In our last weekend report, we discussed the incredible event risk the stock market was facing for the upcoming week and posed that last week’s events were going to be the defining moment for the stock markets trajectory. The outcomes of this past week were anything but predictable. Not only did the market sell down aggressively post some lukewarm mega cap tech earnings, and an FOMC meeting with Powell presser that surprisingly was hawkish, but this also occurred with most of our signaling methodology in alignment. The set up seemed in place to finally throw the bulls out of the ring and back into the corral.

That was before AMZN and META decided to take matters into their own hands and blast through their earnings reports, only to be followed by a gangbuster’s payroll report. This made for a very event heavy and frustrating week for anyone that was making large bets in either direction. We on the other hand opted to sit out the fight, and while we had some residual longs (META/AMZN thankfully), our trading positions were mainly flat or hedged.

We prefer the fat pitch and while we believed one was approaching, we always prefer confirmation and typically avoid binary events. Because this past week was littered with too many landmines to make any large directional call, we remained largely spectators.

Here is an excerpt for that report indicating such:

We were incorrect in our assumption that Powell would remain status quo in his messaging, as he dialed back the pace and timing of any potential cuts. The blowout payroll report has all but sealed that a March cut is likely a non-starter. The current Fed Fund Futures is now only discounting a 22% chance of a cut in March and a 90% chance in May. Compare that to the end of Dec ‘23 where the probabilities of cuts were 81% and 110% for those 2 meetings, respectively.

Typically, these sorts of adjustments are met with volatility in the equity markets, and yet that volatility only lasted for 1 day. So, what’s really happening in the markets? A phenomenal question and one that has no simple answer and one that we don’t think we can accurately pinpoint.

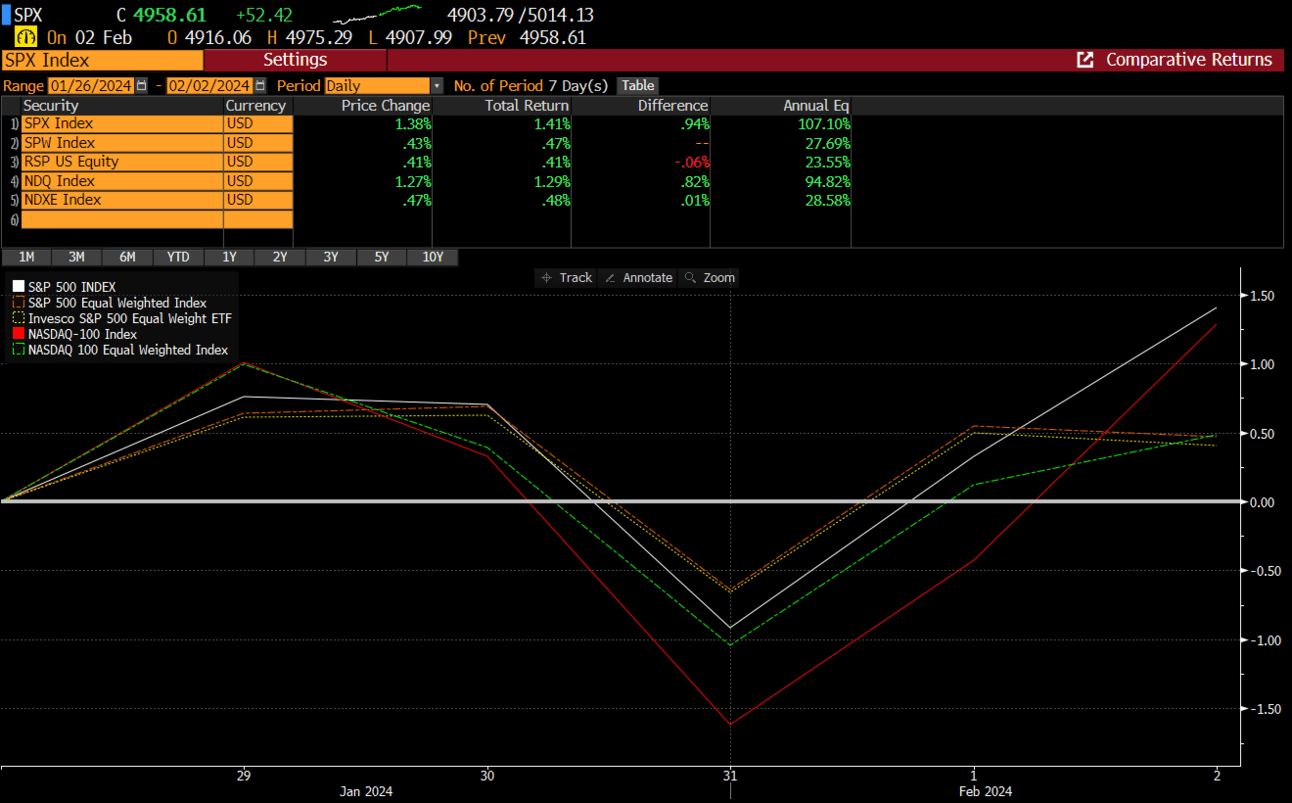

Sure, META and AMZN can drive the indexes higher because of their weight. But the rest of the market is not following suit. In fact, the breadth is quite poor since the start of the year.

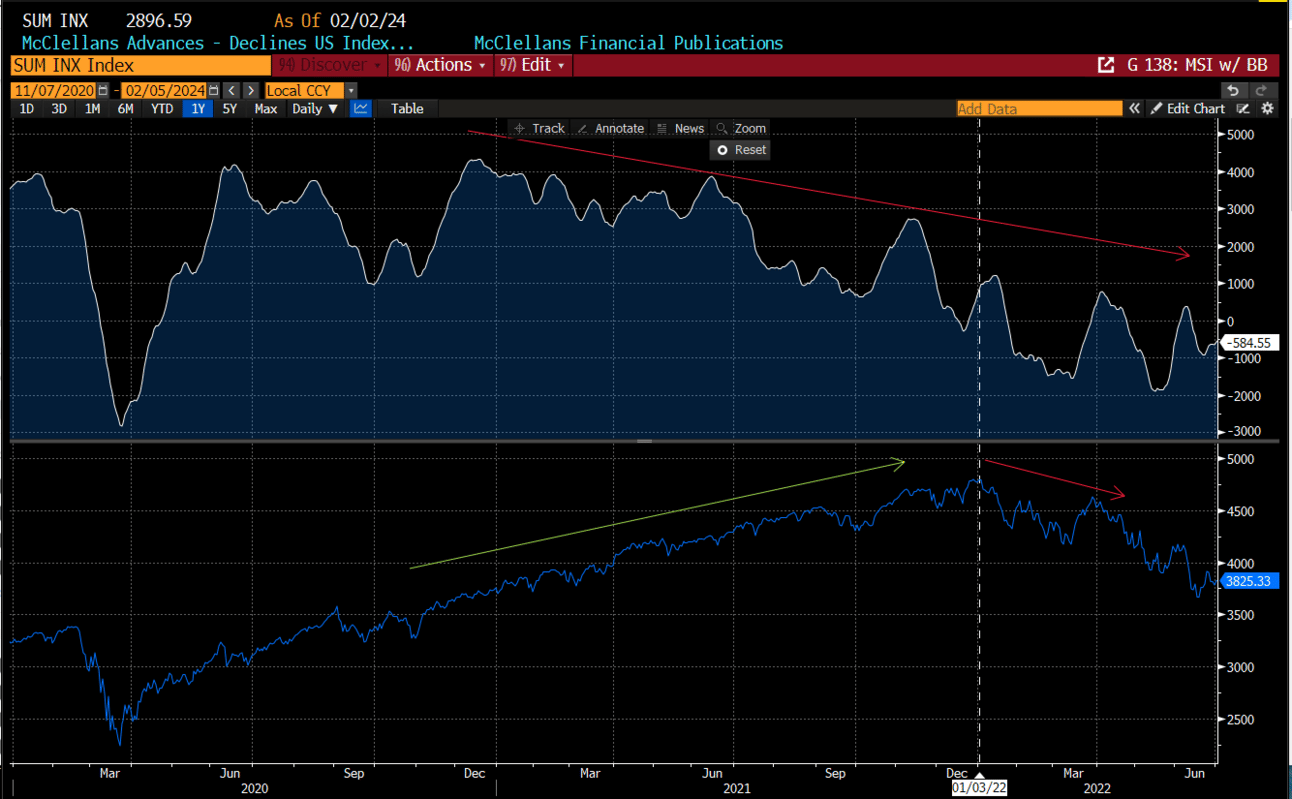

This can be illustrated by the McClellan Summation Index (MSI). Typically, This and the indexes are positively correlated, but currently that is not the case.

A similar phenomenon took place before the peak in Jan 2021. Most stocks were getting sold since the Dec ‘20 peak yet the SPX kept trucking higher, until Jan 2021 when the weight of the weakness finally took over. There are 2 very important distinctions here: 1) the Fed was about to embark on an aggressive rate hike campaign at the beginning of ‘21, which is not currently the case. 2) This divergence lasted for an entire year before it finally mattered. Remember divergences are a condition, and to use them as a singular signal can be devastating to your returns. This is why we weight the evidence before we make our specific calls. Nonetheless, a narrow market is an unhealthy one and something we must consider as we push through a notoriously difficult Feb. Can this all reverse and the rally broaden out? Of course, but for now we must view this as cautionary.

The emergence of AI is very real and something we’ve discussed before as in the early innings. All of the mega caps that reported this week are spending gobs of money in the AI race on related servers, chips, networking gear and all the support and engineering that surrounds the effort. MSFT capital spending was up 68% in the Dec Q to $11.5B. META raised the high end of its capital spending forecast by $2B. AMZN capital spending actually fell but mainly around retail fulfillment and delivery, where its 2024 capex is still above last years at a whopping $48.4B, driven by AI. GOOG also expects capex to be “notably larger” then ‘23. Thats an incredible amount of collective spending and the largest beneficiaries stock prices are reflecting that massive wave of new capital flows: NVDA, AMD, ANET. Is this enough to continue to carry the indexes to higher levels? Sure, don’t underestimate the power of momentum. Is it justified? Thats up for debate. We’d say largely yes, but enthusiasm over burgeoning trends is hard to quantify in real time and they almost always extend too far in one direction. This can set up for some very volatile periods when the narrative shifts. For now, the narrative is alive and well and derailing that momentum is not going to be easy and likely something that requires some sort of catalyst.

The powerful payroll report on Friday should spoil the recession hawks back into their nests, as the economy seems to be strengthening. Non-farm payrolls expanded by 353K, which was 2x what economists were forecasting. Revisions in the prior 2 months were also revised upward by another 126k. Yes, these numbers are noisy and full of seasonal issues, but to disregard this accelerating strength seems a bit misplaced.

Stronger wage growth is not typically good for inflationary trends, so we’ll have to see how that shakes out with the future reads. Here is the take from the Bloomberg Economists who shifted their rate cut assumptions to May.

For now, the week’s events forced the 2/10 year treasury curve to back off its recent ascent to neutrality, with its MACD crossing bearishly.

With regards to the stock market breadth commentary above, the rest of the market had a mediocre week, with 271 stocks fishing higher and 231 lower. Also, the equal weight version of the SPX finished roughly flat. For the year, almost half the stocks in the SPX are down.

Now we find ourselves with the calendar flipping in Feb, and the stock market is defying the bond market, the FOMC and even some of the internals. Feb is typically a difficult month for bulls so if the bears are ever going to show up, this is the time. Feb is the 3rd worst month for the SPX in the last 30 years, behind Sept and Aug. Not only are the chips stacked against the bulls seasonally, but now sentiment is beginning to get a bit too ebullient. The Investor Intelligence newsletter survey hit its highest since mid-21.

The SPX has also just gained for the 13th time in 14 weeks, something it hasn’t done since 1986. Feb tends to start on a high note but then that strength typically fades into mid-month as investors book profits. Thats particularly true if Jan is strong, according to the Stock Trader’s Almanac.

The risks for the stock market to ebb seem to be stacking against it but that doesn’t mean it happens this week or even this month. The action on Friday argues differently. Let’s review.

If you are interested in staying on the right side of the market, we would consider subscribing to review the premium content.