We are having a number of technical issues with this application today and it is making it near impossible to complete the newsletter. For that reason, we will not rehash what was discussed a few days ago if its redundant. Apologies in advance.

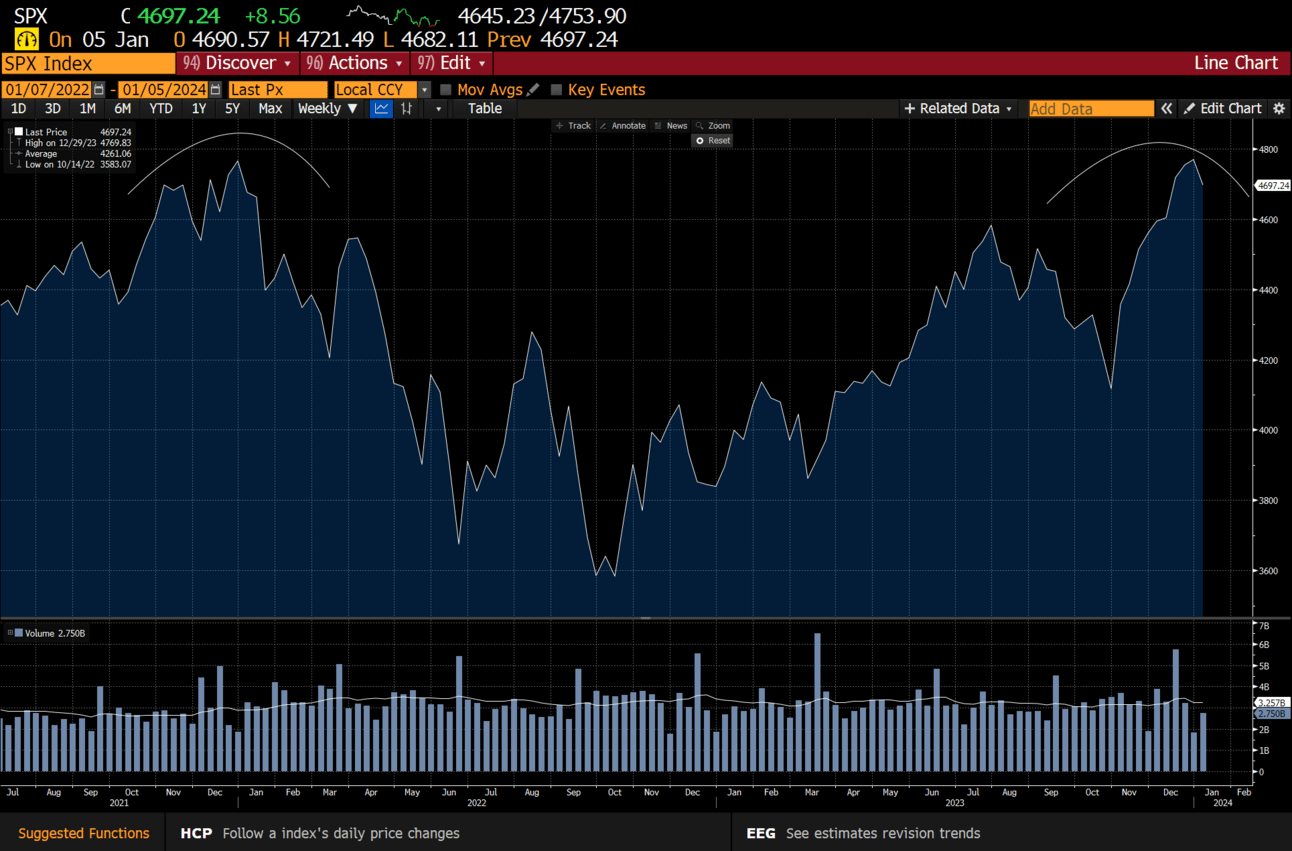

What a difference a week makes! The stock market was flirting with new all-time highs (ATH’s) before the calendar flipped, and now we are talking about a big double top.

The Santa Claus Rally (SCR) was a bust, which typically portends to a difficult Jan. We had already been discounting this when we started writing about our January “hangover” thesis in Mid-December. So, this should not be a big surprise to our readers. We used the late December strength to tighten stops, sell and trim longs and hedge some of our holdings. This leaves us with a very large and opportunistic cash balance for which to deploy capital when the opportunities present themselves.

We wrote in our last weekend report, that late buyers to the rally tend to get punished, and clearly that’s what’s occurred. This sets up for formidable resistance as trapped buyers will be looking to exit as close to breakeven as possible. This is relevant, because rejections like we saw in various instruments imply time is required to heal the scars. Does this mean we retest the lows of the summer? Not necessarily, which likely would require a major change in the narrative.

If you recall, we posted 3 major questions for the stock market this year. One of them being around a soft-landing and the other around inflation. Interestingly enough, last week we got 2 pieces of information that questioned both. Confusion is never good for investors, and certainly the market is confused.

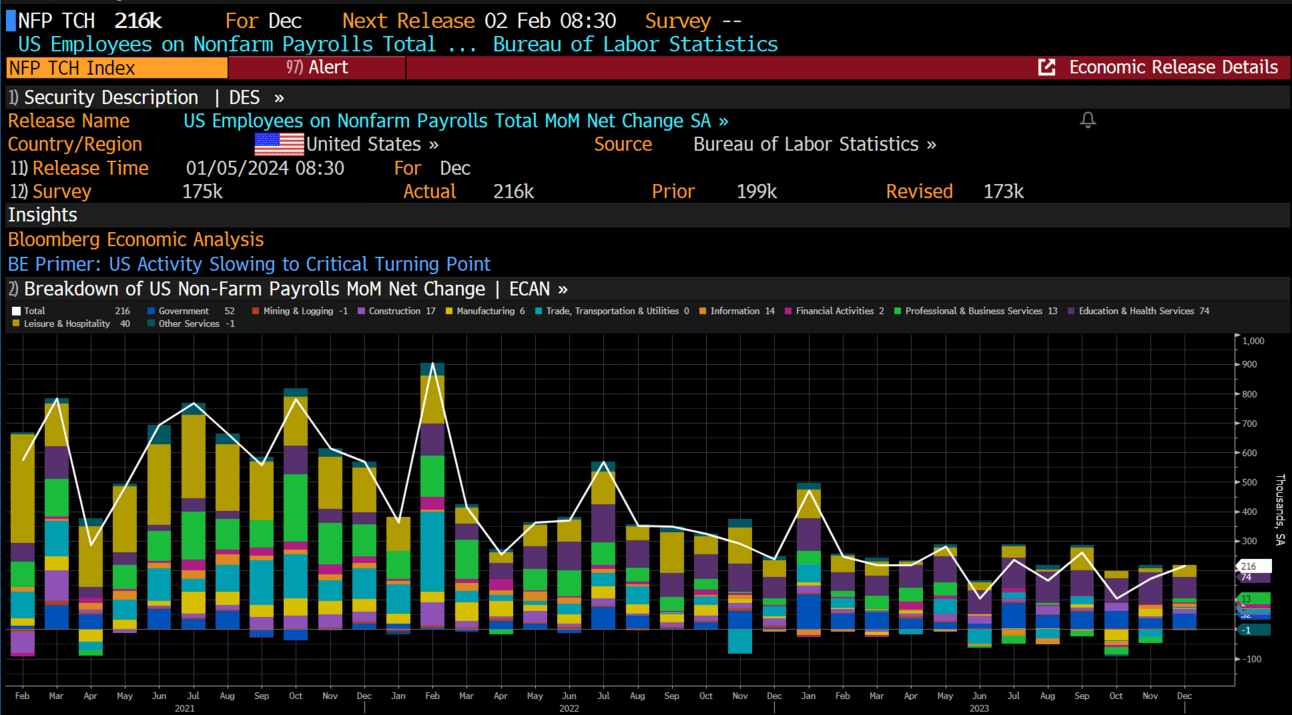

On Friday, the payroll number was released, and came in above expectations. This coupled with a meaningful revision for the prior months. On the surface the payroll number was exceedingly strong and runs counter to the Fed’s dual mandate for higher unemployment. But peeling the onion a bit and there is considerable weakness brewing under the surface and evidenced by the steep drop in labor participation.

The participation rate - the share of the labor force that is looking for work - fell by .3% to 62.5% and was the largest monthly drop in 3 years. It’s also taking longer for the unemployed to find work. Maybe more important was the fall off in temporary-help employment, and often a leading indicator for a recession.

Here is a quick snapshot of Bloomberg’s economists take:

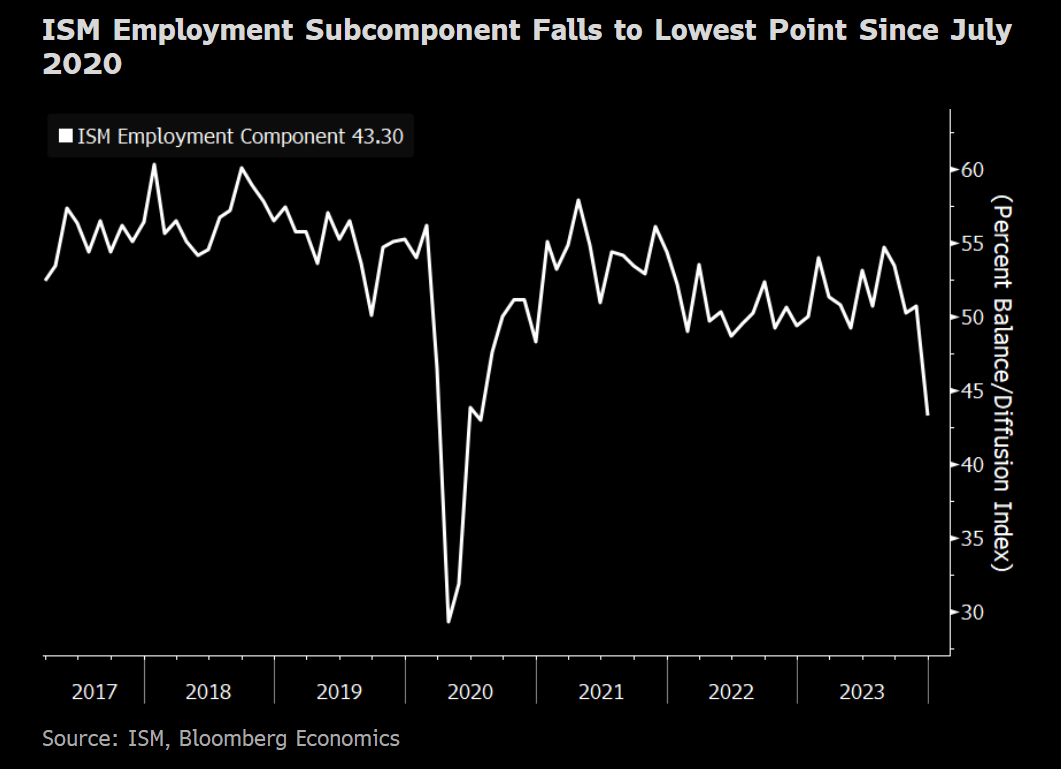

The payroll report was followed by a weaker than expected ISM report. The ISM fell to 50.6 vs 52.7 prior, and below expectations.

New orders, which is a forward-looking indicator of business demand, fell while inventory levels also fell to 49.6, and back into contractionary territory (<50 is contractionary). This implies that firms are reducing inventories in anticipation of lower demand.

The employment component of the index fell sharply and deeper into contractionary territory at 43.3. The ISM subcomponent fell to the lowest level in 2 years:

The bottom line is the pace of any expansion is slowing and companies are reducing inventory and employment plans in anticipation of weaker demand.

Clearly the confusion is evidenced by the 2-year treasury trading on Friday.

These sorts of reports definitely throw questions to the soft-landing narrative, and as we wrote back in Dec, the risk to a disappointment is elevated now that the narrative had shifted to re-weighting an optimistic scenario.

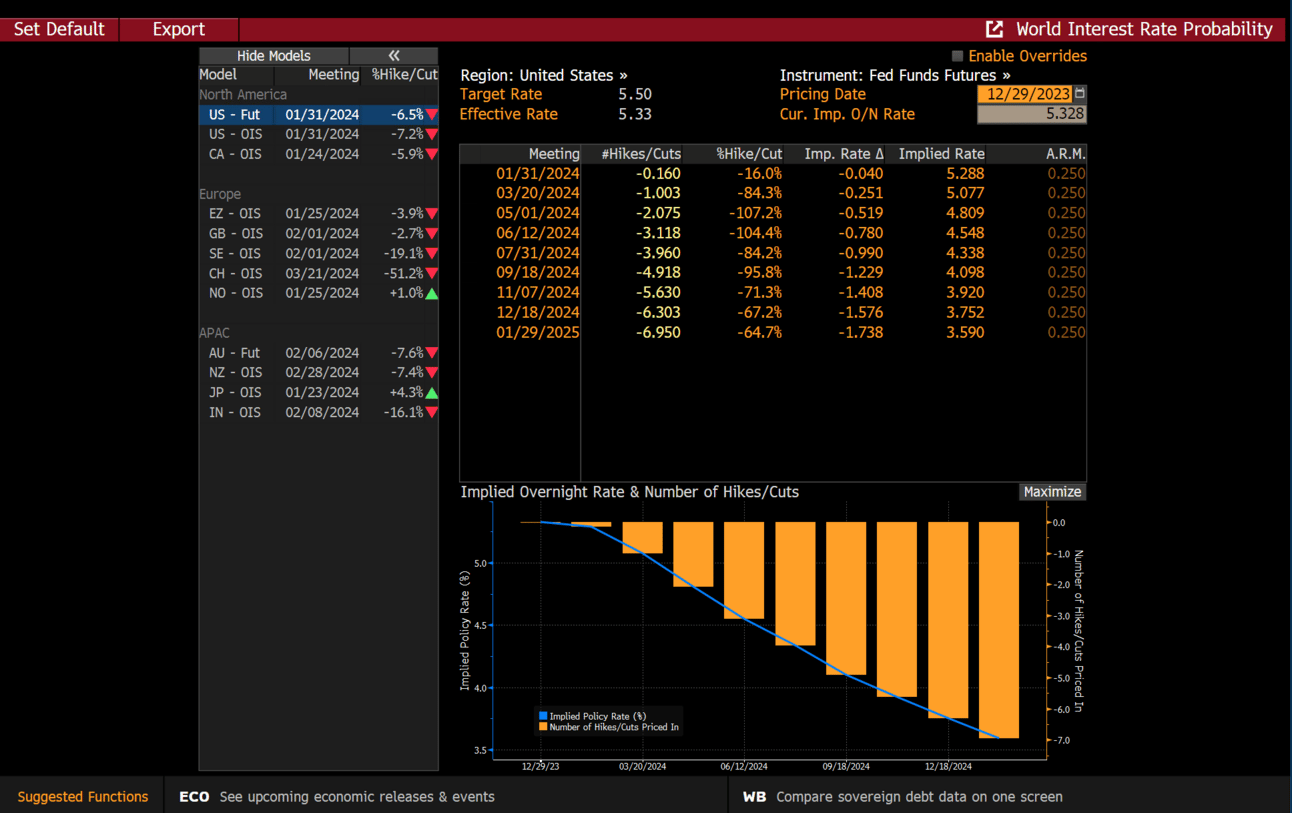

As it stood at the end of last year, the bond market was pricing in a 100% chance of an interest rate cut at the March meeting.

Fast forward a week, and that probability has shrunk to 73%. The velocity of rate cuts for the rest of the year has also been tempered. While these probabilities get whipsawed quite a bit with the macro-economic reports, the adjustment of those probabilities will have an effect on risk markets.

This week there will be no shortage of additional macro reports to contend with, as Dec inflation will be reported this week along with an important jobless claims estimate. Given the trajectory of the PCE (reported in Dec), we would think these will actually be favorable for the market as they should show continued compression, but the jobless claims number may corroborate the ISM unemployment subcomponent highlighted above.

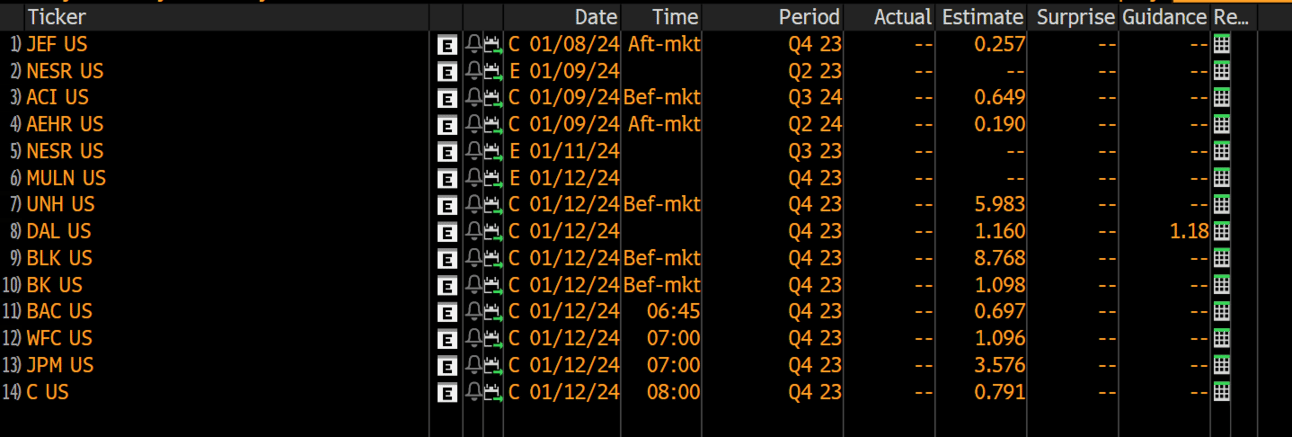

To add to a confusing start to the month, Q4 earnings report will start trickling in with the money center-banks. We suspect their reports will be cautiously optimistic and not sure they will be market moving.

There will also be major company and industry data points circulating with 2 of the largest consumer/retail (ICR) and healthcare conferences (JPM) and the largest electronics show (CES) of the year. This should make for an action-packed week and one fraught with major macro risk as well company and sector specific news flow.

The markets rarely make it easy for participants to feel comfortable and complacent. Our analysis will give you the proper tools to stay with the trend and identify the right opportunities when they present themselves. Are we approaching one of those major pivot points or should we expect more reversion?

Please join the premium discussion below: