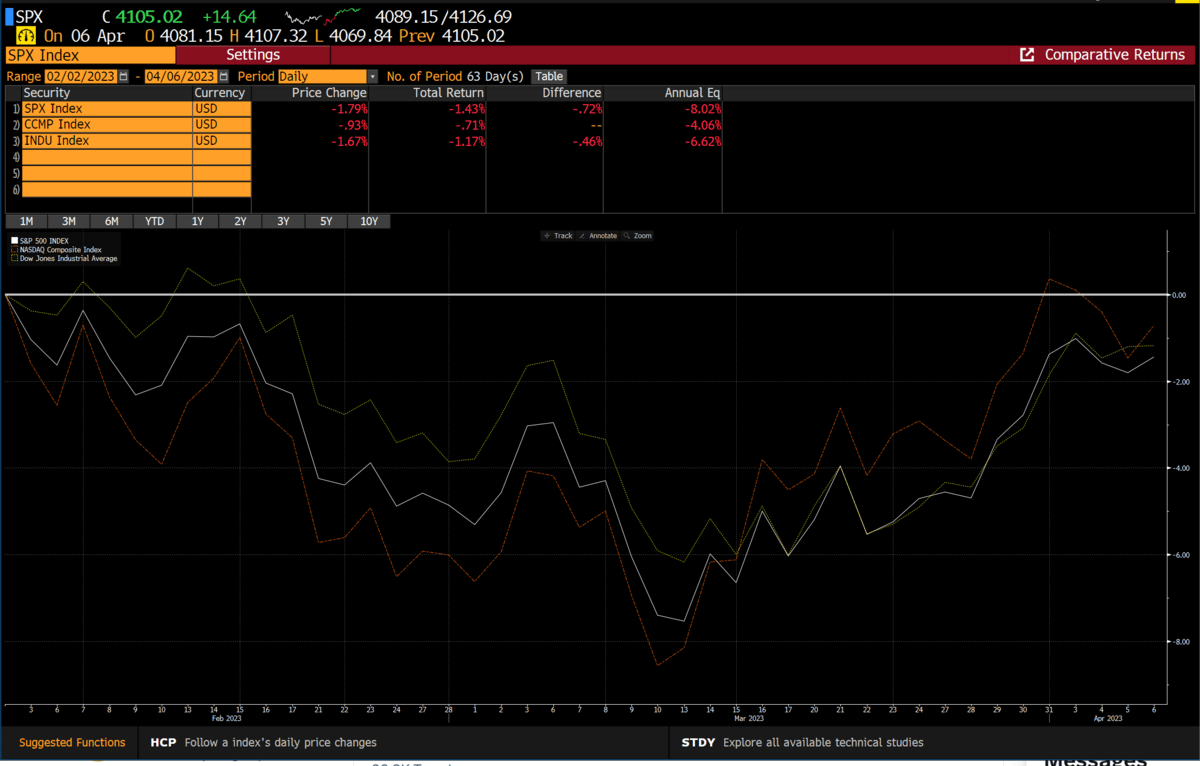

The incessant bearish rant from some of the most widely respected and followed strategists, experts, professional money managers, media talking heads, continues unapologetically. Despite being dead wrong on their stock market prognostications since the end of December, in all of January, since the Feb peak and the end of the 1st Q. The market has now quietly made its way back to just shy of the Feb peak.

This occurring after a banking crisis, softening economic data and incessantly stubborn inflation and employment results, the bears have little to show for it except a lot of wasted energy and undoubtedly some very frustrated followers/investors.

We have no bias. We were massively long at the end of the December, sold the peak in Feb, flipped short, only to flip back long gain with tactical single stock, commodity and index ideas. We have posted sizeable double digit returns on most of our idea suggestions.

Having a bias is expensive from an opportunity cost perspective. The macro is awful, the headlines seemingly are getting worse, EPS numbers continue to get cut, yet the market is currently ignoring all of it. The bears have no shortage of reasons to take the market lower, but it continues to evade them. We have repeatedly written about the lopsided nature of today’s markets. Very few have been positioned correctly for the markets recent rise. This implies the pain trade is still up. The market doesn’t care about opinions, it wants to inflict the most amount of pain to the most amount of people. This means ignoring sentiment and positioning can be very costly. When everyone is positioned bearishly, the market will typically do the opposite. It means everyone has contemplated the bearish scenario and is already being accurately reflected in the stock market. Is the current market structure ignoring future EPS cuts, a worsening macro backdrop, fallout from the banking crisis, a headstrong Fed? Maybe it is.

But why should we care, we know the market is smarter than us. This is why we stick to our rigorous analysis to uncover what’s happening under the surface. Our opinions remain bearish, just like everyone else, but what if those opinions are wrong?

When our weight of the evidence approach tells us to swing in a direction, we simply follow our signals. Thats the beauty of our system. It has no feelings, and it doesn’t care what logic suggests. If you trade the market, your goal isn’t to be right, it’s to make money. The sooner people grasp that reality the more objective they can become. In the interim, the market has no qualms to take the money of the incessantly stubborn. For every winner in the market there is a loser, and we prefer to win.

Which would you prefer?

Last week we suggested the market could run into a bit of trouble given the excessively high McClellan Summation Index. We suggested that being aggressively long was a mistake. We also told our readers that we thought that weakness would get bought. Interestingly enough the market opened higher for the week, sold down -1.6% and almost closed flat.

From last Sunday’s report:

“…we must be cognizant that the market is approaching OB especially per the McClellan Oscillator. This coupled with a much higher oil price vs a week ago, and some risk to being aggressively long is certainly present…That said, we think any weakness will get bought..”

Is the market set up to fail or will it keep surprising the skeptics?

Subscribe below to read our premium content.