Last week we suggested the market would likely be rangebound and consolidate in the absence of any market moving news, and listless trading ensued. The 5-day change in the major indexes was miniscule.

Is this the calm before the storm? This week will undoubtedly move markets as 35% of the SPX is slated to report, including most of the largest cap tech stocks that have driven the market higher this month.

Tech stocks earnings are set to drop the most since ‘09 as companies are cutting spending on software, advertising, etc. There have been some high-profile layoffs at the larger companies, which typically helps margins but is the result of lower sales trends. Friday, $GOOGL announced it has stopped building its proposed San Jose campus. What are they trying to tell us?

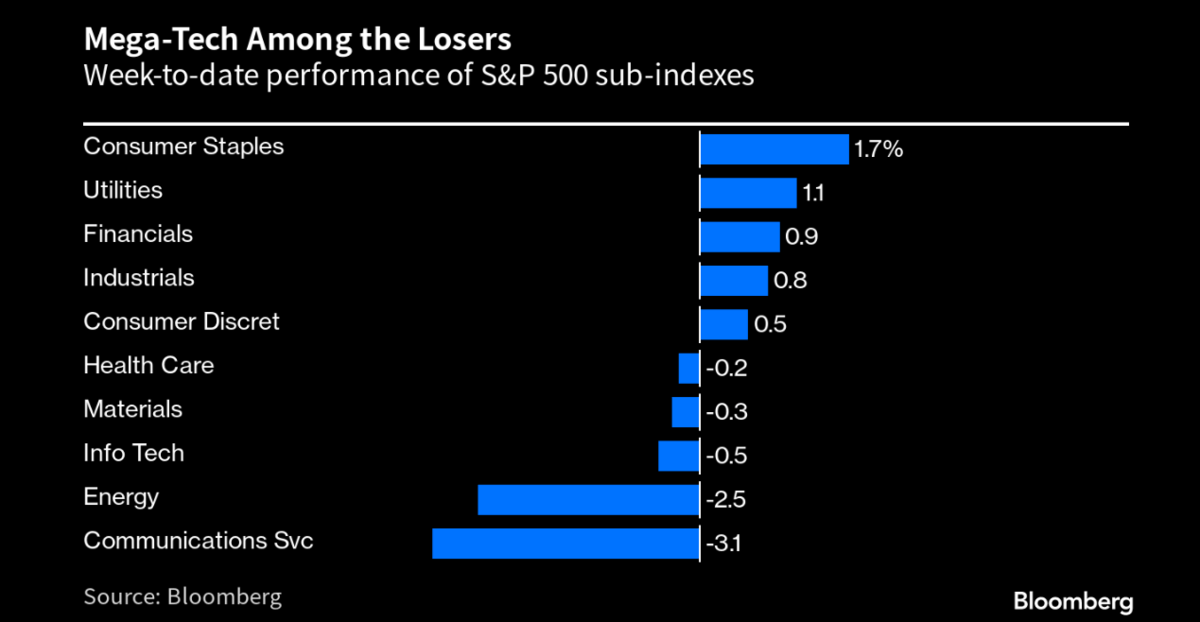

The worst performing sectors last week were led by communications companies (VZ, T reported down earnings), defensives and financials were the top performing.

Rotation into defensives is something we’ve discussed quite a bit in recent reports, and typically precedes a period of risk/off. This would make sense if Bloomberg’s recession-probability model is correct, which sees a 97% chance of a recession occurring as soon as July. This up from the last reading of 76%. Interestingly enough this model was only updated through February, thus the SVB banking fallout hasn’t even been factored in.

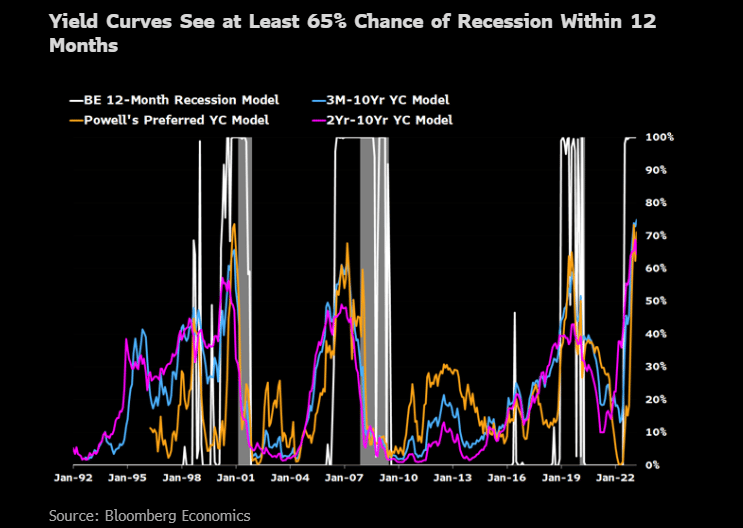

This is also supported by the Bloomberg yield analysis forecasting at least a 65% chance of recession within 12 months.

The yield curves which we track (2/10 yr and 3 month/10 yr) signal a 64% and 75% chance of a downturn in the next 12 months.

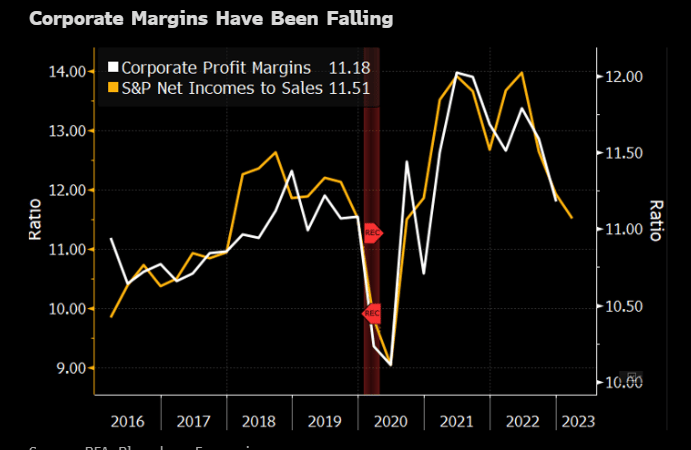

One of the key tenets to the Bloomberg model is falling corporate margins which fell in Q4 and likely will see further deterioration in Q1, as costs have been rising. In turn, Net Income/Sales will likely further weaken. This ratio is a good leading indicator of the business cycle, as CEO’s of companies look to cut additional costs to stem any sales revisions.

This week we will get Q1 GDP, monthly PCE and the ECI. PCE is the preferred inflation reading the Fed tracks and the ECI should offer clues to how corporate margins will be impacted by higher employment costs. This coupled with 1/3 of the SPX reporting and offering forward outlooks, which will undoubtedly impact the markets recent narrow range.

Here is what to expect per Bloomberg’s Economic team:

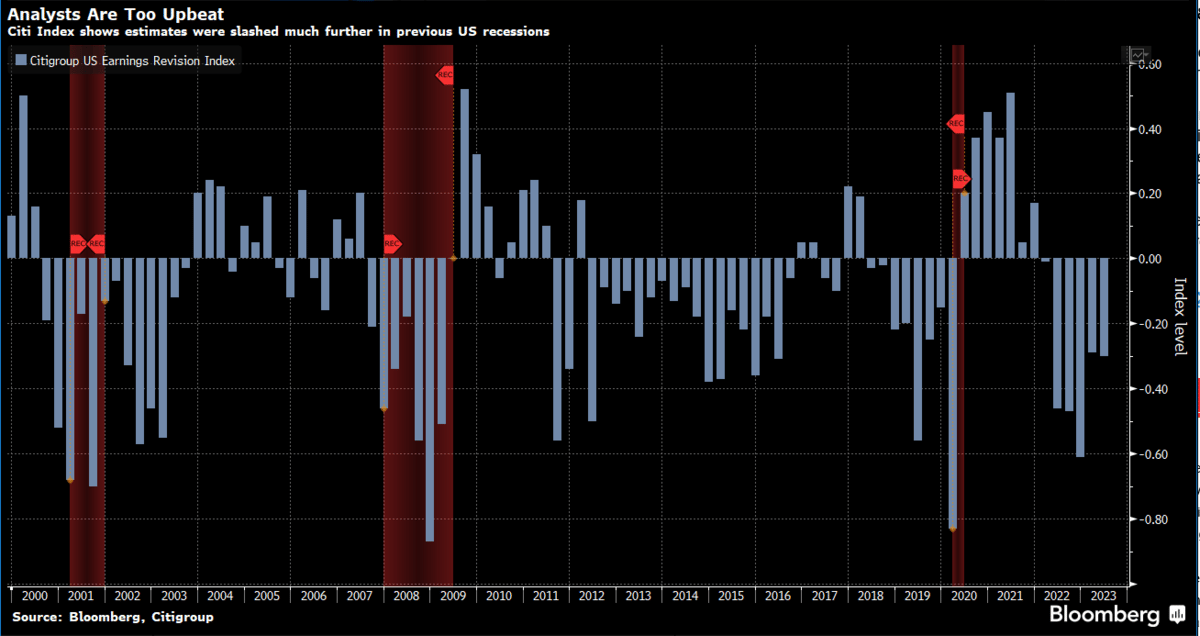

Citigroup’s US earnings revision index has been re-rated lower this year as earnings downgrades have been pervasive, especially into Q1. But according to Citigroup, investors are not fully pricing in any recession, which means stocks still have room to fall.

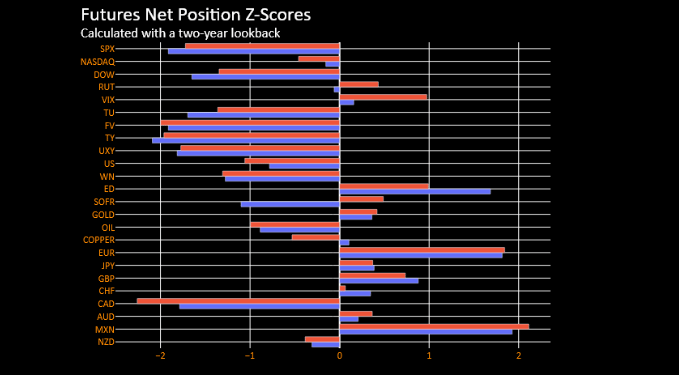

This all sounds quite gloomy and why the bears have been clamoring for a break of the Oct low. The issue with their thesis is that everyone already is positioned for it, and as we always tell our readers, when everyone is positioned so bearishly, rarely are they rewarded.

The recent CTFC report shows the highest SPX futures short position in almost 12 years. We are not here to tell you that the market cannot go lower if everyone is bearish. It certainly can, but arguing for some sort of cataclysmic wipeout is less likely if everyone is positioned for it. Pervasive bearish sentiment is a key reason why we have been arguing for a range bound market this year, frustrating both bears and bulls. How much money has been lost trying to short the market only for it to do the opposite of what’s expected? We’d venture to say quite a bit.

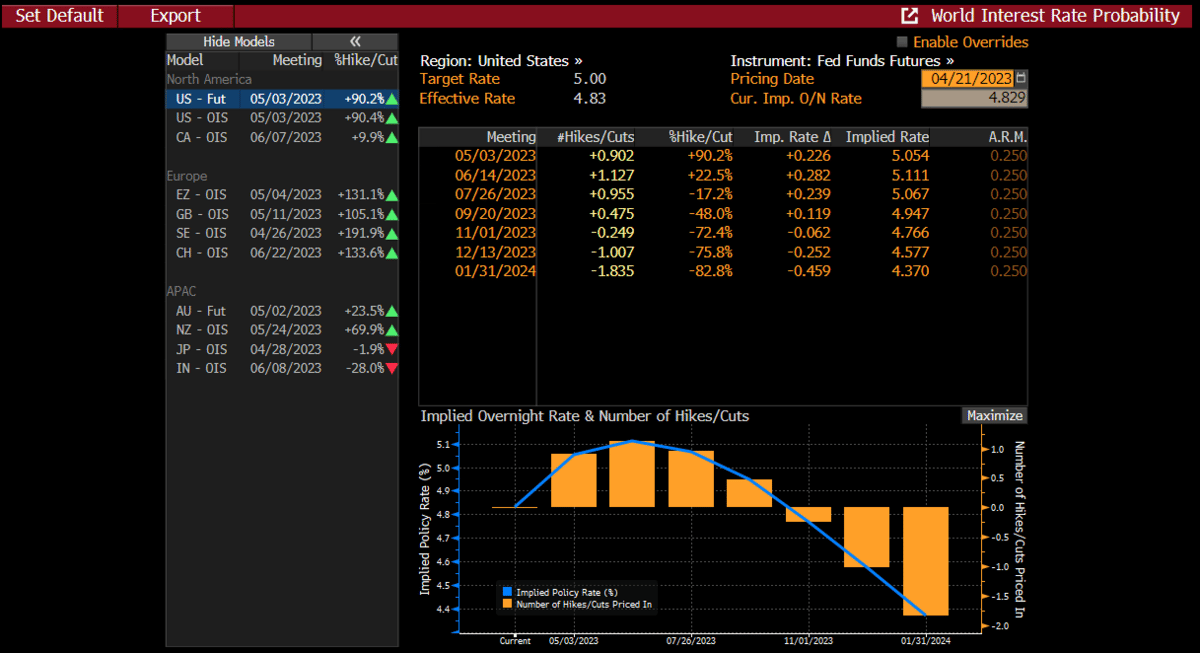

The Fed also meets on May 2-3, and likely sticks to their forecast for an additional 25 bps raise. The key question is do they press their rate hike cycle into Jun or is this the last raise before a pause?

Jun fed rate hike probabilities have increased a bit as of late but only forecasting a 22% chance of an additional hike. PCE and ECI readings this week will likely push Jun in a certain direction, and adjustments in rate hike probabilities do move markets.

This sets up for a very pivotal week. Get your popcorn ready!

While we understand the fundamental case for the market is quite depressing, this is only one piece of the puzzle. We have proprietary signaling methodology to help guide our directional market bets. If you have interest in reviewing more of our analysis on the markets, please consider subscribing below.