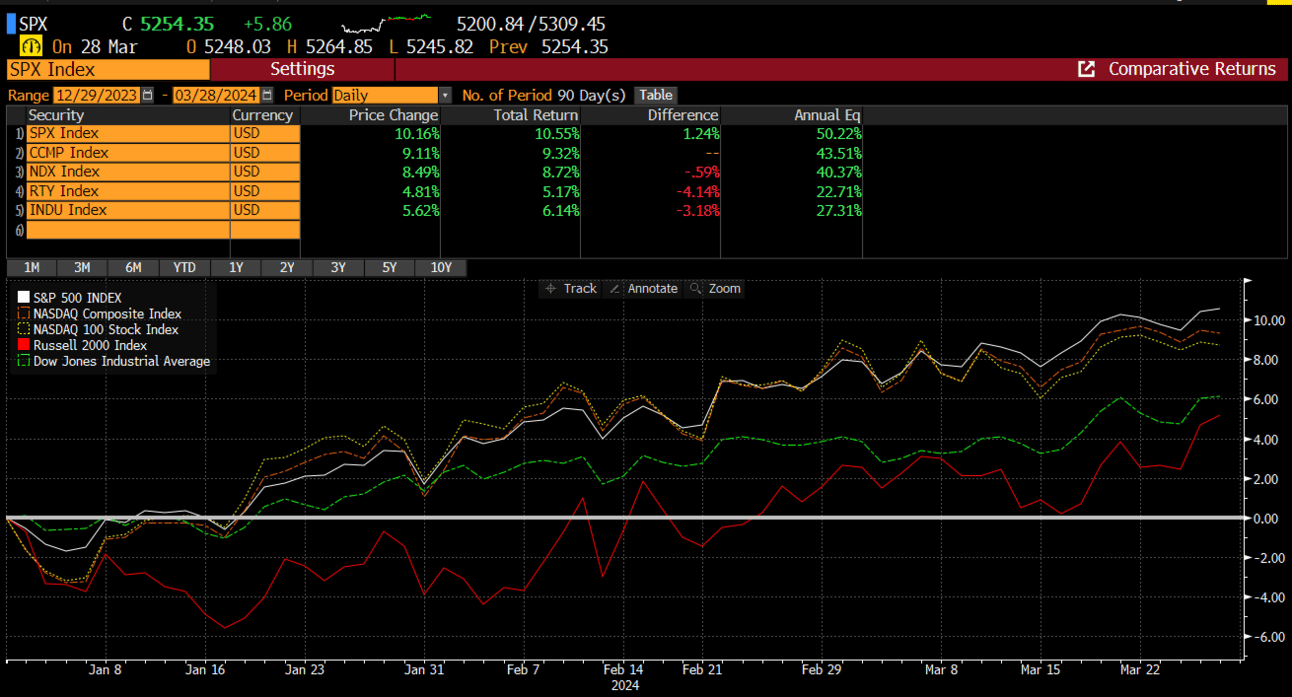

The stock market finished up the quarter with sizeable gains despite all the wranglings of persistent inflation, rhetoric around the pace of rate hikes, and the specter of a slowing economy. We are not economists, nor did we forecast the resiliency of the macro data in the face of decades high interest rates. The thing is, we don’t have to. We follow price, and price has been telling us to be bullish since the Nov ‘23 lows. We have largely been on the right side of the market for the entire bullish trajectory.

When positioned correctly on the right side, its significantly easier to make money in the stock market. Our internal performance over the last year has been nothing short of outstanding. We have shared some of our ideas with premium subscribers during that time frame and most of those ideas have returned handsomely.

Here are a few of our favorites that we have shared and the performance since:

TSM +40%

SQ +46%

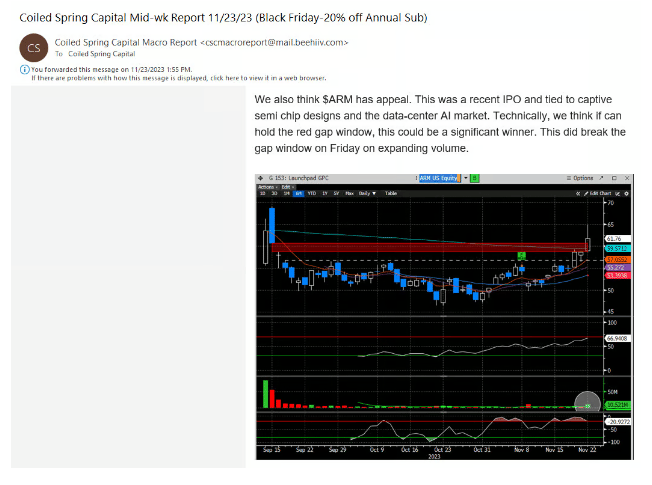

ARM +104%

Semis ETF (SMH) +38%

SMCI +277%

Some of these stocks we still own and some we have already sold, but the performance is notable. The reason we are showcasing this is we want to start sharing all of the ideas we take positions in or find attractive. This will be an add-on to the bi-weekly newsletter and only be available for our premium subscribers. We will offer this optional add-on for a discounted price (30% off), and only for active premium subscribers. Current subscribers will have one week to upgrade to the additional idea-tier. We are hoping to roll out the new offering this week so please monitor your email for the announcement and details. We are very excited to roll out this new feature and we hope you will consider upgrading.

Now that 1Q is in the books, can 2Q and the rest of the year deliver positive returns? The short answer is yes. The SPX posted 22 record closes year to date, which is the most since 2013.

This is also only the 4th time since the turn of the century that 1Q has gained more than 8%. Since 1950, there have been 16 instances with gains in the first Q being+8%, and only once (1987 crash), did the index lose ground the rest of the year.

In the other 15 instances, the index gained an average of +9.7% during the subsequent 3 Q’s. This implies there is a 94% chance of more gains using this historical context. Although, that doesn’t mean that the gains will match those of the first quarter.

When the stock market posts back-to-back quarterly +10% gains, the rest of the year is typically positive as well.

Strength begets strength.

And Apr is one of the strongest months of the year.

It’s going to be a fun month. Consider joining our premium membership below.