Geo-political volatility is some of the hardest to analyze. It creates an extremely newsy environment and one that will whip around risk markets with every rumor or headline. A couple of weeks ago we were advocating caution in one’s approach to allocating capital in the stock market. We didn’t know that Israel and Iran tensions would escalate, but global markets did. Why do we say that?

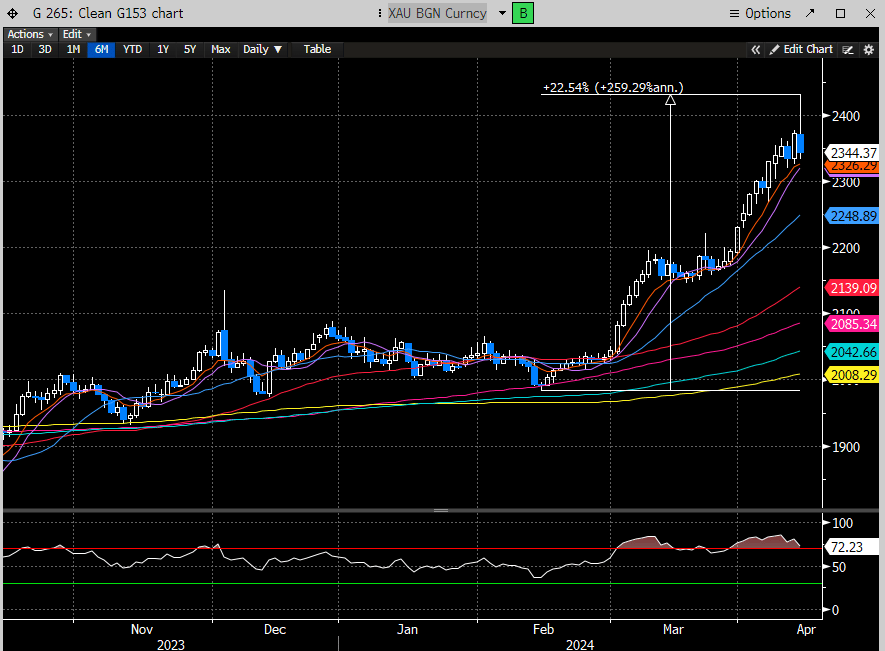

The gold market exploded upwards recently and was being blamed on Chinese central bank buying. Maybe that’s part of it but war escalation doesn’t happen overnight. They are meticulously planned and typically suspected in certain parts of the world. Until Friday’s reversal, this had been on a +22% tear since the middle of Feb.

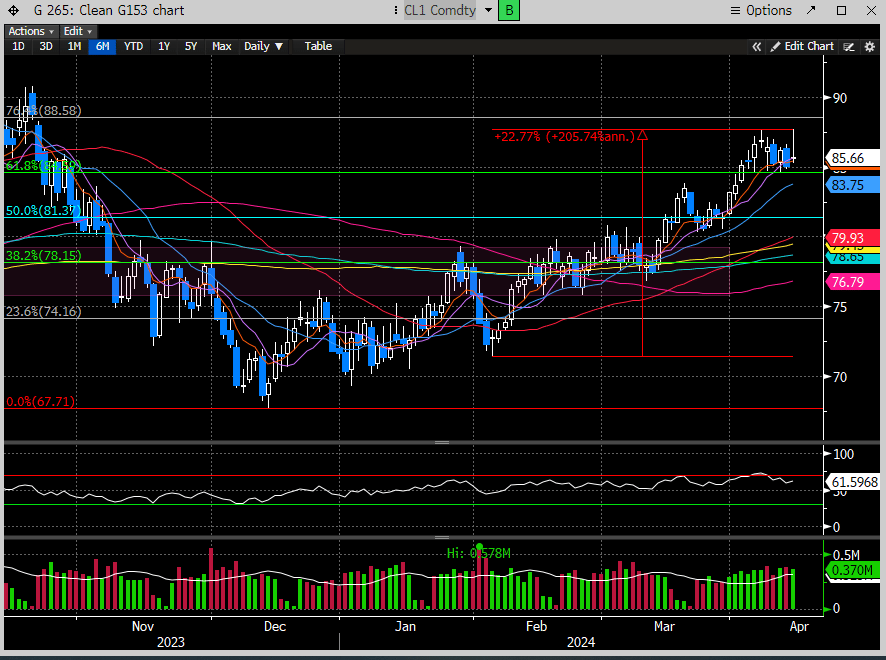

Oil is the most sensitive to geo-political conflict, especially one that emanates from that part of the world. Since the early part of Feb, oil has also rallied +22%.

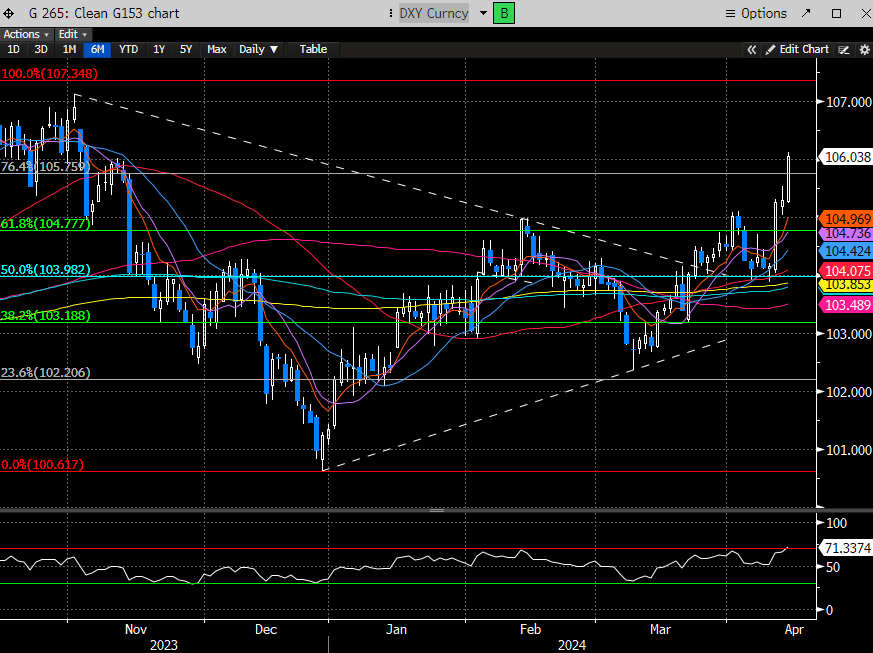

The $USD (DXY) is a safe haven asset and gets bought when global chaos ensues. The DXY is now the highest since Nov.

The point is you don’t have to be a global foreign policy expert, a wartime consultant, or a well-informed politician to be able to read the tea leaves of the market to know that something is amiss, and a risk-off period was brewing. We specifically wrote to get defensive in last weekend’s report as our analysis suggested doing so. The global market is trafficked by the most well-resourced individuals and institutions, who stand to make a fortune if they make the right directional bets. Those bets leave footprints all over the market. And when certain footprints are happening in unison, it screams to us to get defensive. We don’t have to know the reason, which is the beauty of our analysis. We see it coming before the news hits. The rationale for the movements is irrelevant to us. We only care about “the what,” not “the why.”

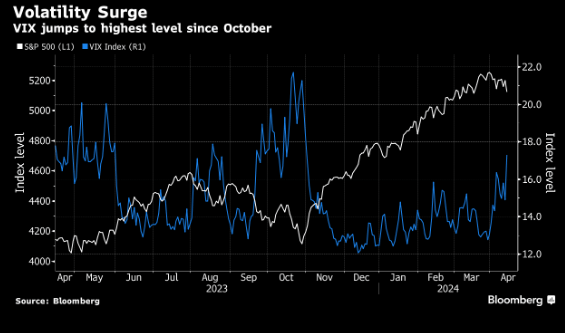

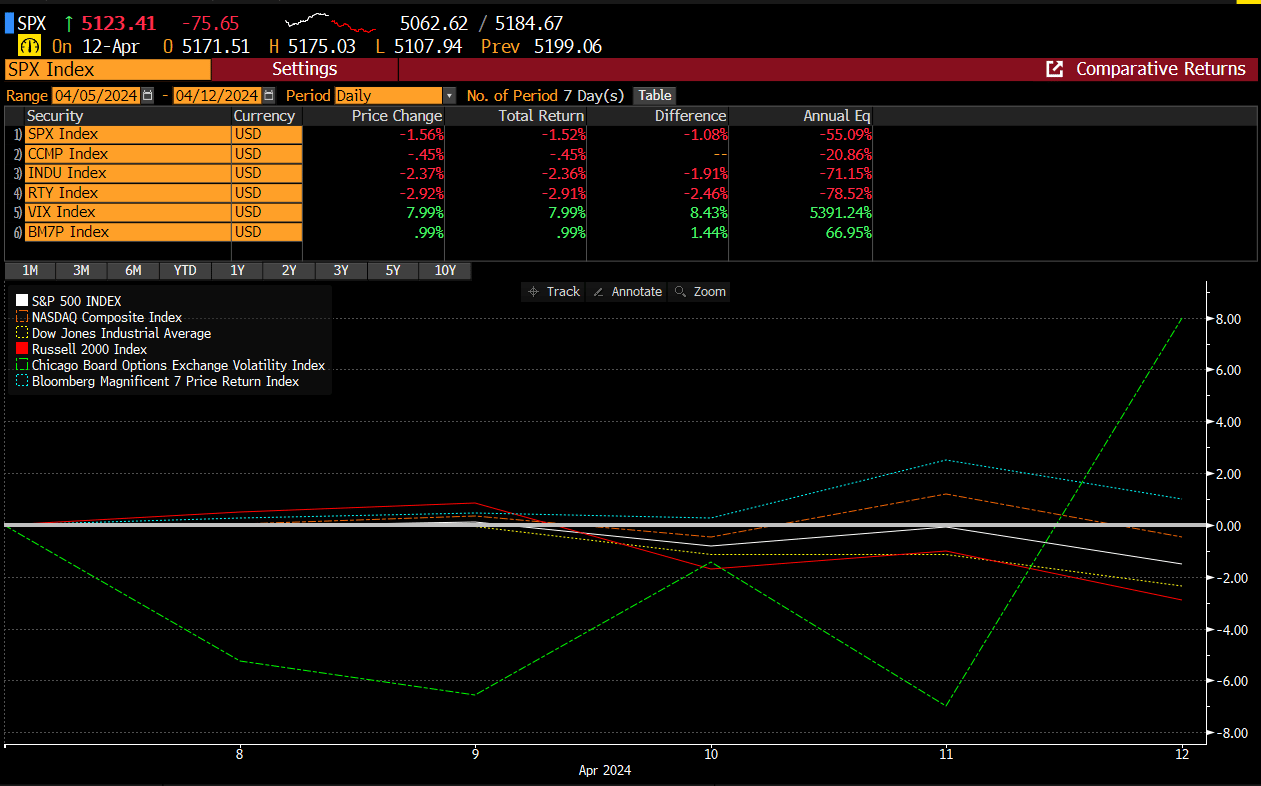

The VIX paints the perfect picture of the fear that was injected into the market last week. On Friday the VIX reached its highest levels since last Oct.

We have been warning our readers about the higher volatility regime since the beginning of the month. Changes of character in the market warrant attention and the March 4th candle to retake the gap window, was that change of character.

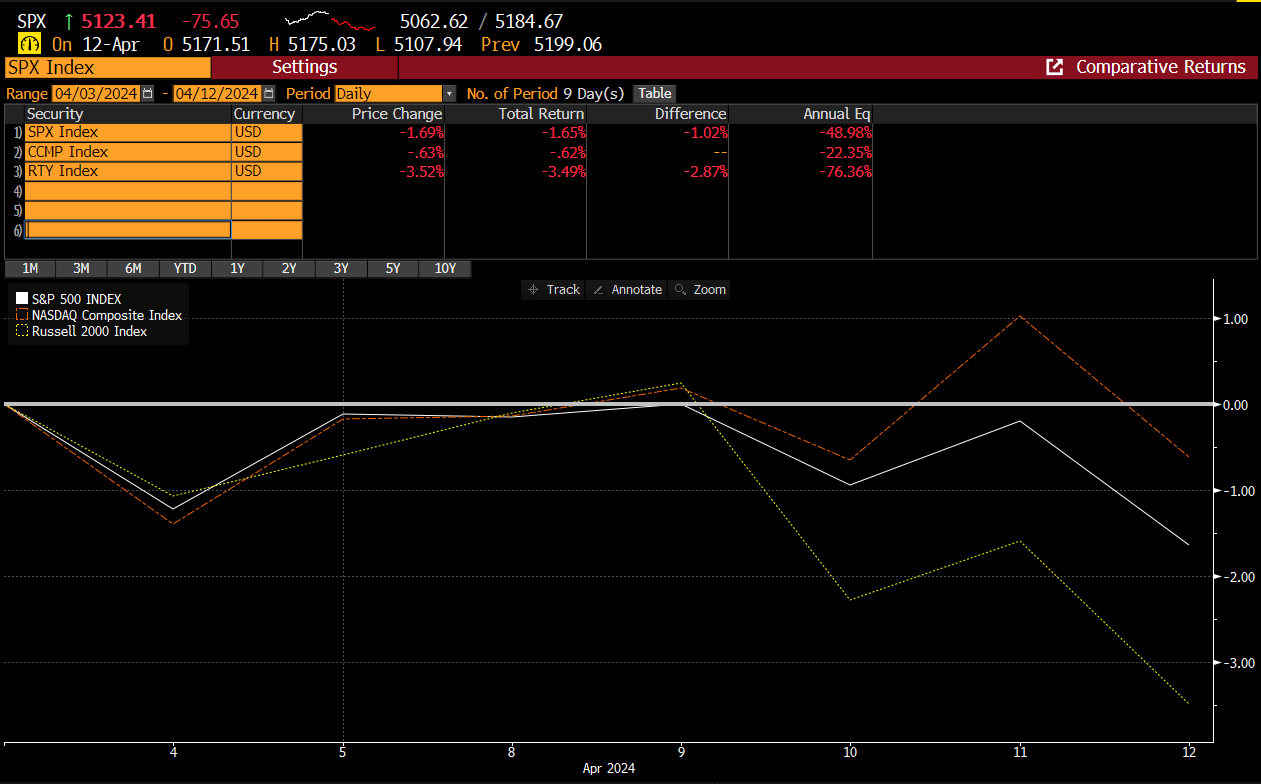

This manifested in the SPX’s biggest weekly decline since Oct. Besides the VIX being green on the week, the Mag7 Index also posted a positive performance.

Coincidentally, we have been advocating sticking with the large caps if looking to trade long. These are now considered safe-haven assets, that do not have any material impact from higher interest rates. Even with heightened geo-political risk, these companies are relatively immune.

Here is the excerpt from our 4/3 report where we highlighted our shift out of SMID caps and back into large caps, notably the Mag 7.

In that report we also presented 4 large caps to consider (AMZN, META, GOOG, NFLX), while we suggested fading NVDA and AMD.

Here is the performance of that trade:

When compared to the indices, this is substantial outperformance.

We’ve also been long gold since the early March breakout, and before Friday’s reversal, this was up over +15%.

Here is the excerpt from that report:

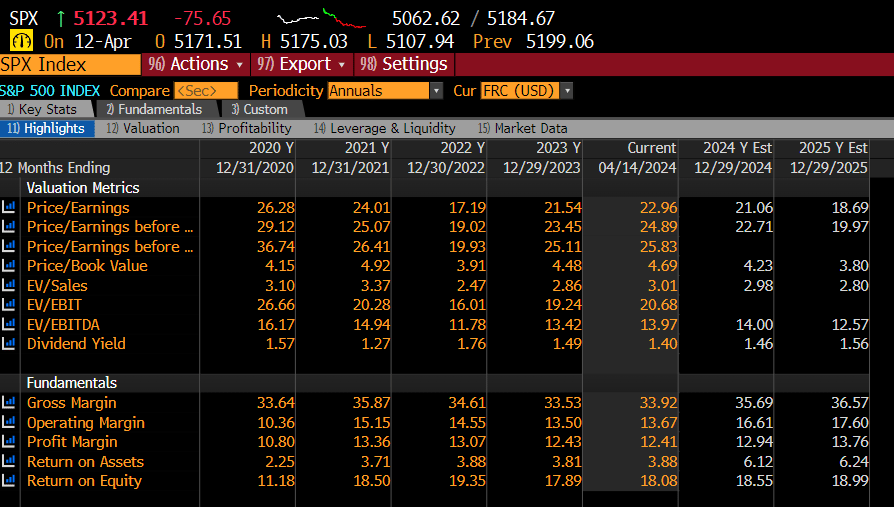

But since we are in the prediction business, the current geopolitical situation, at the very least argues for more volatility, and wild market swings that are fueled by headlines and rumors. And as we alluded to above, it makes the current situation somewhat unanalyzable. While the weekend’s events could certainly have been more devastating, to call the end of a multi-century conflict over, would seem a bit premature. In the US, we were already dealing with a stagflationary scenario, and the ensuing higher rates picture certainly points to a difficult stock market setup. Especially since we are already trading above-average valuations.

Geo-political conflicts historically, have not been the destructor of positive trends, unless, of course, it is the cause of a recession. That scenario is unlikely unless oil spikes to $150. Here is a great chart to consider from Carson Research depicting the performance of major geo-political events in history and their impact on SPX returns.

This analysis implies that market weakness should probably be bought. But that likely requires some more information, and we may even need to see lower levels in the stock market get tested before enticing buyers.

Turbulence is part of investing. Fortunately, we were already positioned for increased volatility coming into this week.

As mentioned in our mid-week, the window for our new CSC Idea Tier is now open for premium members only. As a premium member, you have exclusive access to a reduced membership (40% off) until Thursday. After that, our prices will increase substantially. We work extremely hard to produce actionable and favorable risk/reward setups. Over the last year, these ideas have had a cumulative return of over +700% (past performance is no guarantee of future returns). Please consider joining us.