We love the title of this article by Bloomberg. Why? Because it encapsulates what we have been writing for weeks. When the stock market gets confusing, hard, and volatile, just do less. Trying to fight the confusion or to trade against the trend is a fruitless exercise. There is a time to be aggressive and there is a time to be conservative. Our goal in sharing our thoughts is to help investors decide when the right time is to put all of the chips on the table. Our process is meticulous and rigorous, and it takes us all weekend for us to prepare our analysis and disseminate our views. We are never going to get every wiggle right in the stock market, but if we can help our readers avoid costly drawdowns, like the one we just had with the Nasdaq losing almost -9% from the peak, then we think we did our jobs. Recall that we came into this month quite cautiously and with a heavy cash allocation. Two weeks ago, the market got decimated as momentum stocks finally lost their mojo. This past week, we seemingly were headed for ruin after Weds night’s tech earnings disappointments (namely META) and the ensuing softer GDP and higher PCE inflation readings. What a whammy for a market that was already fragile to begin with.

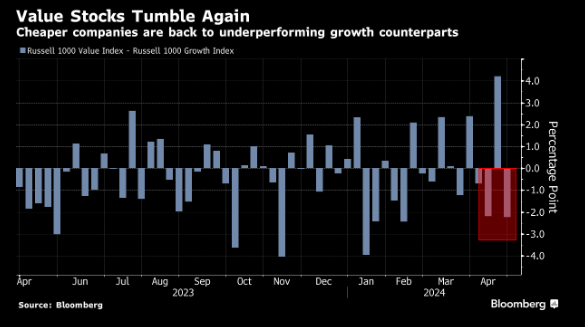

However, the end result was not what the market or professional investors were positioned for, as explicitly titled in the article above. Bill Gross even took to Twitter X to tell his massive follower base to buy value stocks and avoid tech.

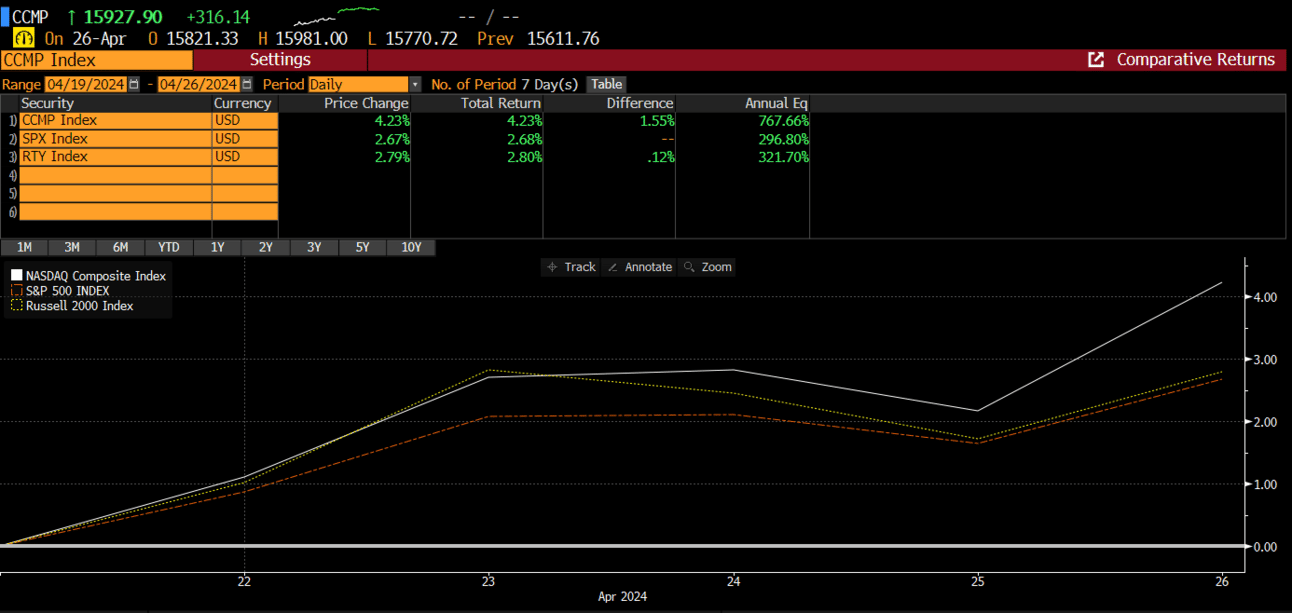

The next evening, 2 of the largest companies in the world threw cold water on that notion and reported strong Q’s, while the Nasdaq proceeded to notch its best session on Friday, since Feb.

The macro signals are not supportive of this rally with treasury yields inching towards 5% and the $USD staying stubbornly high. For this, we cannot blame anyone for their confusion, because we feel the same way. But alas, we follow price first, and not our opinions. And our analysis told us to be long GOOGL into their report. That seemed to work out pretty well as GOOGL trounced expectations and initiated its first dividend. Investors cheered with a +15% AH reaction. (we presented this idea in our new CSC IDEA TIER - below to sign up).

What seemingly looked like another disastrous week for the market, reversed meaningfully from the gap down on Thursday morning.

And closed the week in a very strong fashion.

In our mid-week report, we discussed the possibility that the stock market may have already discounted the weakness, leading to it getting bought. And while this is what happened, it’s not something we had aggressively positioned for; it was just a scenario we were prepared to capitalize on. We also mentioned the importance of weekly closes, as an important barometer for index direction.

One week after that massive wide-ranging candle, the SPX has almost reclaimed the weakness, forming a Bullish Harami (example below).

The Nasdaq is similar.

And momentum investing has regained some of its swagger after a 2 week slide.

While value stocks reversed their reversal.

The earnings for Q1 thus far have beaten expectations and something we posited a few weeks ago as estimates coming into Q1 had been getting cut. Estimate cuts set up for easier hurdles for companies to overcome. Thus far, 81% of companies in the SPX have surprised to the upside, which is taking place in a higher interest rate regime. 1Q estimates are on track to increase by 4.7% vs. a year ago, and compared to the pre-season estimate of 3.8%.

Analysts still expect SPX profits to jump by 8% in ‘24 and 14% in ‘25.

The biggest bugaboo for the stock market this year has been the pace of rate cuts, which continues to get pushed into the background. So far, it hasn’t mattered as companies continue to defy gravity and post robust performance. This makes sense, as higher rates remain in place because the economy is still growing. Should we get rate cuts because the economy begins to slow? That is where we could see a more meaningful correction.

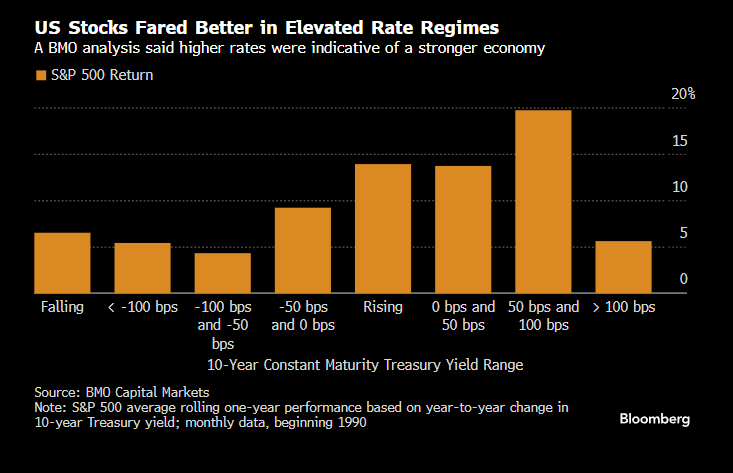

Historically, stocks tend to rally with an economy that can support higher rates.

An analysis by BMO also corroborates the above.

This week, the FOMC meets again regarding interest rates. We don’t expect much in the way of changes, but we do think the tone will be more hawkish. Inflation continues to be the thorn in the side of the Fed, and until we see this retreat, we don’t believe Powell will change his data-dependent stance.

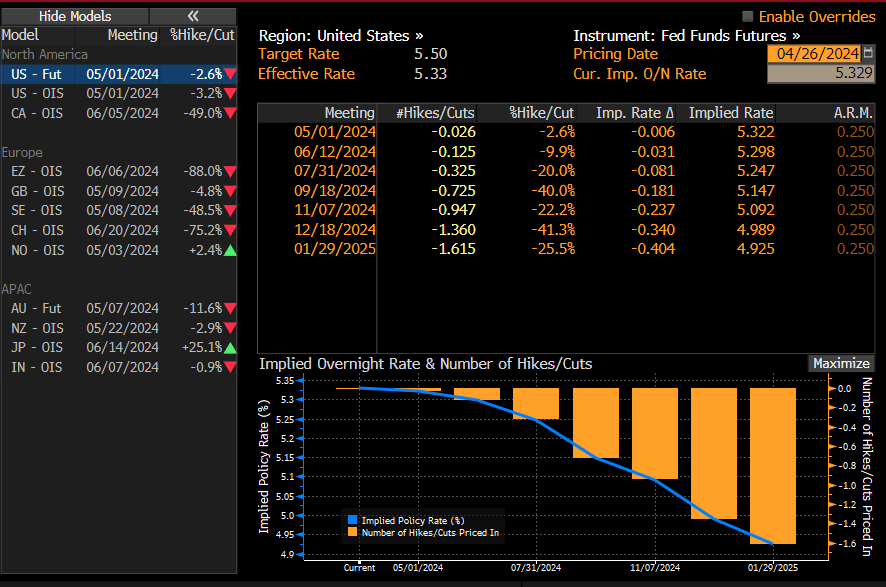

And while the expectations were for 6 rate cuts this year in Jan, the reality is 1-2 are more likely. Fed Fund Futures now indicate a 100% chance of 1 cut by Dec and only a 36% chance of an additional cut by that time. Of course, this can change with some meaningful dis-inflationary reports, but for now, we don’t see much change heading into this week.

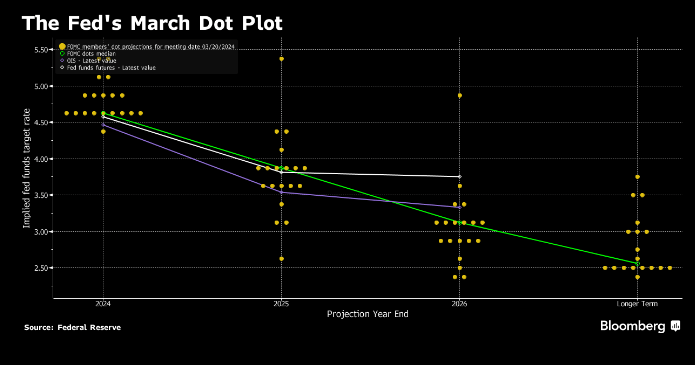

The official interest rate guidance (Dot Plot) from the Fed will not be updated at this meeting, which is slated for Jun.

The bottom line is we must be prepared for a week full of additional landmines, with the FOMC on Weds and the continued earnings barrage, namely some of the Mag 7 (AAPL, AMZN).

Let’s dig into this in our premium analysis…