The stock market just notched its best week in 2024 post the surprising FOMC meeting that proved much more dovish than most were anticipating, even us. Recent hot inflation reports did nothing to spook Powell from his dovish perch, and it seems not much can de-rail the pre-election stock market enthusiasm. Remember that election years tend to be quite positive for the stock market as the incumbent pushes friendly policy to ensure their re-election.

We were explicitly concerned coming into this week as the market was clearly set up for an increasingly hawkish Powell. But alas, Powell wants to keep the economy running hot and stymied any bearish narrative. That bearish positioning had to be unwound quickly and the SPX notched another ATH. The momentum breaches we were seeing in some of the leading stocks 2 weeks ago have somewhat reversed:

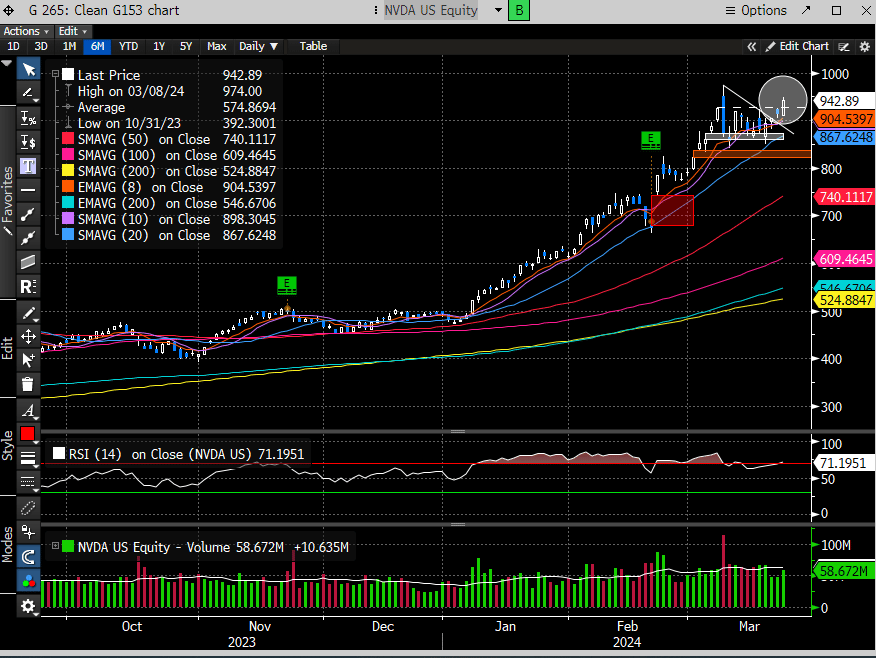

NVDA has broken its recent consolidation and looks to want to test it’s ATH.

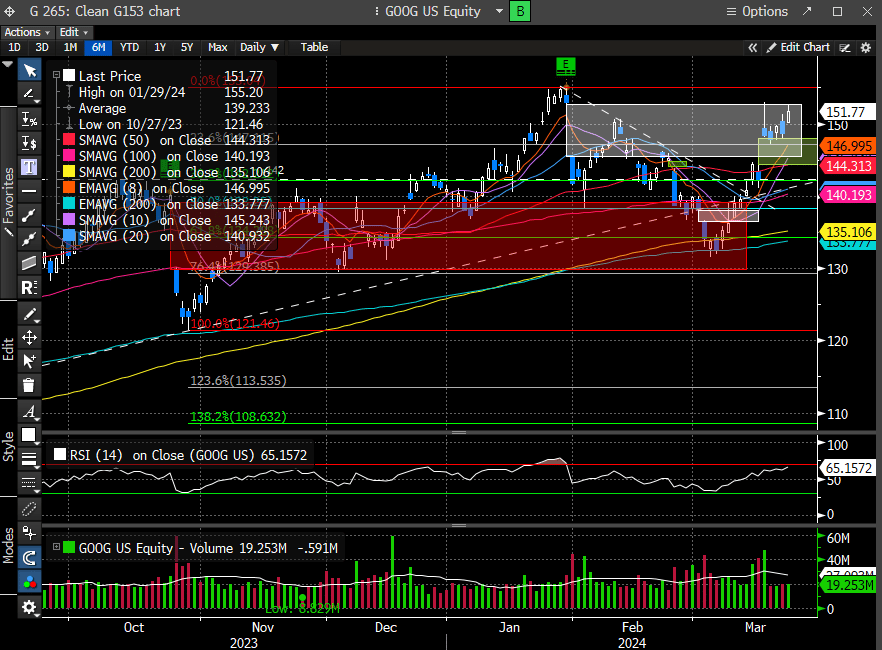

GOOG looked as it if was going to lose its 200 day moving average and drag the market lower. Fast forward 2 weeks and it’s now only a few percentage points away from an ATH.

Semis (SMH) also looks more like a bullish consolidation vs. anything more sinister.

The Mag 7 index closed at an ATH on Friday.

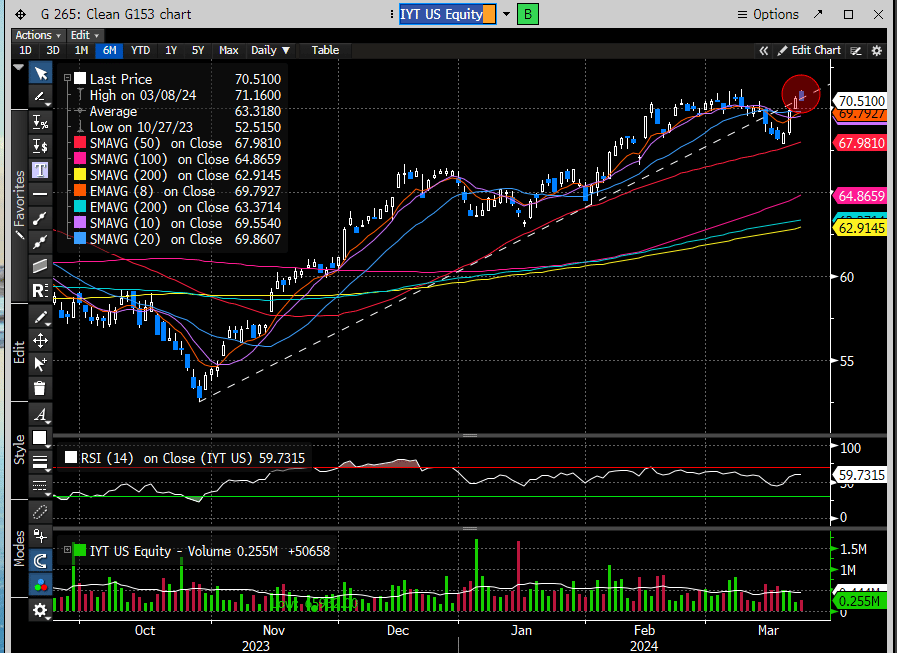

Even Transports (IYT) reversed its slide, testing the 50 day successfully and now bumping up against ATH resistance.

Industrials (XLI) made another ATH last week.

Financials (XLF) made a new closing ATH last week.

Our simple point here is that this is not the type of activity you see when the stock market is getting ready to turn down. Sure, we are overbought, and certainly have some overly ebullient sentiment issues to work through, but markets tend to show their colors in the underlying drivers of index price somewhere, before contagion spreads. We don’t see much in the above to suggest that is present. Of course, this can change quickly, but for now, the drivers of bullish continuation seem to be pervasive.

Not only is the Fed dovish about their interest rate direction, but so is most of the world. The European Central Bank and the Bank of England similarly signaled lowered rates ahead, while the Swiss National Bank made a surprise cut last week. We know the China PBOC is attempting to reignite their economy with looser and stimulative central bank measures, and Brazil and Mexico are already well along into their rate cut trajectory. That leaves Japan on an island, who just last week put an end to their decades old zero interest policy by signaling a target raise, but overall, their policy still remains quite accommodative. Concerted global bank liquidity is NOT a bearish consideration for risk markets.

Despite still elevated rates, the housing, manufacturing and labor market data all point to a resilient economy. This has led to the narrative that good or bad news is good news. Why? Because if the reports that come in are supportive of positive economic growth, they support the “soft landing” narrative. But if the reports are disappointing, then the Fed will cut rates to re-ignite activity. This seems like a “goldilocks” environment and why the stock market remains bid.

We have maintained for some time that a real correction likely won’t come until the first rate cut. This chart is supportive of that.

Currently there is over 75% of the SPX over the 200-day average, which is the best since 2021. To us, this sounds a bit too enthusiastic, and a difficult risk/reward to being aggressively long as most participants seem to be loaded on one side of the boat. This is also occurring with valuations in the stock market on the higher side of history.

The stock market does not move in a straight line and predicting trend change in a very bullish tape is not an easy endeavor. Momentum in the stock market is still alive and well as described above in certain instruments. Trend change usually starts with momentum breaks, and while we were seemingly getting that 2 weeks ago, those breaches have largely reversed. Our goal is to uncover signals in the market as early as possible, which helps not only to play defense, but to maximize the profits by not getting caught in a drawdown scenario.

We do this all for a very fair price. Please join us.