Recession or no recession, that is the question? Or is it? The stock market continues to defy conventional wisdom that we are headed for one given the level of treasury curve inversions. The incessant bearish Fintwit/Strategist/Media chorus will have you believe that the worst is yet to come, as we head into the teeth of earnings season where the expectations are for a lowered full year outlook, the banking crisis was just an appetizer and that the real fall out will occur over the summer.

We are not here to be the arbiter of truth. We believe that all of the bearish views have considerable merit. We believe in price, and the signals the stock market sends.

Currently, the SPX has spent the bulk of the year above the 200 day Moving average. The 200-day average may seem silly to some strategists, but it is a clear indicator of intermediate long-term trends. This doesn’t mean we can’t have nasty corrections or reversions, in-fact, given the level of uncertainty out there, we would certainly bet on continued choppy and erratic markets. This means a non-trending market and shows to be trapped in a large range. The SPX 3800-4200 is the range we have been in for almost 1/3 of the year.

This chart depicts that range fairly well but also illustrates the predominance of SPX days above the 200 day MA.

What does this mean? It means if you are positioned for some cataclysmic wipe out and a retest of the lows, you have been on the wrong side of the market. If you are buying breakouts thinking we are on our way to make ATH’s, you are extremely frustrated as most breakouts have eventually failed. We have been saying all year that we think we are in a range bound market, and one which would frustrate bulls and bears, who chase every swing higher and lower. This has certainly played out thus far.

One question perma-bears should be asking themselves: How could the SPX be closing in on 8 month highs given all the uncertainty out there? It’s certainly an enigma. Last year we wrote many times that the stock market had started discounting a recession much earlier than in previous periods. In some areas of the growth sector, the peak was in Feb of ‘21.

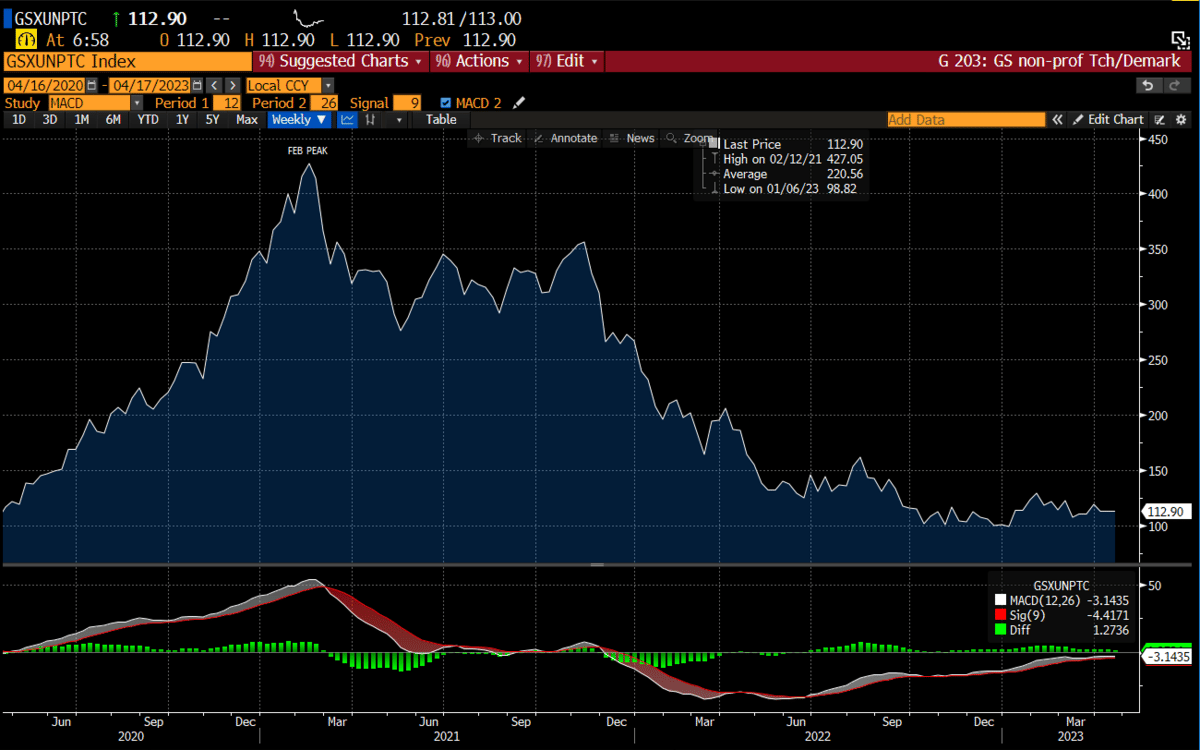

Here is a chart of the Goldman Sachs basket of non-profitable tech companies:

It is now been over 2 years since this group has peaked. Shouldn’t it be logical to consider that maybe the market could be pricing in a recovery much sooner than what is visible? Markets change, investors are becoming increasingly sophisticated with their predictive models and trading flows are dominated by algorithmic trading. This notion is highly conceivable.

One thing is for certain is that changes in the money supply undoubtedly drive markets. Liquidity is the most important driver of intermediate stock market direction. There is no need to over-think it, it’s a fact. And all markets are inextricably linked to liquidity.

Notice that M2 month/month changes peaked in Feb ‘21, which coincides with large parts of the tech sector.

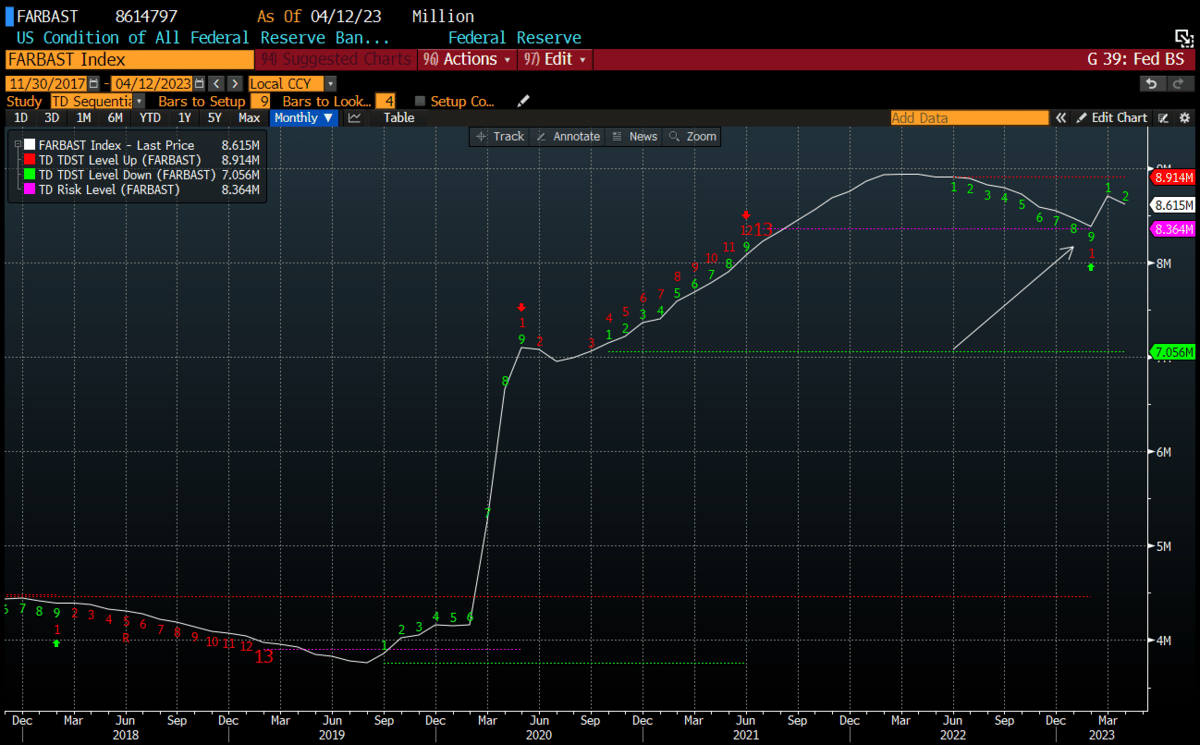

What happened one month ago, after the SVB debacle? The Fed started increasing their balance sheet to support deposits.

We’ve shown this chart before. It’s the Fed Balance sheet overlaid with DeMark signals. How could DeMark signals be relevant to the Fed BS. They just are, and we simply accept it.

The Fed balance sheet started expanding right around when the banking crisis began.

Guess what else started inflecting during the teeth of the banking crisis?

We’ll say it again, liquidity drives markets.

Take it one step further, as sellers have been unable to drive prices lower in the face of some very challenging news. If the notion of pricing in a recovery is true, then maybe the recovery is already underway.

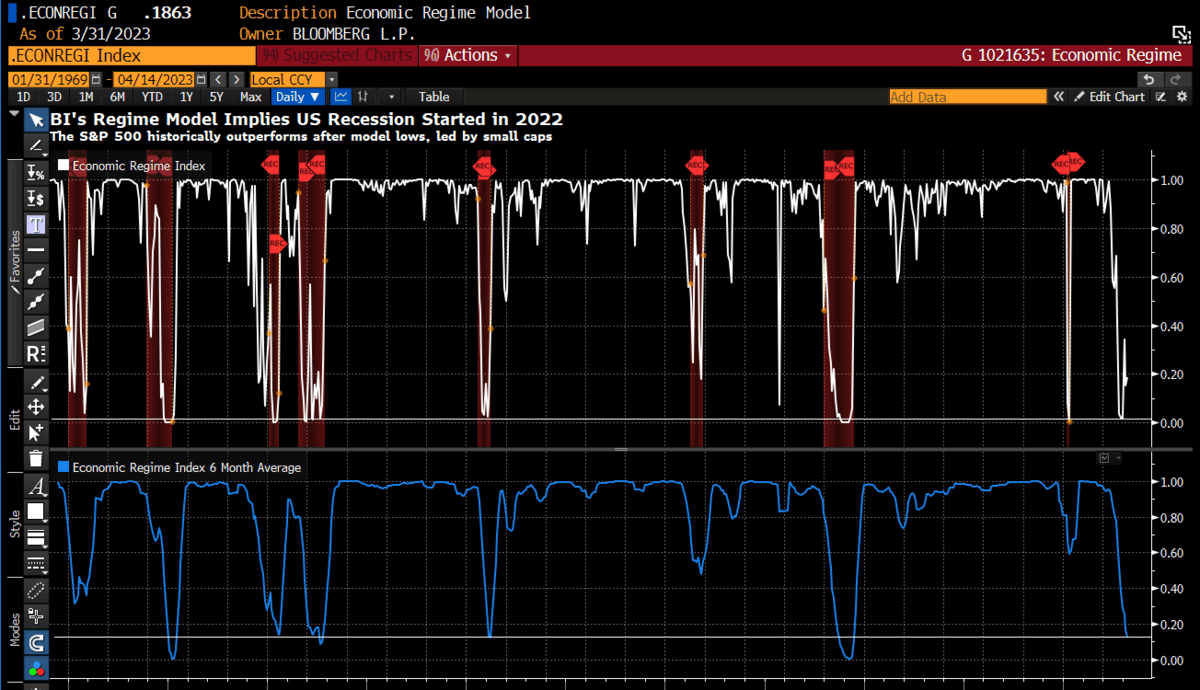

The chart below depicts that things may not be as bad as they seem. According to a Bloomberg intelligence model, known as the Economic Regime Index, the worst of the economic pain has already occurred. In their explanation, the worst of the pain was experienced in Jun - Dec ‘22. Remember the stock market bottomed in Oct. So, this window where a bottom was formed would make sense.

Looking at the past 8 recessions since 1970, the SPX returned +8.9% on average after the 3 months the Bloomberg Intelligence model hit its low, and +20% over the next 12 months. Contrast this comment to an SPX that is now up almost +8% for the year.

The bond market is telling you that the Fed will stop raising rates this year despite the rhetoric for continued hikes. There is now an 81% chance for a 25 bps hike in May and 100% by Jun. This implies the next 25 bps will be the last of this cycle.

There is an interesting take on the yield curve and inflation in a Barrons article over the weekend.

Regarding the yield curve inversion, the article posits that the inversion is being driven by the Fed who is borrowing trillions of dollars from money market mutual funds and banks by paying current rates of +4.8% to money funds and +4.9% to banks. The Fed is trying to keep those fund flows from entering the bond market, which would suppress yields on the spike in demand. Effectively this would undermine the Fed’s efforts to keep short rates high. While we are not here to debate the validity of this argument, it does make sense in the context of a heavily inverted yield curve and lack of evidence of a nasty recession. That said, the article does go on to mention that the Fed is going too far with their rate trajectory and the probability of a recession is growing.

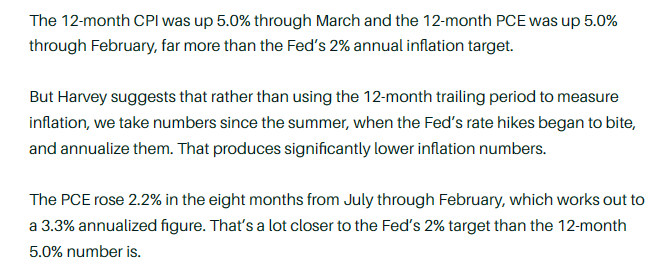

The 2nd part of the article talks about the effect interest rates have had on inflation. And if you measure inflation impact since the summer, arguably 6 months into the rate cycle campaign, the desired effects to dampen inflation are not that far off from the Fed’s targeted goals.

These are certainly interesting takes and something we must consider. If the curve inversion is Fed-inflicted, and if inflation reduction is closer to the targeted Fed range than the headlines suggest, and the teeth of economic slowdown has already occurred, then the SPX trading near an 8-month high is not that far-fetched.

Now let’s analyze some charts to find if there is confirmation.

To read more of our analysis on today’s market, please subscribe below.