Election years are typically good for the stock market but not for the mind. The incessant brow beating of sound bites and news clips of each of the candidates defaming each other to gain edge with the American people is not only exhausting, but embarrassing. The political environment in the US is nothing but a circus, and something we have chosen to keep at a distance from our purview as we attempt to dissect the machinations of the stock market. The unfortunate reality is that whoever does win the candidacy will have direct correlation to specific areas of the stock market. While it is too early to discuss those implications, as we move into the summer, the volatility leading up to the election will undoubtedly increase. We present this only to be prepared for that increased volatility as we head into the fall.

Speaking of volatility, there isn’t much. This can be evidenced by an unusually low VIX reading, which currently ~30% below the 20-year average.

This lack of volatility has helped propel the SPX to rise +22% since the Oct ‘23 low. This is the media’s definition of a bull market, which is one that moves at least 20%. We don’t necessary subscribe to this philosophy, but it is one, nonetheless.

Imagine being stuck with some bearish view since then and missing one of the fastest rallies in a generation. Why do these people have an audience? Interestingly enough, some of them are still singing the same tune (Diamond Mike, Lead Lag, etc). We find this fascinating, because at what point do these people admit that they are wrong? We’ve already seen some notable bears capitulate. Mike Wilson at Morgan Stanley, a notable bear who missed the entire rally the last 1.5 years, flipped bullish in Jan.

Here is our post on TwitterX one year ago discussing that following Mike has led to disastrous outcomes.

Hedge Eye, who literally ridiculed bulls since Oct ‘22 for buying into the rally, turned tide and flipped bullish a week ago. Let’s be honest, what model tells you to short the entire rally and then change your tune when we break the all-time SPX high? The reality is, there are better ways, and we think we have a much better methodology. Is it perfect? Of course not, but it works, and it keeps our readers and us on the right side of the market.

While we had been looking for a top in the stock market into the end of Jan, the evidence we were looking for never materialized. And instead of fighting the tape, kicking and screaming, sitting in unprofitable short positions, we pivoted back to getting long large and mega caps growth stocks.

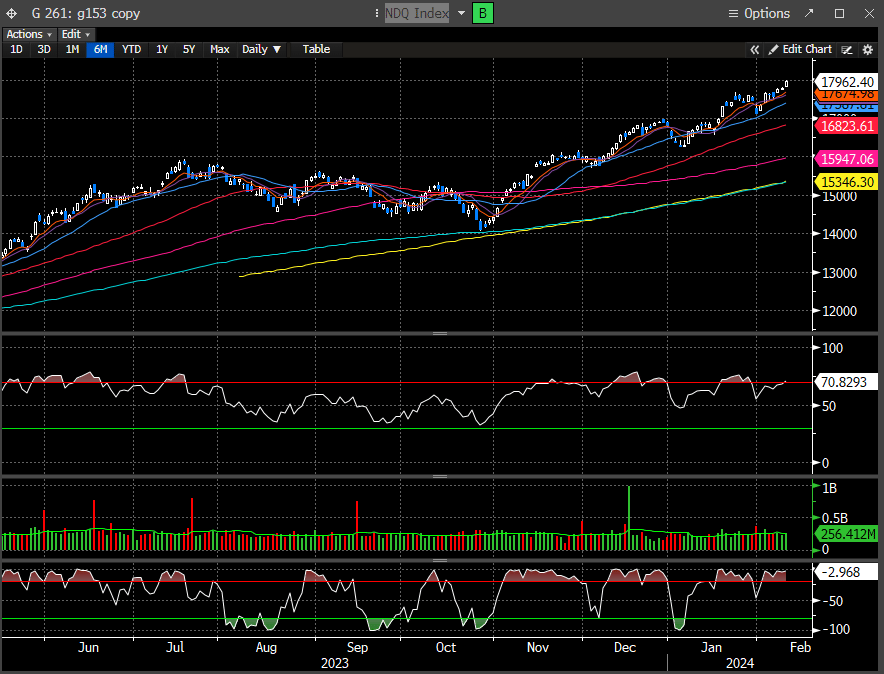

How has that trade fared? The Nasdaq 100 just made another ATH on Friday.

Making predictions in the stock market are always going to be riddled with failure, but staying wrong is a choice. We suggest you choose wisely who to follow and what content to digest.

It is important to note that when notable bears turn bullish, that is a major warning sign. And we can’t think of a more contrarian signal then the publicly boisterous, arrogant and unapologetic Hedge Eye, turning bullish near the recent highs.

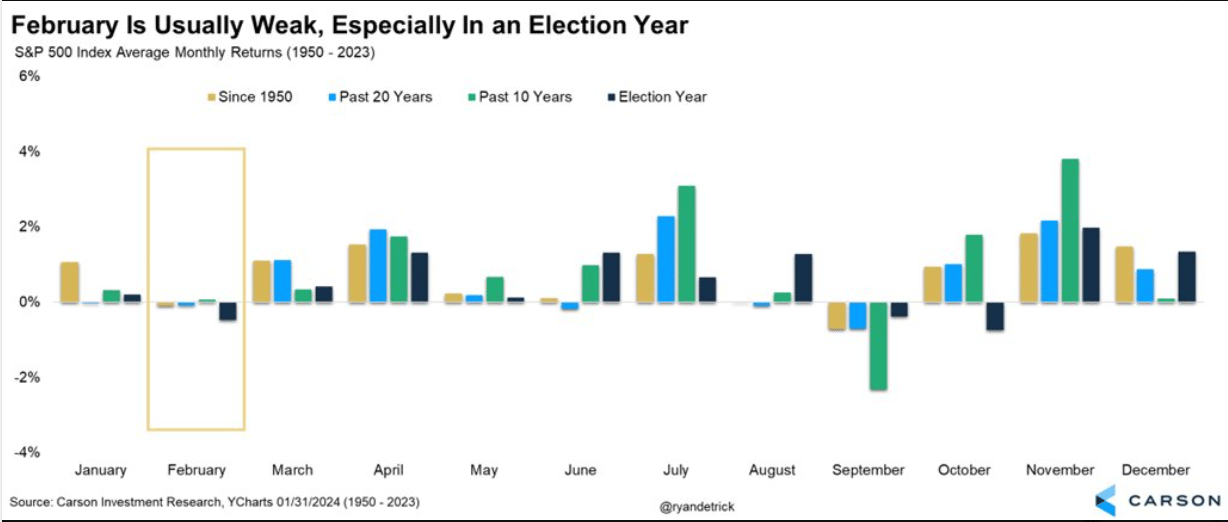

This week we have the all-important NVDA report, CPI, PPI and it’s an OPEX week. Historically, the stock market tends to struggle in the back half of Feb, especially in an election year.

The SPX is up 14 of 15 weeks, which hasn’t happened, ever.

And now we are approaching a rare event where the SPX hasn’t had a 2% pullback in 70 trading days.

None of these are outright signals to get bearish, we are simply presenting conditions to consider. We are weight of the evidence analysts, and this factors into our analysis. Price is paramount, and so far, price is not telling us to be overly concerned, yet. Maybe that changes this week?

Don’t get left out of big moves in the markets. We can help keep you on the right side. Please consider subscribing below.