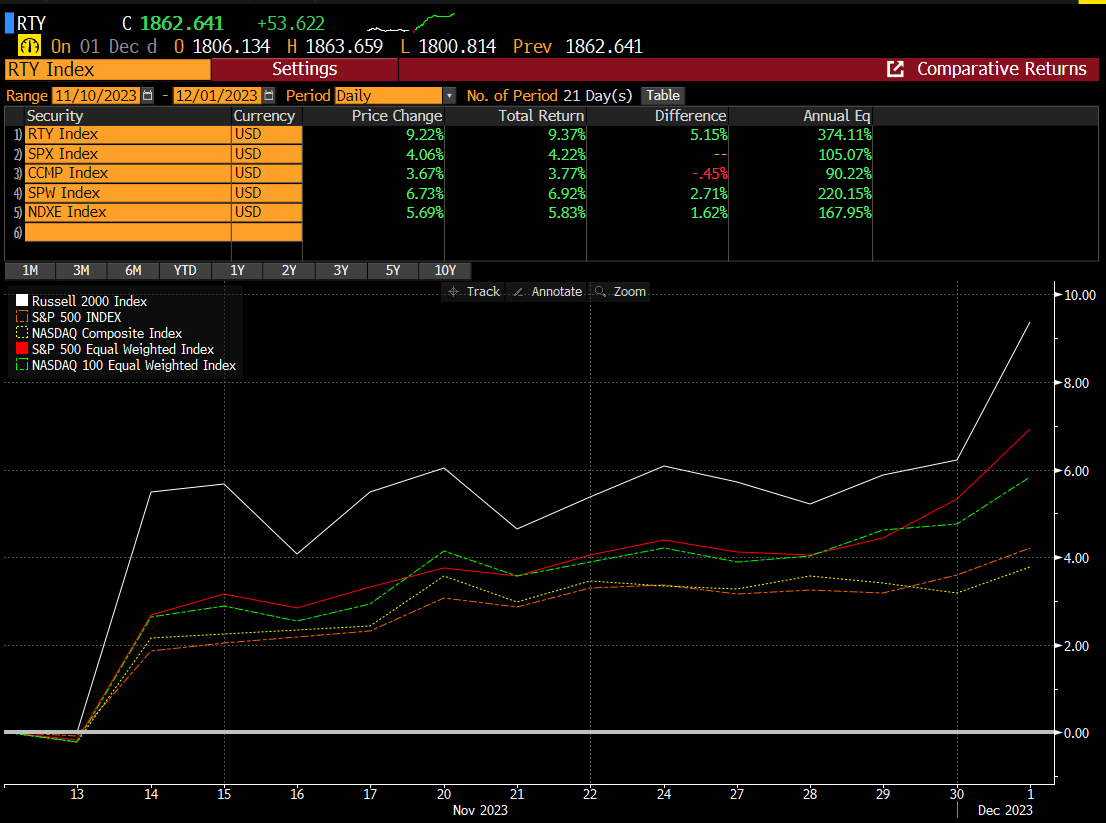

Since we started touting our rotational thesis, the outperformance is notable. The Russell is up 2x the SPX during that time span, and even the equal weight (SPW) is outperforming by over 50%.

We then followed up in our mid-week report (11/15/23) discussing for the likelihood of the rally that began at the end of Oct to broaden out.

Here is the excerpt from that report:

While the stock market had gotten a bit overheated off the Oct lows, we were quite adamant in our reports to stick with a bullish NT view.

In our Thanksgiving Day report, we reiterated that a pull back in the indexes never materialized, which should be interpreted bullishly.

Here is that excerpt:

The bottom line is, despite the obvious newfound euphoria that found its way into the markets, leaving indicators a bit stretched, we stuck with our view, and maintained the single stock exposure heading into this past week.

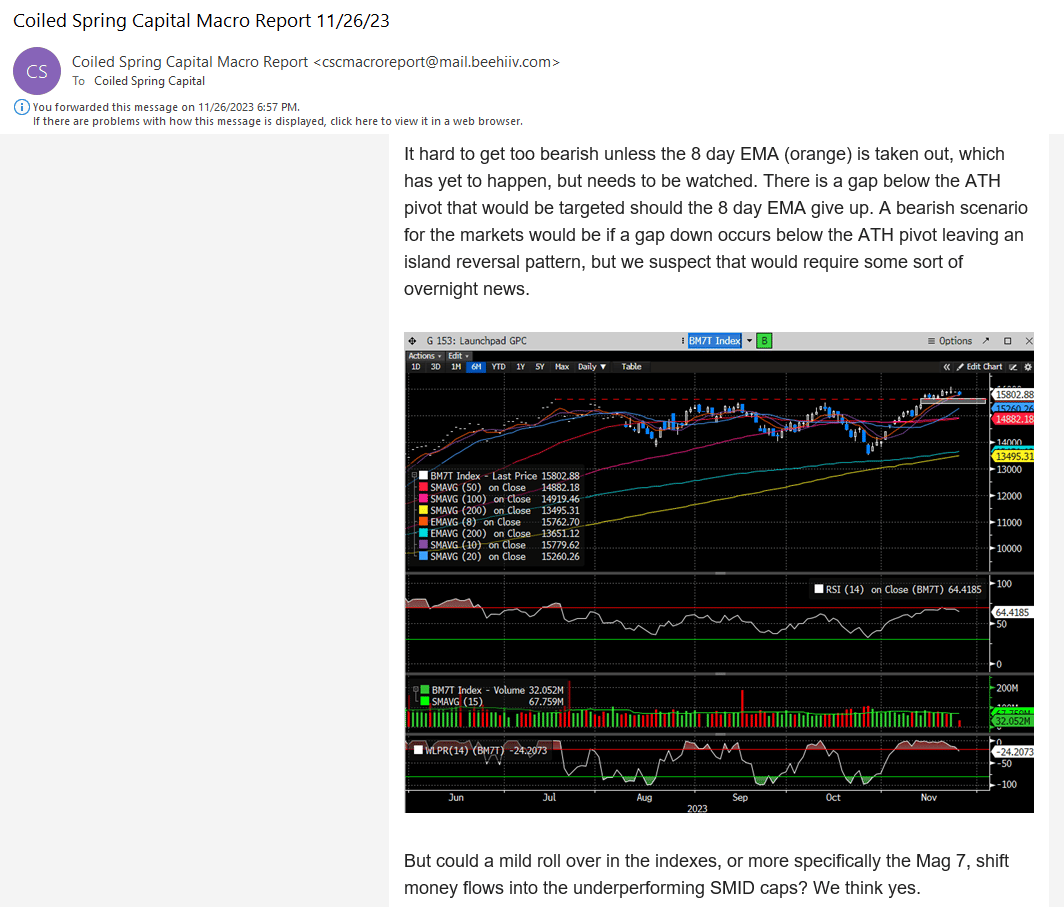

The Mag 7 index was beginning to show its fatigue as we outlined in this passage from our 11/26 report:

In fact, we doubled down on our belief that this apparent weakness in the Mag7 index would be more rotational vs. anything else, and that rotation would benefit SMID Caps.

Here is that excerpt:

“…could a mild roll over in the indexes, or more specifically the Mag 7, shift money flows into the underperforming SMID caps? We think yes.”

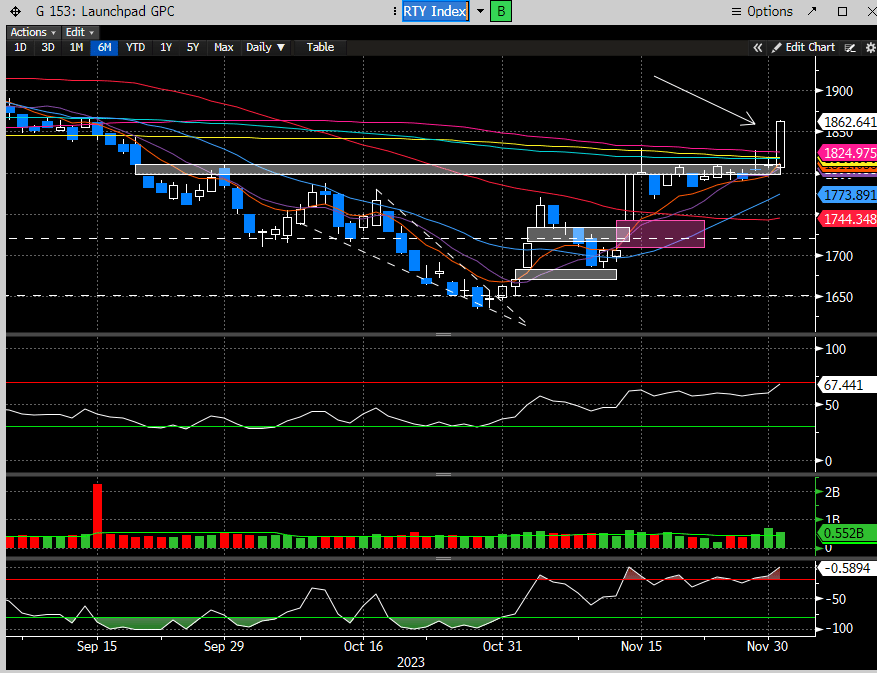

And followed with this comment about the Russell setting up to take out the 200 day MA.

Here is that excerpt:

And since this report, published 11/26, the Russell retook the 200 day and managed to outperform the Mag 7 index by +400BPS.

The purpose of this exercise is not to pat ourselves on the back (although we are quite proud of this call and so is our wallet), its only to illustrate the immense value our research provides. There is an overwhelming amount of content out there, and while we do not ascribe to be the most astute, or the best, we do think our major inflection calls are as good as any out there for the price ($24.95/month). We are considering raising this price at the turn of the year to account for our higher costs, thus we highly advise locking in at the current rate. Current subscribers will not be impacted by the additional hike. We hope you will join us.

The next order of business: where do we go from here? Stocks just had their best month in a more than year. This rally has been energized by slowing inflation, a less hawkish Powell, and a bond market that has rolled over.

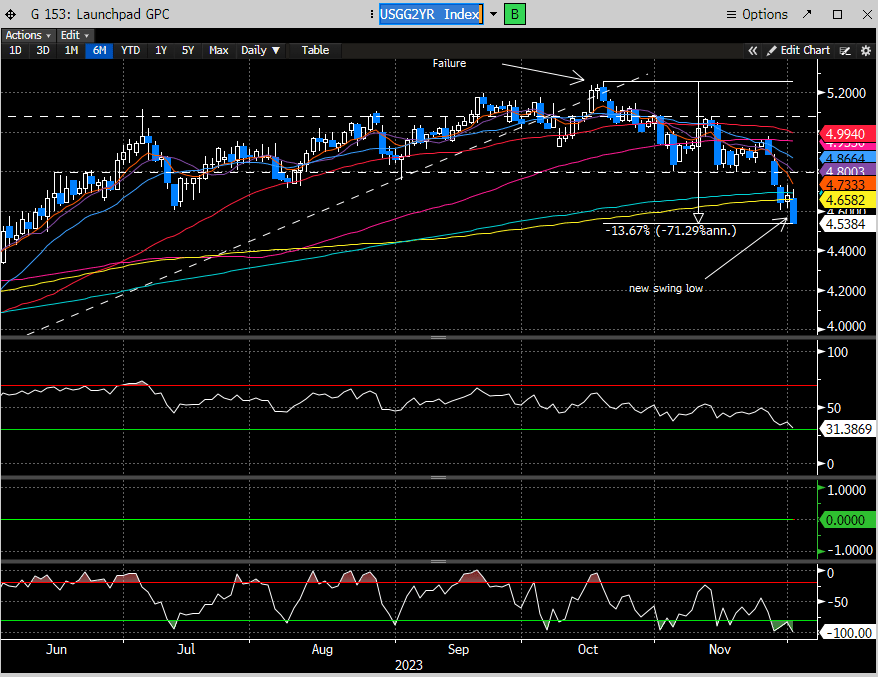

The 2-year rate is now down -13.7% since the peak in late Oct. Coincidentally, as our readers can attest, we called for the top in rates back in Oct.

Lower rates imply the potential for rate cuts next year. The persistent bears in Oct, were calling for: lower earnings outlook from reporting companies, which didn’t happen; accelerating inflation, which also hasn’t happened; a more hawkish Powell, the opposite is actually what happened. Now their narrative is for no rate cuts in ‘24, which remains to be seen, as Powell on Friday pushed back against future rate cuts in the 1H’24, while also proclaiming rates are “into restrictive territory.” The market dismissed his no-rate cut rhetoric and cued in on the “restrictive” comment. This sent the Russell screaming (+3% on the day). As we tell our readers, this cohort of stocks is most sensitive to interest rates and a higher cost of capital, and thus, Powell’s comment cemented the idea that no more rate hikes are on the table for the foreseeable future.

This caused a repricing of risk in the SMID caps. As our avid readers can attest, a repricing of any asset is meaningful. A repricing implies that it was mispriced. In simpler terms, a large cohort of SMID cap stocks were priced for a “higher rates for longer scenario.” Meaning, there was significant bankruptcy or dilution probabilities being priced in. The market is starting to believe that those probabilities are now much less, and thus these stocks need to be repriced for a different future. This is not something that occurs overnight, and typically takes weeks.

We read from notable bears over the weekend, that the reason the stock market moves were so exacerbated on Friday was that certain hedge funds capitulated their bearish positioning and some even closed down portfolios for underperforming managers. While we understand this dynamic, which certainly can be a contributor, we disagree it’s the overarching reason for the bullish response. This was a good old-fashioned repricing, and if bears want to ignore that reality, then good luck to them.

Something else to consider, the earnings for the most recent Q were actually much better than feared and showed a re-acceleration year/year. Recall this was one of the reasons listed above for the bearish narrative. SPX earnings were +4.1% higher vs. last year which was after 3 straight quarters of declines. Stocks work on rate of change, so there should be no surprise that the stock market is screaming into year end, as there is a growing belief that earnings have troughed. While the outlooks were a bit tempered, they still remained positive for ‘24. We actually wrote about this in a Sept report, discussing the notion of tempered outlooks, which could be considered positive since earnings estimates for ‘24 appeared too high, but still growing. Current SPX earnings estimates are around $245, which implies growth of more than 11% vs flat in ‘23. If $245 is accurate, then the SPX is currently trading just shy of 19x. This is not cheap, but it’s not expensive, especially coming out of a recessionary environment.

Despite what seemed like a torrid advance in the stocks we are involved in, the SPX itself was a bit muted (+.8% on the week). Recall what we say about being OB, and that time or price can resolve this condition. This seems to somewhat satisfy that condition.

More importantly, history remains on the side of the bulls for continuation. Since 1950, Dec is the 3rd best month of the year for the stock market, averaging a 1.4% gain, according to the Stock Trader’s Almanac.

But are risks growing for disappointment in the short to intermediate term?

Premium analysis below.