Since the post FOMC rally that started in early November, the bearish community has been calling for some cataclysmic stock market wipeout, accompanied by various narratives for said wipeout. While we appreciate most of the arguments made, as incessant bears are usually quite thoughtful in their reasoning, their analysis is largely absent some very obvious (to us anyway) arguments. What makes stocks go up? More buyers than sellers. When money moves into the stock market, its typically not a 1-day event. It occurs over many months as institutions add exposure daily to build their positions. This is an important concept to understand as that money doesn’t exit en masse, unless accompanied by some sort of event. That event could take the form of an important macro-economic report that shifts the narrative, an unforeseen black swan (eg. China invades Taiwan, banking crisis, international virus, etc), or even remarks from Powell at a FOMC presser. We repeatedly discuss that stock market tops are a process, and not something that typically occurs overnight unless accompanied by something usually unforeseen. If our contention is correct, then why do so many market participants continually attempt to call tops and position their portfolios for that outcome?

Strong market trends are just that, strong. And they are strong for a reason. Most of the time they track the underlying strength in the economy, whether visible or not.

Q4 stock market performance:

Q4 was quite a strong Q for stock market performance, and most of the bears will have you believe that it’s all FOMO driven multiple expansion without any substance. The reality is that’s completely incorrect. Q4 GDP was released last week and crushed the expectations (+3,3% vs 1.8% estimate). Without going too far into the details, this somewhat cements the recessionary calls as premature, if even possible, at all.

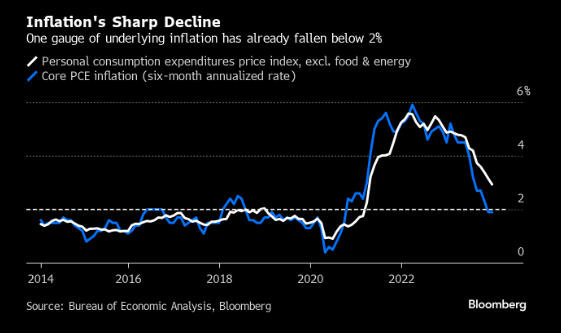

The other predominant view held by the bears is that inflation will reaccelerate, forcing the Fed to reconsider their rate cut path. PCE was reported on Friday, and continued to deflate. The PCE came in at +2.6% in Dec vs +7.1% seen in 2022. This is now the slowest annual pace of inflation in nearly 3 years.

This doesn’t mean that it can’t or won’t reaccelerate, just that the prevailing bear narratives for those fighting the index trajectory have been dead wrong. This is why we follow price vs. our opinions. Index prices have been advocating this reality. The stock market continues to be the best predictor of economic outcomes and why following price is much more profitable vs being entrenched in an opinion.

In our last report we discussed at length potential clues for identifying market tops, or at least ST interim tops, so we encourage reviewing that report as it holds relevance to our discussion below.

This week could very well be the defining week for the stock market pushing higher or falling back down to test support levels. Not only do we have the FOMC on Weds, but we have most of the Mag 7 and a good number of important large caps reporting. We will also get payrolls on Friday. Lastly, it’s month end on Weds, which should invite some extra volatility as institutions window dress their portfolios.

As our readers can attest, when the market is facing binary type events, we take more of a defensive posture, and do less, trade smaller, and await confirmation for the stock markets next move. We love this quote for Vladimir Lenin, which we think sums up this week: “There are decades when nothing happens, and there are weeks when decades happen.” Surely there isn’t 10 years’ worth of market data getting packed into this week, but the logic is applicable.

The biggest risk we see is whether the Fed walks back their rate cut path. Currently, the bond market still believes 5-6 interest rates cuts by Dec and a <50% chance of a cut at the March meeting (contrast this to an 80% probability of a March cut at the end of Dec).

The new bear narrative has shifted towards the FOMC potentially disappointing the street expectations as those sorts of cuts will only occur if the economy falls off the rails. Bulls believe the dovish rhetoric will remain in place as the Fed has achieved its target inflation goal and now Fed Funds are too restrictive, especially in an election year. What do we think? We think the Fed will stay status quo. But that’s just an opinion (see comment about opinions above).

Recently, we have seen the US Citi Economic Surprise Index (CESI) start to lift off the bottom. This is a notable change from the recent downdraft since Aug. This is bullish, especially since it is occurring in tandem with the SPX. It means the improvement in the data is being reflected in the stock market indexes, meaning good news is being treated, as good news.

But then there is the notion of the 2/10 year treasury curve un-inverting. Currently this is hovering around -0.2%. When you are trading/investing in the stock market you need to worry about what might happen, not what already has happened. The improvement in the CESI is lagging but the curve is trying to signal what will happen. Un-inverting has been a reliable precursor to a recession. According to Barron’s, the stock market has dropped in 3 of the 8 times over the past 44 years when the yield curve has un-inverted after being inverted for at least 3 months, including 2 drops of 10% or more over the following 12 months. An economic slowdown usually occurs 9 months after the maximum yield curve inversion (mid-’23), implying that one could come soon.

So, what’s this all mean? For one, there is increased risk to disappointment from the Fed and from the Mega cap tech companies reporting this week. The stock market has priced in quite a bit of good news. Contrast this to the period at the end of Oct, where the stock market was pricing in a possible recession. This implies the risk/reward at current levels is more challenging and the easy money from the Oct ‘22 lows has been made. The overcrowding in the Mag 7 is evident, which were responsible for 24% of the index’s gain last year and now represent 29% of the SPX. Certainly, any earnings disappointments here will be felt with index pain, and given where the implied volatility (IV) is for the mega cap names into earnings this week, there is a bit of complacency to be concerned about.

Take AAPL for instance, the IV is now at a 6 year low.

MSFT is at a 2.5 year low.

META is at a 4 year low.

Regardless, these are all things to take into consideration when thinking about the next moves for the indexes and how to position portfolios. Is it time for the stock market to consolidate its gains, or are we going to continue pushing higher?

Consider subscribing below for more analysis.