We want to thank all of our readers for being understanding of our heavy travel schedule the last couple of weeks. The time zone as well as our schedule did not permit as much time to writing our reports as we can typically allocate. If you have been with us for a while, you know that we write our reports every week without many interruptions, even if it falls over vacation periods. We hope you appreciate our dedication to offering our readers timely assessments of the stock market and its instruments, even when its fairly difficult for us to produce our analysis.

For the last 2 weeks we have been setting the tone for the stock market to falter, as the apparent momentum in a large number of instruments began to show cracks. Tops in stock markets are a process, and very strong markets must exhibit momentum breaches to even consider a turn is in the offing. We very explicitly gave multiple examples of momentum leaving the market, despite the SPX still hovering around ATH’s. Cracks forming beneath the surface area of index price are tantamount to an earthquake opening, swallowing up the objects that sit on the surface. At first, they appear as small cracks, but eventually consume everything in its path.

Those cracks first appeared on March 8th with NVDA and the Semis. These are days to take notice and should be considered as massive momentum breaches.

Global markets are built on confidence, and when that confidence wanes, it becomes contagious and eventually spreads. For a very strong trend to reverse, either some cataclysmic news event has to occur that shakes that confidence, resulting in cascading selling, or cracks in the ground need to first appear, that eventually open up, sucking in more and more people until we get a rush to the exit. This is where the term comes from, “risk happens slow and then all at once.” There is nobody at the finish line waving the caution flag for market participants to start getting guarded with their allocations/investments. And most participants have very little experience in identifying turning points until its already happened. Hence why risk happens all at once. Because the crack opens up so quickly and rapidly that it sucks everything in its wake. Our goal and our commitment to our readers, is to identify these moments, or at least prepare you for their eventual coming.

This doesn’t mean that the stock market has to have some massive drawdown, it just means that we prefer to be more defensive until we see a better market set up. Last week we wrote that the stock market trajectory is supported by higher EPS estimates and re-accelerating macro-economic growth. This would suggest that dips into meaningful areas should be supported. More on those levels in the premium section.

This week we have 2 very important events that we think will shape the ST trade.

Tomorrow is NVDA’s GTC event which undoubtedly will offer some important announcements with respect to their new AI products. This event is well understood, and most institutions have been keeping NVDA bid in front of that event. The bigger question is, will we get a “sell the news” type reaction or has that been discounted since the Mar 8th peak? We really have no idea, but the reaction will certainly have implications for the rest of the stock market, mainly the tech/growth trade.

Equally important, the FOMC is slated to give their decision on interest rates this Weds. While we do not expect much in the way of NT changes, the directional cues offered by Powell will be quite important. He has been on record recently discussing his confidence around the possibility of cutting rates, but this was offered before the latest round of hot inflation reports (CPI/PPI). And as mentioned in our mid-week, the Dot Plot will be released for the first time since Dec. Should this meaningfully get altered, we should expect increased volatility.

The Fed has been supporting the 3-rate cut trajectory for ‘24. We don’t see much change to that forecast despite the bears calling for a rate hike. We think it’s too early in the year for them to dial back those forecasts. Whether 3 occur or none by the end of the year, we don’t think we will get adjustment clarity for at least a few more months.

Here is what the Bloomberg Economists think:

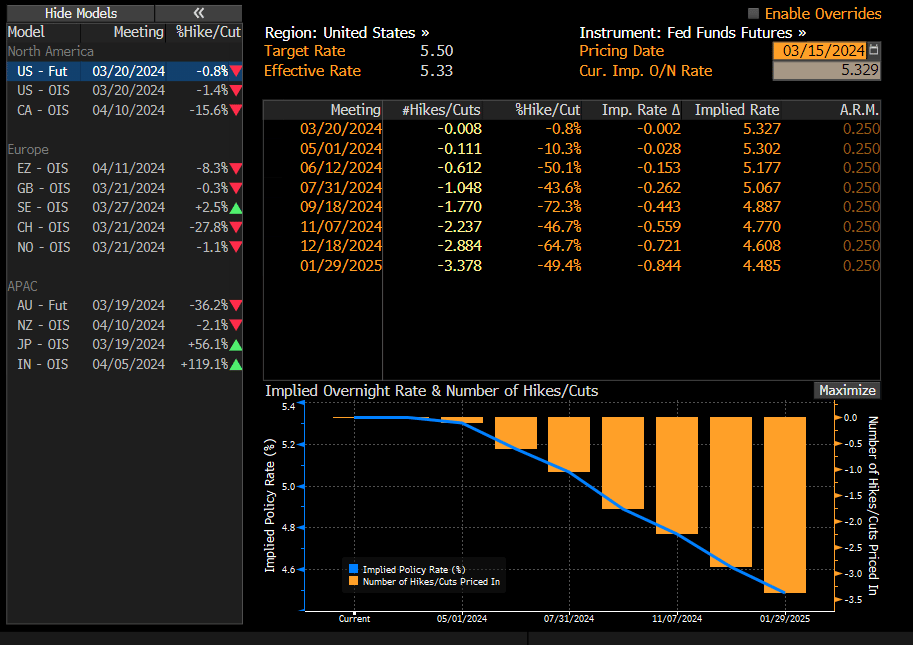

And the Bond market is supportive of that notion with almost 3 rate cuts by Dec ‘24. Interestingly, the forecast for the first cut continues to sink with now only a 61% chance by Jun. This is down from 95% at the beginning of March.

But does the stock market need rate cuts to stay supported? This is something we discussed in last week’s report, and the answer is seemingly, no. The economy has demonstrated that it is strong enough to stand on its own feet despite where interest rates currently reside, and the economists tend to agree.

This does not mean that stocks have to hold their trajectory. Markets do not move in a straight line and trying to ascertain how much of the good news has been priced in, is a difficult question and never an exact science. This is why we conduct rigorous analysis, as we are always attempting to uncover areas of the market that show exhaustive characteristics. Our goal is to identify trend change as early as possible and stay with that trend to maximize returns.

If you wish to her our conclusions, please consider subscribing below.