The stock market had a very respectable week despite several less-than-stellar earnings reports.

The crosscurrents remain opaque and the waters choppy, but our analysis continues to trump opinions. We were unequivocally bullish coming into this week.

Here is a snapshot of our conclusion page from last week:

US companies are still on track to post their best quarterly earnings relative to expectations in at least 2 years. Of the 459 companies reported this Q, profits are, on average, 8.4% higher than expected, according to Bloomberg. ~79% have beaten profit expectations vs. 75% last quarter.

There is some belief that the expectation of a recession last year has forced companies to tighten their belts and rein in costs. This is seemingly a big driver of the profitability upside we are witnessing. Coupled with the street estimate earnings cuts that took place before the reporting season and the set up for earnings beats remain robust.

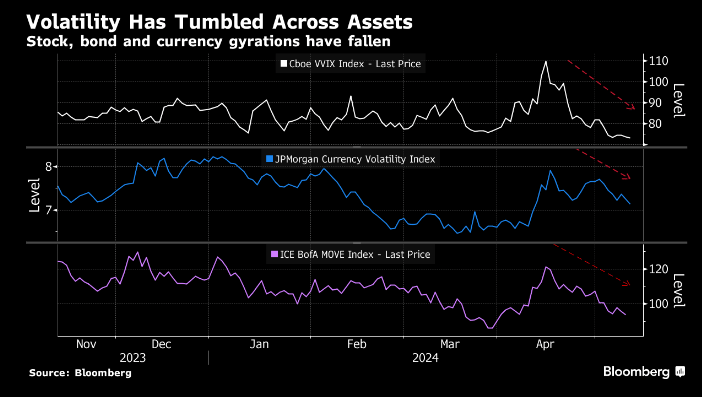

The calm that has fallen over the stock market as companies are handling the higher rate regime against a stronger and more resilient economic backdrop is evident in the volatility complex.

There is now a prevailing notion that the Fed “put” is back, which has implications for future macro releases. This means weaker releases could be spun as good news as the Fed will come to the rescue should the economy slow too quickly. Robust releases may also be cheered as companies continue benefiting from the positive economic undercurrents.

The skeptics will say the lack of volatility is too complacent, but we disagree. We just saw the volatility complex push briefly into backwardation in April. Typically, a period of calm follows, which is now just in the early stages.

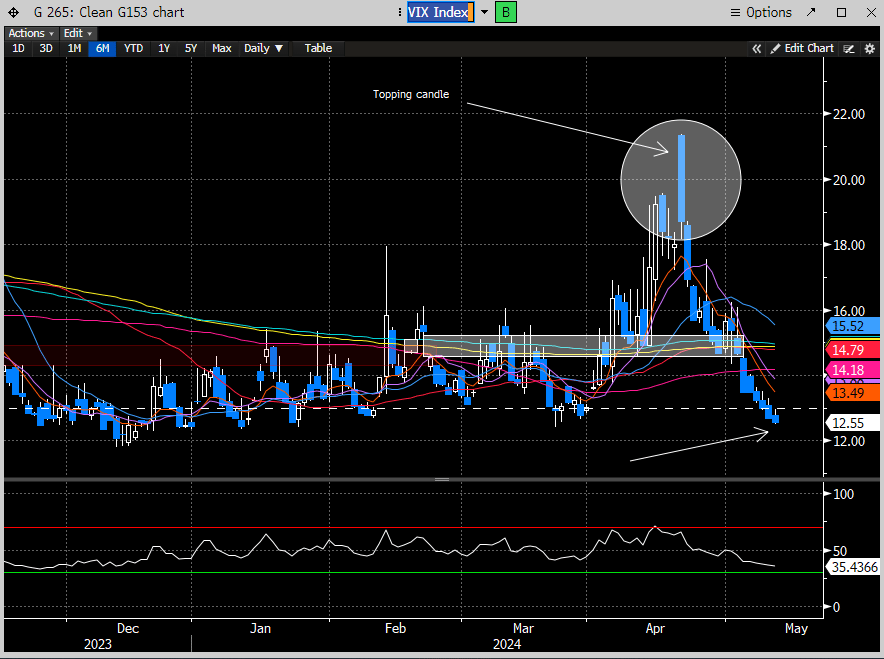

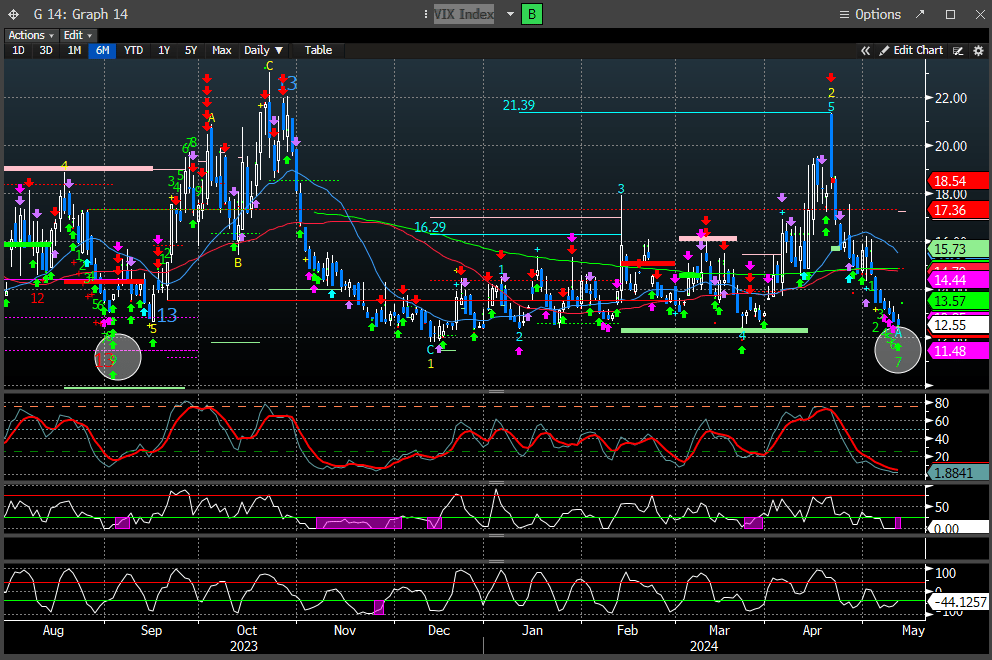

Here is a chart of front-month volatility vs 3-month volatility. When the ratio approaches 1 and reverts, we historically enter a period of benign volatility. Lower volatility is typically associated with a higher stock market.

The VIX has broken our white gap window volatility zone and continued to sink, testing the March lows.

This doesn’t mean we cannot have flare-ups in volatility. This week, we will get information on last month’s inflation with the PPI/CPI.

Either of these reports has the power to disrupt the current market equilibrium, especially since the Fed remains data-dependent.

The VIX can also print a DeMark 9 buy this week on Tuesday, right around when these reports are issued. The timing is uncanny. The last 9 buy occurred in Sept ‘23, close to the lows before reverting +78%. We are not suggesting this will happen again and are only pointing out that the setup for higher volatility this week is present.

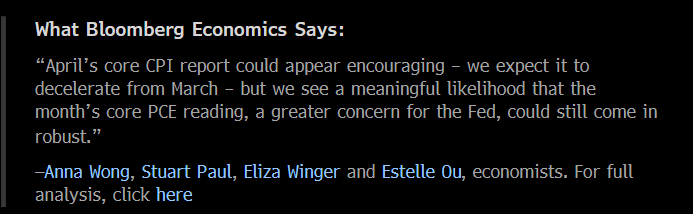

Expectations for inflation this week are for a mild downtick month/month, but the core still remains sticky. Any moderation will be the first in 6 months and could be cheered by the stock market. Compared to the April report, the core CPI is projected to rise +3.6%, the smallest increase in three years.

The overall CPI likely climbed last month due to stronger gasoline prices, which recently reached a 6-month high.

Here is the Bloomberg’s economist view:

The bottom line is that stickier or higher inflation will pose additional downside risks to the economic growth outlook. The impact should start to show up in consumer spending habits. There are already anecdotal evidence that lower-income consumers are pulling back.

This implies that this week’s inflation reports pose quite a risk for the stock market, which we view as somewhat binary. Based on last week’s softening employment numbers, with wage growth also decelerating, consumption could be at risk. This adds more emphasis to this week’s inflation statistics, as lower purchasing power for consumers will only exacerbate this trend.

After a strong week for the stock market, we remain on high alert for any reversal. The reaction to any adverse report will prove equally important and will be analyzed in our mid-week update.