Risk happens slow and then all at once. This is a hard concept to grasp in real time but in hindsight it becomes glaringly obvious. We have been writing since the beginning of April that we were cautious on the stock market and to start playing defense. That means to be less aggressive with deploying capital, taking smaller positions with tight risk parameters and to simply do less. We specifically stated that we didn’t want to get caught in a painful drawdown as the risks were mounting.

We were well positioned for this correction by not being very invested in our trading accounts. This doesn’t mean we were short, because we weren’t. The stock market had been sending mixed signals for months making the timing of the reversal more difficult. The first sign to get short would have come on the Apr 2nd gap down, but that doesn’t mean shorting the market would have been easy. In fact, the market retested the highs 2 days later. Being a good short seller is a very specific skill, and while we can tell you directionally what might happen and be correct most of the time, sitting in shorts takes a certain fortitude to sit through what sometimes seems illogical. We think not being involved is just as good as being short in a corrective scenario. It preserves mental capital for when the really big opportunities to make money holding long positions occurs. We always advocate that you don’t need to be in the market all the time, you just need to be on the right side of the market at the right time. This is what we attempt to do for our readers, and we think we do it as well if not better than most. We had been very long the stock market from the very early days of Nov up until the 1st week of April. The last couple of weeks have been hard to hold longs and we have found ourselves stopping out of our small positions early to avoid what seemed inevitable. Friday was that inevitability.

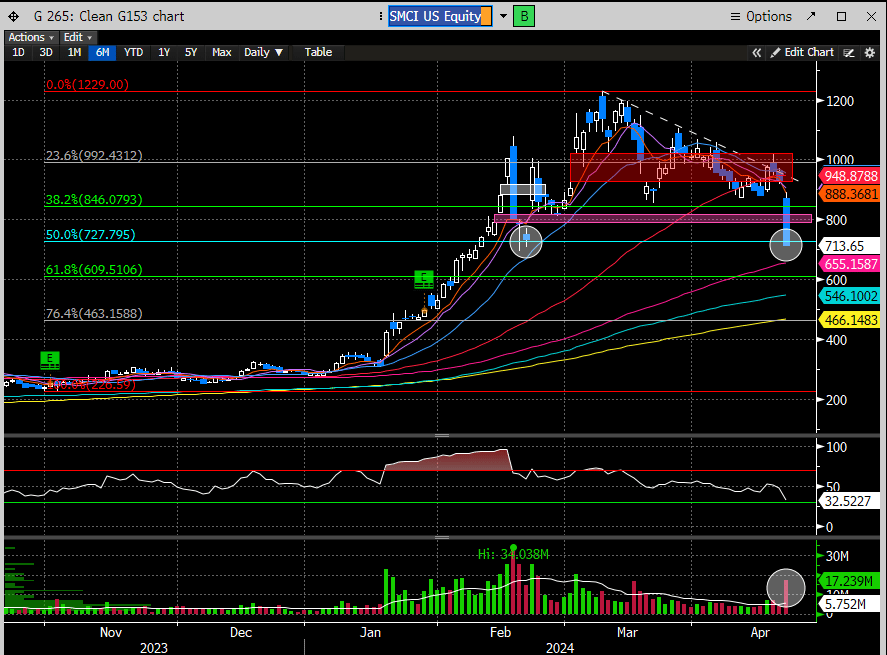

What do we mean by that? The last stalwarts of market momentum were the stocks most exposed to the AI thematic. These stocks finally got decimated after what seemed like an innocuous message from SMCI. Investors turned sour on the group after the company released their earnings date, but because this didn’t occur with a positive preannouncement, the entire group got aggressively unwound. Welcome to the world of trend following algo’s. The same enthusiasm that took these stocks to stratospheric heights, was abruptly reversed sending these stocks through all sorts of support and causing some very real technical damage. This is a good example of “domino theory,” once one falls the contagion spreads.

Here is the SMCI chart that lost multiple areas of support in Friday’s massacre.

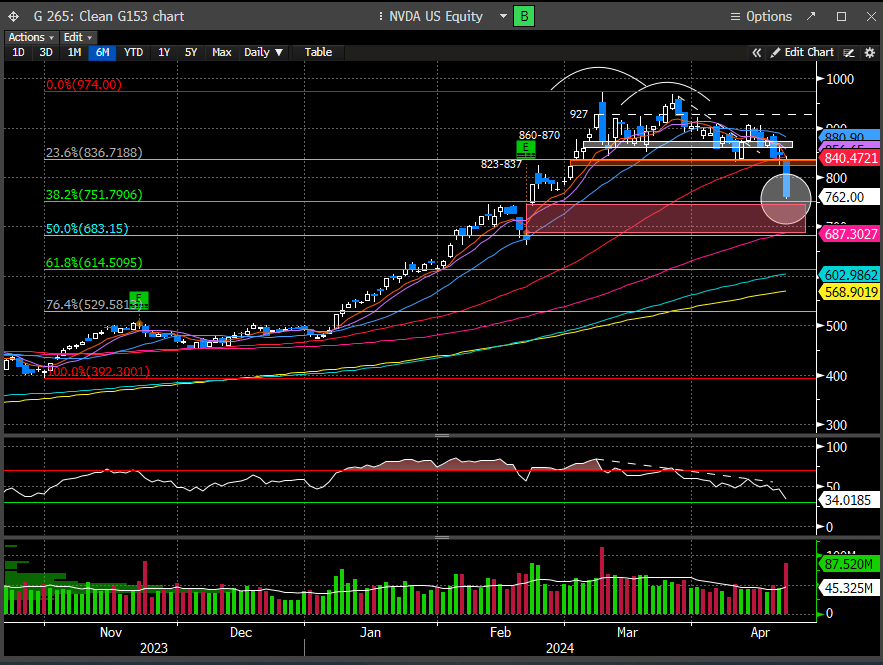

NVDA was no party either, which is probably the most over owned stock on the planet. What’s interesting about NVDA, is that if you know how to read technicals, you would have sold this stock long before Friday’s washout.

AMD has been on our sell list for weeks, so no surprise this continued to fall apart.

ARM, is a stock we wrote about for our readers back in November in the $50’s. It’s hard to imagine this is close to round tripping.

Anyway, the point should be well received: Risk happens slow, and then all at once. Helping our clients avoid these painful drawdowns is our goal, and we think we delivered again.

What most don’t understand is that money exiting the areas of the market does not happen all at once. It happens slowly, and what’s called distribution. This has been apparent to us since March and for those that know where to look. But that doesn’t mean you can’t make money on the long side during a distribution phase, it just means that you need to be more selective on where to deploy that capital.

s

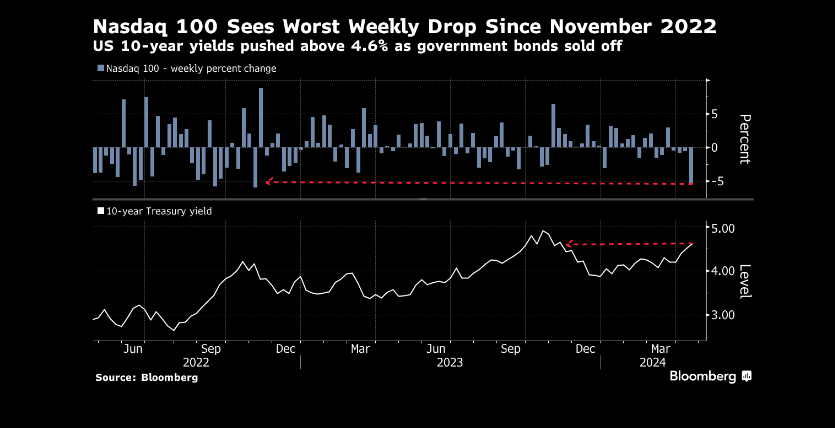

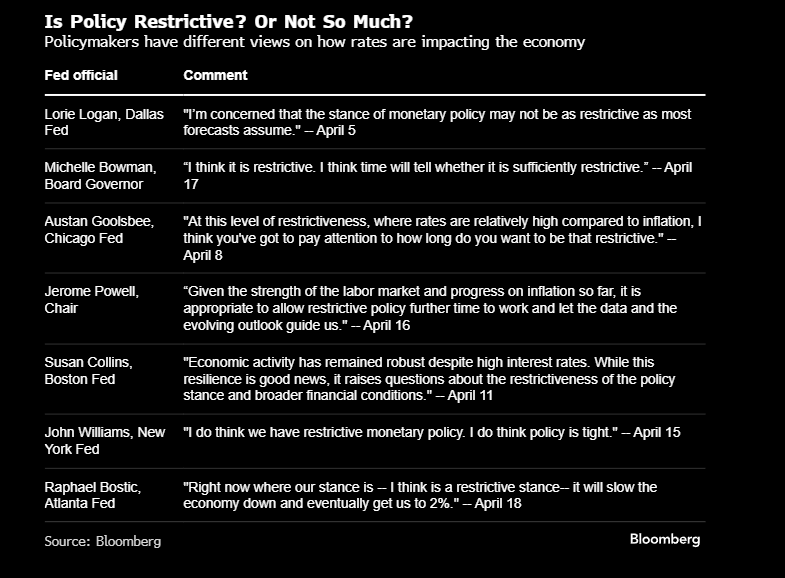

So, while not much has changed with respect to the economic drivers for the economy, the expectation for that growth is changing. Most the of the reversal in expectations has to do with stubborn inflation and an interest rate cut trajectory that keeps getting pushed out. Throw in some geopolitical risk and an earnings season that could disappoint, and we have a cocktail for a major correction.

Here is a list of recent Fed policy makers and their view on inflation.

After last week’s beatdown in the stock market, Y-T-D performance has almost been undone in the Dow and the Nasdaq.

Does it get any easier this week? Unfortunately, not. We will get another inflation report on Friday (PCE). Estimates are for more re-acceleration. Can this report surprise the market and come in below expectations? Sure. And could that reverse the recent slide? Definitely. Are we willing to make that bet? Negative.

The technical damage to the indices are real. This sort of carnage doesn’t typically reverse on a dime unless accompanied by some unforeseen news event or a macro report (i.e. PCE) that takes investors by surprise. We can only play with the cards we are dealt, and this is looking more like a pair of twos in a blackjack game. That said, there were some interesting developments last week that we are tracking that could still produce tradeable areas or even sectors seeing rotation away from growth.

Let’s dig into those opportunities in our premium section.