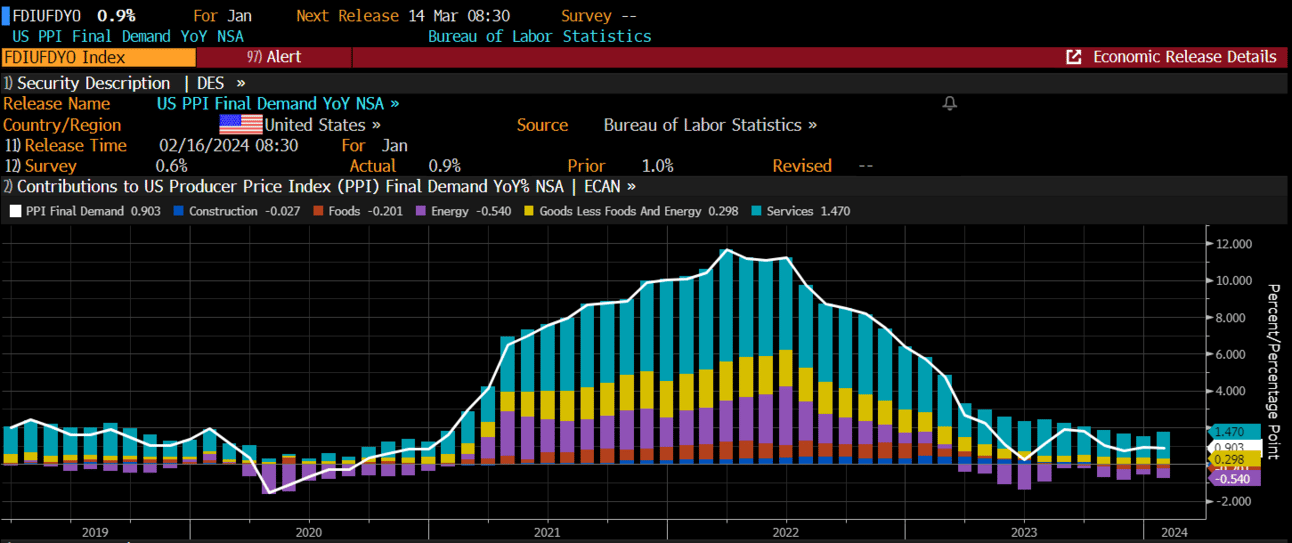

The last week in the stock market proved to be quite the tug of war between momentum buyers and the macro. Not only did we get a higher-than-expected CPI report, but the PPI equally stressed the Fed’s goal of killing inflation.

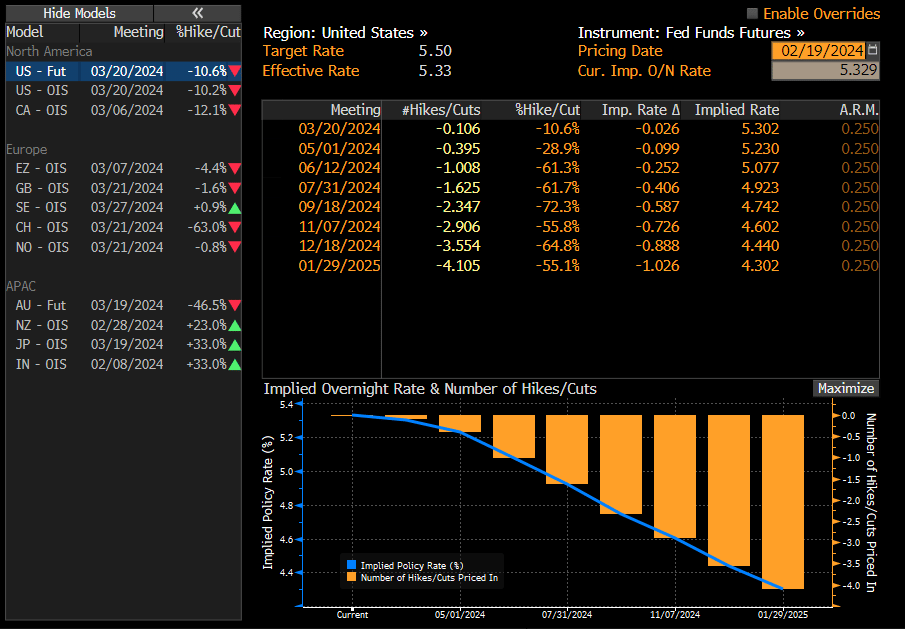

The reacceleration was driven by services inflation, which is proving to be stickier than estimated. A pair of hotter than expected inflation prints is destroying the dovish narrative for the bulls, who walked into this year with the hopes of 150 bps of interest rate cuts. That has been cut in half from six, 25 bps cuts that were expected by the end of the year, to now only forecasting 3.

We know Fed Fund Futures get kicked around by the macro reports quite a bit, but this sort of reversion in such a short amount of time typically is met with more dislocation in risk markets. So far, stocks are ignoring the macro. Should they be, is the bigger question?

Currently the 2-year treasury rates are the highest they’ve been since the beginning of December, and now testing the 50% retracement level from the Oct peak. This is where treasury rates collapsed back in Dec post the Nov CPI report, which helped propel the stock market to new ATH’s in Jan. Clearly this is an important level to watch.

The macro releases this week are quite light and thus NT yield direction may not be revealed until the following week when the PCE is reported, which is the preferred inflation indicator for the Fed. The hotter than expected CPI/PPI this week suggests the PCE will also come in above expectations. This seems like a poor risk/reward for stocks into that report, especially since we are entering a seasonal soft patch for the stock market.

And after 14 up weeks for the SPX, we finally closed down. Thats quite the run for the SPX, and one of the longest in our generation. 15 up weeks has not happened since the early 90’s, and never before that (according to ChatGPT).

We mistakenly said it had never happened before in our last weekend’s report.

Occurring only once in history, and into an OPEX week with 2 pivotal inflation reports, were enough reason for us to keep things a bit light in our approach to stock market exposure.

On Weds, NVDA will report, and never can we remember where a company specific earnings report had such influence on stock market direction. But given how far this has come in such a short amount of time and the importance it has around the AI thematic, we do think it warrants specific attention.

NVDA’s market cap has reached $1.8T this past week and surely expectations for their report are running quite high. It’s outperformance vs. some of its larger peers is substantial.

NVDA’s revenue is expected to more than triple for a second straight Q. This is unprecedented for a company of this size and buoyed by soaring demand in its datacenter business as most companies are racing to develop and implement AI workloads.

Since breaking out of its 7-month base in Jan, the stock has returned almost 50%. If ever there was going to be a sell on the news event, this looks like a prime candidate. The bigger question we have is will a “sell the news” reaction force rotation into other areas of the stock market, or just sink the market. Conversely, will NVDA’s numbers be so fantastic, as to drive the indexes to test higher levels? This seems quite binary and binary to us is a poor risk/reward. We will dig further into this set up in the premium section of our report. Sign up below if you want to know our conclusions.

Another warning sign, and something we have discussed in previous reports, is when Wall Street Strategists change their tune from being overly bearish to now bullish. We highlighted a few of these strategists last week, so we will not rehash. Now we are seeing bullish strategists’ trip over themselves to raise their targets to keep up with the stock markets ascent. We’d say that’s overly bullish behavior and consider that as a similar warning signal.

For example, just months after setting his 2024 SPX target, Goldman Sachs’ David Kostin, is boosting his forecast for the 2nd time. He is referring to increased profit expectations for the companies who have reported. Kostin now sees the SPX closing the year around 5200, implying a ~4% rise from Friday’s close.

This was a bump from his 5100-target offered in mid-Dec. In Nov, his prediction was 4700 by the end of ‘24. So, in essence he has jacked up his target by 500 points or almost 11% in 2.5 months. While we understand the underlying reasons for this target increase, it doesn’t leave that much upside to get excited about, but also doesn’t incorporate how much good news is already being priced into the market. The more good news that gets priced into the market the higher the risk of disappointment. Clearly, we were given some disappointing news last week on the inflation front, which undoubtedly can alter the course of this year’s trajectory, should the Fed reverse course. Investors look at risk/reward before contemplating deploying capital and if the risk is skewed to the downside, then why be aggressively allocating that capital?

This is merely a hypothetical and something to ponder. We are not making a definitive call that the markets are topping. We probability weight our predictions, which usually require more information and confirmation. Will a resolution come this week?

Let’s dig in below.