A whirlwind weekend of emotion for us this weekend. Coaching soccer for our oldest daughter’s tournament, ended with a devastating 2-3 loss in the finals. They played amazing all tournament and we are all so proud of their effort.

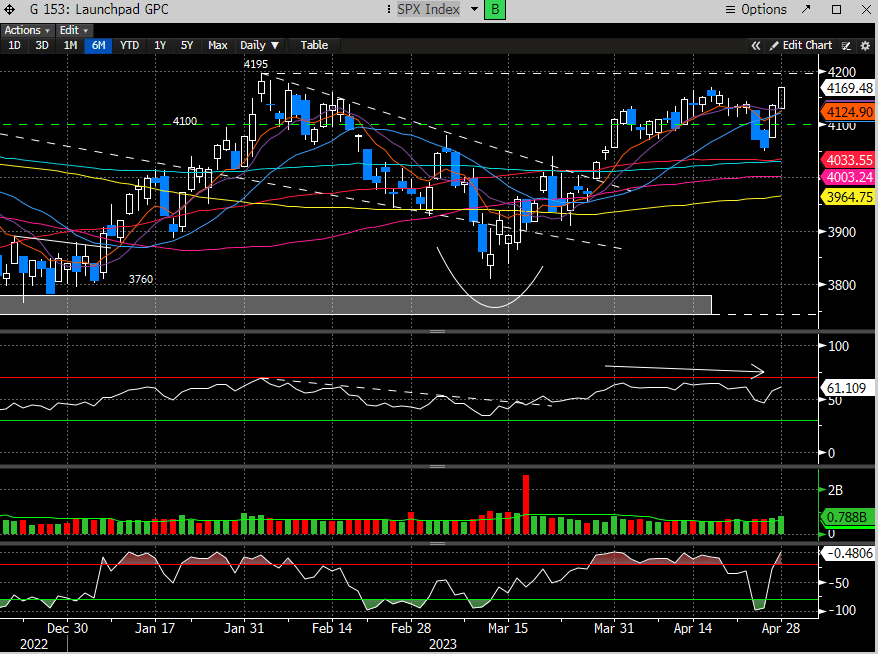

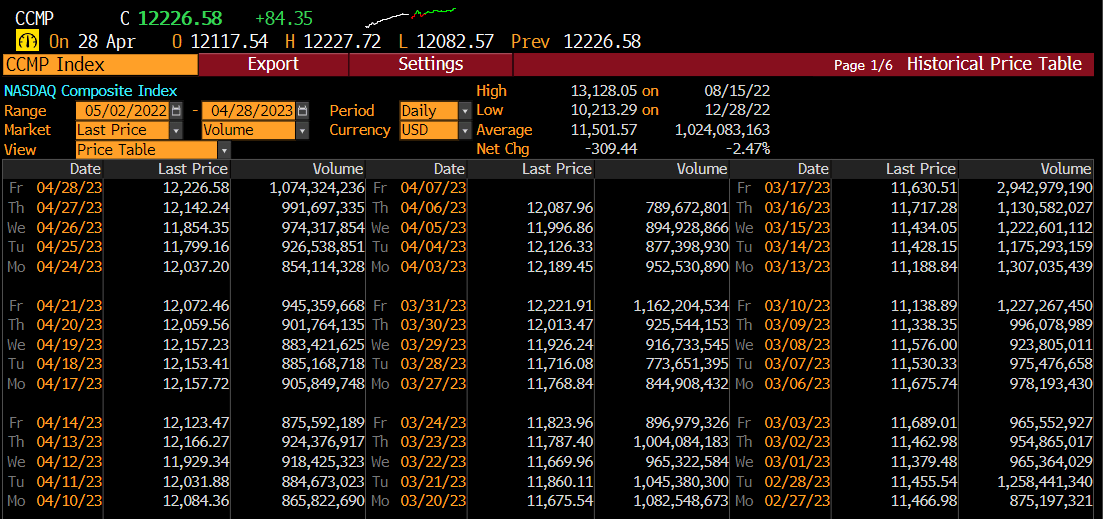

Why are we telling you this? The stock market can be equally devastating when on the wrong side of the market. This past week gave the bears an opportunity to put the bulls back in their box, but they failed to deliver. The SPX and the Nasdaq found support right near their 50 day MA’s and now is testing recent Feb highs.

The volume on Friday expanded. In fact, the 2 day sell off earlier in the week, was on lower than average volume for the SPX.

The volume also expanded on the Nasdaq rally on Friday. These are bullish considerations.

Why does this matter? Because as we have written many times in the past, the lopsided bearish sentiment implies too much weight is centered around the downside scenario. When everyone is positioned for a crash, rarely does it work out that way. This is the most anticipated recession of all time, and while some can make the argument that the valuations are too high for where are in the cycle, stocks never bottom out before a recession starts, earnings cuts are not priced in, the macro is getting worse, etc. etc. The reality is the market has likely discounted this scenario. 2022 was a very bad year for stock markets. If the market started discounting a recession in ‘21, why can’t the market be discounting a recovery in ‘23? Most of the street is anticipating a recovery in ‘24. Thats only 7 months away. We have maintained that the market is likely stuck in a big range until earnings start to re-accelerate which should occur next year. That implies a rangebound market until that visibility improves.

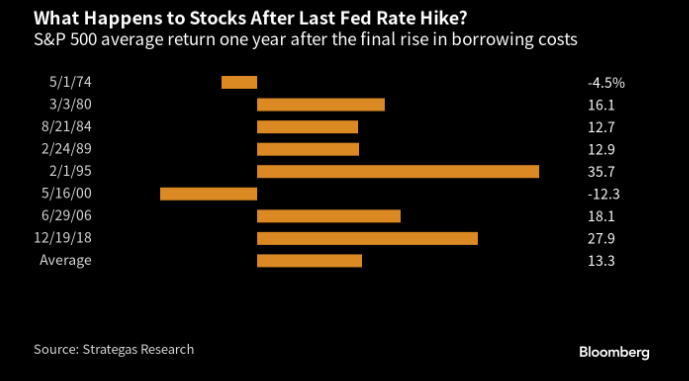

This week we will get the FOMC and the Fed Fund Futures are pricing in an 88% chance of a 25 bps hike. More importantly is that they are anticipating an end to the Fed hikes after May and cuts by July. Whether this gets adjusted this week based on their commentary is anyone’s guess.

Interestingly enough, history has shown that buying stocks at the end of a rate hiking cycle has proven to be a winning strategy in the wake of a low inflationary environments like in the 90’s, but in an inflationary scenario, much like now, stocks fell in the 3 months after the last hike.

Is it different this time?

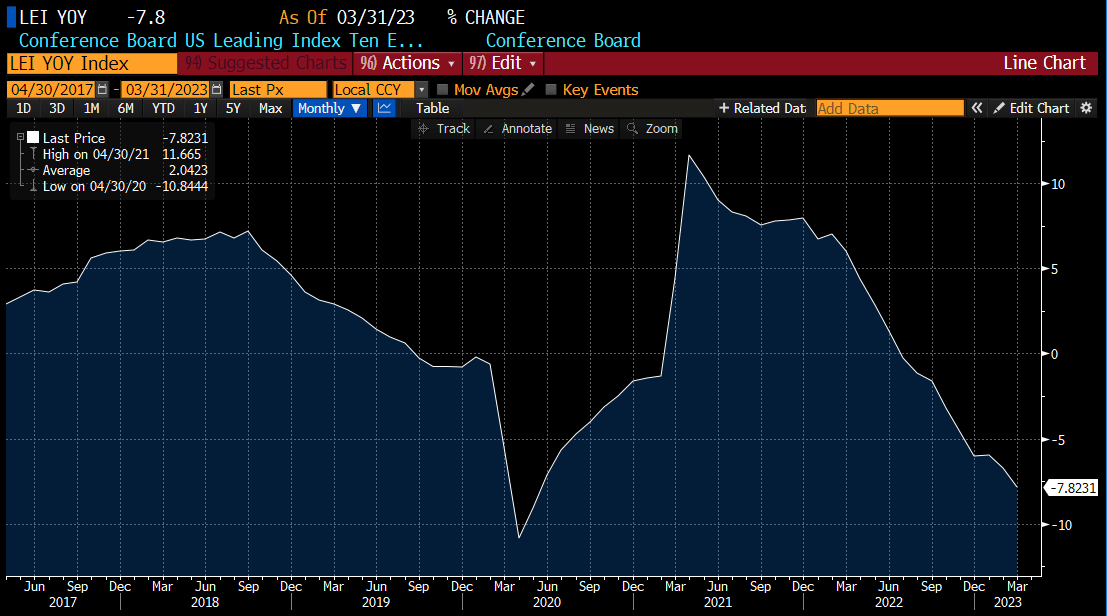

The Conference Board of Leading Economic Index has been negative for 12 months. In the past 50 years, there were just 3 instances when this happened: 1974, 1980 and 2008. Each time that happened the US economy was already in a recession. If that’s true, then the notion that the lows of Oct will hold has merit.

Most forecasters believe that growth will slow considerably in the 2H of the year. It makes sense that it will given all the bank turmoil, and macro-economic fallout. But multiple low quarters of growth is not a death nail for the stock market. Sounds more like range bound fodder to us.

To inject more confusion into the markets, the rally on Friday occurred in the face of stubbornly high inflation coupled with lower consumer spending.

There is also substantial confusion around the lack of participation in the market. Less than 1/3 of stocks in the SPX have outperformed the index, the fewest at this point since 1999. 5 stocks (AAPL, MSFT, NVDA, META and AMZN) have delivered 60% of the index’s return this year, according to Jefferies.

Lack of participation can last for some time before becoming infected by the rest of the market. Or the laggards could simply play catch up. At this point it is tough know how things will go. We know the seasonality calendar has turned in the favor of the bears, especially given a persistent Fed, and a possible debt ceiling showdown in Jun, maybe “sell in May,” makes sense?

To learn more about how we are viewing the markets into the Fed meeting and beyond, please consider subscribing below.